Understanding Orbiter Finance Token Distribution Method Everything You Need to Know

Are you curious about Orbiter Finance’s token distribution method? Look no further! In this article, we will break down everything you need to know about how Orbiter Finance distributes its tokens.

Orbiter Finance is a revolutionary blockchain platform that aims to change the way we think about finance. With their unique token distribution method, they are setting a new standard for transparency and fairness in the crypto space.

The token distribution process starts with the creation of the Orbiter Finance token, known as ORB. These tokens are initially held by the development team and are gradually released into circulation through various distribution mechanisms.

One of the key features of Orbiter Finance’s token distribution method is its commitment to ensuring a wide and diverse distribution of tokens. This means that the tokens are not held by a small group of individuals or entities, but are instead distributed to a broader community of users.

Through a combination of a fair launch, token sales, airdrops, and liquidity mining programs, Orbiter Finance ensures that the distribution of tokens is equitable and accessible to all. This allows for a more decentralized and inclusive ecosystem, where users have equal opportunity to participate and benefit from the growth of the platform.

Overview of Orbiter Finance

Orbiter Finance is a cutting-edge decentralized finance (DeFi) project built on the Ethereum blockchain. It aims to revolutionize the world of lending and borrowing by offering a transparent, efficient, and secure platform for users to interact with their digital assets.

One of the key features of Orbiter Finance is its token distribution method. The project utilizes a fair and decentralized distribution model to ensure the wide availability and accessibility of its native token, ORT. This distribution method is designed to reward long-term holders and incentivize participation in the project’s ecosystem.

Orbiter Finance also employs various mechanisms to maintain liquidity and enhance stability within the platform. These include a reserve fund, which is used to counterbalance any fluctuations or shocks that may occur in the market. Additionally, the project implements an innovative algorithmic stablecoin model to provide a reliable and predictable peg against a specific fiat currency.

Moreover, Orbiter Finance prioritizes security and privacy, utilizing robust protocols and smart contract audits to safeguard user assets and transactions. The project is committed to maintaining a high level of transparency, ensuring that users can trust in the integrity of the platform and the safety of their investments.

Overall, Orbiter Finance offers a comprehensive and user-friendly DeFi solution that combines cutting-edge technology with a fair distribution model, liquidity mechanisms, and a strong focus on security. It aims to empower individuals to take control of their finances and explore the potential of decentralized finance.

Importance of Token Distribution

The token distribution method plays a crucial role in the success and sustainability of any blockchain project. It determines how tokens are allocated among various stakeholders, including investors, team members, and the community. Here are a few reasons why token distribution is important:

Ensures Fairness and Transparency

A well-defined token distribution helps ensure fairness and transparency in the project. It ensures that tokens are allocated according to a predetermined set of rules, without any bias or favoritism. By providing a clear and transparent distribution mechanism, it fosters trust among participants and helps prevent the concentration of tokens in the hands of a few individuals or entities.

Aligns Incentives

Token distribution also aligns incentives among participants. By distributing tokens to different stakeholders, such as early investors, developers, and community members, it encourages their active participation and contribution to the project. It incentivizes them to hold and use the tokens, as they have a stake in the success of the project.

Furthermore, token distribution can be designed in a way that rewards long-term supporters and discourages short-term speculative behavior. By implementing vesting schedules or lock-up periods for certain tokens, it promotes a more sustainable and stable token ecosystem.

Facilitates Network Effects

An effective token distribution method helps facilitate network effects. By distributing tokens to early adopters and active community members, it encourages their engagement and contribution to the network. This, in turn, attracts more users and participants, leading to increased network adoption and value.

Conclusion

Token distribution plays a vital role in establishing a fair and transparent ecosystem, aligning incentives among participants, and promoting network effects. By carefully designing the token distribution method, blockchain projects can lay the foundation for long-term success and sustainability.

Understanding Orbiter Finance’s Token Distribution Method

One of the key aspects of Orbiter Finance is its unique token distribution method. This method is designed to ensure a fair and equitable distribution of tokens to the community while also incentivizing participation and long-term commitment.

The token distribution is carried out through a combination of different mechanisms. One of the main mechanisms is the initial token sale, where a portion of the total token supply is made available for purchase by participants. This allows individuals to acquire a stake in the project and become part of the Orbiter Finance community.

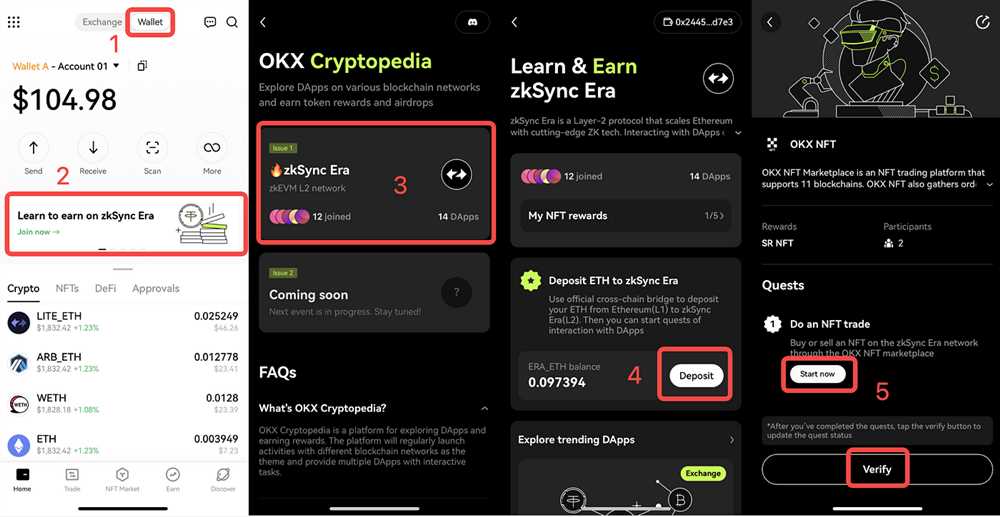

In addition to the initial token sale, a portion of the token supply is allocated for liquidity mining. This means that users who provide liquidity to the Orbiter Finance platform are rewarded with tokens. This incentivizes users to contribute to the liquidity pool and ensures the smooth operation of the platform.

Furthermore, Orbiter Finance employs a staking mechanism to distribute tokens to users who actively participate in the network. By staking their tokens, users can earn additional tokens as a reward for their contribution to the platform’s security and stability.

Finally, Orbiter Finance also reserves a portion of the token supply for future development and team incentives. This ensures that the project has the necessary resources to continue growing and innovating over time.

| Token Distribution Method | Percentage |

|---|---|

| Initial token sale | 50% |

| Liquidity mining | 25% |

| Staking rewards | 15% |

| Development and team incentives | 10% |

Overall, Orbiter Finance’s token distribution method aims to create a decentralized and inclusive ecosystem, where users are rewarded for their contributions and have a stake in the project’s success. By ensuring a fair and transparent distribution of tokens, Orbiter Finance promotes community engagement and long-term value creation.

Token Allocation and Supply

The token allocation of Orbiter Finance’s native token, ORBT, is designed to be fair and transparent.

A total supply of 1 billion ORBT tokens has been created. The distribution of these tokens is as follows:

- 40% allocated for public sale: This portion of the tokens will be available for purchase by the general public during the initial token sale. The sale will be conducted through a decentralized launchpad platform to ensure fairness.

- 30% allocated for liquidity: These tokens will be used to provide initial liquidity for the ORBT token on decentralized exchanges. This allocation is essential to ensure a healthy and liquid market for ORBT from the start.

- 15% allocated for team and advisors: This percentage of tokens will be distributed among the project’s core team members and advisors. It incentivizes their involvement and dedication to the long-term success of the project.

- 10% allocated for partnerships and collaborations: These tokens will be reserved for forming strategic partnerships and collaborations with other projects and platforms. This allocation aims to foster growth and expand the project’s reach.

- 5% allocated for the reserve fund: This portion of tokens will be held in reserve to ensure the project’s stability and sustainability. It provides a safety net for unexpected expenses and future development.

Overall, the token allocation and supply of ORBT tokens are carefully planned to support the project’s growth, ensure fairness, and incentivize key contributors. The distribution strategy aims to strike a balance between public participation, liquidity provision, and long-term sustainability.

Token Distribution Mechanism

Orbiter Finance has designed a comprehensive token distribution mechanism to ensure a fair and transparent allocation of tokens to its users. This mechanism aims to incentivize early adopters and long-term investors while also promoting liquidity and stability in the market.

The token distribution process begins with the launch of the Orbiter Finance platform. During the initial phase, a certain percentage of tokens will be allocated to the team, advisors, and early backers. These tokens will be locked for a predetermined period to prevent them from being dumped on the market and to ensure the commitment of the project’s core stakeholders.

A significant portion of the token supply will be allocated for public sale. This allows anyone interested in the project to participate and acquire the tokens at a fair price. The public sale will be conducted in multiple rounds, with each round progressively increasing the token price to reward early participants and encourage them to become long-term supporters of the project.

To further incentivize users to hold onto their tokens, Orbiter Finance will implement a staking mechanism. Users who stake their tokens will earn additional rewards, such as a share of the platform’s transaction fees or exclusive access to certain features and services. This mechanism not only encourages token retention but also enhances the overall ecosystem’s growth and stability.

Additionally, Orbiter Finance will reserve a portion of the token supply for partnerships, strategic collaborations, and future development. This ensures that the project has the necessary resources to expand its operations, forge alliances with other industry players, and continuously improve its products and services.

Overall, Orbiter Finance’s token distribution mechanism is designed to create a balanced and equitable distribution of tokens, benefiting both early participants and long-term supporters. By implementing various incentives and locking mechanisms, the project aims to foster a sustainable and thriving ecosystem that rewards all stakeholders.

Benefits of Orbiter Finance’s Token Distribution Method

Orbiter Finance’s token distribution method offers several key benefits for both investors and the broader community.

1. Fair Distribution

One of the major benefits of Orbiter Finance’s token distribution method is its commitment to fair distribution. The project aims to ensure that tokens are distributed in an inclusive and equitable manner, minimizing the concentration of tokens in the hands of a few individuals or entities. This approach helps to prevent market manipulation and promotes a more decentralized ecosystem.

2. Community Empowerment

By utilizing a token distribution method that involves participation from the community, Orbiter Finance aims to empower its users and create a sense of ownership. This encourages active community engagement and fosters a stronger and more vibrant ecosystem. Users have the opportunity to contribute to the network’s growth by acquiring tokens and participating in governance processes.

During the token distribution process, tokens are often allocated to individuals who actively contribute to the project, such as early supporters, developers, and other key stakeholders. This ensures that those who have a vested interest in the success of Orbiter Finance are rewarded, further incentivizing participation and collaboration.

These benefits ultimately contribute to the long-term success and sustainability of Orbiter Finance, helping to create a more robust and resilient ecosystem.

What is Orbiter Finance?

Orbiter Finance is a decentralized financial platform built on the Ethereum blockchain. It aims to provide users with various financial services, including lending, borrowing, and staking, with a focus on yield optimization.

How does Orbiter Finance’s token distribution work?

Orbiter Finance uses a fair launch distribution method for its tokens. This means that no tokens are reserved for the team, developers, or any other parties prior to the launch. The tokens are distributed through liquidity mining, where users can earn tokens by providing liquidity to the platform.

What are the benefits of participating in Orbiter Finance’s token distribution?

By participating in Orbiter Finance’s token distribution, users have the opportunity to earn tokens as a reward for providing liquidity to the platform. These tokens can be used for various purposes within the Orbiter Finance ecosystem, such as governance and staking, potentially leading to additional financial benefits.