Understanding the Cross-Rollup Transfer Technology of Orbiter Finance A Closer Look

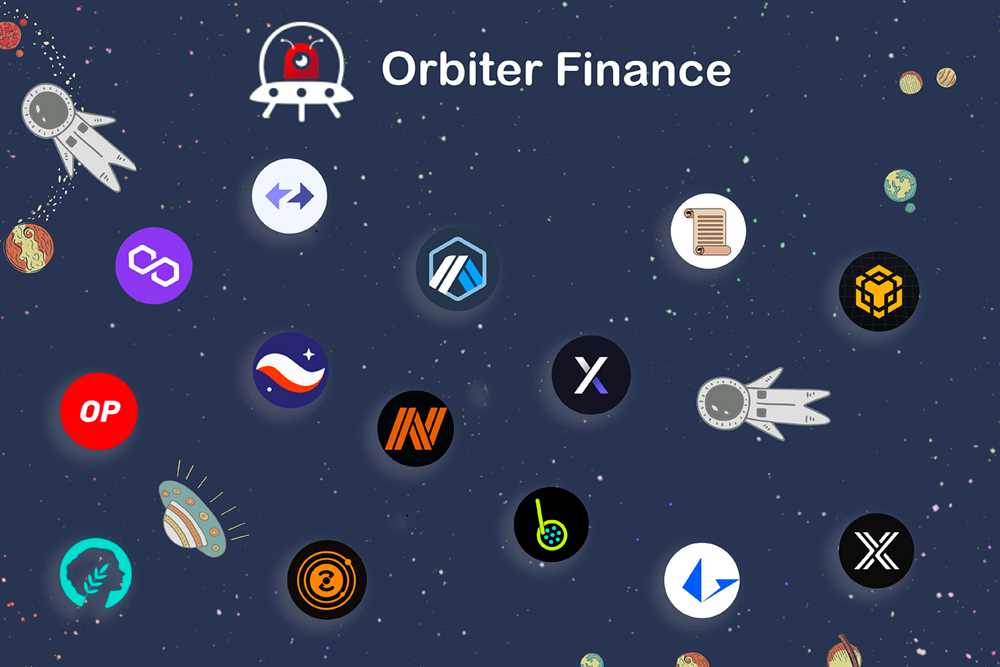

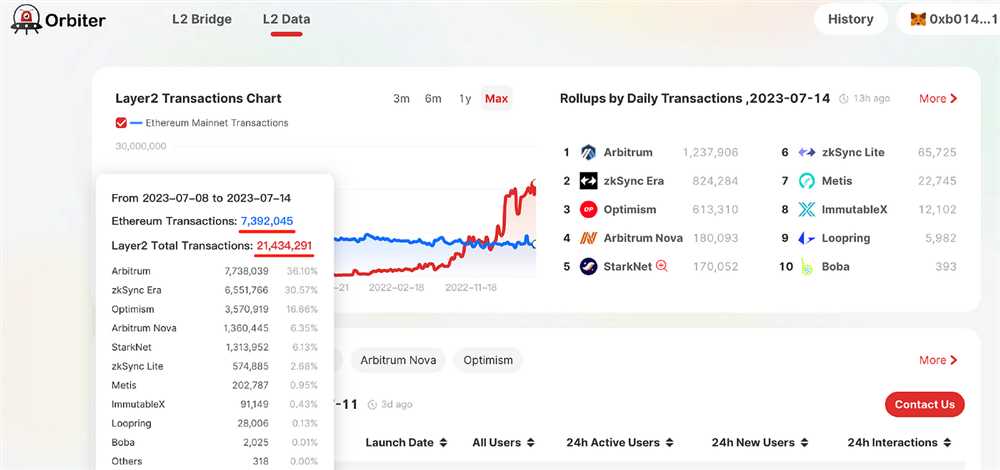

If you’re a cryptocurrency enthusiast, you’ve probably heard of Orbiter Finance, a rapidly emerging decentralized finance (DeFi) protocol that has been making waves in the blockchain community. One of the key features that sets Orbiter Finance apart is its innovative cross-rollup transfer technology, which allows for seamless movement of assets across different layer 2 solutions.

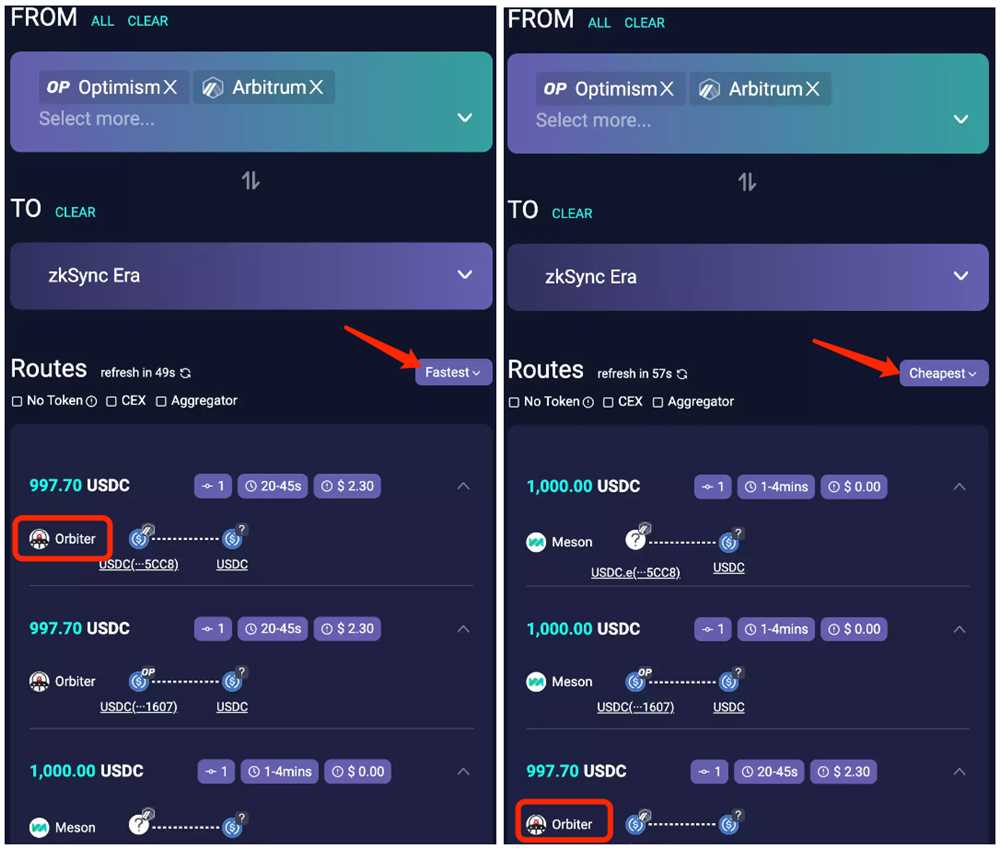

Traditional DeFi protocols often face scalability issues, with high transaction fees and slow confirmation times. Orbiter Finance aims to address these challenges by leveraging the power of cross-rollup transfers. This technology enables users to transfer assets between layer 2 solutions, such as Optimism and Arbitrum, with ease and efficiency.

But how does this cross-rollup transfer technology work?

When a user initiates a cross-rollup transfer on Orbiter Finance, the protocol securely locks the assets on the source layer 2 solution and mints an equivalent representation of those assets on the destination layer 2 solution. This process ensures that the user’s assets are not only safe but also instantly available on the new layer 2 solution.

For example, let’s say you have some ETH tokens on the Optimism network, but you want to utilize a DApp on the Arbitrum network. Instead of going through the tedious process of withdrawing your assets from Optimism, waiting for the Ethereum mainnet confirmation, and then depositing them onto Arbitrum, you can simply perform a cross-rollup transfer on Orbiter Finance. This process significantly reduces the time and cost associated with moving assets between layer 2 solutions.

In addition to its convenience, cross-rollup transfers on Orbiter Finance also come with other benefits. By allowing users to freely move their assets across layer 2 solutions, the protocol promotes interoperability and enhances the overall user experience within the DeFi ecosystem. Furthermore, by reducing reliance on the Ethereum mainnet, Orbiter Finance contributes to the scalability and sustainability of the blockchain network.

In conclusion, Orbiter Finance’s cross-rollup transfer technology offers a promising solution to the scalability challenges faced by traditional DeFi protocols. With its ability to seamlessly transfer assets between layer 2 solutions, Orbiter Finance is paving the way for a more efficient and interconnected decentralized finance ecosystem. As the demand for layer 2 solutions continues to grow, the importance of cross-rollup transfer technology cannot be overstated.

What is Cross-Rollup Transfer Technology?

In the world of blockchain and cryptocurrency, cross-rollup transfer technology is a method of transferring assets between different rollup chains. Rollup chains are layer-2 solutions that help scale the throughput of Ethereum, allowing more transactions to be processed at a lower cost.

Cross-rollup transfer technology enables users to move their assets seamlessly across these different chains, without needing to go through the main Ethereum network. This offers several advantages, including faster transaction speeds, lower fees, and improved scalability.

With cross-rollup transfer technology, assets can be transferred from one rollup chain to another by following a specific set of protocols and smart contracts. These protocols ensure that the transaction is secure and transparent, and that the assets are not lost or compromised during the transfer process.

By utilizing cross-rollup transfer technology, users can take advantage of the benefits of different rollup chains, such as lower fees on some chains or faster confirmation times on others. This flexibility allows users to optimize their transactions based on their individual needs and preferences.

Overall, cross-rollup transfer technology plays a crucial role in improving the scalability and usability of blockchain networks. It enables users to move their assets more efficiently and effectively, while also reducing costs and increasing transaction speeds. As the adoption of rollup chains continues to grow, cross-rollup transfer technology will become increasingly important in the world of decentralized finance.

The Importance of Cross-Rollup Transfer in Orbiter Finance

In the world of decentralized finance (DeFi), new technologies and concepts are constantly emerging to solve long-standing challenges. One such technology is cross-rollup transfer, and it plays a crucial role in the Orbiter Finance ecosystem.

Orbiter Finance aims to provide users with a seamless and efficient way to transfer assets between different rollups. A rollup is a scaling solution that aggregates multiple transactions into a single one, reducing the congestion and costs associated with the Ethereum network. However, each rollup operates as an isolated layer, meaning that asset transfers between different rollups are not possible by default. This is where cross-rollup transfer comes into play.

Cross-rollup transfer allows users to move assets from one rollup to another, enabling liquidity flow across different layers. This technology unlocks a range of benefits for users and the DeFi ecosystem as a whole:

Enhanced Liquidity

By enabling cross-rollup transfer, Orbiter Finance improves liquidity access for users. Previously, users were limited to a single rollup, leading to fragmented liquidity and restricted trading options. With cross-rollup transfer, users can seamlessly move their assets to different rollups, tapping into a wider range of markets and trading opportunities.

Reduced Costs

Another significant benefit of cross-rollup transfer is the reduction in transaction costs. As mentioned earlier, rollups aggregate multiple transactions into a single one, reducing gas fees. By allowing cross-rollup transfer, Orbiter Finance further optimizes the cost-efficiency of asset transfers, making it more affordable for users to move their assets between rollups.

Improved User Experience

Cross-rollup transfer simplifies the user experience within the Orbiter Finance ecosystem. Instead of having to withdraw assets from one rollup and deposit them into another, users can simply initiate a cross-rollup transfer, saving time and reducing complexity. This streamlined process enhances user adoption and engagement with the platform.

As the DeFi ecosystem continues to evolve, technologies like cross-rollup transfer become increasingly important. By enabling the seamless transfer of assets between different rollups, Orbiter Finance contributes to a more interconnected and efficient DeFi landscape.

Disclaimer: The information provided here is for informational purposes only and should not be taken as investment advice. Always conduct your own research before making any investment decisions.

How Cross-Rollup Transfer Works

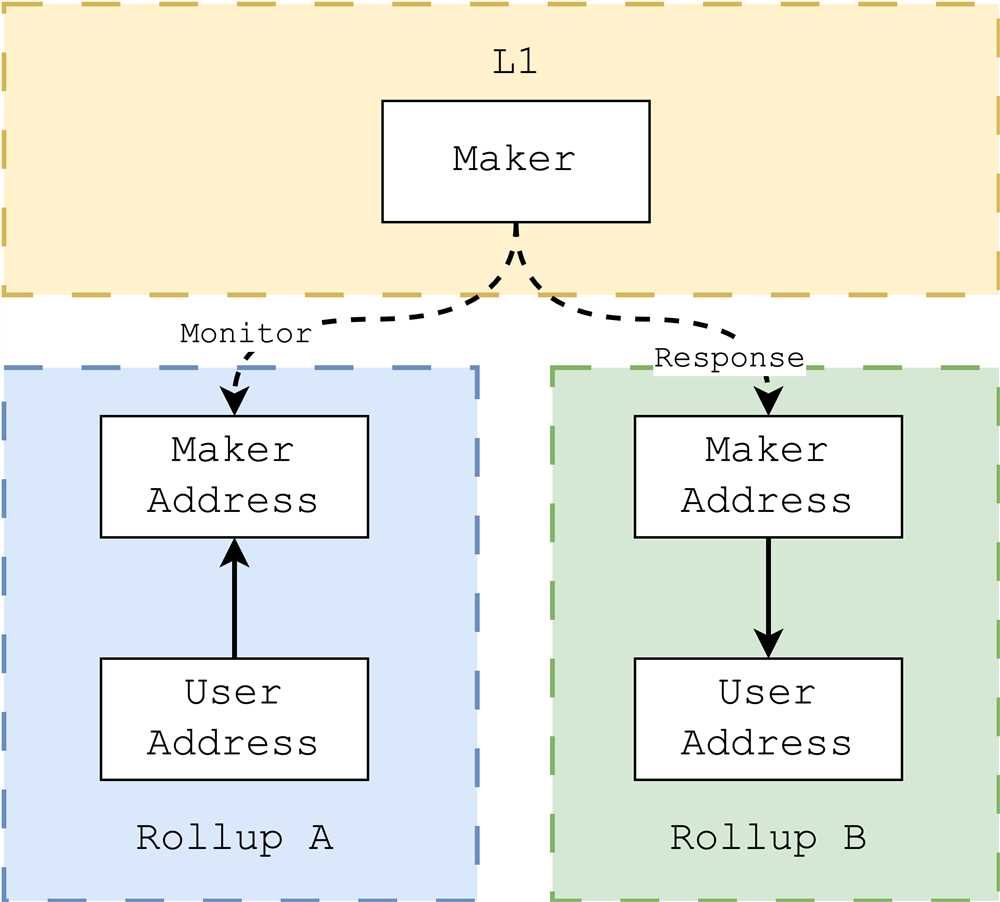

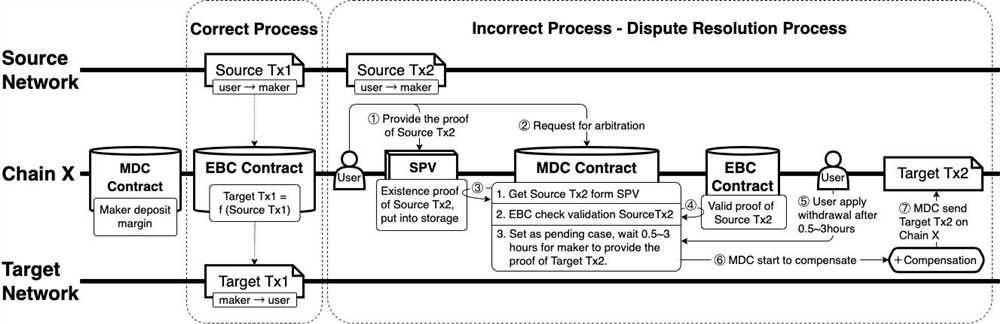

The cross-rollup transfer technology used by Orbiter Finance allows for seamless asset transfers between different rollup chains. Here is a step-by-step explanation of how it works:

- User initiates a cross-rollup transfer by specifying the asset to be transferred and the destination rollup chain.

- The transfer request is verified by the source rollup chain to ensure that the user has sufficient funds.

- The source rollup chain locks the user’s funds and creates a proof of ownership.

- The proof of ownership is submitted to the destination rollup chain.

- The destination rollup chain verifies the proof of ownership and accepts the transfer request.

- The destination rollup chain credits the user’s account with the transferred funds.

- The source rollup chain unlocks the user’s funds.

This process ensures that assets can be transferred between rollup chains in a secure and efficient manner. The use of proofs and verification steps helps to prevent double spending and other fraudulent activities.

By enabling cross-rollup transfers, Orbiter Finance opens up new possibilities for users and developers in the decentralized finance (DeFi) space. It allows for the interoperability of different rollup chains, which can help improve scalability and reduce transaction costs.

Overall, the cross-rollup transfer technology offered by Orbiter Finance is a key innovation that brings more flexibility and efficiency to the world of blockchain-based financial transactions.

Step-by-Step Process of Cross-Rollup Transfer

In order to understand the cross-rollup transfer technology of Orbiter Finance, it is important to have a clear understanding of the step-by-step process involved. This section will provide a detailed breakdown of each step:

Step 1: The user initiates the cross-rollup transfer by selecting the desired token and specifying the desired transfer amount.

Step 2: The user’s transaction request is broadcasted to the Orbiter Finance network.

Step 3: The Orbiter Finance network validates the transaction request and verifies the user’s account balance to ensure sufficient funds are available for the transfer.

Step 4: If the user’s account balance is sufficient, the Orbiter Finance network locks the specified amount of tokens in a smart contract.

Step 5: The locked tokens are then transferred to the Orbiter Finance network’s designated cross-rollup contract.

Step 6: The designated cross-rollup contract then unlocks the tokens and transfers them to the recipient’s account on the target rollup chain.

Step 7: The recipient’s account on the target rollup chain is credited with the transferred tokens.

Step 8: The cross-rollup transfer is considered complete and both the sender and recipient receive a confirmation of the successful transfer.

This step-by-step process ensures a secure and efficient cross-rollup transfer of tokens within the Orbiter Finance network. By utilizing smart contracts and designated cross-rollup contracts, Orbiter Finance is able to facilitate seamless transfers while maintaining the integrity of the network.

The Benefits of Cross-Rollup Transfer Technology

The introduction of the cross-rollup transfer technology by Orbiter Finance comes with several key benefits for users and the overall ecosystem:

1. Improved scalability: Cross-rollup transfer technology significantly enhances the scalability of the blockchain network. By allowing efficient movement of assets across different rollups, it reduces congestion and optimizes transaction speeds. This benefit is particularly important during periods of high network activity when delays and increased gas fees commonly occur.

2. Enhanced interoperability: Cross-rollup transfer technology promotes interoperability between different chains and rollups. It enables seamless communication and transfer of assets between different layer 2 solutions, creating a cohesive ecosystem. This interoperability facilitates the integration of various decentralized applications, enhancing the overall user experience.

3. Lower fees and costs: With cross-rollup transfers, users can enjoy lower fees and costs compared to traditional on-chain transactions. By leveraging layer 2 solutions, which are known for their cost-efficiency, cross-rollup transfer technology streamlines the transfer process and reduces transaction fees. This makes it more affordable for users to engage in activities such as trading, lending, and staking.

4. Security and privacy: Cross-rollup transfer technology prioritizes security and privacy. By utilizing layer 2 solutions and cryptographic techniques, it ensures the safe transfer of assets without compromising sensitive information. This helps in protecting user funds and preserving their privacy, contributing to a more secure and trustworthy ecosystem.

5. Increased accessibility: The implementation of cross-rollup transfer technology makes decentralized finance (DeFi) more accessible to a wider range of users. It removes barriers such as high gas fees and network congestion, enabling users from all backgrounds to participate in DeFi activities. This inclusivity promotes financial freedom and expands the reach of blockchain technology.

Overall, the benefits of cross-rollup transfer technology offered by Orbiter Finance are key drivers in advancing the scalability, interoperability, affordability, security, and accessibility of blockchain networks and decentralized finance as a whole.

What is cross-rollup transfer technology?

Cross-rollup transfer technology is a technology developed by Orbiter Finance that enables the seamless transfer of assets between different rollups. It allows users to move their assets from one rollup to another without any friction, ensuring interoperability and scalability within the Orbiter ecosystem.

How does Orbiter Finance achieve cross-rollup transfers?

Orbiter Finance achieves cross-rollup transfers through the use of bridges. These bridges act as connectors between different rollups, allowing assets to be transferred back and forth. The transfers are enabled through smart contracts, which verify and facilitate the movement of assets across the different rollups.

What are the benefits of cross-rollup transfer technology?

Cross-rollup transfer technology offers several benefits. One, it allows for increased scalability within the Orbiter ecosystem by distributing the load across different rollups. Two, it ensures interoperability, as users can easily move their assets between different rollups. Three, it reduces transaction costs and improves efficiency by facilitating seamless transfers. Overall, it provides a smoother and more efficient user experience within the Orbiter Finance platform.

Can cross-rollup transfers be performed with any asset?

Cross-rollup transfers can be performed with any asset that is supported by the Orbiter Finance platform. The specific assets that can be transferred between rollups may vary depending on the bridges and smart contracts in place. It’s important to check the supported assets before initiating a cross-rollup transfer to ensure compatibility.