Understanding the Effect of Withholding Fees on Orbiter Finance Investments: A Comprehensive Analysis

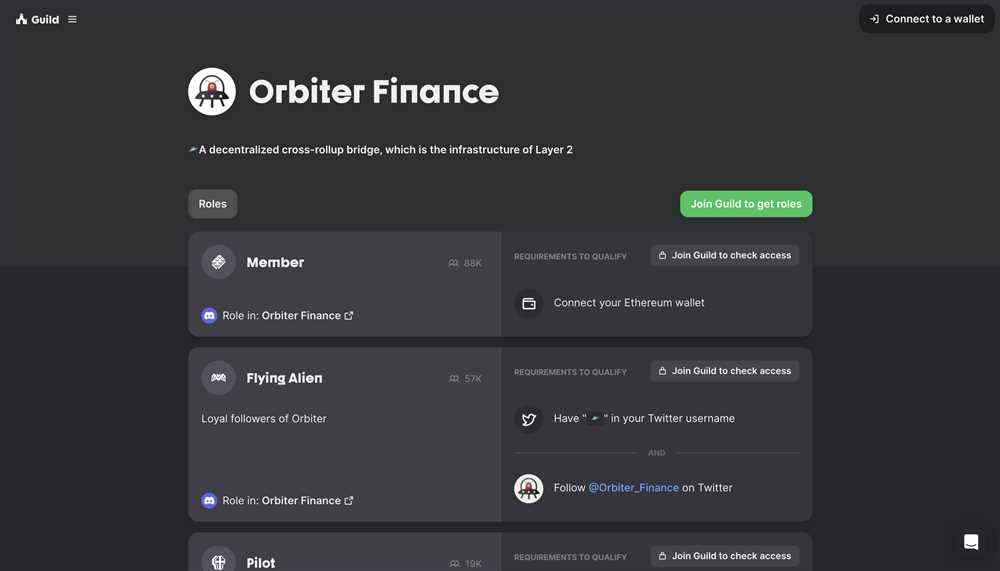

Are you tired of high fees eating into your investment returns? Look no further than Orbiter Finance, the revolutionary platform that puts you in control of your financial future. With our innovative approach, you can say goodbye to those unnecessary withholding fees that have been draining your hard-earned money.

At Orbiter Finance, we understand the importance of maximizing your investment potential. That’s why we have designed a fee structure that is transparent, fair, and tailored to your needs. Unlike traditional financial institutions, we believe in putting the power back in your hands.

With our platform, you can say goodbye to hidden fees and hello to unlimited possibilities. Whether you are new to investing or a seasoned pro, Orbiter Finance offers a range of investment products and services to suit your unique goals and risk tolerance.

Don’t let unnecessary fees drag down your investment performance. Join Orbiter Finance today and start taking control of your financial future.

Why Withholding Fees Matter

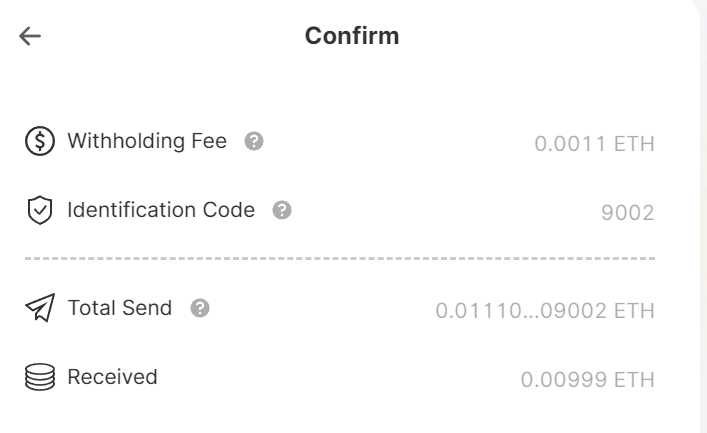

Withholding fees can have a significant impact on your investments in Orbiter Finance. These fees are the charges that are deducted by the investment company from your account whenever you make a withdrawal or sell your investments. While they may seem like a small percentage, over time, these fees can add up and eat into the growth potential of your investments.

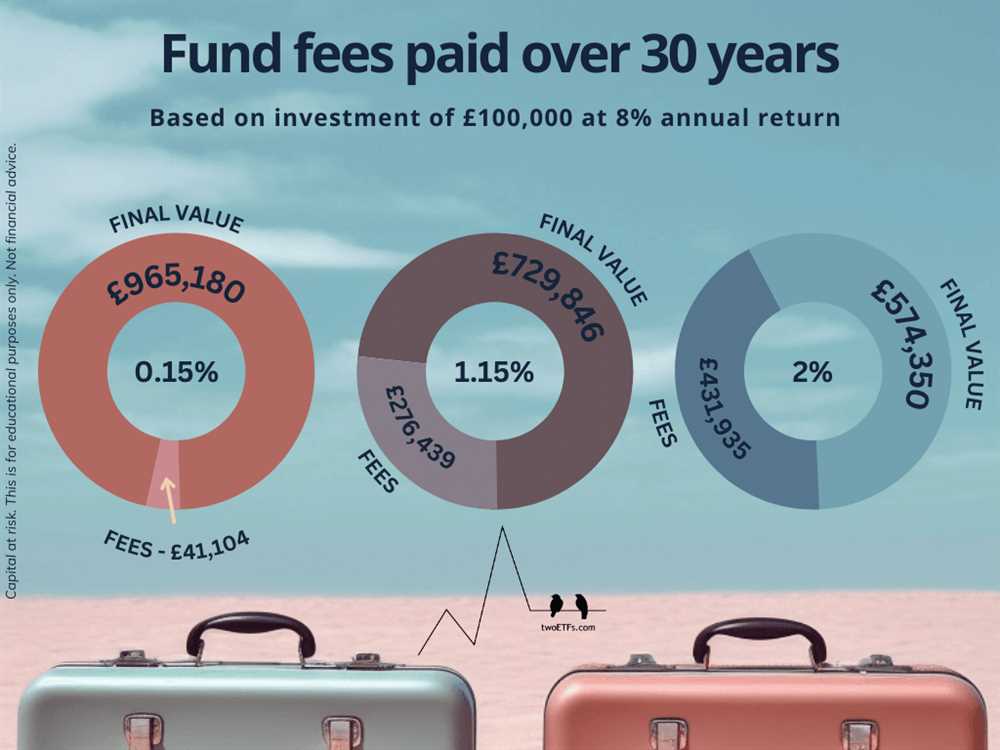

One of the main reasons why withholding fees matter is that they can erode your investment returns. Even a small fee of 1% can have a compounding effect and significantly reduce your overall returns over the long term. For example, if you have an investment of $100,000 and the withholding fee is 1% per year, you would be paying $1,000 in fees every year. Over a period of 10 years, that amounts to $10,000.

Another reason why withholding fees matter is that they can limit your access to your own money. When you need to withdraw funds from your investment account, you may be required to pay a fee. This can be problematic if you have an unexpected expense or need access to your funds for an emergency. These fees can make it challenging to manage your finances effectively and access the money you need when you need it.

Furthermore, withholding fees can also create a disincentive for investors to actively manage their portfolios. If you know that you will be charged a fee every time you sell or make a withdrawal, you may be hesitant to make any changes to your investments. This can prevent you from taking advantage of potential opportunities or adjusting your strategy as market conditions change.

To ensure that your investments in Orbiter Finance are optimized for growth, it is essential to consider the impact of withholding fees. By being aware of these fees and understanding their long-term effects, you can make informed decisions about your investment strategy and maximize your potential returns.

Calculating the True Cost

When investing in Orbiter Finance, it’s important to consider the true cost of your investments. This goes beyond just the fees that are withheld. To calculate the true cost, you need to take into account several factors:

- Withholding Fees: These are the fees that Orbiter Finance deducts from your investment. They are typically a percentage of your total investment and can vary depending on the specific investment option you choose.

- Annual Expenses: In addition to withholding fees, Orbiter Finance may charge annual expenses for managing your investment. These expenses cover administrative costs, research, and other operational expenses.

- Opportunity Cost: By investing in Orbiter Finance, you are potentially giving up other investment opportunities. It’s important to consider the potential returns you could have earned by investing in other options.

- Taxes: Depending on your jurisdiction, you may be liable to pay taxes on your investment gains. It’s important to factor in any taxes you may have to pay when calculating the true cost.

- Inflation: Over time, the value of money decreases due to inflation. When calculating the true cost of your investments, it’s important to take into account the impact of inflation on the purchasing power of your returns.

When considering investing in Orbiter Finance, it’s essential to calculate the true cost of your investments. By taking into account all of these factors mentioned above, you can make an informed decision about whether Orbiter Finance aligns with your financial goals and objectives.

Choosing the Right Investment Strategy

When it comes to investing your hard-earned money, choosing the right investment strategy is crucial. It can make a significant difference in the returns you generate and the risks you mitigate. Here are a few important factors to consider when selecting the right investment strategy:

1. Define Your Financial Goals

Before selecting an investment strategy, it’s essential to define your financial goals. Are you investing for retirement? Are you saving for a down payment on a house? Understanding your objectives will help you determine the right investment strategy that aligns with your goals.

2. Assess Your Risk Tolerance

Every investor has a different risk tolerance. Some individuals are comfortable with taking on higher levels of risk to pursue higher returns, while others prefer a more conservative approach. Assessing your risk tolerance will help you identify the investment strategy that best suits your comfort level.

3. Consider your Time Horizon

Your time horizon refers to the length of time you intend to keep your investments before needing to access the funds. If you have a longer time horizon, you may be able to tolerate more market volatility, allowing you to consider more aggressive investment strategies. Shorter time horizons may require more conservative approaches.

4. Diversify Your Portfolio

Diversification is a key component of any successful investment strategy. By spreading your investments across different asset classes and industries, you can reduce the risk associated with any single investment and potentially enhance your overall returns. Consider diversifying your portfolio through a mix of stocks, bonds, real estate, and other investment options.

5. Review and Rebalance Regularly

Investing is an ongoing process, and it’s important to regularly review and rebalance your portfolio to ensure it continues to align with your investment strategy and goals. Market conditions and your personal circumstances may change over time, so periodic adjustments can help you stay on track.

By carefully considering these factors and doing thorough research, you can choose the right investment strategy that works best for you. Remember, it’s important to consult with a financial advisor or investment professional to ensure your chosen strategy aligns with your specific needs and objectives.

What are withholding fees?

Withholding fees are fees that are deducted from your investment returns. They are usually a percentage of the total investment amount and are taken out before the returns are distributed to investors.

How do withholding fees affect my investments in Orbiter Finance?

Withholding fees can have a significant impact on your investments in Orbiter Finance. These fees reduce the amount of returns you receive, which means less money in your pocket. It is important to consider the impact of withholding fees when making investment decisions.

Can you give an example of how withholding fees can affect my investments?

Sure! Let’s say you have invested $10,000 in Orbiter Finance and the withholding fee is 2%. This means that $200 will be deducted from your returns before they are distributed to you. If the investment generates a return of 5%, you would normally expect to receive $500. However, after deducting the withholding fee, you would only receive $300.