Understanding the Technology behind Orbiter Finance A Deep Dive into Cross-Rollup Bridges

Orbiter Finance has emerged as a fascinating project in the world of decentralized finance (DeFi). At its core, Orbiter Finance aims to revolutionize the way assets are transferred and exchanged across different blockchains. One of the key technologies that make this possible is the concept of cross-rollup bridges. In this article, we will take a deep dive into this innovative technology and explore how it enables seamless interoperability between different blockchains.

Traditional blockchains are often limited in their ability to communicate and share information with each other. This can create barriers for users who want to transfer and trade assets across different chains. However, cross-rollup bridges offer a solution to this problem by establishing a secure and reliable connection between blockchains.

The concept of a cross-rollup bridge involves creating a bridge between two or more blockchains, allowing them to share information and transfer assets seamlessly. This is achieved through the use of smart contracts, which act as intermediaries between the different chains. These smart contracts facilitate the transfer of assets by locking them on one chain and issuing corresponding tokens on the other chain.

One of the key advantages of cross-rollup bridges is their ability to maintain a high level of security while facilitating fast and efficient transfers. By leveraging the security features of the underlying blockchains, cross-rollup bridges ensure that assets are transferred in a secure and trustless manner. Additionally, the use of smart contracts provides an extra layer of security, as all transactions are executed according to predefined rules and conditions.

In conclusion, cross-rollup bridges represent a groundbreaking technology that is set to transform the world of decentralized finance. By enabling seamless interoperability between different blockchains, Orbiter Finance is paving the way for a future where assets can be transferred and exchanged in a secure, efficient, and decentralized manner. As the DeFi space continues to evolve, cross-rollup bridges will undoubtedly play a vital role in unlocking the full potential of blockchain technology.

The Importance of Cross-Rollup Bridges in DeFi

In the world of decentralized finance (DeFi), interoperability is a crucial factor for the success and scalability of various applications and protocols. Cross-rollup bridges play a pivotal role in enabling seamless communication and value transfer between different blockchains and layer-2 solutions. They serve as the connective tissue that allows assets and data to flow freely across various networks, unlocking a wide range of possibilities for users and developers.

Enhanced Liquidity and Accessibility

By connecting different layer-2 solutions, cross-rollup bridges enhance liquidity and accessibility for users. They enable users to easily transfer their assets, such as tokens, between various networks without the need for complex and time-consuming processes. This opens up new opportunities for arbitrage, trading, and liquidity provision, ultimately benefiting the overall DeFi ecosystem.

Moreover, cross-rollup bridges promote accessibility by removing the barriers that exist between different networks. Users can seamlessly interact with protocols and applications on various blockchains, expanding their access to a wider range of financial products and services. This allows for more inclusive participation and democratization of finance.

Scalability and Efficiency

One of the key challenges in the DeFi space is scalability. As the popularity and usage of DeFi applications grow, the underlying blockchains can become congested, resulting in slower transaction times and higher fees. Cross-rollup bridges address this scalability issue by offloading transactions to layer-2 solutions, which are designed to handle a higher volume of transactions at lower costs.

By leveraging cross-rollup bridges, users can enjoy faster and more efficient transactions, as well as lower fees. This helps to reduce friction and improve the overall user experience, making DeFi more accessible and user-friendly.

Interoperability and Collaboration

Interoperability is a key driver of innovation and growth in the DeFi space. Cross-rollup bridges facilitate collaboration between different blockchains, layer-2 solutions, and protocols, allowing them to seamlessly communicate and leverage each other’s functionalities. This enables developers to build more sophisticated and interconnected applications that can tap into the strengths of multiple networks.

The interoperability provided by cross-rollup bridges also fosters the development of cross-chain liquidity pools and composability. Users can pool their assets from different networks together, increasing liquidity and enabling new use cases, such as decentralized exchanges and lending protocols.

In conclusion, cross-rollup bridges play a vital role in enhancing the interoperability, scalability, and accessibility of the DeFi ecosystem. They enable seamless communication and value transfer between different networks, opening up new possibilities for users and developers. As the DeFi space continues to evolve, cross-rollup bridges will be instrumental in driving innovation and unlocking the full potential of decentralized finance.

How Cross-Rollup Bridges Work

Cross-rollup bridges are a crucial component of Orbiter Finance’s ecosystem, enabling the seamless transfer of assets between different rollup chains. These bridges provide interoperability and liquidity across multiple layer 2 solutions, enhancing scalability and efficiency in the decentralized finance (DeFi) space.

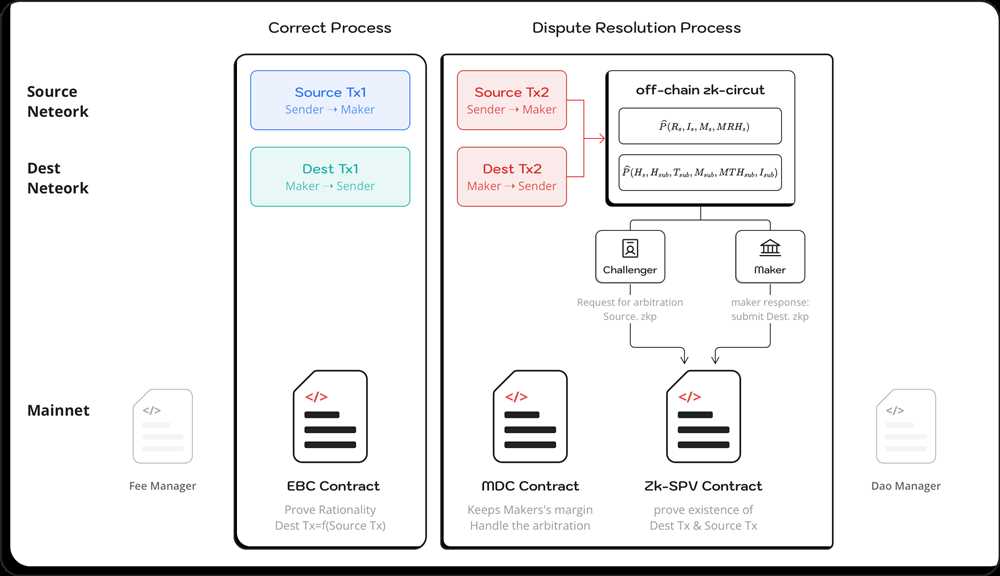

The primary function of a cross-rollup bridge is to facilitate the movement of assets from one rollup chain to another. This is achieved through a multi-step process that involves the following key components:

| 1. Asset Locking | The first step in the cross-rollup bridge process is locking the assets on the source rollup chain. This ensures that the assets are securely held and cannot be accessed or transferred while the bridge transaction is in progress. |

| 2. Message Passing | After the assets are locked, a message is generated and passed to the recipient rollup chain. This message contains all the necessary information about the asset transfer, such as the amount, sender, and recipient addresses, to ensure a smooth transaction. |

| 3. Asset Minting | Once the message is received by the recipient rollup chain, the assets are minted on the new chain. This process creates new representations of the assets that can be used and transferred within the recipient chain’s ecosystem. |

| 4. Asset Unlocking | Finally, the assets are unlocked on the recipient rollup chain, allowing users to freely use and transfer them within the chain’s ecosystem. This step completes the cross-rollup bridge process, enabling seamless asset transfers between different rollup chains. |

Overall, cross-rollup bridges play a critical role in expanding the reach and usability of layer 2 solutions. By enabling the transfer of assets between different rollup chains, these bridges enhance liquidity, scalability, and efficiency in the decentralized finance ecosystem, ultimately contributing to the growth and adoption of the industry.

The Benefits and Challenges of Cross-Rollup Bridges

As the demand for blockchain scalability and interoperability grows, cross-rollup bridges have emerged as a potential solution to bridge the gap between different layer 2 scaling solutions. These bridges allow users to seamlessly transfer assets and data between different rollup chains, enabling greater interoperability and flexibility in the blockchain ecosystem.

Benefits of Cross-Rollup Bridges

1. Improved Scalability: Cross-rollup bridges can significantly enhance the scalability of layer 2 solutions by allowing transactions to be processed off-chain and then settled on the main chain. This reduces the burden on the main chain and increases overall network capacity, making it easier to handle high transaction volumes.

2. Seamless Asset Transfers: With cross-rollup bridges, users can transfer assets between different rollup chains without the need for complex and time-consuming processes. This simplifies the user experience and facilitates the movement of assets across multiple chains, promoting liquidity and interoperability.

3. Cost Efficiency: By offloading transactions to layer 2 solutions, cross-rollup bridges can significantly reduce transaction costs compared to conducting transactions solely on the main chain. This makes it more affordable for users to interact with decentralized applications (dApps) and contributes to wider adoption of blockchain technology.

Challenges of Cross-Rollup Bridges

1. Security Risks: Connecting multiple layer 2 solutions through cross-rollup bridges introduces additional security risks. The bridges themselves need to be secure and properly audited to ensure the integrity of asset transfers and prevent potential vulnerabilities or attacks.

2. Cross-Chain Compatibility: Different rollup chains may utilize different technologies, consensus mechanisms, or smart contract languages, creating compatibility challenges when building cross-rollup bridges. Ensuring seamless interoperability across different chains requires careful planning and coordination.

3. Governance and Consensus: Cross-rollup bridges require effective governance and consensus mechanisms to ensure decentralized decision-making and prevent centralization. This includes deciding on bridge parameters, handling potential disputes, and maintaining transparency and trust among the participating chains.

In conclusion, cross-rollup bridges present numerous benefits for blockchain scalability and interoperability. However, they also come with challenges that need to be addressed to ensure their secure and efficient integration into the blockchain ecosystem.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol that aims to provide users with a seamless experience in accessing various DeFi platforms and protocols.

How does Orbiter Finance work?

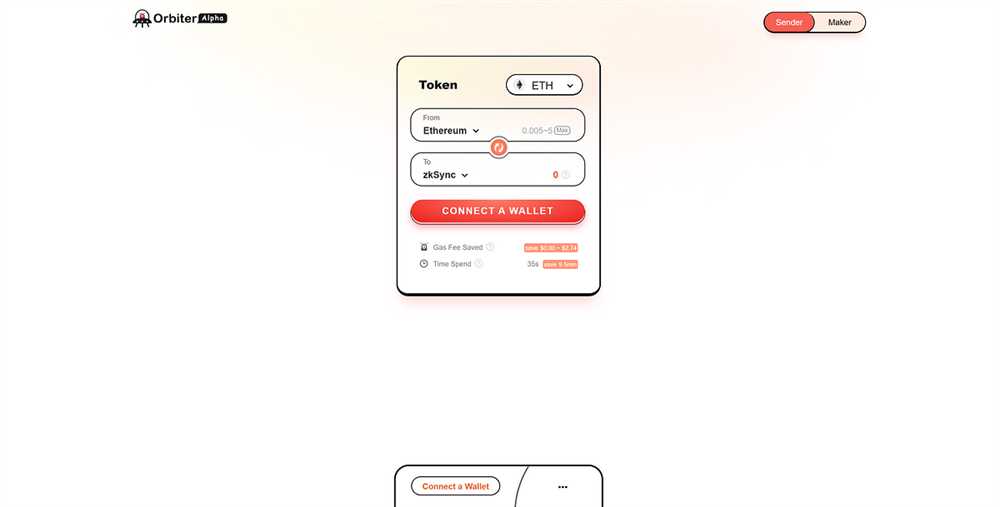

Orbiter Finance works by utilizing cross-rollup bridges, which are a technological solution allowing the transfer of assets and data between different layer 2 solutions or rollups.

What are cross-rollup bridges?

Cross-rollup bridges are technological solutions that enable the transfer of assets and data between different layer 2 solutions or rollups. They help create interoperability and enhance the scalability of decentralized applications.

Why are cross-rollup bridges important for DeFi?

Cross-rollup bridges are important for DeFi because they enable seamless asset transfers and data exchange between different layer 2 solutions or rollups. This improves overall interoperability, scalability, and accessibility of decentralized finance applications.