Understanding Yield Farming and its Benefits: A Deep Dive into Orbiter Finance’s Opportunities for Investors

Explore Orbiter Finance’s Opportunities and take advantage of the growing trend of Yield Farming.

If you’re looking for ways to grow your crypto investments, yield farming might be the answer you’ve been searching for. Yield farming, also known as liquidity mining, is a decentralized finance (DeFi) concept that allows you to earn passive income by lending or staking your cryptocurrencies. With Orbiter Finance, you can tap into the potential of yield farming and maximize your earnings.

How does yield farming work?

Yield farming involves providing liquidity to decentralized exchanges (DEXs) and other DeFi protocols in exchange for rewards. By lending or staking your assets, you become an essential part of the DeFi ecosystem, helping to fuel its liquidity and earning rewards for your contribution.

Why choose Orbiter Finance?

Orbiter Finance offers a user-friendly platform that allows you to easily participate in yield farming. With our advanced algorithms and automated strategies, you can optimize your yield farming experience and maximize your profits. Whether you’re a beginner or an experienced crypto investor, Orbiter Finance provides a secure and efficient way to leverage the potential of yield farming.

Don’t miss out on the potential rewards of yield farming! Start exploring Orbiter Finance’s opportunities today and take your crypto investments to new heights.

What is Yield Farming?

Yield Farming is a term used in the world of decentralized finance (DeFi) that refers to the process of earning a return on investment by providing liquidity to a decentralized platform. In this context, “yield” refers to the interest or rewards that are generated from participating in various DeFi protocols.

Yield Farming involves locking up or staking cryptocurrencies in smart contracts to earn passive income. This can be done by depositing your funds into liquidity pools, which are pools of tokens that users contribute to and are used for various decentralized applications (DApps).

When you participate in Yield Farming, you become a liquidity provider, as your funds are used by other users to trade or lend assets, and you are rewarded with interest or fees generated by those transactions. This allows you to earn a yield on your cryptocurrency holdings while also contributing to the overall liquidity of the DeFi ecosystem.

There are various strategies and opportunities available for Yield Farming, depending on the platform and protocol you choose to participate in. These can include staking stablecoins, providing liquidity to decentralized exchanges, or participating in yield aggregators that automatically optimize your returns by moving your funds between different protocols.

Benefits of Yield Farming

Yield Farming offers several potential benefits for cryptocurrency holders:

- High Returns: Yield Farming can provide higher returns compared to traditional savings accounts or traditional financial investments.

- Liquidity Provision: By becoming a liquidity provider, you contribute to the overall liquidity of the DeFi ecosystem.

- Diversification: Yield Farming allows you to diversify your cryptocurrency holdings by participating in different protocols and strategies.

- Automation: Some yield aggregators automate the process of optimizing returns by automatically moving funds between different protocols.

However, it’s important to note that Yield Farming also carries risks, including smart contract vulnerabilities, impermanent loss, and market volatility. It’s crucial to do thorough research and understand the risks before participating in Yield Farming.

In conclusion, Yield Farming is a method for cryptocurrency holders to earn passive income and contribute to the liquidity of the DeFi ecosystem. It offers potential high returns and diversification opportunities, but also carries risks that should be carefully considered.

Defining yield farming in the crypto world

Yield farming, also known as liquidity mining, has become a popular concept in the world of cryptocurrency. It refers to the process of providing liquidity to decentralized finance (DeFi) protocols by locking up crypto assets in smart contracts. In return for providing liquidity, users are rewarded with additional tokens.

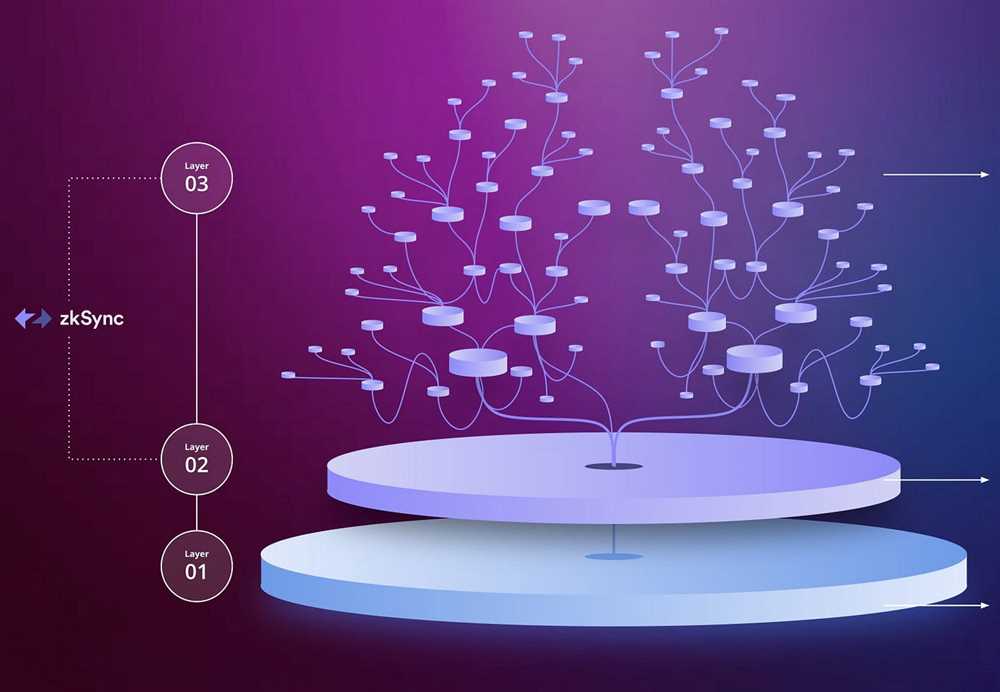

The main goal of yield farming is to maximize returns on investment by seeking out the highest yield opportunities available in the crypto market. This is achieved by leveraging different DeFi protocols and strategies, such as automated market makers (AMMs), lending and borrowing platforms, and yield aggregators.

How does yield farming work?

Yield farming involves several steps. First, users need to select the appropriate DeFi protocols to provide liquidity. They deposit their crypto assets into smart contracts and receive liquidity tokens in return, which represent their share of the liquidity pool.

Once the liquidity is provided, users can then stake these liquidity tokens in yield farming protocols to earn additional tokens as rewards. The rewards can vary depending on the protocol, and can include native governance tokens, protocol-specific tokens, or a share of transaction fees generated by the protocol.

It’s important to note that yield farming involves risk, as the value of the rewarded tokens can fluctuate and there is also the risk of smart contract vulnerabilities or hacker attacks. Therefore, it’s crucial for participants to do thorough research and due diligence before engaging in any yield farming activities.

Benefits of yield farming

Yield farming provides several benefits to participants. Firstly, it allows them to earn passive income by leveraging their existing crypto assets. This can be especially attractive in an environment of low traditional interest rates.

Additionally, yield farming can offer higher returns compared to traditional savings or investment methods. By actively managing their liquidity and exploring different opportunities, participants can potentially generate higher yields and maximize their returns.

Furthermore, yield farming promotes the growth and development of the DeFi ecosystem. By providing liquidity to decentralized protocols, users contribute to the overall liquidity and stability of the market. This, in turn, attracts more users and investors, leading to further innovation and advancement in the crypto space.

| Key Takeaways |

|---|

| Yield farming involves providing liquidity to DeFi protocols in exchange for additional tokens. |

| It aims to maximize returns by leveraging different DeFi strategies and protocols. |

| Yield farming involves risks, such as token volatility and smart contract vulnerabilities. |

| Benefits of yield farming include passive income generation, higher returns, and contributing to the growth of the DeFi ecosystem. |

Understanding Orbiter Finance

Orbiter Finance is a revolutionary decentralized finance (DeFi) platform that aims to provide users with a simple and secure way to participate in yield farming and earn incredible returns on their investments. By leveraging innovative blockchain technology, Orbiter Finance enables users to access and explore a wide range of opportunities in the DeFi space.

With Orbiter Finance, users can take advantage of various yield farming strategies to maximize their returns. Yield farming, also known as liquidity mining, involves providing liquidity to decentralized exchanges (DEXs) and earning rewards in the form of additional tokens or fees. This allows users to not only earn passive income but also contribute to the liquidity and growth of the DeFi ecosystem.

Orbiter Finance offers a user-friendly interface and intuitive tools that make it easy for anyone, regardless of their level of expertise, to participate in yield farming. The platform provides access to multiple farming pools, each with its own unique set of opportunities and potential returns. Users can choose the farming pool that aligns with their investment goals and risk appetite.

One of the key features of Orbiter Finance is its transparent and secure smart contract system. All farming pools on the platform are powered by smart contracts, which are autonomous and self-executing. This ensures that all transactions and rewards are carried out in a transparent and trustless manner, without the need for intermediaries or centralized control.

Furthermore, Orbiter Finance is built on the Binance Smart Chain (BSC), which offers high performance, low fees, and excellent security. This allows users to conduct transactions quickly and cost-effectively, without compromising on the safety of their funds.

In addition to yield farming, Orbiter Finance also offers other features such as staking and governance. Staking allows users to lock their tokens and earn additional rewards, while governance gives users the power to participate in the decision-making process of the platform. This ensures that the community has a say in the development and future direction of Orbiter Finance.

In conclusion, Orbiter Finance is a comprehensive and user-friendly DeFi platform that allows users to participate in yield farming and explore various opportunities in the DeFi space. With its transparent smart contract system, intuitive interface, and robust security features, Orbiter Finance is poised to revolutionize the way users interact with decentralized finance.

Exploring the opportunities offered by Orbiter Finance

Orbiter Finance is a revolutionary platform that offers numerous opportunities for individuals seeking to maximize their earnings through yield farming. Yield farming is a process that allows users to earn passive income by providing liquidity to various decentralized finance protocols.

One of the key opportunities offered by Orbiter Finance is the ability to earn high yields on cryptocurrencies. By participating in the platform’s yield farming strategies, users can capitalize on the volatility of different digital assets and generate substantial returns on their investments.

Another exciting opportunity provided by Orbiter Finance is the ability to diversify one’s portfolio. The platform supports a wide range of cryptocurrencies, allowing users to invest in multiple assets and reduce their overall risk exposure. This diversification strategy enables individuals to hedge against market fluctuations and maximize the potential for earning profits.

Furthermore, Orbiter Finance offers users the opportunity to actively participate in the governance of the platform. By holding the native token of the platform, known as ORB, users have the power to vote on important decisions and shape the future direction of Orbiter Finance. This level of participation not only provides users with a sense of ownership but also empowers them to contribute to the growth and success of the platform.

Lastly, Orbiter Finance provides users with a user-friendly interface and comprehensive analytics tools to monitor their investments. This allows users to make informed decisions based on real-time data and ensure that their yield farming strategies are optimized for maximum profitability.

In conclusion, Orbiter Finance offers a plethora of opportunities for individuals interested in yield farming. From earning high yields on cryptocurrencies to diversifying portfolios and actively participating in platform governance, Orbiter Finance strives to provide a comprehensive and user-friendly platform for users to maximize their earnings potential.

How Can Yield Farming Benefit Me?

Yield farming is a revolutionary concept in the world of decentralized finance (DeFi) that allows users to earn passive income by providing liquidity to various DeFi protocols. Here are some of the ways in which yield farming can benefit you:

1. High Potential Earnings: Yield farming offers the potential for high returns compared to traditional financial instruments. By participating in yield farming, you can earn a percentage of the annual percentage yield (APY) as rewards for providing liquidity to the protocols.

2. Diversification: Yield farming allows you to diversify your investment portfolio by participating in multiple DeFi protocols simultaneously. This diversification helps spread risk and provides an opportunity to earn rewards from different sources.

3. Flexibility and Control: Yield farming allows you to have full control over your funds. You can choose when and how much liquidity to provide, as well as which protocols to participate in. This flexibility allows you to optimize your earning potential and adapt to changing market conditions.

4. Passive Income: By participating in yield farming, you can earn passive income without actively trading or managing your funds. Once you provide liquidity, you can sit back and watch your earnings grow over time, making it an attractive option for individuals who want to generate passive income.

5. Early Access to New Projects: Yield farming often provides early access to new projects and tokens. This gives you the opportunity to invest in promising projects before they gain mainstream attention, potentially maximizing your returns.

6. Community Participation: Yield farming allows you to actively participate in the DeFi community. You can engage with other yield farmers, join discussions, and contribute to the development and growth of the DeFi ecosystem.

Overall, yield farming can offer a range of benefits, from high potential earnings and diversification to passive income and community engagement. However, it is important to conduct thorough research, understand the risks involved, and carefully evaluate each yield farming opportunity to make informed decisions.

Exploring the advantages of yield farming

Yield farming, also known as liquidity mining, is an innovative way for cryptocurrency holders to earn passive income by providing liquidity to decentralized finance (DeFi) protocols.

One of the major advantages of yield farming is the potential for high yields. By staking or lending their cryptocurrencies, users can earn rewards in the form of additional tokens or fees generated by the protocol.

Another advantage of yield farming is the ability to diversify one’s cryptocurrency portfolio. By participating in different yield farming protocols, users can spread their risks and potentially increase their overall returns.

Yield farming also provides an opportunity to participate in governance of the DeFi protocols. By holding the protocol’s governance token, users can have a say in the decision-making process and influence the direction of the protocol.

Moreover, yield farming allows users to take advantage of various farming strategies. These strategies may include compounding, where users reinvest their earned rewards, and leveraged farming, where users borrow funds to increase their farming returns.

Additionally, yield farming can be a more accessible and inclusive way to participate in the cryptocurrency ecosystem. Unlike traditional financial systems, anyone with an internet connection can get involved in yield farming and start earning passive income.

In conclusion, yield farming presents numerous advantages for cryptocurrency holders. From high yields and diversification to governance participation and innovative farming strategies, yield farming offers a range of benefits that can enhance one’s cryptocurrency investment journey.

What is yield farming?

Yield farming is a way to generate passive income by lending or staking cryptocurrencies on decentralized finance (DeFi) platforms. It involves the use of smart contracts to earn rewards in the form of additional tokens or fees.

How can yield farming benefit me?

Yield farming can benefit you by providing an opportunity to earn high yields on your cryptocurrency holdings. It allows you to put your idle assets to work and generate passive income through lending or staking. However, it’s important to note that yield farming also carries certain risks, such as smart contract vulnerabilities and market volatility.

What opportunities does Orbiter Finance offer for yield farming?

Orbiter Finance offers various opportunities for yield farming. They have a user-friendly platform that allows you to easily lend or stake your cryptocurrency assets and earn rewards. They also provide options to participate in liquidity mining and yield aggregation, which can further enhance your earnings. Moreover, Orbiter Finance aims to mitigate risks by implementing secure and audited smart contracts.