Allegations Against Orbiter Finance for Questionable Transaction Practices

Discover the truth about Orbiter Finance and their alleged questionable transaction practices.

Are your hard-earned funds at risk?

Orbiter Finance, a leading financial institution, has recently come under scrutiny for their alleged involvement in questionable transaction practices.

Customers are raising concerns about unexplained fees, unauthorized transactions, and suspicious account activity.

Join the discussion and find out if your financial security is compromised.

Don’t let your money be jeopardized. Learn the facts and protect your assets.

Stay informed. Stay in control.

Visit our website for more information and take charge of your financial future.

Orbiter Finance Accused

Orbiter Finance, a leading financial institution, has recently come under scrutiny for their questionable transaction practices. Allegations have surfaced regarding their lack of transparency and ethical standards.

Several customers have reported experiencing unauthorized charges on their accounts, while others have noticed discrepancies in their transaction history. It is alleged that Orbiter Finance may have engaged in deceptive practices, such as hidden fees and excessive interest rates.

Lack of Transparency

One of the main concerns raised by customers is Orbiter Finance’s lack of transparency. Many individuals have complained about the complexity of their contracts and the difficulty in understanding the terms and conditions. This lack of clarity has led to confusion and frustration, as customers feel misinformed and misled.

Questionable Ethical Standards

Customers have also expressed concerns about Orbiter Finance’s ethical standards. There have been claims of aggressive sales tactics, with representatives pressuring individuals into signing up for financial products without fully disclosing the associated risks. Additionally, some customers have reported difficulties in receiving clear and accurate information when attempting to resolve issues or dispute charges.

As these allegations continue to surface, it is important for consumers to be cautious when considering any financial services offered by Orbiter Finance. It is crucial to thoroughly research any company and carefully read all terms and conditions before entering into any financial agreements. Seeking advice from trusted financial advisors or consulting consumer protection agencies can also provide guidance and support in making informed decisions.

of Questionable Transaction

Orbiter Finance is currently facing scrutiny and accusations of engaging in questionable transaction practices. These allegations have raised concerns about the integrity and transparency of the company’s financial operations.

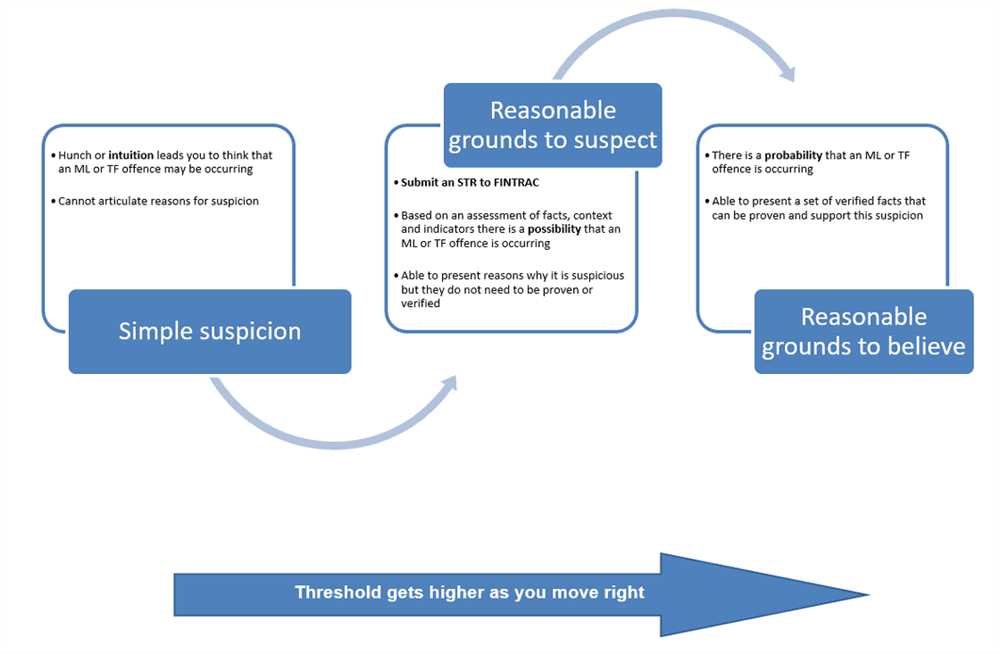

One of the main concerns raised is the company’s alleged involvement in suspicious transactions that may be linked to money laundering or other illicit activities. These transactions have caught the attention of regulatory bodies and law enforcement agencies, who are now investigating the matter.

Additionally, there have been reports of Orbiter Finance facilitating transactions with questionable parties or entities that have been flagged for illegal activities or unethical practices. These transactions have raised concerns about the company’s compliance with anti-money laundering and know-your-customer regulations.

Furthermore, there have been allegations of Orbiter Finance engaging in deceptive transaction practices, such as artificially inflating prices or manipulating financial data to create an illusion of profitability. These practices not only undermine the trust of investors and customers but also have potential legal ramifications.

As a result of these allegations, Orbiter Finance’s reputation and trustworthiness have been severely affected. Investors and potential clients are growing increasingly cautious about engaging in any financial transactions with the company, given the questionable nature of its practices.

| Impact of Questionable Transaction Practices: |

|---|

| Potential damage to the company’s reputation and brand image. |

| Loss of trust from investors, customers, and other stakeholders. |

| Regulatory investigations and potential legal consequences. |

| Possible financial losses for individuals or entities involved in transactions with Orbiter Finance. |

It is crucial for Orbiter Finance to address these allegations promptly and transparently. The company must demonstrate its commitment to responsible and ethical financial practices to rebuild trust and regain confidence from its stakeholders.

Please note that the information provided above is based on allegations and ongoing investigations. The final outcome of these investigations and the veracity of the allegations are yet to be determined.

Practices

Orbiter Finance takes pride in our commitment to ethical and transparent business practices. We understand the importance of maintaining a high level of trust with our clients and the wider community.

Our team of experienced professionals adheres to strict guidelines and industry standards to ensure that every transaction is conducted with the utmost integrity. We have implemented robust internal controls and comprehensive risk management frameworks to prevent any questionable practices.

Data Security

We recognize the sensitive nature of financial transactions and the importance of safeguarding our clients’ information. Orbiter Finance utilizes state-of-the-art encryption technology to protect data transmission and storage. We strictly comply with international privacy regulations to ensure the highest level of security.

Customer Support

At Orbiter Finance, we believe in providing exceptional customer service to our clients. Our dedicated customer support team is available 24/7 to address any concerns or inquiries. We strive to maintain open and transparent communication channels to build long-term relationships based on trust and mutual understanding.

When you choose Orbiter Finance, you can be confident that you are partnering with a company that upholds the highest standards of ethical business practices. We remain committed to transparency, integrity, and exceptional service.

Allegations of Unethical

Recent allegations have surfaced regarding the unethical practices of Orbiter Finance. These allegations suggest that the company has engaged in questionable transaction practices, raising concerns about its business ethics and integrity.

1. Misleading Advertising

One of the main allegations against Orbiter Finance revolves around misleading advertising. It is claimed that the company has been using deceptive tactics to lure customers, making false promises and exaggerating the benefits of their products or services. Such practices not only undermine trust but also mislead consumers into making uninformed decisions.

2. Unfair Treatment of Customers

Another concerning allegation is the unfair treatment of customers by Orbiter Finance. It is alleged that the company has engaged in practices such as overcharging, hidden fees, and manipulation of contract terms to exploit its customers. This behavior not only violates ethical standards but also shows a lack of respect for consumer rights and fair business practices.

These allegations have raised significant concerns among consumers and industry experts, prompting calls for a thorough investigation into Orbiter Finance’s practices. If proven true, the company may face severe consequences, including legal penalties and damage to its reputation.

In order to address these allegations, it is essential for Orbiter Finance to transparently communicate its processes and showcase a commitment to ethical business practices. Rebuilding trust will be crucial for the company to regain its reputation and retain its customer base.

Consumers are advised to be cautious when dealing with Orbiter Finance and to thoroughly research any financial decisions before entering into any agreement with the company. It is important to read and understand all terms and conditions, as well as to seek independent financial advice when necessary.

Business Conduct

At Orbiter Finance, we strive to maintain the highest level of business conduct and operate with transparency and integrity. We understand that the trust of our customers is paramount, and we are committed to delivering exceptional service while adhering to the highest ethical standards.

Our Code of Ethics

Our Code of Ethics serves as a guiding principle for all employees at Orbiter Finance. We expect all members of our team to exhibit professionalism, responsibility, and honesty in their interactions with clients, partners, and colleagues.

Transparency and Accountability

Transparency is a core value at Orbiter Finance. We believe in providing our customers with clear and accurate information about our products, services, and transaction processes. We ensure that all transactions are conducted in a transparent manner, and our clients are fully informed of any potential risks or costs.

Furthermore, Orbiter Finance maintains a strong system of internal controls to ensure accountability and prevent any improper or unethical practices. Our employees are regularly trained on compliance and risk management to ensure that they are up-to-date with the latest regulations and industry best practices.

Customer Satisfaction

At Orbiter Finance, customer satisfaction is our top priority. We are committed to going above and beyond to meet our customers’ needs and exceed their expectations. We value feedback from our clients and use it to continuously improve our products and services.

In the rare event that a customer raises a complaint or concern, we have a dedicated customer support team that promptly investigates and resolves any issues. We are committed to ensuring that our clients have a positive experience throughout their journey with us.

By upholding these principles of business conduct, Orbiter Finance aims to build long-lasting relationships with our clients and maintain our reputation as a trusted and reliable financial institution.

Potential Legal Implications

Orbiter Finance’s questionable transaction practices may have serious legal ramifications for both the company and its clients. These practices have raised concerns among regulatory authorities and may lead to investigations, fines, and potential lawsuits.

One potential legal implication is that Orbiter Finance could face allegations of fraud and misrepresentation. If it is discovered that the company engaged in deceptive practices or provided false information to its clients, it could be held legally liable for any financial losses incurred by its clients as a result.

Another potential legal consequence is that Orbiter Finance may be in violation of various financial regulations and laws. The company’s questionable transaction practices may violate anti-money laundering laws, securities regulations, or consumer protection laws. If found guilty of such violations, Orbiter Finance could be subject to significant fines and regulatory sanctions.

In addition to legal consequences for the company, clients who have been adversely affected by Orbiter Finance’s questionable transaction practices may have grounds to pursue legal action. They may be able to file lawsuits seeking compensation for their financial losses, as well as punitive damages for the harm caused by the company’s actions.

Furthermore, the reputation and public perception of Orbiter Finance may suffer as a result of these potential legal implications. Clients and potential clients may lose confidence in the company’s integrity and reliability, leading to a decline in business and financial losses.

In conclusion, Orbiter Finance’s questionable transaction practices could have significant legal implications for both the company and its clients. These potential legal consequences may include allegations of fraud, violations of financial regulations, lawsuits, fines, and reputational damage. It is important for both the company and its clients to seek legal advice and take appropriate action to address these issues.

| Potential Legal Implications |

|---|

| 1. Allegations of Fraud and Misrepresentation |

| 2. Violation of Financial Regulations and Laws |

| 3. Legal Action by Affected Clients |

| 4. Reputational Damage |

What is Orbiter Finance?

Orbiter Finance is a financial institution that offers various financial services such as loans, investments, and banking solutions.

What are the questionable transaction practices that Orbiter Finance has been accused of?

Orbiter Finance has been accused of engaging in questionable transaction practices like hidden fees, unfair interest rates, and deceptive marketing tactics. These practices have raised concerns among customers and regulatory authorities.

How can I protect myself from falling victim to questionable transaction practices by financial institutions?

To protect yourself, it is important to do thorough research on financial institutions before conducting any transactions with them. This includes reading reviews, checking their licenses and certifications, and understanding the terms and conditions of any agreements. Additionally, it is advisable to consult with a financial advisor or seek legal guidance to ensure that you are making informed decisions.