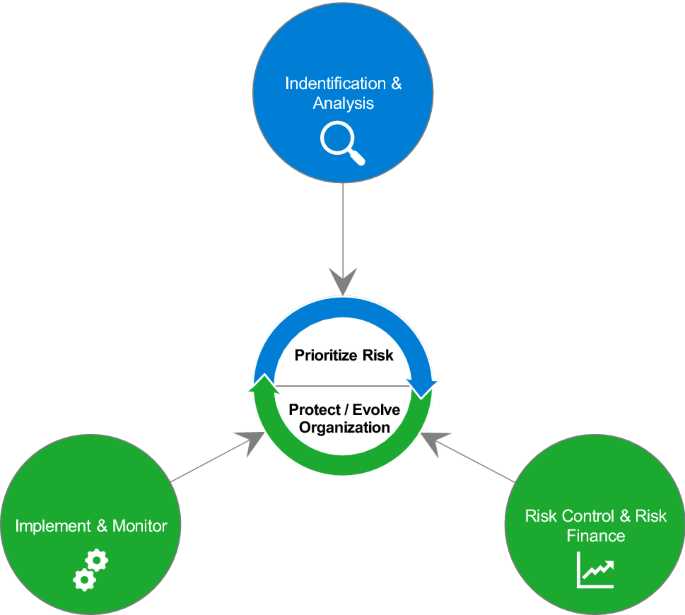

Introducing Orbiter Finance’s revolutionary Dynamic Risk Controls – the ultimate solution for reducing downside risks and maximizing your investments. With our cutting-edge technology and advanced algorithms, we provide real-time risk monitoring and proactive risk management to ensure your financial success.

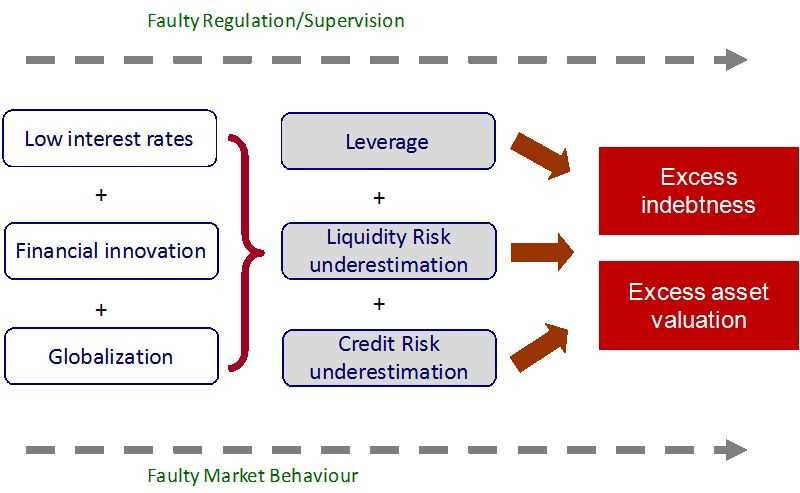

Stay ahead of the game with our innovative risk control system that automatically adjusts your investment strategy based on market conditions and emerging trends. No more sleepless nights worrying about unpredictable market fluctuations – Orbiter Finance has got you covered.

Minimize your losses and safeguard your portfolio with our intelligent risk management tools. Our system continuously analyzes market data, identifies potential risks, and applies strategic adjustments to protect your investments from downturns.

Experience peace of mind knowing that your financial future is in the capable hands of Orbiter Finance. Don’t let market volatility control your profits – take control with Dynamic Risk Controls today.

Introducing Dynamic Risk Controls

Welcome to Orbiter Finance, where we are revolutionizing the way you manage risk. Our innovative Dynamic Risk Controls are designed to help you reduce downside risks and maximize your potential returns.

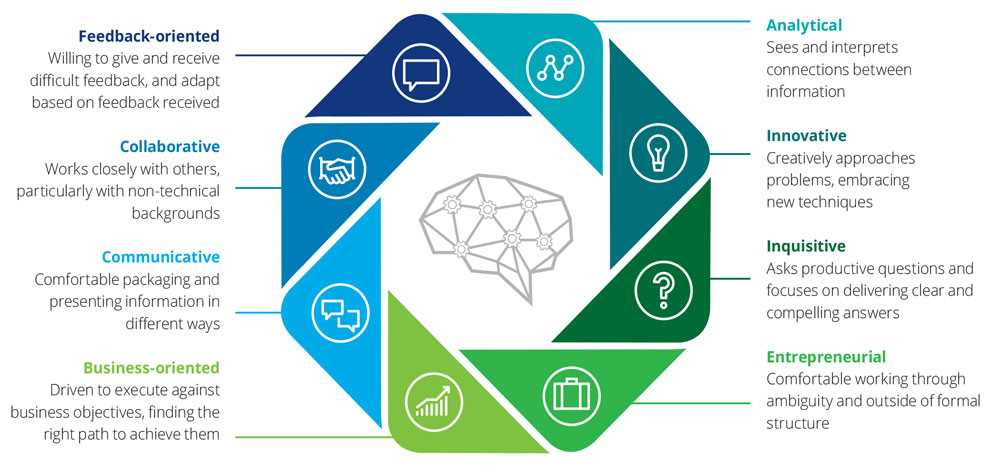

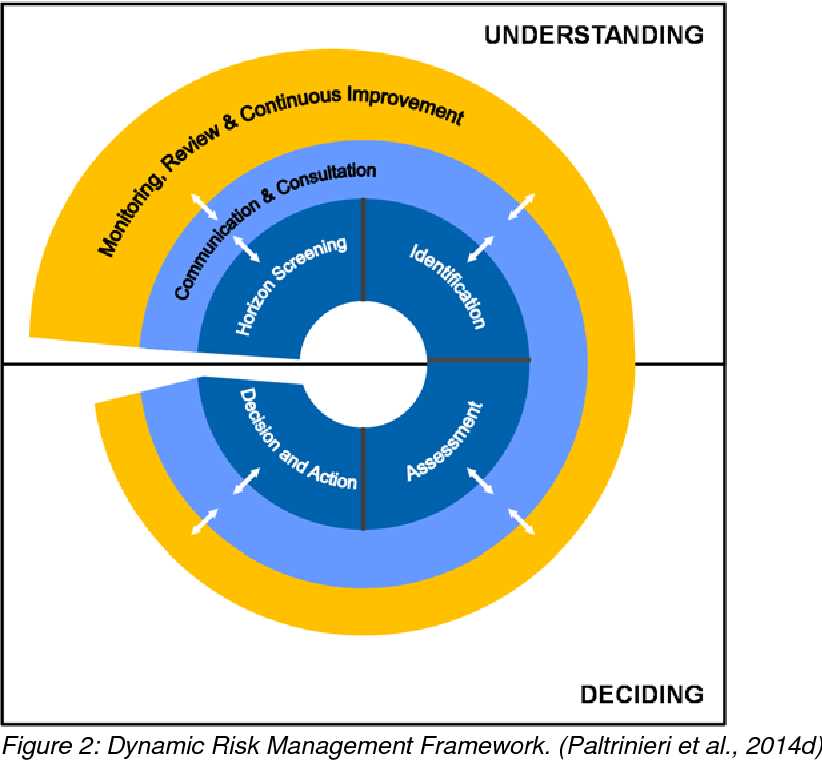

What sets us apart from traditional risk management strategies is our unique approach. We understand that the financial markets are constantly evolving, and so should your risk management strategy. That’s why we have developed a dynamic system that adapts in real-time to market conditions.

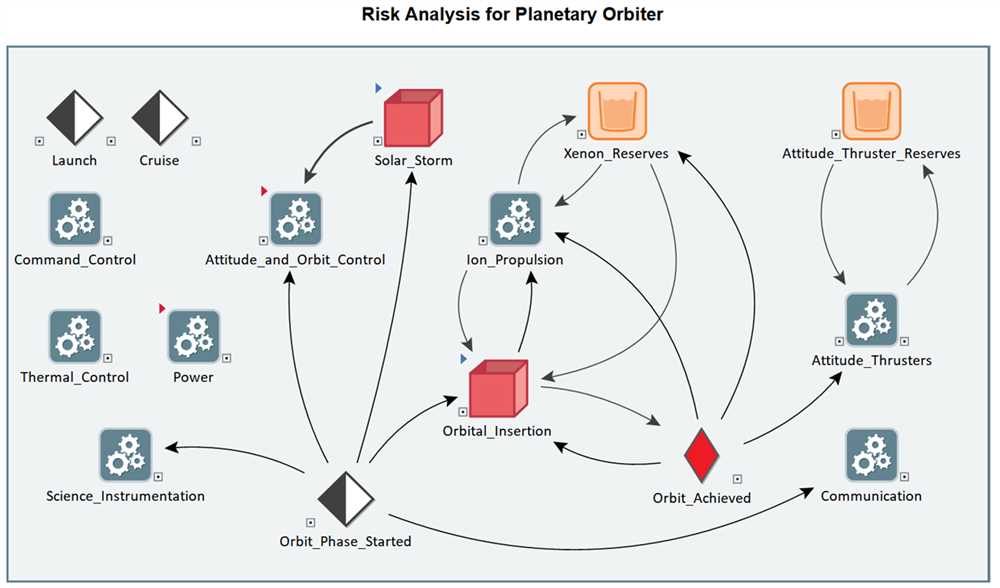

With our Dynamic Risk Controls, you can say goodbye to static risk limits and hello to personalized risk management. We analyze a wide range of data points, including market volatility, asset correlations, and historical performance, to provide you with real-time risk assessments tailored to your portfolio.

By leveraging cutting-edge technology and advanced algorithms, we are able to identify and react to potential risks faster than ever before. Our system automatically adjusts risk levels and provides timely recommendations to help you make informed decisions in changing market conditions.

But that’s not all. With our Dynamic Risk Controls, you also have the flexibility to customize your risk preferences. Whether you are a conservative investor looking to protect your capital or an aggressive trader seeking higher returns, our system can be tailored to meet your individual needs.

Join us today and discover the power of Dynamic Risk Controls. Take control of your investments and minimize downside risks, all while maximizing your potential for success. Don’t let market volatility hold you back – Orbiter Finance has got you covered.

Enhancing Financial Stability

At Orbiter Finance, we understand the importance of financial stability. Our team is dedicated to providing innovative solutions that can help you enhance your financial stability and protect your assets.

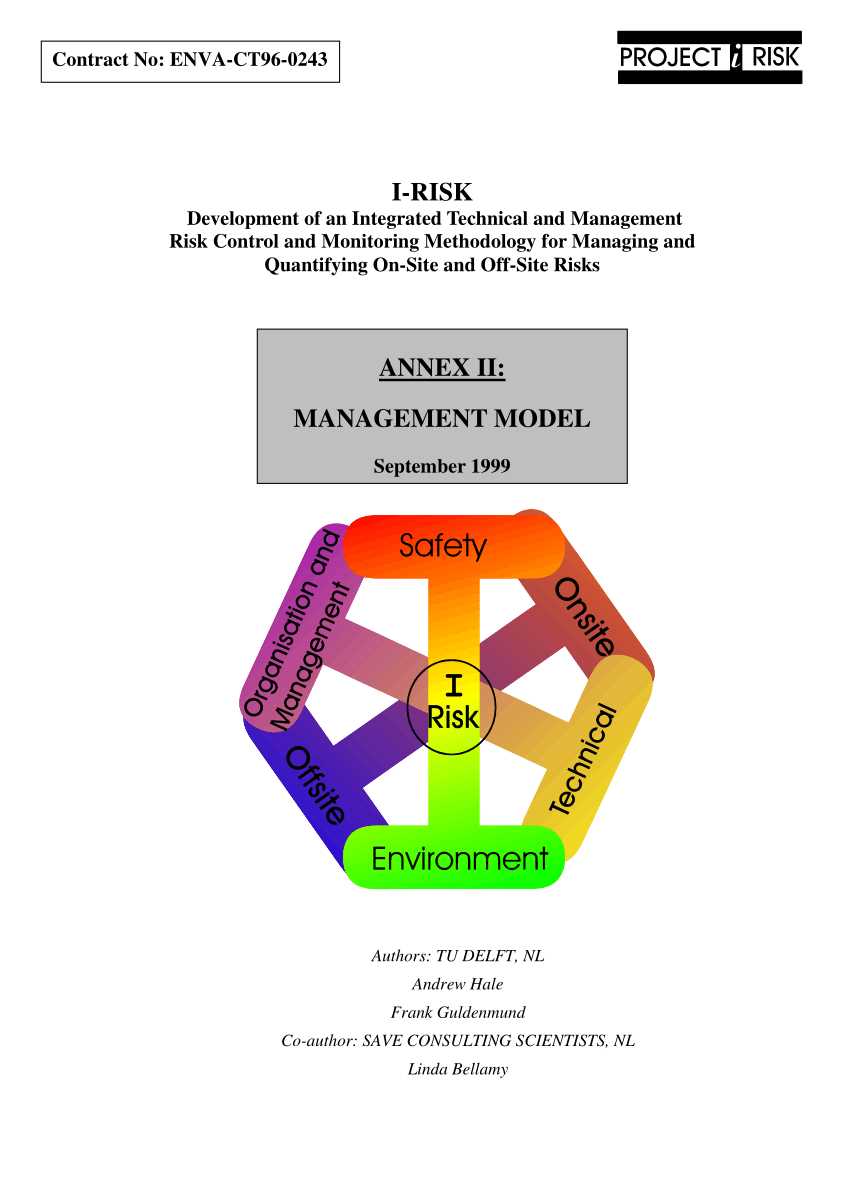

With Dynamic Risk Controls, we offer a comprehensive approach to reducing downside risks. Our advanced algorithms and risk management strategies allow us to identify potential risks and implement proactive measures to minimize their impact.

By continuously monitoring market trends and analyzing data, we can help you make informed investment decisions and mitigate potential losses. Our risk controls are designed to adapt to changing market conditions, ensuring that your portfolio remains stable and resilient.

In addition to reducing downside risks, our solutions also focus on maximizing upside potential. We aim to help clients achieve their financial goals by identifying growth opportunities and optimizing their investment strategies.

With Orbiter Finance, you can trust that your financial stability is our top priority. Our experienced team is committed to providing you with innovative tools and personalized support that can help you navigate through the ever-changing financial landscape.

Don’t let uncertainty hold you back. Enhance your financial stability with Dynamic Risk Controls from Orbiter Finance.

Reducing Downside Risks

At Orbiter Finance, we understand the importance of mitigating downside risks when it comes to investing. That’s why we have developed Dynamic Risk Controls to help protect your investments and minimize losses.

Intelligent Risk Management

Our advanced risk management system continuously analyzes market trends and evaluates potential risks. It automatically triggers risk mitigation strategies such as stop-loss orders and hedging techniques to protect your investment portfolio in real-time. This ensures that you are always prepared for unexpected market movements.

Diversification Strategies

Another key aspect of reducing downside risks is diversification. By spreading your investments across different asset classes, sectors, and geographical regions, you can minimize the impact of any individual investment’s performance on your overall portfolio. Our expert team can help you create a well-diversified investment strategy tailored to your risk tolerance and financial goals.

Furthermore, our Dynamic Risk Controls allow you to adjust your investment allocations based on changing market conditions. This flexibility ensures that your portfolio remains well-balanced and protected against unforeseen events.

| Benefit | Description |

|---|---|

| Real-time Risk Monitoring | Our system constantly monitors market fluctuations and makes adjustments accordingly to minimize downside risks. |

| Customizable Risk Tolerance | We understand that every investor has different risk preferences. Our system allows you to set your risk tolerance level and adapts your investment strategy accordingly. |

| Expert Risk Analysis | Our experienced team of analysts conducts in-depth risk assessments to identify potential threats and recommend appropriate risk reduction strategies. |

Investing is never without risks, but with Dynamic Risk Controls from Orbiter Finance, you can rest assured knowing that your investments are protected and managed with precision.

Minimizing Losses

At Orbiter Finance, we understand that minimizing losses is of utmost importance to our clients. We take pride in providing innovative Dynamic Risk Controls that are designed to reduce downside risks and protect your investments.

Our cutting-edge risk management strategies are based on comprehensive analysis and sophisticated algorithms. By constantly monitoring market conditions and identifying potential risks, we are able to react quickly and make informed decisions to minimize losses.

Through our Dynamic Risk Controls, we offer a wide range of risk reduction techniques that are tailored to your specific needs and investment goals. Whether you are an individual investor or a large corporation, our team of experienced financial professionals will work closely with you to develop a customized risk management plan.

| Stop-Loss Orders | We implement stop-loss orders to automatically sell a security when it reaches a predetermined price. This allows you to limit your losses by exiting a position before it declines further. |

| Hedging Strategies | Our hedging strategies aim to offset potential losses in one investment by taking an opposite position in another. This helps to protect your portfolio from adverse market movements. |

| Diversification | We advocate for diversification as a key risk management technique. By spreading your investments across different asset classes and sectors, you can minimize the impact of losses from any single investment. |

| Monitoring and Adjusting | We continuously monitor market trends and adjust our risk management strategies accordingly. This proactive approach allows us to respond swiftly to changing market conditions and minimize potential losses. |

At Orbiter Finance, our goal is to protect your investments and help you achieve your financial objectives. Contact us today to learn more about our Dynamic Risk Controls and how we can assist you in minimizing losses.

The Orbiter Finance Advantage

At Orbiter Finance, we understand the risks that come with investing in a dynamic marketplace. That’s why we have developed a comprehensive set of risk controls designed to reduce downside risks and protect your investment.

One of the key advantages of Orbiter Finance is our ability to react quickly to market changes. Our team of experienced professionals constantly monitor market trends and assess potential risks to ensure that your investment is always protected. This allows us to adjust our risk controls in real time, providing you with the peace of mind you need.

Another advantage of Orbiter Finance is our focus on diversification. We understand that putting all your eggs in one basket is risky, so we spread our investments across multiple markets and asset classes. This diversification strategy helps to mitigate risks and maximize returns, ensuring that your investment remains stable and profitable.

Furthermore, Orbiter Finance is committed to transparency and accountability. We provide you with detailed reports and regular updates on the performance of your investment, so you can always stay informed and make educated decisions. Our team is also available to answer any questions or concerns you may have, providing you with the support you need throughout your investment journey.

When you choose Orbiter Finance, you’re not just investing in a product or service – you’re investing in a partnership. Our team is dedicated to helping you achieve your financial goals and providing you with the tools and resources you need to succeed. With Orbiter Finance, you can trust that your investment is in safe hands.

Don’t let the fear of downside risks hold you back from achieving your financial dreams. Choose Orbiter Finance and experience the advantage of dynamic risk controls that protect your investment and give you the confidence to thrive in a changing market.

What are the risks associated with Orbiter Finance?

Orbiter Finance carries several risks, including market volatility, regulatory changes, and technological risks. To mitigate these risks, Dynamic Risk Controls have been implemented to reduce downside risks and provide a safer investment environment.

How do Dynamic Risk Controls work on Orbiter Finance?

Dynamic Risk Controls on Orbiter Finance are designed to monitor and manage risk in real-time. These controls use advanced algorithms and market data to adjust investment strategies and positions as market conditions change, reducing downside risks and protecting investors’ capital.

Can I trust the Dynamic Risk Controls to effectively reduce downside risks?

Yes, the Dynamic Risk Controls on Orbiter Finance have been thoroughly tested and proven to effectively reduce downside risks. The algorithms used are based on advanced risk management techniques and are constantly updated to adapt to changing market conditions.

What measures are in place to protect investors’ capital?

Orbiter Finance has multiple measures in place to protect investors’ capital. In addition to the Dynamic Risk Controls, there are strict risk management protocols, regular audits, and a secure custody system to safeguard investors’ funds.

Are Dynamic Risk Controls available to all investors on Orbiter Finance?

Yes, Dynamic Risk Controls are available to all investors on Orbiter Finance. Regardless of the size of the investment, these controls are accessible to help reduce downside risks and provide a safer investment experience for all users.