Are you ready to take control of your finances?

Orbiter Finance’s Flow Chart is the ultimate tool for mastering the art of financial planning. With our innovative chart, you can easily navigate through the complex world of personal finance and make informed decisions that will help you reach your financial goals.

Why choose Orbiter Finance?

- Simplicity: Our flow chart simplifies complex financial concepts into easy-to-understand visuals, making it accessible for everyone.

- Comprehensive: From budgeting to investments, our flow chart covers every aspect of personal finance, helping you create a solid financial plan.

- Customizable: Tailor the flow chart to fit your financial goals and priorities, ensuring that your plan is unique to your circumstances.

- Expert Guidance: Benefit from Orbiter Finance’s expertise and guidance in financial planning, ensuring that you make informed decisions every step of the way.

Don’t let financial planning overwhelm you.

Start your journey towards financial success with Orbiter Finance’s Flow Chart today and take control of your future!

Overview of Orbiter Finance’s Flow Chart for Mastering Financial Planning

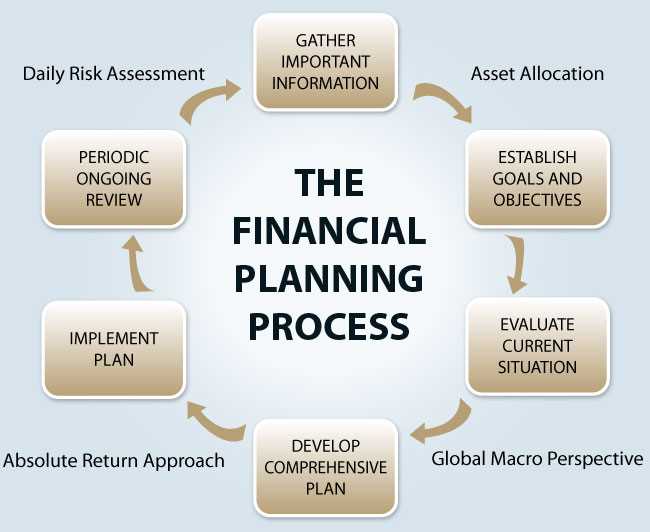

Orbiter Finance offers a comprehensive flow chart that helps individuals master the art of financial planning. This flow chart serves as a roadmap to guide individuals through the intricacies of financial planning and helps them make informed decisions for a secure future.

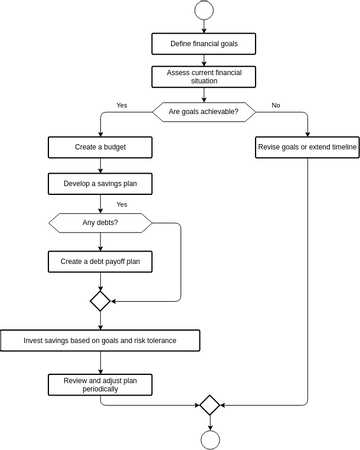

Understanding the Flow Chart

The flow chart provided by Orbiter Finance is designed to simplify the complex world of financial planning. It breaks down the process into clear and manageable steps, helping individuals navigate through each stage with ease. Whether you are a beginner or an experienced investor, this flow chart serves as a valuable tool to enhance your financial knowledge and decision-making abilities.

Key Components of the Flow Chart

The flow chart consists of several key components that cover all aspects of financial planning:

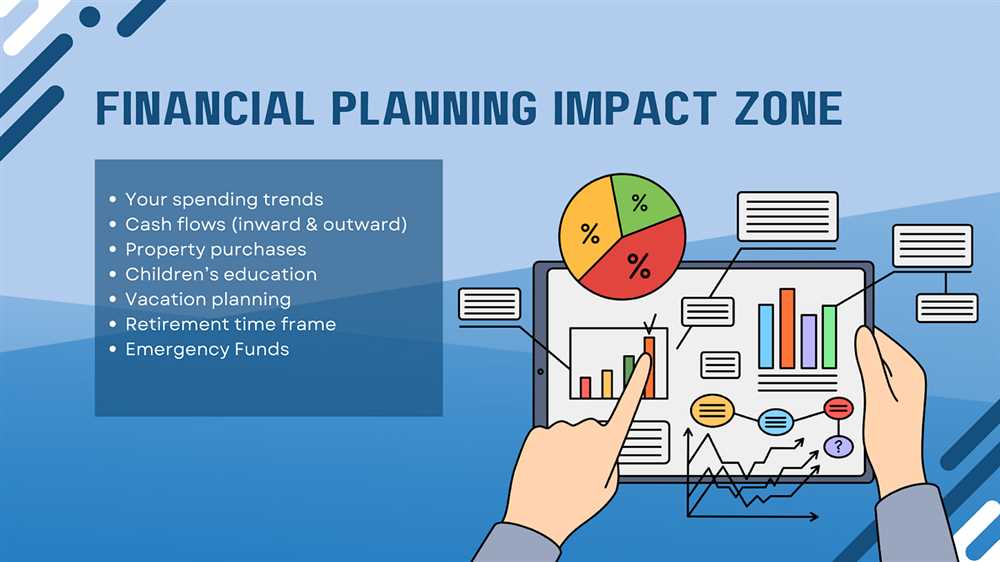

| 1. Goal Setting: | Identify and prioritize your financial goals, whether it’s saving for retirement, buying a house, or funding your children’s education. |

| 2. Budgeting: | Create a realistic budget that aligns with your goals and helps you track your income, expenses, and savings. |

| 3. Risk Management: | Understand and evaluate the various risks you may face, such as market volatility, inflation, and unexpected events, and develop strategies to mitigate those risks. |

| 4. Investment Planning: | Learn about different investment options, diversification, and asset allocation to build a well-balanced portfolio that maximizes returns and minimizes risk. |

| 5. Tax Planning: | Explore tax-efficient strategies to minimize your tax liability and optimize your overall financial plan. |

| 6. Estate Planning: | Ensure your assets are distributed according to your wishes and minimize estate taxes through proper estate planning. |

Each component of the flow chart is further elaborated with detailed guidance, tips, and resources, making it a comprehensive tool for anyone looking to master the art of financial planning.

With Orbiter Finance’s flow chart, you can enhance your financial literacy, take control of your financial future, and achieve your long-term goals. Start mastering the art of financial planning today!

Section 2: Understanding the Flow Chart

Orbiter Finance’s Flow Chart is a powerful tool for mastering the art of financial planning. This section will provide you with a deep understanding of how to interpret and utilize the information presented in the flow chart.

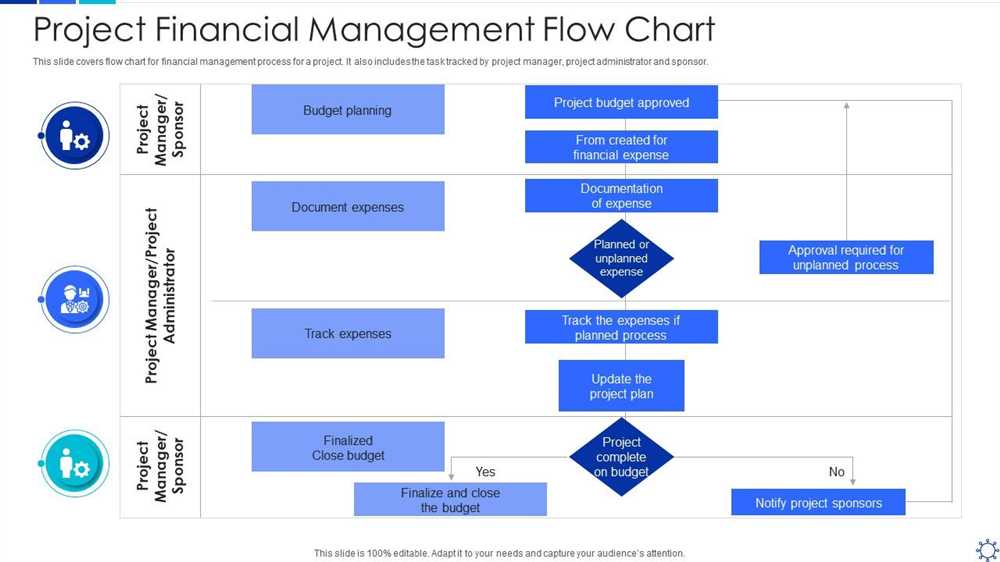

The flow chart is divided into several sections, each representing a key aspect of financial planning. The starting point is the “Current Financial Situation” section, which assesses your current assets, liabilities, and cash flow. This information serves as the foundation for developing a comprehensive financial plan.

From there, the flow chart branches out into different areas, including “Financial Goals and Objectives,” “Risk Assessment,” “Investment Strategies,” “Retirement Planning,” and “Estate Planning.” Each section is interconnected, allowing you to easily see how different aspects of your financial plan influence one another.

The flow chart also includes arrows and decision points, indicating the different paths you can take depending on your financial goals and circumstances. These decision points provide guidance on which steps to prioritize and when to reassess your plan based on changes in your circumstances.

One of the key benefits of Orbiter Finance’s Flow Chart is its simplicity and user-friendly design. The flow chart is easy to read and provides a clear overview of your entire financial plan. Whether you’re new to financial planning or a seasoned professional, the flow chart will help you make more informed decisions and achieve your financial goals.

In conclusion, understanding the flow chart is crucial for mastering the art of financial planning. It provides a comprehensive and visual representation of your financial plan, allowing you to assess your current situation, set goals, and develop strategies to achieve them. With Orbiter Finance’s Flow Chart, you have the tools you need to take control of your financial future.

Section 3: Benefits of Mastering Financial Planning with Orbiter Finance

Mastering financial planning with Orbiter Finance provides numerous benefits that can greatly enhance your financial well-being. Here are some of the key benefits:

- Increased Financial Security: By mastering financial planning, you gain a better understanding of your financial situation and can make informed decisions to increase your financial security. This includes creating an emergency fund, managing debt, and planning for retirement.

- Improved Financial Stability: With Orbiter Finance’s flow chart, you can streamline your financial planning process and stay organized. This helps you track your income, expenses, and investments, leading to improved financial stability and the ability to achieve your financial goals.

- Enhanced Wealth Accumulation: With proper financial planning, you can optimize your investments, reduce unnecessary expenses, and allocate your resources effectively. This leads to enhanced wealth accumulation over time, providing you with greater financial freedom and opportunities.

- Better Decision Making: Understanding the flow chart and mastering financial planning empowers you to make better financial decisions. You will have the knowledge and tools to evaluate different options, weigh the risks and benefits, and choose the most suitable strategies for your financial future.

- Peace of Mind: By mastering financial planning, you gain peace of mind knowing that you are in control of your financial destiny. You will have the confidence to navigate through financial challenges and enjoy a more stable and fulfilling financial life.

In conclusion, mastering financial planning with Orbiter Finance’s flow chart offers numerous benefits that can positively impact your financial well-being. Take the first step towards financial success and start mastering the art of financial planning today!

What is “Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart” about?

“Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart” is a book that aims to help individuals understand and navigate the complex world of financial planning using a flow chart developed by Orbiter Finance.

Who is the author of “Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart”?

The author of “Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart” is not specified.

Can this book be used by beginners in financial planning?

Yes, “Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart” is designed to be accessible to beginners in financial planning. The flow chart provided in the book simplifies complex concepts and makes it easier for newcomers to understand and apply financial planning principles.

Are there any practical examples or case studies included in the book?

Yes, “Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart” includes practical examples and case studies to illustrate the concepts and principles discussed in the book. These examples help readers apply the flow chart to real-life situations and enhance their understanding of financial planning.

Is the flow chart provided in the book applicable to all financial situations?

The flow chart provided in “Mastering the Art of Financial Planning with Orbiter Finance’s Flow Chart” is designed to be a versatile tool that can be applied to a wide range of financial situations. However, individual circumstances may vary, and it is recommended to seek professional advice when dealing with complex financial matters.