Exploring the Secure and Reliable Approach of Orbiter Finance’s Bridging Method for Safe Cross-L1 Transfers

In the world of cryptocurrency, one of the biggest challenges is the inability to seamlessly transfer assets across different blockchains and Layer-1 protocols. This has created a barrier for liquidity providers and traders who want to take advantage of opportunities on various networks. However, Orbiter Finance has introduced a revolutionary bridging method that solves this problem, offering a risk-free way to transfer assets across Layer-1 protocols.

The bridging method developed by Orbiter Finance is built on a foundation of security and trust. Unlike traditional methods that rely on custodial solutions, Orbiter Finance ensures that the assets being transferred are never in the custody of a third party. This eliminates the risk of hacks, scams, or mismanagement that can plague centralized solutions.

By utilizing decentralized bridges, Orbiter Finance is able to facilitate cross-L1 transfers without compromising security. These bridges act as gateways between different blockchains, allowing assets to be transferred in a trustless manner. The process is transparent and verifiable, ensuring that every transaction is recorded on the blockchain for anyone to see. This level of transparency instills confidence in users, knowing that their assets are protected.

The risk-free nature of Orbiter Finance’s bridging method is further enhanced by its use of smart contracts. These contracts are programmed to execute specific actions once certain conditions are met. With Orbiter Finance’s smart contracts, users can be assured that their assets will only be transferred when all predetermined conditions are fulfilled. This eliminates the possibility of any unauthorized or fraudulent transfers.

Overall, Orbiter Finance’s bridging method offers a secure and risk-free solution for cross-L1 transfers. By leveraging the power of decentralized bridges and smart contracts, Orbiter Finance has created a system that ensures the safety of assets while allowing users to take advantage of opportunities across different blockchains and Layer-1 protocols. With this innovative approach, Orbiter Finance is setting a new standard for seamless and secure asset transfers in the cryptocurrency space.

What is Orbiter Finance’s Bridging Method?

Orbiter Finance’s Bridging Method is a unique solution that allows for seamless transfers and conversions between different Layer 1 (L1) blockchains. It facilitates the movement of assets across different blockchains while minimizing any associated risks.

In the context of cross-L1 transfers, the Bridging Method acts as a bridge between two distinct L1 blockchains, enabling users to transfer tokens between them. By leveraging the bridging capabilities, users can access and utilize assets on multiple L1 blockchains efficiently and securely.

The Bridging Method ensures the risk-free nature of these transfers by employing a variety of mechanisms. Firstly, it makes use of a decentralized network of validators to verify and validate transactions, ensuring their accuracy and integrity. This decentralization adds an extra layer of security and reduces the risk of fraudulent or unauthorized transactions.

Additionally, Orbiter Finance’s Bridging Method incorporates a time-locked mechanism that establishes a specific time period during which the transfer is executed. This mechanism allows users to have full control over their funds during the transfer process, reducing the risk of potential losses or theft.

Moreover, the Bridging Method includes a transparent and auditable process that allows users to track the progress of their transfers. This transparency ensures that users have visibility into every step of the transfer and can verify its completion without any doubts or concerns.

Overall, Orbiter Finance’s Bridging Method offers a secure and efficient solution for cross-L1 transfers, enabling users to leverage the advantages and opportunities provided by multiple L1 blockchains. Its risk-free nature, coupled with its transparency and decentralized validation process, makes it an ideal choice for seamless and secure asset transfers.

Why is the Bridging Method Considered Risk-Free?

The bridging method developed by Orbiter Finance is widely regarded as a risk-free solution for cross-L1 transfers. This method ensures the secure and efficient movement of assets between different Layer 1 (L1) blockchains, without exposing users to unnecessary risks.

Smart Contract Security

One of the primary reasons why the bridging method is considered risk-free is due to the high level of smart contract security implemented by Orbiter Finance. The bridging contracts are rigorously audited and thoroughly tested to ensure that they are free from vulnerabilities and potential exploits. This reduces the likelihood of any security breaches or loss of funds during the cross-L1 transfer process.

Economic Incentives

Orbiter Finance’s bridging method also includes economic mechanisms that incentivize participants to act in good faith and discourage any malicious behavior. By implementing penalties and rewards, the protocol encourages honest behavior and discourages any attempts at fraud or manipulation. This enhances the overall security and trustworthiness of the bridging method.

The use of secure oracles: The bridging method relies on secure oracles to obtain accurate and reliable information about the state of both the source and destination blockchains. This ensures that the transfer process is based on up-to-date and valid data, further reducing the risk of errors or fraud.

Proven track record: Another reason why the bridging method is considered risk-free is its proven track record. Orbiter Finance has successfully facilitated numerous cross-L1 transfers without any major incidents or security breaches. This demonstrates the effectiveness and reliability of their bridging solution.

In conclusion, the bridging method developed by Orbiter Finance is considered risk-free due to its implementation of smart contract security measures, economic incentives to deter malicious behavior, reliance on secure oracles, and its proven track record. Users can confidently utilize this method to transfer assets between different Layer 1 blockchains without exposing themselves to unnecessary risks.

Benefits of Orbiter Finance’s Bridging Method

Orbiter Finance’s bridging method offers several benefits that make it a reliable and secure approach for cross-L1 transfers:

1. Risk-Free Nature: The bridging method employed by Orbiter Finance ensures a risk-free transfer of assets between different Layer 1 blockchains. With the use of smart contracts and oracles, the process is transparent and verifiable, eliminating the risk of asset loss or manipulation.

2. Fast and Efficient: Orbiter Finance’s bridging method allows for quick and seamless cross-L1 transfers. By leveraging the underlying technology of the blockchains involved, transactions can be completed in a matter of seconds, providing users with a seamless experience.

3. Greater Liquidity: With Orbiter Finance’s bridging method, users can access a wider range of liquidity options. By bridging assets between different Layer 1 blockchains, users can tap into additional markets and trading opportunities, increasing their financial flexibility and potential returns.

4. Interoperability: Orbiter Finance’s bridging method promotes interoperability between different Layer 1 blockchains. This allows for seamless communication and interaction between platforms, enabling users to take full advantage of the features and capabilities offered by different blockchains.

5. Enhanced Security: Orbiter Finance’s bridging method prioritizes security and employs multiple layers of encryption and authentication. This ensures that user assets are protected from unauthorized access or potential vulnerabilities, providing peace of mind to users.

By leveraging the benefits of Orbiter Finance’s bridging method, users can enjoy a seamless and secure experience when transferring assets between different Layer 1 blockchains, unlocking new possibilities and opportunities in the decentralized finance space.

Seamless Cross-L1 Transfers

Orbiter Finance offers a unique bridging method that enables seamless cross-L1 transfers, providing users with a risk-free way to transfer assets between different Layer-1 blockchain networks. This innovative solution is designed to address the challenges and limitations associated with cross-L1 transfers, ensuring a smooth and efficient experience for users.

By leveraging Orbiter Finance’s bridging method, users can easily transfer their assets from one Layer-1 network to another without the need to worry about the security and reliability of the process. The risk-free nature of this solution guarantees that the transferred assets are protected throughout the entire transfer process, minimizing the potential for losses or security breaches.

Benefits of Orbiter Finance’s Seamless Cross-L1 Transfers

- Efficiency: Orbiter Finance’s bridging method enables quick and efficient cross-L1 transfers, ensuring that users can seamlessly move their assets between different Layer-1 networks within a short timeframe.

- Security: The risk-free nature of the bridging method ensures that users’ assets are protected throughout the transfer process, minimizing the potential for losses or security breaches.

- Reliability: Orbiter Finance’s solution is designed to be reliable and robust, providing users with a seamless experience and ensuring the successful completion of cross-L1 transfers.

Overall, Orbiter Finance’s seamless cross-L1 transfers offer users a secure and efficient way to transfer assets between different Layer-1 blockchain networks. With the risk-free nature of this solution, users can have peace of mind knowing that their assets are protected throughout the entire transfer process.

Fast and Secure Transactions

When it comes to transferring assets between different Layer 1 blockchains, speed and security are of the utmost importance. Orbiter Finance’s bridging method offers both fast and secure transactions, ensuring that your assets are transferred quickly and safely.

Fast Transactions

With Orbiter Finance’s bridging method, transactions are processed at lightning speed. This is achieved through a combination of optimized protocols and innovative technology. Unlike traditional methods, which can take hours or even days to complete a transfer, Orbiter Finance’s bridging method ensures that your assets are transferred within minutes.

By leveraging cutting-edge technology and efficient protocols, Orbiter Finance eliminates unnecessary delays and bottlenecks that often slow down transactions. This means that you can quickly and easily transfer your assets between different Layer 1 blockchains, without having to wait for extended periods of time.

Secure Transactions

While speed is important, security is paramount when it comes to transferring assets. With Orbiter Finance’s bridging method, you can rest assured that your transactions are secure and protected.

Orbiter Finance employs robust security measures to safeguard your assets during the cross-L1 transfer process. This includes implementing industry-standard encryption protocols, multi-factor authentication, and continuous monitoring and auditing. These measures ensure that your assets remain safe and protected throughout the entire transaction process.

Additionally, Orbiter Finance’s bridging method is designed to be resistant to various types of attacks, including those aimed at compromising the integrity of transactions or stealing assets. Through advanced security mechanisms and rigorous testing, Orbiter Finance ensures that your assets are secure and protected from any potential threats.

Overall, Orbiter Finance’s bridging method offers fast and secure transactions for transferring assets between different Layer 1 blockchains. With their optimized protocols and robust security measures, you can trust that your assets will be transferred quickly and safely, without compromising on security.

How Does Orbiter Finance’s Bridging Method Work?

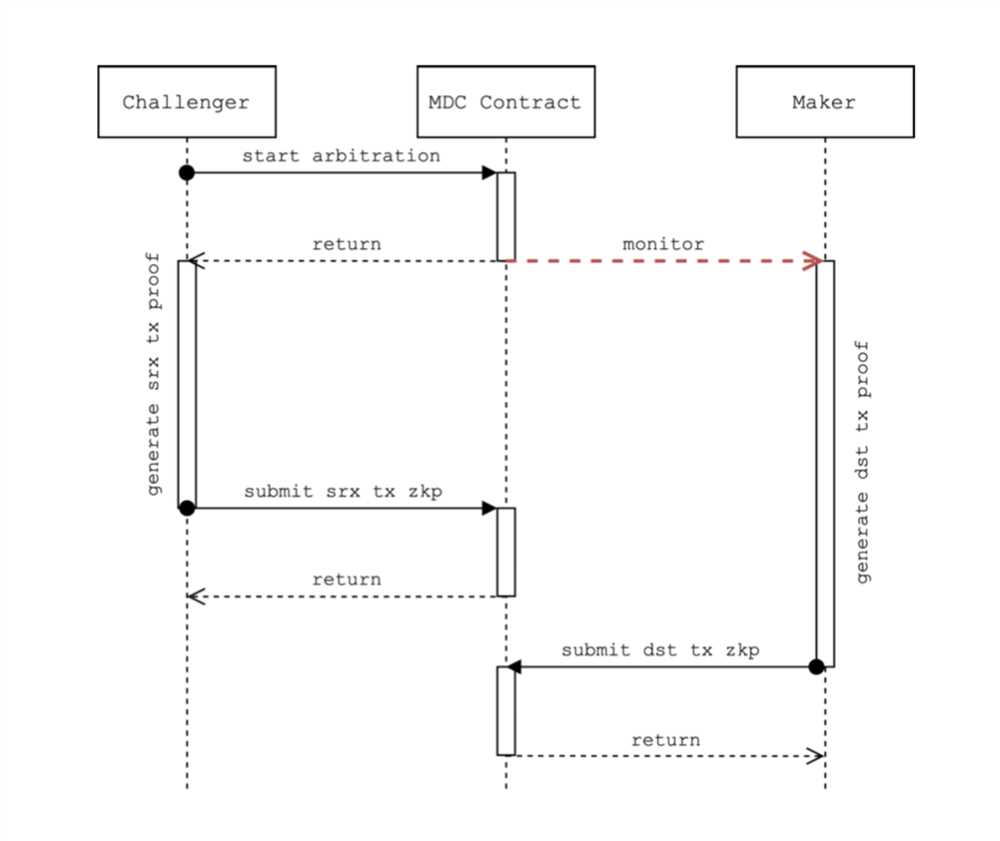

Orbiter Finance’s bridging method is a unique approach to facilitate cross-L1 transfers, ensuring a risk-free and secure transaction process. This method works by leveraging the power of smart contracts and multiple blockchains to bridge assets between two different Layer 1 networks.

When a user initiates a cross-L1 transfer on the Orbiter Finance platform, the transaction is securely executed through a series of steps:

- Selection of Source and Destination Chains: The user selects the source and destination chains for the asset transfer. These can be any Layer 1 blockchain networks supported by Orbiter Finance.

- Locking of Assets: The user locks the assets they want to transfer on the source chain. This process is done through a smart contract, which ensures the locked assets will be securely held until the entire transfer process is completed.

- Generation of a Proof of Locked Assets: Once the assets are locked, a proof of the locked assets is generated on the source chain. This proof is necessary to validate the transfer on the destination chain.

- Asset Transfer: The proof of locked assets is submitted to the Orbiter Finance bridge contract, which then triggers the transfer of assets from the source chain to the destination chain. This transfer process is facilitated through a trusted arbitrage mechanism, ensuring that the assets are transferred at the best available rates.

- Finalization and Unlocking of Assets: Once the assets are successfully transferred to the destination chain, the user can finalize the process by unlocking the assets on the destination chain. This gives the user full control and ownership of the transferred assets on the new chain.

By following this bridging method, Orbiter Finance ensures a seamless and risk-free cross-L1 transfer experience for its users. The use of smart contracts and the trusted arbitrage mechanism guarantee the security and integrity of the asset transfers, minimizing any potential risks involved in the process.

Smart Contract Architecture

Orbiter Finance’s bridging method for cross-L1 transfers relies on a robust smart contract architecture that ensures the risk-free nature of the process. The smart contracts used in this architecture play a crucial role in securely transferring assets between different Layer 1 blockchain networks.

The architecture consists of multiple smart contracts that interact with each other to facilitate the cross-L1 transfers. These contracts are deployed on both the source and destination blockchains and work together to ensure a smooth and secure transfer process.

One of the main components of the smart contract architecture is the escrow contract. This contract holds the assets being transferred until the transfer is completed successfully. It acts as a trusted intermediary between the source and destination blockchains, ensuring that neither party can abscond with the assets.

Additionally, the architecture includes verification contracts that are responsible for ensuring the validity of the transfer. These contracts verify the authenticity of the assets being transferred, checking for any potential fraud or tampering. They also enforce any necessary conditions or requirements for the transfer to take place.

The smart contract architecture also includes governance contracts that govern the overall functioning of the bridging method. These contracts allow for decentralized decision-making and ensure the transparency and fairness of the process.

To ensure the highest level of security, the smart contracts are audited by trusted third-party security firms. This ensures that there are no vulnerabilities or loopholes in the contracts that could be exploited by malicious actors.

Table: Key Components of the Smart Contract Architecture

| Component | Description |

|---|---|

| Escrow Contract | Holds the assets being transferred until completion |

| Verification Contracts | Ensure validity of the transfer and prevent fraud |

| Governance Contracts | Ensure transparency and decentralization of decision-making |

| Third-Party Audits | Ensure the security and integrity of the smart contracts |

In conclusion, the smart contract architecture used in Orbiter Finance’s bridging method for cross-L1 transfers is designed to ensure the risk-free nature of the process. By leveraging multiple smart contracts and rigorous auditing, the architecture provides a secure and efficient way to transfer assets between different Layer 1 blockchain networks.

What is Orbiter Finance’s bridging method for cross-L1 transfers?

Orbiter Finance’s bridging method for cross-L1 transfers is a risk-free way to transfer assets between different Layer 1 blockchain networks. It involves using a bridge contract on one blockchain to lock the assets while creating a representation of the locked assets on another blockchain. This allows users to freely move their assets between different Layer 1 networks without the risk of losing them.

How does Orbiter Finance ensure the risk-free nature of their bridging method?

Orbiter Finance ensures the risk-free nature of their bridging method by using a bridging contract that locks the assets on one blockchain and creates a representation of the locked assets on another blockchain. This ensures that the assets are securely held and can be freely transferred between different Layer 1 networks without the risk of loss or theft.

Why is having a risk-free method for cross-L1 transfers important?

Having a risk-free method for cross-L1 transfers is important because it allows users to freely move their assets between different Layer 1 blockchain networks without the fear of losing them. This increases liquidity and accessibility for users and encourages adoption of different Layer 1 networks.

Can Orbiter Finance’s bridging method be used for any type of asset?

Yes, Orbiter Finance’s bridging method can be used for any type of asset that is compatible with the blockchain networks involved in the cross-L1 transfer. This includes cryptocurrencies, tokens, and other digital assets.

Are there any fees associated with using Orbiter Finance’s bridging method?

Yes, there are fees associated with using Orbiter Finance’s bridging method. These fees may vary depending on the specific transfer and the blockchain networks involved. However, the fees are typically lower than traditional methods of transferring assets between different Layer 1 networks.