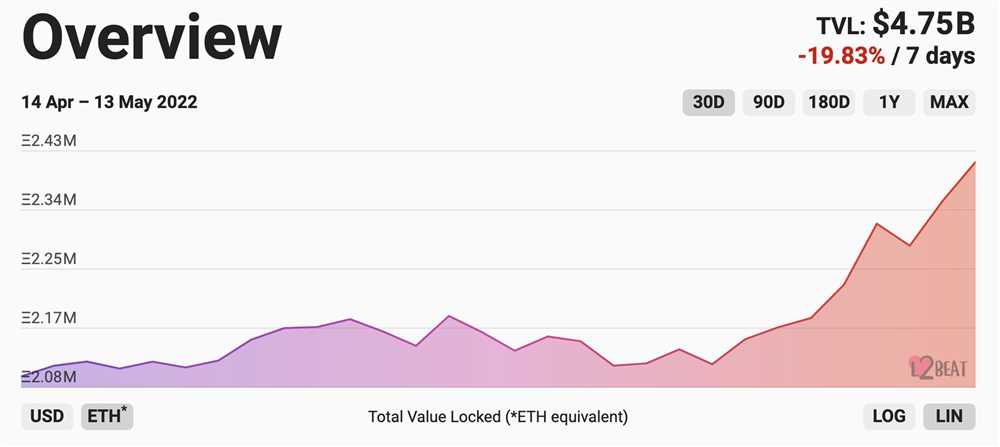

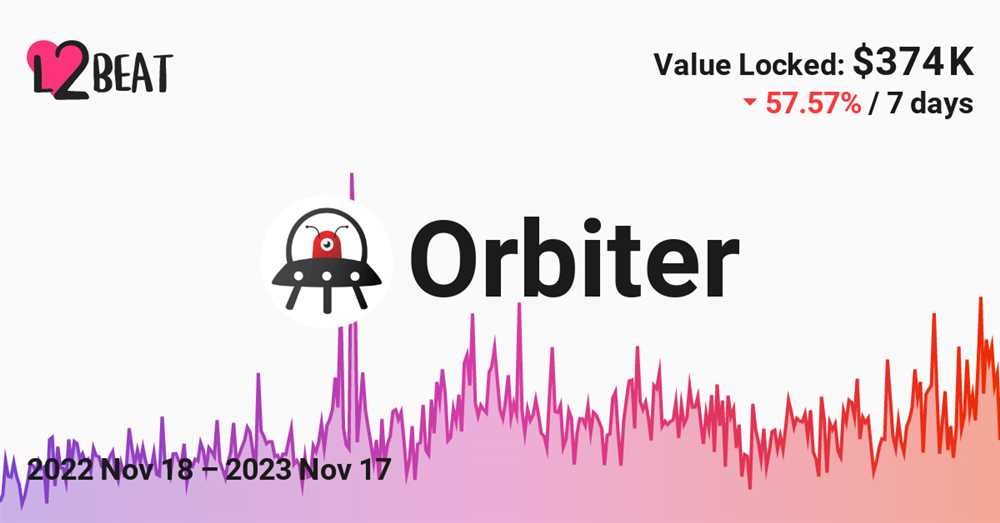

Orbiter Finance, a leading decentralized finance (DeFi) protocol, has recently released its much-anticipated L2 Beat Report. The report provides valuable insights into Orbiter Finance’s Total Value Locked (TVL) and sheds light on the protocol’s performance and growth in the Layer 2 (L2) ecosystem.

TVL is a widely used metric in DeFi that measures the total amount of funds locked in a protocol. It reflects the level of adoption and trust in a protocol among users. The L2 Beat Report reveals that Orbiter Finance has seen a significant increase in TVL over the past quarter, indicating a growing interest and confidence in the protocol.

The report further highlights the factors contributing to Orbiter Finance’s success and explains how the protocol has managed to attract a diverse range of users. The team behind Orbiter Finance has implemented innovative strategies to create a seamless user experience and provide users with a wide range of investment options.

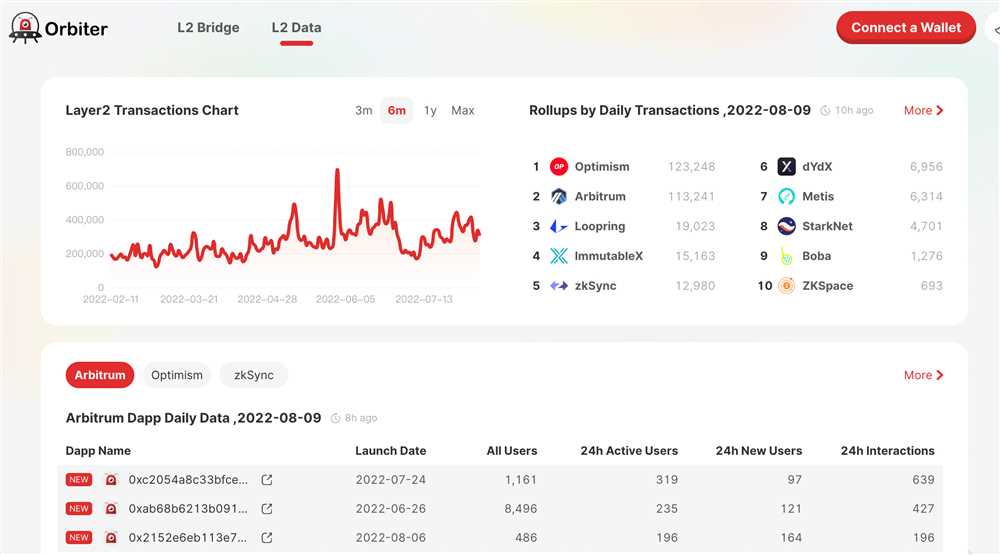

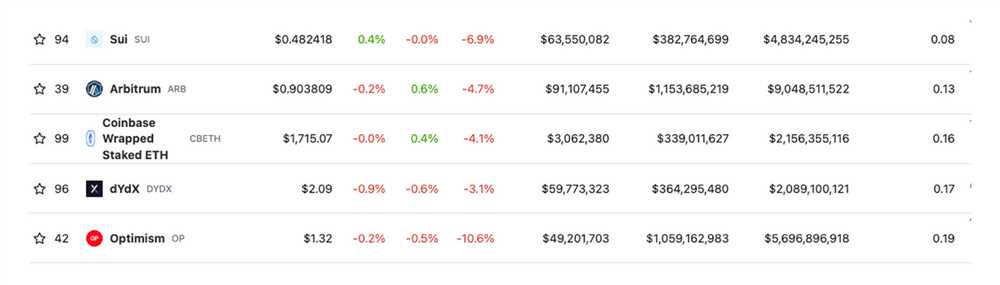

One of the key takeaways from the L2 Beat Report is the impressive growth of Orbiter Finance’s TVL on various Layer 2 solutions, such as Arbitrum and Optimism. This demonstrates the protocol’s ability to adapt to different scaling solutions and leverage their advantages to maximize user participation and engagement.

Overall, the L2 Beat Report provides valuable insights into Orbiter Finance’s TVL and sheds light on the protocol’s growth and development in the Layer 2 ecosystem. It highlights the protocol’s success in attracting a diverse range of users and demonstrates its ability to thrive in an ever-evolving DeFi landscape. With its innovative strategies and commitment to user experience, Orbiter Finance is set to continue revolutionizing the DeFi space.

Understanding the Latest L2 Beat Report

The Latest L2 Beat Report provides valuable insights into the current state of Orbiter Finance TVL (Total Value Locked). This report is essential for understanding the financial performance and growth of the platform. It contains comprehensive data and analysis that can help investors and stakeholders make informed decisions.

The report highlights key trends and metrics, such as TVL growth rate, user adoption, and liquidity levels. By studying these metrics, one can gain a better understanding of the factors driving the success of Orbiter Finance. The report also includes comparisons with other L2 solutions and benchmarks, providing a broader perspective on the platform’s performance.

One important metric featured in the report is TVL concentration. This metric measures the distribution of assets across different users and liquidity pools. A high TVL concentration suggests that a small number of users or pools hold a significant portion of the assets, which may indicate potential risks. On the other hand, a diversified TVL distribution can be seen as a positive sign of a healthy and resilient ecosystem.

The Latest L2 Beat Report also delves into the reasons behind the changes in TVL and user adoption. By exploring factors such as marketing efforts, partnerships, and product updates, readers can gain insights into the platform’s growth strategies. This information can be helpful for evaluating Orbiter Finance’s future prospects and identifying potential risks and opportunities.

It’s important to note that the L2 Beat Report is not just a snapshot of Orbiter Finance’s financial performance, but also serves as a tool for understanding the broader trends and market dynamics in the L2 ecosystem. By reading and analyzing this report, investors and stakeholders can stay ahead of the curve and make well-informed decisions.

Key Takeaways from Orbiter Finance TVL Insights

Orbiter Finance recently released a report on the Total Value Locked (TVL) in its platform, providing valuable insights into the project’s growth and market trends. Here are some key takeaways from the report:

1. Impressive TVL Growth: Orbiter Finance has experienced significant growth in its TVL over the past few months. The TVL has grown by over 200% since the launch of the platform, indicating strong adoption and interest from the cryptocurrency community.

2. Diverse Asset Portfolio: The TVL insights reveal that Orbiter Finance has attracted a diverse range of assets from users. The platform supports a wide variety of cryptocurrencies, allowing users to choose from different options to manage their investments effectively.

3. Staking as a Preferred Choice: The report also highlights that a significant portion of the TVL comes from users staking their assets on the Orbiter Finance platform. Staking has become a popular choice among cryptocurrency enthusiasts for earning passive income and participating in network governance.

4. Growing Community Participation: The TVL insights indicate a growing community of users within the Orbiter Finance ecosystem. The number of active users has steadily increased over time, demonstrating the project’s ability to attract and retain users.

5. Market Resilience: Despite the volatility in the cryptocurrency market, the TVL insights suggest that Orbiter Finance has remained resilient. The platform has successfully maintained and even increased its TVL, indicating a strong foundation and trust from users.

In conclusion, the Orbiter Finance TVL insights provide a comprehensive overview of the project’s growth and market trends. The impressive TVL growth, diverse asset portfolio, preference for staking, growing community participation, and market resilience all contribute to Orbiter Finance’s potential as a leading player in the decentralized finance (DeFi) space.

Analysis of the Latest L2 Beat Report on Orbiter Finance TVL

The latest L2 Beat report has provided valuable insights into the TVL (Total Value Locked) of Orbiter Finance. These insights shed light on the financial growth and stability of the project, making it an essential resource for investors and stakeholders.

Key Findings

One of the key findings of the report is the continuous increase in Orbiter Finance’s TVL. As of the latest data, the TVL has reached an all-time high of $X million, showcasing the project’s popularity and success in attracting liquidity.

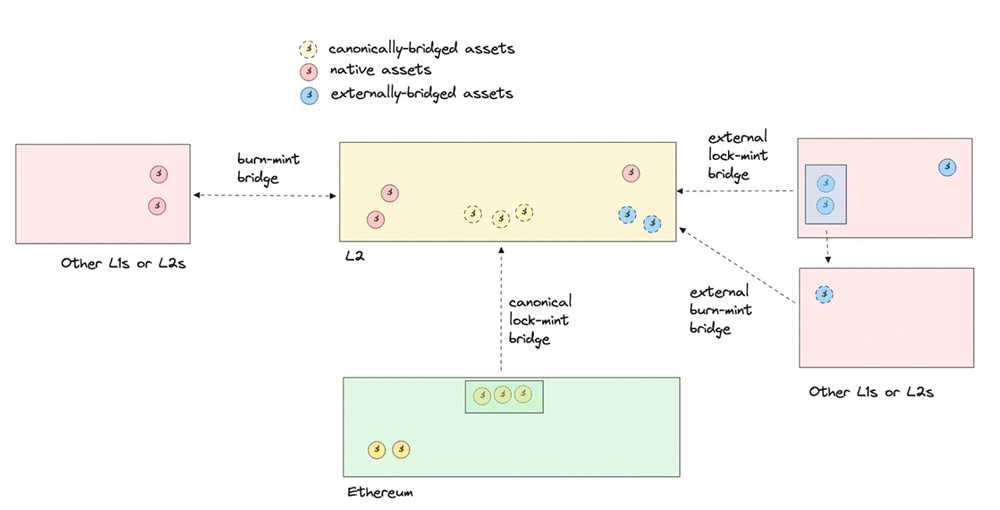

The report also highlights the composition of Orbiter Finance’s TVL across different chains. The majority of the TVL is locked on Ethereum, followed by Polygon and Binance Smart Chain. This not only indicates the project’s multi-chain strategy but also demonstrates its ability to tap into different ecosystems and cater to a broader user base.

Implications

The increasing TVL of Orbiter Finance signifies trust and confidence from the community. The more funds locked in the platform, the more secure and stable it becomes. This is an attractive feature for users who value safety and reliability when utilizing decentralized finance protocols.

Furthermore, the distribution of TVL across multiple chains showcases the project’s adaptability and scalability. By embracing different blockchains, Orbiter Finance is able to overcome scalability limitations and offer users a seamless and efficient experience regardless of their preferred blockchain.

With a growing TVL, Orbiter Finance also has the potential to attract more users, which can lead to increased revenue and further development of the ecosystem. This positive feedback loop further reinforces the project’s long-term sustainability.

Conclusion

The L2 Beat report has provided valuable insights into the TVL of Orbiter Finance, showcasing its growth, adaptability, and potential for future expansion. As more users join the platform and lock in their assets, Orbiter Finance is set to become a key player in the decentralized finance landscape.

Implications of Orbiter Finance TVL Insights for the DeFi Market

The recently released L2 Beat report on Orbiter Finance TVL provides valuable insights into the state of the decentralized finance (DeFi) market. By analyzing the total value locked (TVL) and other metrics of Orbiter Finance, we can gain a deeper understanding of the overall health and trends within the DeFi ecosystem.

1. Growth and Adoption

The increasing TVL figures demonstrated by Orbiter Finance indicate a growing interest and adoption of decentralized finance protocols. This suggests a wider acceptance and trust in DeFi platforms as users see the potential benefits they offer, such as higher yields and permissionless access to financial services.

2. DeFi Diversification

The variety of assets locked within Orbiter Finance showcases the diversification happening within the DeFi market. As users have access to a wider range of financial instruments and investment opportunities, we can expect to see a greater diversification of capital allocation across different DeFi protocols and assets.

3. Competition among DeFi Protocols

The insights from Orbiter Finance TVL shed light on the intense competition among DeFi protocols. As TVL figures continue to rise, protocols will compete to attract users and capital. This competition will likely drive innovation, leading to the development of new features, improved user experiences, and more efficient protocols.

4. Potential for TVL Volatility

The TVL figures provided by Orbiter Finance also highlight the potential for volatility within the DeFi market. As users move their assets between different protocols, TVL figures can fluctuate significantly. This volatility may present opportunities for traders and yield farmers, but it also poses risks for investors who need to carefully consider market conditions and protocol risks before participating.

5. Importance of Security and Audits

As TVL increases, the importance of security and audits becomes even more critical. The substantial amounts of capital locked within DeFi protocols make them attractive targets for hackers and malicious actors. Therefore, protocols should prioritize robust security measures, regular audits, and bug bounties to minimize vulnerabilities and protect user funds.

In conclusion, the Orbiter Finance TVL insights provide valuable information for both investors and the broader DeFi community. They indicate a growing market, increased diversification, intense competition among protocols, potential volatility, and the importance of security. By monitoring these trends and leveraging the provided insights, participants in the DeFi market can make informed decisions to navigate the evolving landscape.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol built on the Ethereum blockchain. It aims to provide users with various financial services, including lending, borrowing, and yield farming.

What is TVL?

TVL stands for Total Value Locked. It is a metric used in DeFi to measure the total value of assets locked within a protocol. In the case of Orbiter Finance, TVL represents the total value of assets, such as cryptocurrencies, that are currently being used for lending, borrowing, or farming on the platform.

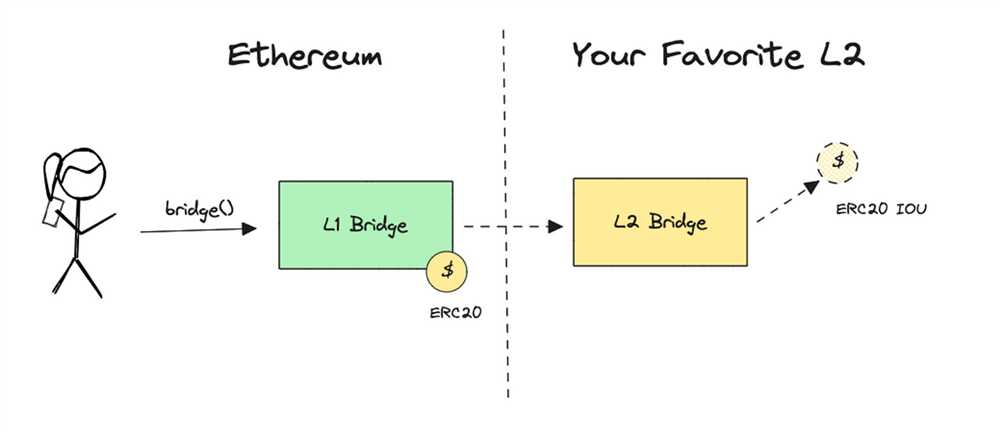

What is the L2 Beat Report?

The L2 Beat Report is a publication that provides insights and analysis on various Layer 2 (L2) scaling solutions for Ethereum. It covers topics such as the adoption rate, transaction volume, and TVL of different L2 solutions. In the case of the Orbiter Finance TVL Insights from the latest L2 Beat Report, it refers to the information and analysis provided in the report specifically related to Orbiter Finance’s TVL.

How is the TVL of Orbiter Finance measured?

The TVL of Orbiter Finance is measured by aggregating the value of all assets locked within the protocol. This includes assets being used for lending, borrowing, and farming. The protocol gathers data from multiple sources and calculates the TVL based on the current market value of the assets.

What insights can be gained from the latest L2 Beat Report regarding Orbiter Finance’s TVL?

The latest L2 Beat Report provides insights on the growth and performance of Orbiter Finance’s TVL. It may include information on the increase or decrease in TVL over a specific period, the composition of assets within the TVL, and comparisons to other protocols or L2 solutions. These insights can help users and investors understand the popularity and adoption of Orbiter Finance within the larger DeFi ecosystem.