Complete Decentralization Orbiter Finances Vision for Asset Liquidity Without Asset Minting

Decentralized finance (DeFi) has revolutionized the traditional financial sector by providing permissionless, transparent, and inclusive financial services to millions of individuals around the world. However, despite its many advantages, DeFi still faces challenges when it comes to asset liquidity. Traditional DeFi platforms rely on asset minting, which can introduce centralization risks and undermine the principles of decentralization.

Enter Orbiter Finance, a pioneering project that envisions a future of complete decentralization in asset liquidity. Unlike other DeFi platforms, Orbiter Finance does not rely on asset minting, ensuring that every transaction is performed on-chain without the need for any intermediaries. This groundbreaking approach not only enhances security but also promotes trust and transparency among users.

Orbiter Finance achieves this complete decentralization through its innovative liquidity protocol, which is built on a secure and scalable blockchain infrastructure. By leveraging the power of blockchain technology, Orbiter Finance enables users to trade assets directly from their wallets, eliminating the need for any third-party custodians or intermediaries. This not only streamlines the trading process but also empowers users with full control over their assets.

Furthermore, Orbiter Finance’s protocol ensures that the liquidity is always available, regardless of market conditions or asset scarcity. Through its unique liquidity mining mechanism, users are incentivized to provide liquidity to the platform, creating a vibrant and resilient ecosystem. This approach not only enhances market efficiency but also prevents liquidity shortages, making Orbiter Finance the go-to platform for asset liquidity.

In conclusion, Orbiter Finance’s vision for asset liquidity without asset minting represents a major leap forward in the evolution of decentralized finance. By eliminating centralized intermediaries and reliance on asset minting, Orbiter Finance ensures complete decentralization, trust, and transparency. With its scalable and secure infrastructure, it paves the way for a future where individuals have full control over their assets, without compromising on liquidity or security.

Complete Decentralization: Orbiter Finance’s Vision for Asset Liquidity Without Asset Minting

In the world of decentralized finance (DeFi), one of the main challenges is providing liquidity for digital assets. Traditionally, this has involved the process of asset minting, where new tokens are created to represent the underlying assets and provide liquidity to the market. However, this process often introduces centralization risks and can be inefficient.

Orbiter Finance has a different vision for asset liquidity – one that doesn’t involve asset minting at all. Instead, Orbiter Finance aims to achieve complete decentralization by creating a protocol that allows users to directly trade their existing assets on various blockchain networks.

The Problem with Asset Minting

Asset minting, although widely used in DeFi, comes with several drawbacks. Firstly, the process of minting new tokens requires a central authority or entity to mint and distribute them. This introduces centralized control and counteracts the principles of decentralization that DeFi aims to achieve.

Secondly, minting new tokens often requires a collateralization process, where users have to lock their existing assets as collateral to create new tokens. This can result in locked assets and reduced liquidity, as users may not be willing to collateralize their assets for minting purposes.

Orbiter Finance’s Solution: Direct Asset Trading

Orbiter Finance solves the liquidity problem without asset minting by allowing users to trade their existing assets directly. Instead of creating new tokens, users can utilize a decentralized exchange (DEX) to trade their assets with others in the network.

This approach eliminates the need for a central authority or entity to mint new tokens, as the existing assets are used directly in trading. It also ensures that the assets are always backed by actual holdings, enhancing transparency and reducing the risk of fraud.

In addition, this direct asset trading approach offers greater flexibility for users, as they can trade their assets without the need for collateralization. This increases liquidity and allows users to freely manage and utilize their assets in the DeFi ecosystem.

Advantages of Complete Decentralization

By adopting a complete decentralization approach to asset liquidity, Orbiter Finance offers several advantages:

- Enhanced security: Eliminating the need for asset minting reduces the risk of centralized control and improves the overall security of the protocol.

- Improved liquidity: Direct asset trading ensures that assets are always available for trading, increasing overall market liquidity.

- Greater user control: Users have full control over their assets and can freely trade them without the need for collateralization.

- Transparency: By utilizing existing assets for trading, Orbiter Finance ensures transparency and reduces the risk of fraudulent activities.

Orbiter Finance’s vision for asset liquidity without asset minting represents a new approach to solving the liquidity challenges in DeFi. By embracing complete decentralization and direct asset trading, Orbiter Finance paves the way for a more secure, transparent, and user-centric decentralized finance ecosystem.

Advantages of Complete Decentralization in Asset Liquidity

Complete decentralization offers numerous advantages in ensuring asset liquidity within the Orbiter Finance ecosystem. By removing the need for asset minting and centralized control, this approach brings forth several key benefits:

1. Immutable Ownership

With complete decentralization, asset ownership is recorded on a blockchain, making it immutable and transparent. This ensures that no single entity or organization can manipulate the ownership records or control the liquidity of assets. It provides trust and confidence to participants in the ecosystem.

2. Enhanced Security

Decentralization eliminates the single point of failure that exists in centralized systems, reducing the risk of hacks and security breaches. Assets stored on decentralized networks are protected by the consensus mechanism of the blockchain, making them resistant to unauthorized access and tampering.

3. Global Accessibility

By removing the need for intermediaries and centralized institutions, complete decentralization enables global accessibility to asset liquidity. Users from different parts of the world can participate in liquidity pools and trade assets directly, without the need to rely on a specific jurisdiction or centralized entity.

4. Empowering Ownership

Decentralization empowers individuals to have direct ownership and control over their assets. Users can participate in governance decisions, such as voting for protocol upgrades and changes, ensuring that their voice is heard and influencing the direction of the ecosystem.

5. Interoperability

Through decentralized networks and protocols, complete decentralization promotes interoperability between different assets and platforms. This allows for seamless liquidity provision and trading across various ecosystems, fostering a more efficient and connected financial landscape.

In conclusion, complete decentralization in asset liquidity brings numerous advantages such as immutable ownership, enhanced security, global accessibility, empowering ownership, and interoperability. These benefits contribute to a more transparent, secure, and inclusive financial ecosystem within Orbiter Finance.

The Role of Orbiter Finance in Achieving Complete Decentralization

In the world of decentralized finance (DeFi), one of the main goals is to achieve complete decentralization. This means eliminating the need for any central authority or intermediaries, and instead allowing users to have full control over their assets and decisions. Orbiter Finance plays a crucial role in this vision by providing a platform that enables asset liquidity without the need for asset minting.

What is Asset Liquidity?

Asset liquidity refers to the ease with which an asset can be bought or sold without affecting its price. In traditional financial markets, liquidity is provided by market makers and intermediaries who facilitate the buying and selling of assets. However, in the world of DeFi, the goal is to achieve liquidity without relying on centralized entities.

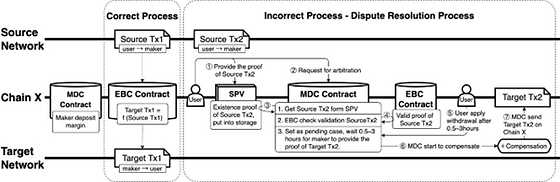

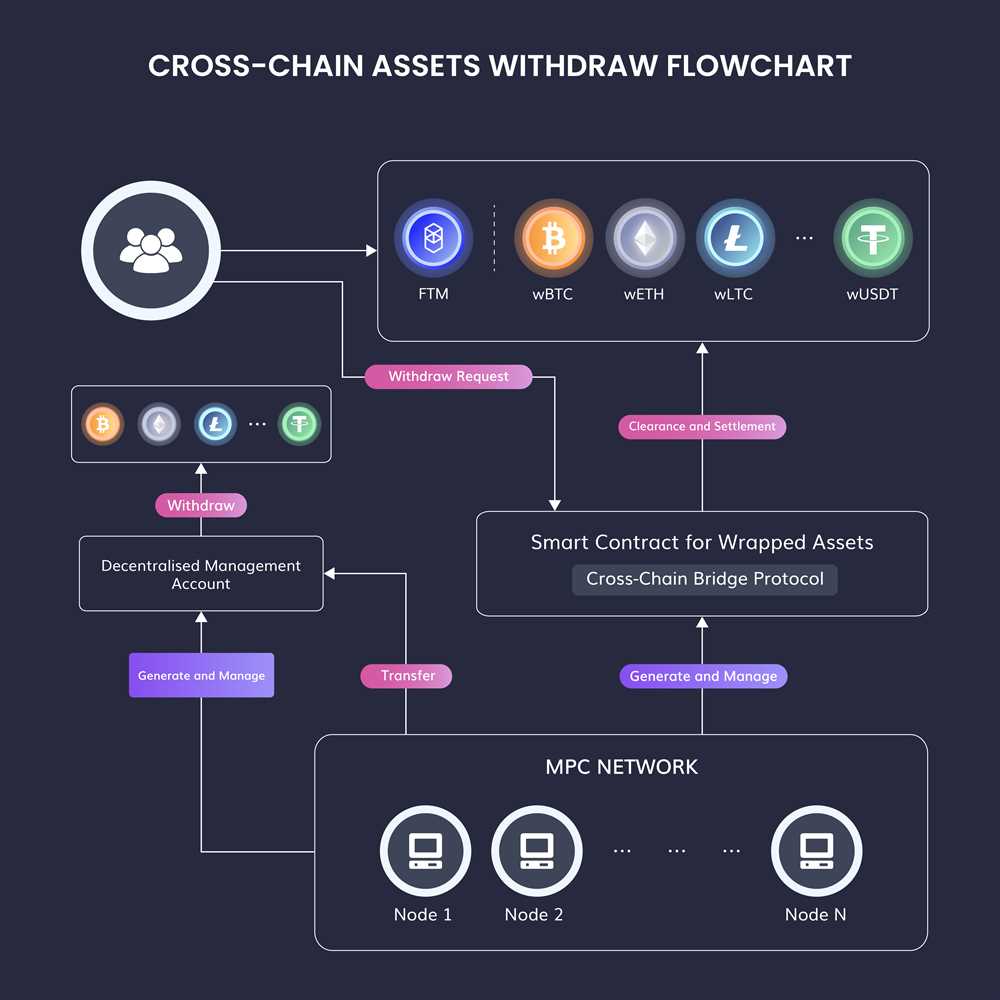

Orbiter Finance achieves this by leveraging decentralized exchanges (DEXs) and liquidity pools. DEXs allow users to trade assets directly with each other, eliminating the need for intermediaries. Liquidity pools, on the other hand, provide a way for users to contribute their assets and earn rewards in return. The combination of these two features allows Orbiter Finance to offer decentralized asset liquidity to its users.

The Role of Asset Minting

Asset minting is a common practice in DeFi, where new tokens are created to represent real-world assets or other digital assets. However, this approach introduces centralization, as the authority to mint tokens lies with a centralized entity. Orbiter Finance takes a different approach by eliminating the need for asset minting altogether.

Instead of minting new tokens, Orbiter Finance enables users to lock their assets in liquidity pools, which are then used to provide liquidity for trading. This means that the assets themselves are used for liquidity, rather than creating new tokens. By doing so, Orbiter Finance ensures that the entire process remains decentralized, with users having full control over their assets.

Conclusion

Orbiter Finance plays a pivotal role in achieving complete decentralization in the world of DeFi. By providing a platform that enables asset liquidity without the need for asset minting, Orbiter Finance empowers users to have full control over their assets and decisions. Through the use of decentralized exchanges and liquidity pools, Orbiter Finance creates a decentralized ecosystem where users can trade assets directly with each other and contribute their assets to provide liquidity. This innovative approach sets Orbiter Finance apart and contributes to the overall goal of achieving complete decentralization in DeFi.

What is Orbiter Finance?

Orbiter Finance is a decentralized platform that aims to provide asset liquidity without the need for asset minting. It allows users to borrow and lend assets without the need for a centralized authority.

How does Orbiter Finance achieve asset liquidity without asset minting?

Orbiter Finance achieves this by utilizing decentralized protocols and smart contracts. Instead of minting new assets, it allows users to borrow and lend existing assets on the platform, utilizing the liquidity pools.

What are the benefits of asset liquidity without asset minting?

The benefits include reduced risk of inflation, as there is no need to create new assets. It also allows for faster and more efficient borrowing and lending, as assets are readily available in the liquidity pools.

Is Orbiter Finance fully decentralized?

Yes, Orbiter Finance aims to be fully decentralized by utilizing blockchain technology and smart contracts. This eliminates the need for a centralized authority and ensures trust and transparency in asset borrowing and lending.

Can anyone participate in asset borrowing and lending on Orbiter Finance?

Yes, anyone with access to the platform can participate in asset borrowing and lending on Orbiter Finance. However, users should ensure they understand the risks involved and are familiar with how decentralized finance works.