Cross-Rollup vs Cross-Chain: Solving Unique Challenges in Interoperability with Orbiter Finance

Interoperability has become a buzzword in the world of blockchain technology. As the industry continues to grow and evolve, the need for seamless communication and transfer of assets between different chains has become increasingly important. Two popular approaches to achieving interoperability are cross-rollup and cross-chain solutions.

Cross-rollup solutions aim to enable communication and asset transfers between different Layer-2 rollup chains. These chains are built on top of existing Layer-1 blockchains, such as Ethereum, and provide scalability and cost-efficiency benefits. However, cross-rollup solutions face challenges when it comes to interoperability with Layer-1 chains and other Layer-2 solutions.

On the other hand, cross-chain solutions focus on enabling communication and asset transfers between different Layer-1 chains. These solutions aim to bridge the gap between different blockchains, allowing users to transfer assets across chains without the need for centralized intermediaries. While cross-chain solutions offer broader interoperability capabilities, they often suffer from scalability and security issues.

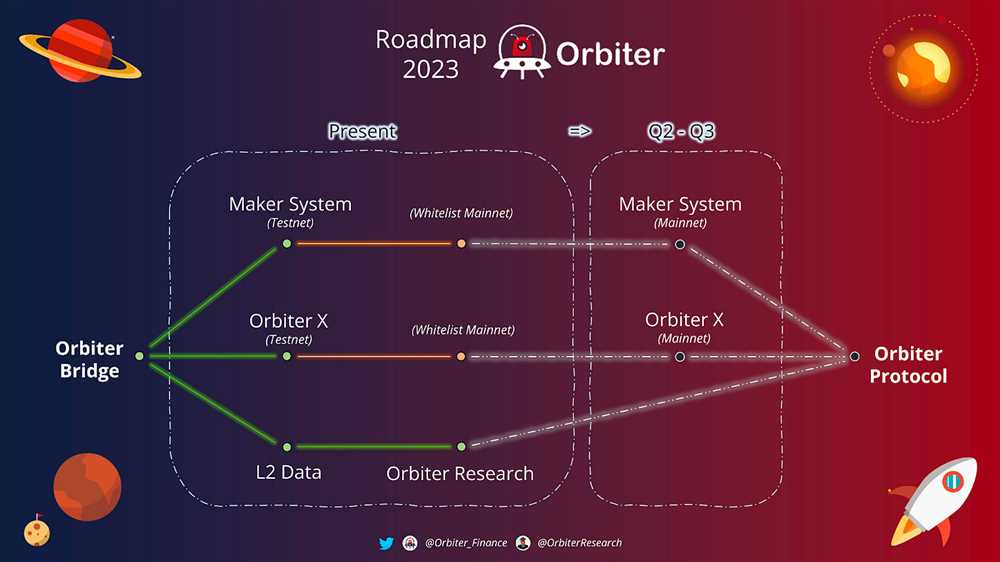

Orbiter Finance, a cutting-edge blockchain project, has developed a unique solution that combines the benefits of both cross-rollup and cross-chain approaches. By leveraging a combination of Layer-1 and Layer-2 technologies, Orbiter Finance aims to provide seamless interoperability while addressing the scalability and security concerns. With its innovative protocol, Orbiter Finance aims to revolutionize the way assets are transferred and communicated in the blockchain ecosystem.

Introducing Cross-Rollup Technology

In the world of decentralized finance (DeFi), interoperability is a critical challenge that needs to be addressed in order to unlock the full potential of blockchain technology. With the rapid growth of different Layer 1 blockchains and Layer 2 solutions, it has become more important than ever to find a way to connect and transfer assets seamlessly across multiple networks.

One promising solution to this challenge is cross-rollup technology. Unlike cross-chain solutions, which aim to connect different blockchains, cross-rollup technology focuses on enabling interoperability between different Layer 2 solutions, specifically rollups.

So, what exactly is a rollup? A rollup is a Layer 2 scaling solution that allows for the aggregation and bundling of transactions off-chain, reducing congestion and costs on the main Ethereum network. It achieves this by compressing multiple transactions into a single transaction that is then submitted to the main Ethereum network.

The Benefits of Cross-Rollup Technology

Cross-rollup technology offers several benefits compared to cross-chain interoperability solutions:

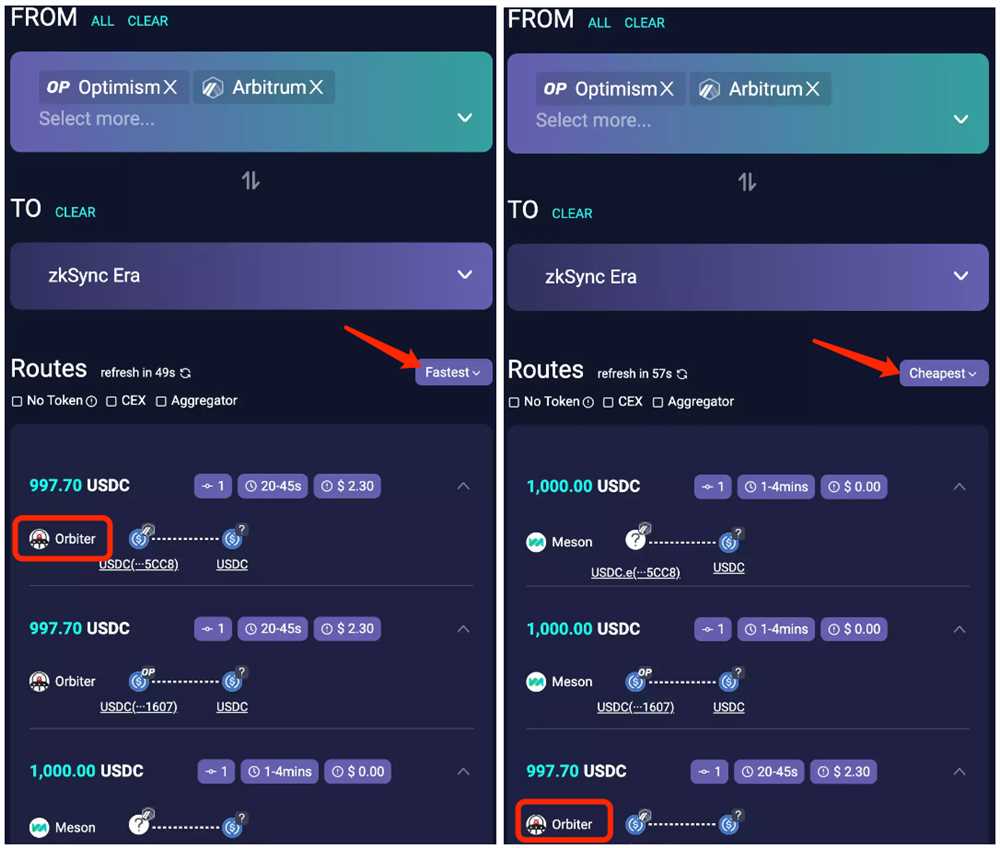

- Reduced Costs and Faster Transactions: By enabling seamless asset transfers between different rollups, cross-rollup technology can help reduce transaction fees and increase transaction speed.

- Enhanced Scalability: With cross-rollup technology, the capacity of a single rollup can be increased by connecting it with other rollup networks, allowing for greater scalability and throughput.

- Better User Experience: Cross-rollup technology provides users with a seamless experience, enabling them to easily interact with assets across different rollup networks without the need for complex bridging solutions.

Overall, cross-rollup technology offers a powerful solution to the interoperability challenges faced by the DeFi ecosystem. By enabling the seamless transfer of assets across different Layer 2 rollup solutions, it unlocks new possibilities for innovation and collaboration in the world of decentralized finance.

The Benefits of Cross-Chain Interoperability

Cross-chain interoperability offers numerous benefits for decentralized finance (DeFi) projects and the wider blockchain ecosystem. By allowing different blockchains to communicate and share information, cross-chain interoperability opens up new possibilities for innovation and collaboration.

One of the key benefits of cross-chain interoperability is increased liquidity. By connecting different blockchains, DeFi projects can tap into a larger pool of assets and users, increasing liquidity and improving market efficiency. This can help to reduce slippage and transaction costs, making it easier and more cost-effective for users to participate in the decentralized finance space.

Another benefit of cross-chain interoperability is improved scalability. By bridging different blockchains, projects can take advantage of the scalability features of each chain and distribute the workload across multiple networks. This can help to alleviate congestion and improve transaction speeds, enabling faster and more efficient processing of transactions.

Cross-chain interoperability also enhances security and decentralization. By enabling different blockchains to communicate and share information, projects can leverage the security features of multiple networks, making it more difficult for malicious actors to compromise the system. Additionally, cross-chain interoperability promotes decentralization by enabling projects to tap into the diverse and distributed resources of multiple blockchains, reducing reliance on any single network.

Furthermore, cross-chain interoperability promotes collaboration and innovation within the blockchain ecosystem. By facilitating communication and data transfer between different blockchains, projects can easily collaborate with other projects, share resources, and build on each other’s work. This can lead to the development of new and innovative solutions that benefit the entire blockchain community.

In conclusion, cross-chain interoperability offers a wide range of benefits for decentralized finance projects and the blockchain ecosystem as a whole. From increased liquidity and improved scalability to enhanced security and collaboration, cross-chain interoperability helps to unlock the full potential of blockchain technology and drive innovation forward.

Orbiter Finance’s Innovative Approach to Interoperability

Orbiter Finance is revolutionizing the way interoperability is achieved in the blockchain industry. With its innovative approach, Orbiter Finance bridges the gap between different blockchains, enabling seamless communication and transactions between them.

One of the key challenges in achieving interoperability is the lack of a standardized protocol for communication between blockchains. Orbiter Finance solves this issue by using a unique cross-chain protocol that allows for decentralized and trustless transactions between different chains.

Cross-Rollup vs Cross-Chain

Unlike traditional cross-rollup solutions, Orbiter Finance’s cross-chain approach enables interoperability between entirely separate blockchains. This means that assets can be transferred between chains that have no direct connection or shared infrastructure.

By leveraging this cross-chain interoperability, Orbiter Finance opens up a world of possibilities for decentralized finance (DeFi) applications. Users can seamlessly move assets and liquidity between different chains, allowing for greater efficiency and flexibility in their financial activities.

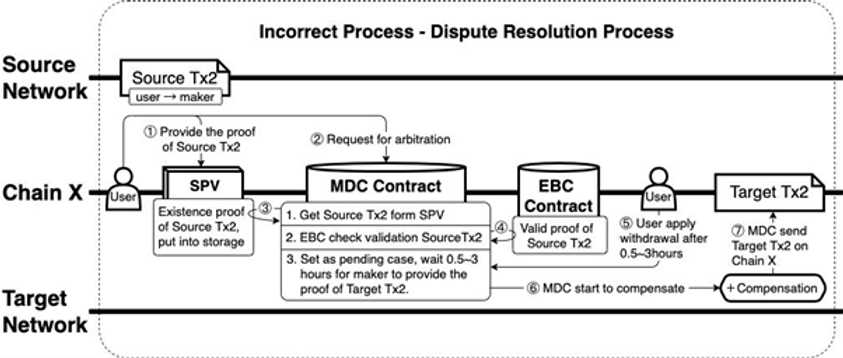

Secure and Efficient Transactions

Orbiter Finance’s innovative approach not only ensures interoperability but also prioritizes security and efficiency in transactions. By utilizing advanced cryptographic techniques, Orbiter Finance ensures that assets are transferred securely and without the risk of theft or tampering.

Furthermore, Orbiter Finance’s cross-chain network is designed to optimize transaction speed and minimize fees. This allows users to enjoy fast and cost-effective transactions, eliminating the barriers that have traditionally hindered the widespread adoption of blockchain technology.

Revolutionizing the Blockchain Industry

Through its innovative approach to interoperability, Orbiter Finance is driving the adoption of blockchain technology to new heights. By enabling seamless communication and transactions between different blockchains, Orbiter Finance is paving the way for a truly decentralized and interconnected blockchain ecosystem.

With its focus on security, efficiency, and user experience, Orbiter Finance is poised to revolutionize the blockchain industry and unlock the full potential of decentralized finance.

What is the difference between Cross-Rollup and Cross-Chain?

While both Cross-Rollup and Cross-Chain are solutions for interoperability, they differ in their approach. Cross-Rollup focuses on scaling Layer 2 solutions within a single blockchain network, allowing users to move assets between different Layer 2 applications. On the other hand, Cross-Chain enables communication and asset transfer between different blockchain networks, which can be based on different protocols.

How does Orbiter Finance address the interoperability challenges?

Orbiter Finance addresses interoperability challenges by introducing a Cross-Rollup solution that aims to bring Layer 2 scaling and interoperability to Ethereum. By leveraging Rollup technology, Orbiter enables users to move their assets across different Layer 2 applications seamlessly and efficiently.

What are the benefits of using Orbiter Finance’s Cross-Rollup solution?

Orbiter Finance’s Cross-Rollup solution offers several benefits. Firstly, it allows for fast and cost-effective transactions on Layer 2, reducing the need for expensive and congested Layer 1 transactions. Secondly, it provides interoperability between different Layer 2 applications, enabling users to seamlessly navigate and utilize various decentralized finance (DeFi) protocols. Lastly, it enhances overall scalability and usability of the Ethereum ecosystem.

Can you give an example of how Orbiter Finance’s Cross-Rollup solution works?

Sure! Let’s say a user wants to transfer an ERC-20 token between two different Layer 2 applications, A and B, within the Orbiter Finance ecosystem. The user can initiate a transaction on Application A, which will then be processed on Layer 2. Once the transaction is confirmed, the user’s token balance will be updated on Layer 2. The user can then interact with Application B and use the transferred token without any additional steps or delays.

Does Orbiter Finance’s Cross-Rollup solution have any limitations?

While Orbiter Finance’s Cross-Rollup solution offers significant benefits, it does have a few limitations. Firstly, it currently only supports Ethereum-based assets, limiting interoperability with assets from other blockchain networks. Secondly, the interoperability is limited to applications within the Orbiter Finance ecosystem and does not extend to other Layer 2 or Layer 1 networks. However, the team is actively working on expanding the solution’s capabilities and interoperability.