Navigating Withholding Fees Tips for Successful Investing with Orbiter Finance

Investing can be a rewarding endeavor, but it’s important to be aware of the potential pitfalls along the way. One such obstacle that investors often encounter is withholding fees. These fees are typically imposed on investments when income is paid to non-resident investors.

At Orbiter Finance, we understand the importance of maximizing your investment returns and minimizing unnecessary costs. To help you navigate withholding fees and optimize your investment strategy, we’ve compiled a list of tips:

1. Research the tax laws: Before making any investment, it’s crucial to familiarize yourself with the tax laws of the country where the investment is located. Understanding the specific rules regarding withholding fees will help you plan your investments more effectively.

2. Seek professional advice: Consulting with a tax expert or financial advisor who specializes in international investments can provide valuable insights and guidance. They can help you navigate the complex tax regulations and ensure you stay compliant.

3. Consider tax treaties: Many countries have tax treaties in place to prevent double taxation and reduce withholding fees. It’s essential to determine if there is a tax treaty between your home country and the country where the investment is located. This could help lower or eliminate withholding fees.

4. Optimize your investment structure: Structuring your investments in a tax-efficient manner can help minimize withholding fees. Exploring options such as investing through a holding company or utilizing tax-efficient investment vehicles can make a significant difference in your overall returns.

5. Stay informed: Tax laws and regulations can change, so it’s crucial to stay up-to-date with any updates or amendments that may affect your investments. Regularly monitoring tax developments will ensure you can adapt your strategy accordingly.

By keeping these tips in mind and partnering with Orbiter Finance, you can navigate the complexities of withholding fees and make informed investment decisions. Our team of experts is dedicated to helping you achieve your financial goals and maximize your returns.

Disclaimer: This article is for informational purposes only and is not intended as tax or investment advice. You should consult with a professional advisor before making any investment decisions.

Orbiter Finance: Tips for Successful Investing

Investing can be an exciting and rewarding journey. With Orbiter Finance, you can take your investment to new heights and achieve your financial goals. Here are some valuable tips to ensure your investing journey is successful:

1. Set Clear and Realistic Goals

Before you start investing, it’s important to set clear and realistic goals. Knowing what you want to achieve will help guide your investment strategy and ensure you stay focused. Whether you’re saving for retirement, a new home, or your children’s education, having clear goals will keep you motivated.

2. Diversify Your Portfolio

Diversification is key to successful investing. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the risk of your portfolio and increase your chances of earning consistent returns. Consider investing in stocks, bonds, real estate, and other assets to build a well-rounded portfolio.

Orbiter Finance offers a wide range of investment options to help you diversify your portfolio effectively. Our team of experienced financial advisors can guide you through the process and help you make informed investment decisions.

Remember, investing involves risk, and diversification does not guarantee a profit or protect against loss. It’s important to carefully consider your risk tolerance and investment objectives before making any investment decisions.

With Orbiter Finance, you’ll have access to a variety of investment tools, research, and resources to help you make informed decisions and navigate the ever-changing market.

Start your journey towards successful investing with Orbiter Finance today and watch your wealth take off!

Navigating Withholding Fees

When it comes to investing with Orbiter Finance, it’s important to understand and navigate the concept of withholding fees. These fees, also known as tax withholding, can have a significant impact on your investment returns and should not be overlooked.

What are withholding fees?

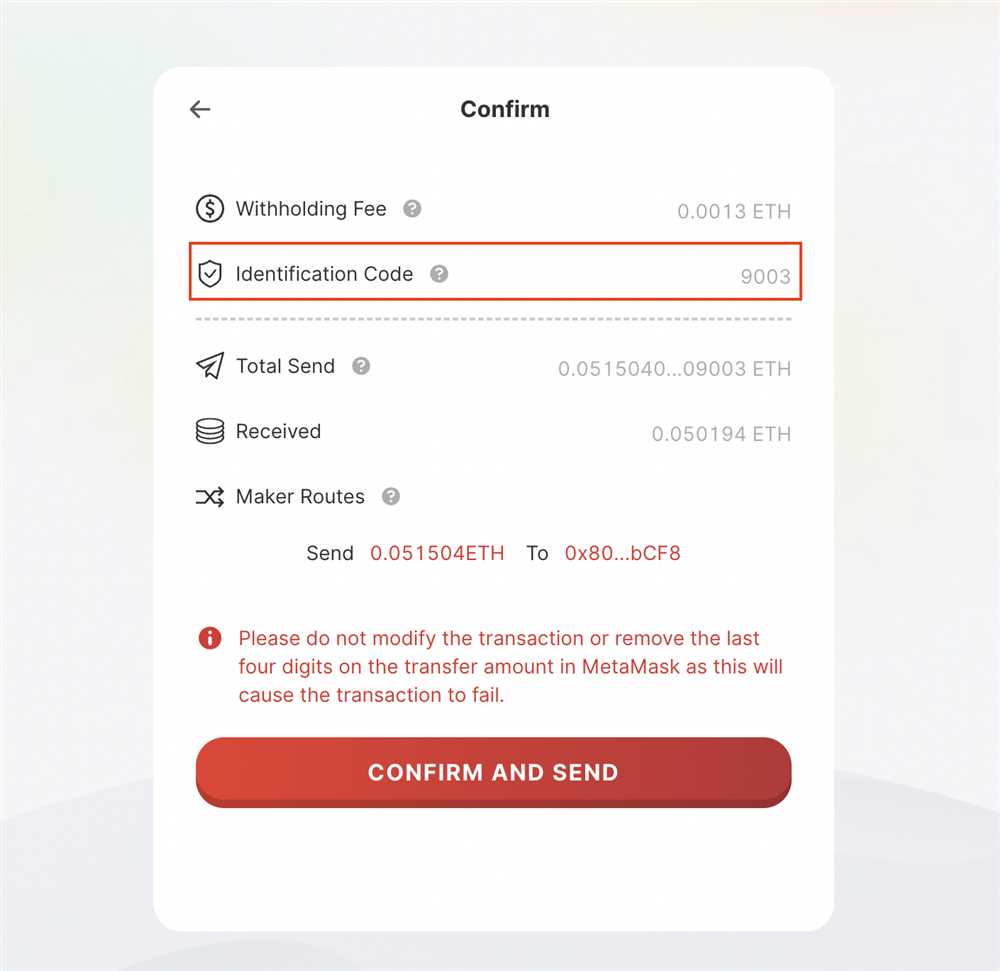

Withholding fees are the portion of investment returns that are withheld by the relevant tax authorities. They are deducted directly from your investment earnings and are often used to cover any tax liabilities that may arise from your investments.

The percentage of withholding fees can vary depending on various factors such as the type of investment and the country where the investment is held. It’s important to familiarize yourself with the specific withholding rules and regulations of the country in which you are investing to ensure you are aware of the potential impact on your returns.

Minimizing withholding fees

While withholding fees are generally unavoidable, there are strategies you can employ to minimize their impact on your investment returns. Here are a few tips:

- Invest in tax-efficient funds: Consider investing in funds that are specifically designed to minimize withholding taxes. These funds are structured in a way that aims to reduce the impact of withholding fees on your returns.

- Utilize tax treaties: Some countries have tax treaties in place that allow for reduced or eliminated withholding taxes on certain types of investments. Make sure to understand and take advantage of any applicable tax treaties when investing internationally.

- Optimize your portfolio allocation: By diversifying your investments across different countries and regions, you may be able to reduce the overall impact of withholding fees. However, it’s important to carefully consider the potential risks and benefits of international investments.

- Stay informed: Tax laws and regulations can change over time, so it’s important to stay informed and regularly review your investment strategy to ensure you are maximizing your returns while minimizing withholding fees.

By understanding and effectively navigating withholding fees, you can make more informed investment decisions and potentially increase your overall returns. At Orbiter Finance, we are dedicated to helping our clients navigate the complexities of investing and maximize their investment potential.

Choosing the Right Investments

When it comes to investing, choosing the right investments can make all the difference. Here at Orbiter Finance, we understand that every investor has unique goals and risk tolerance. That’s why we offer a wide range of investment options to cater to your individual needs.

Evaluate Your Goals and Risk Tolerance

Before you start investing, it’s important to evaluate your financial goals and risk tolerance. Are you investing for retirement, saving for a down payment on a house, or looking to grow your wealth? Understanding your goals will help you determine the investment strategy that is right for you.

Additionally, it’s important to assess your risk tolerance. Are you comfortable with higher-risk investments that offer the potential for higher returns, or do you prefer more conservative investments with lower returns but greater stability? Knowing your risk tolerance will guide you in choosing investments that align with your comfort level.

Diversify Your Portfolio

One key principle of successful investing is diversification. Diversifying your portfolio means spreading your investments across different asset classes, such as stocks, bonds, and real estate. This helps to reduce risk by ensuring that if one investment underperforms, others may offset the losses.

At Orbiter Finance, we offer a diverse range of investment options, including mutual funds, ETFs, individual stocks, and more. Our experienced advisors can help you build a portfolio that is tailored to your specific goals and risk tolerance.

Remember, past performance is not indicative of future results. It’s important to regularly review your investments and make adjustments as needed to ensure that they continue to align with your goals and risk tolerance.

With Orbiter Finance, you are not alone in your investment journey. Our team of experts is here to guide you every step of the way, helping you make informed decisions and navigate the complexities of the market.

Start choosing the right investments today and set yourself up for a successful financial future with Orbiter Finance.

Diversifying Your Portfolio

One of the key strategies for successful investing is diversifying your portfolio. Diversification involves spreading your investments across different asset classes, sectors, and geographic regions to reduce risk and maximize potential returns. Here are some tips on how to effectively diversify your portfolio:

1. Asset Classes

Investing in a mix of asset classes is essential for diversification. This includes stocks, bonds, real estate, commodities, and cash. Each asset class has its own risk and return characteristics and may perform differently under different market conditions. By allocating your investments across various asset classes, you can mitigate the impact of any single asset class on your overall portfolio.

2. Sectors

Within each asset class, it’s important to diversify across different sectors. Sectors represent different industries such as technology, healthcare, energy, and finance. By investing in a variety of sectors, you can reduce the impact of a downturn in any single sector on your overall portfolio.

3. Geographic Regions

Diversifying across geographic regions is another key aspect of portfolio diversification. Different countries and regions may have different economic cycles, political factors, and currency risks. By investing in a mix of domestic and international markets, you can reduce the impact of any single region on your portfolio.

4. Risk Tolerance

Consider your risk tolerance when diversifying your portfolio. Your risk tolerance is an important factor in determining the proportion of your investments allocated to different asset classes. If you have a higher risk tolerance, you may be comfortable investing a larger portion of your portfolio in stocks. On the other hand, if you have a lower risk tolerance, you may prefer a larger allocation to bonds and cash.

Remember, diversification does not guarantee profits or protect against loss, but it can help to manage risk in your investment portfolio. It’s important to regularly review and rebalance your portfolio to maintain diversification as your financial goals and market conditions change.

By actively diversifying your portfolio, you can increase your chances of achieving your financial goals while minimizing risk.

Monitoring and Adjusting Your Investments

Once you have invested with Orbiter Finance, it is crucial to monitor and adjust your investments regularly to ensure their success. By staying informed and making necessary changes, you can maximize your returns and minimize any risks.

Stay Informed

Monitoring your investments involves staying informed about market trends, economic indicators, and industry news. This information will help you make informed decisions about when to buy, sell, or hold your investments.

You can stay informed by:

- Reading financial news and reports

- Following market influencers and experts

- Attending investment seminars and conferences

- Utilizing financial analysis tools and research

Analyze Your Investments

Regularly analyze the performance of your investments to identify areas that are performing well and areas that may need adjustment. This analysis can help you make informed decisions about whether to keep, adjust, or divest certain investments.

Here are some factors to consider when analyzing your investments:

| Factor | Description |

|---|---|

| Return on Investment (ROI) | Assess the profitability of your investments by comparing the return to the initial investment. |

| Risk Level | Evaluate the level of risk associated with each investment and determine if it aligns with your risk tolerance. |

| Market Conditions | Consider how market conditions may impact the performance of your investments. |

| Diversification | Ensure that your investment portfolio is diversified to minimize risk and take advantage of different market opportunities. |

Based on your analysis, you can make informed decisions about whether to adjust your investments by reallocating funds, diversifying further, or divesting from underperforming assets.

Remember, monitoring and adjusting your investments is an ongoing process that requires regular attention. By staying informed and proactive, you can make the most of your investments with Orbiter Finance.

What are withholding fees?

Withholding fees are taxes that are withheld from your investment earnings by the government. These fees are deducted before you receive any profits from your investment.

How do withholding fees affect my investment returns?

Withholding fees can significantly impact your investment returns. If the fees are high, they can eat into your profits and reduce the overall returns you receive from your investment. It’s important to take them into account when considering the potential returns of an investment.