Secure Your Financial Future with Orbiter Finance

Are you tired of feeling overwhelmed when it comes to managing your finances? With Orbiter Finance’s personalized financial planning tools, you can take control of your financial future and achieve your goals.

Customized Solutions

Orbiter Finance understands that everyone’s financial situation is unique. Our personalized financial planning tools provide customized solutions tailored to your specific needs and goals. Whether you’re saving for retirement, planning for a major purchase, or looking to grow your investments, Orbiter Finance has you covered.

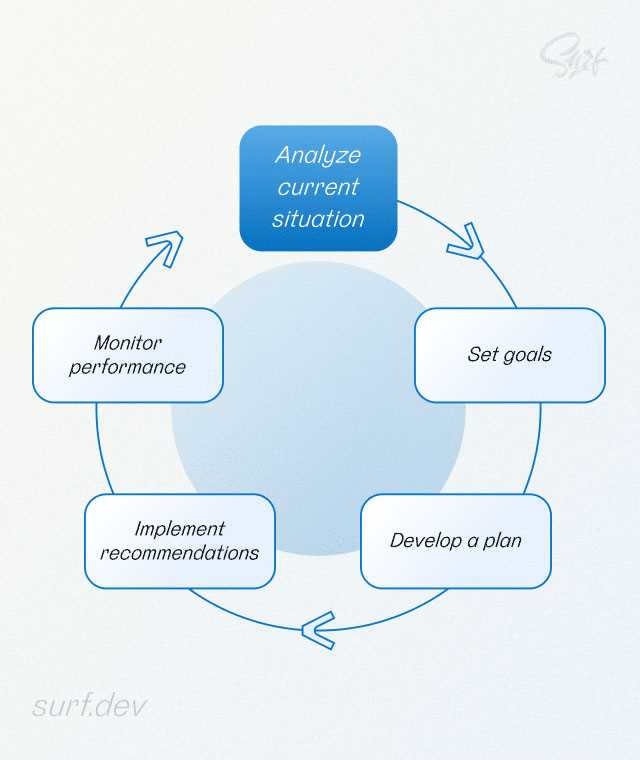

Comprehensive Analysis

Our financial planning tools offer a comprehensive analysis of your current financial situation. Using advanced algorithms and data analysis, we provide insights into your income, expenses, investments, and more. With this information, you can make informed decisions and optimize your financial strategy.

Easy-to-Use Interface

We believe that managing your finances should be simple and stress-free. That’s why our financial planning tools feature an easy-to-use interface. Whether you’re a financial expert or just starting out, our intuitive platform makes it easy to navigate and understand your financial data.

Real-time Updates

Stay up-to-date with the latest changes in your financial landscape. Our personalized financial planning tools provide real-time updates, so you can monitor your progress and make adjustments as needed. No more waiting for monthly statements or guessing where you stand financially.

Start Planning Your Future Today

Don’t wait another day to secure your financial future. Experience the benefits of Orbiter Finance’s personalized financial planning tools and take control of your finances. Sign up now and start planning for a brighter tomorrow.

Save Time and Money

Managing your finances can be time-consuming and overwhelming. At Orbiter Finance, we understand that your time is valuable, and we strive to provide you with personalized financial planning tools that can help you save both time and money.

Efficient Tools

Our personalized financial planning tools are designed to make managing your finances easier and more efficient. With our easy-to-use budgeting tools, you can track your expenses, set financial goals, and monitor your progress all in one place. This saves you time that would otherwise be spent manually tracking your finances or using multiple tools.

Smart Automated Solutions

Our intelligent automation technology helps you make better financial decisions quickly. Through our algorithms and analysis, we can provide you with smart recommendations on saving strategies, investment opportunities, and tax planning. This not only saves you time but also helps you make informed decisions that can potentially save you money in the long run.

| Benefits of saving time: | Benefits of saving money: |

| – Allows you to focus on other important aspects of your life | – Helps you build a strong financial foundation |

| – Reduces stress and worry | – Enables you to achieve your financial goals faster |

| – Provides more free time for leisure activities | – Helps you avoid unnecessary expenses |

| – Increases productivity | – Allows you to invest and grow your wealth |

At Orbiter Finance, we believe that time is money. By utilizing our personalized financial planning tools, you can save both time and money, giving you more control over your financial future.

Efficient Financial Planning

Efficient financial planning is crucial for achieving your financial goals and securing a stable financial future for yourself and your family. With Orbiter Finance’s personalized financial planning tools, you can streamline your financial management process and make informed decisions that will lead to greater financial security and success.

Automated Budgeting

One of the key features of Orbiter Finance’s financial planning tools is the automated budgeting system. Say goodbye to the tedious process of manually tracking your income and expenses. With our innovative technology, you can easily set up a budget that fits your financial goals and track your spending in real-time. This automated system will provide you with valuable insights into your spending habits, helping you identify areas where you can save and allocate funds more efficiently.

Goal-Based Planning

Orbiter Finance’s personalized financial planning tools also offer goal-based planning, which allows you to set specific financial goals and create a roadmap for achieving them. Whether you’re saving for a house, planning for retirement, or looking to invest in your education, our tools will help you outline the steps needed to reach your goals. By breaking down your goals into manageable tasks and tracking your progress along the way, you’ll stay motivated and on track towards financial success.

Comprehensive Financial Analysis

In addition to budgeting and goal-based planning, Orbiter Finance’s tools provide comprehensive financial analysis. With features such as expense categorization and income tracking, you’ll have a clear view of your overall financial health. Our tools will generate detailed reports and visualizations, allowing you to identify trends, analyze your cash flow, and make data-driven decisions. This comprehensive analysis will empower you to make smart financial choices and maximize your financial potential.

Efficient financial planning is within your reach with Orbiter Finance’s personalized financial planning tools. Take control of your financial future and start achieving your goals today.

Reduce Costs and Expenses

At Orbiter Finance, we understand the importance of minimizing costs and expenses in order to maximize your financial success. Our personalized financial planning tools are designed to help you identify and reduce unnecessary expenses, allowing you to save more money and achieve your financial goals faster.

- Expense Tracking: Easily track your expenses and identify areas where you can cut back. Our tools provide detailed reports and analysis to help you understand where your money is going.

- Budget Creation: Create a customized budget that aligns with your financial goals. Our tools allow you to set spending limits for different categories and track your progress in real-time.

- Bill Management: Say goodbye to late fees and extra charges. Our tools provide reminders and notifications for upcoming bills, ensuring that you never miss a payment and incur unnecessary expenses.

- Comparison Shopping: Find the best deals and save money on your everyday purchases. Our tools provide price comparisons and recommendations, helping you make informed decisions and get the most value for your money.

- Financial Efficiency Analysis: Our tools analyze your financial habits and provide recommendations for optimizing your spending. Identify areas where you can make small changes that add up to big savings over time.

With Orbiter Finance’s personalized financial planning tools, reducing costs and expenses has never been easier. Start saving money today and take control of your financial future.

Reach Your Financial Goals

At Orbiter Finance, we understand that everyone has different financial goals. Whether you dream of buying a new house, starting your own business, or retiring early, our personalized financial planning tools can help you reach your goals faster.

Our innovative platform allows you to create a customized financial plan that aligns with your unique circumstances and aspirations. By taking into account factors such as your income, expenses, savings, and investment preferences, our tools provide you with a clear roadmap to achieve your goals.

With Orbiter Finance’s personalized financial planning tools, you can track your progress in real-time. Our user-friendly interface makes it easy to monitor your savings, investment returns, and debt reduction. You’ll have a complete picture of your financial health, allowing you to make informed decisions and adjust your plan as needed.

In addition to helping you reach your short-term goals, our tools also assist in long-term financial planning. Whether you’re saving for your children’s education or building a retirement nest egg, our innovative features analyze your financial data and offer recommendations on asset allocation, investment strategies, and tax optimization.

Orbiter Finance is committed to your financial success. Our personalized financial planning tools empower you to take control of your financial future and make informed decisions that align with your goals. Start using our platform today and see how we can help you reach new heights in your financial journey.

| Key Features: | – Customized financial plan tailored to your goals |

| – Real-time tracking of savings, investments, and debt reduction | |

| – Recommendations on asset allocation and investment strategies | |

| – Tax optimization strategies |

Personalized Goal Setting

At Orbiter Finance, we understand that everyone has different financial goals and aspirations. That’s why our personalized financial planning tools include a feature for setting your own unique goals.

With our goal setting tool, you can define specific objectives that align with your individual financial situation and dreams. Whether you’re saving for a down payment on a house, planning for retirement, or aiming for a dream vacation, our tool will help you create a roadmap to achieve your goals.

Setting goals is just the beginning. Our personalized goal setting tool also provides ongoing tracking and monitoring of your progress. You’ll be able to see how close you are to reaching each milestone and make adjustments along the way if needed. We believe that seeing your progress in real-time will motivate you to stay on track and keep pushing towards your goals.

What sets Orbiter Finance’s personalized goal setting tool apart is the level of customization. We understand that life is constantly changing, and your goals may evolve over time. That’s why our tool allows you to update and modify your goals as needed. Whether you want to accelerate your timeline or adjust the target amount, the flexibility is in your hands.

With Orbiter Finance’s personalized goal setting tool, you’ll have the power to turn your dreams into reality. Start planning for a brighter financial future today!

What are the benefits of Orbiter Finance’s personalized financial planning tools?

Orbiter Finance’s personalized financial planning tools offer a range of benefits for users. These tools can help individuals create customized financial plans based on their unique financial goals and circumstances. They provide users with valuable insights and recommendations to help them make informed decisions about their finances. Additionally, these tools can help track spending and savings, monitor investments, and provide users with a clear picture of their overall financial health.

How can Orbiter Finance’s personalized financial planning tools help me with my financial goals?

Orbiter Finance’s personalized financial planning tools can be a valuable resource for individuals looking to achieve their financial goals. These tools allow users to set specific targets and create actionable plans to work towards those goals. They can provide recommendations on how to allocate and invest funds, track progress, and make adjustments as needed. By using these tools, individuals can gain better control over their finances and increase their chances of reaching their desired financial outcomes.

Can Orbiter Finance’s personalized financial planning tools help me with budgeting?

Yes, Orbiter Finance’s personalized financial planning tools can definitely assist you with budgeting. These tools can help you track your income and expenses, identify areas of overspending, and create a budget that aligns with your financial goals. By providing a clear overview of your finances, these tools enable you to make more informed decisions about your spending habits. They can also send alerts and reminders to help you stay on track with your budget and avoid unnecessary expenses.