Earning Interest in the Digital Age: Exploring Orbiter Finance’s Decentralized Lending Services

Are you tired of earning minimal interest on your savings? Are you looking for innovative ways to grow your wealth? Look no further than Orbiter Finance, the leading platform for decentralized lending.

With Orbiter Finance, you can take advantage of the power of blockchain technology to earn attractive interest rates on your cryptocurrencies. Whether you hold Bitcoin, Ethereum, or any other major digital asset, our platform allows you to put your idle assets to work.

Unlike traditional banks, which provide minimal interest rates, Orbiter Finance harnesses the potential of decentralized finance (DeFi) to offer you competitive rates of return. By lending your cryptocurrencies to borrowers, you can earn high yields that were previously only accessible to institutional investors.

But what sets Orbiter Finance apart from other DeFi platforms? Our cutting-edge technology and rigorous risk management protocols ensure the safety of your funds. We have implemented smart contracts that automatically enforce lending terms and protect against default risks.

Furthermore, Orbiter Finance provides you with full transparency and control over your investments. You can track your earnings in real-time and withdraw your funds at any point without facing any penalties or hurdles.

Join thousands of satisfied users who have already started earning interest with Orbiter Finance. Don’t miss out on the opportunity to grow your wealth in a decentralized and secure manner. Sign up today and unlock the potential of decentralized lending!

Earning Interest with Orbiter Finance:

Orbiter Finance offers a unique opportunity for individuals to earn interest on their holdings by participating in decentralized lending. By utilizing blockchain technology and smart contracts, Orbiter Finance provides a secure and transparent platform for borrowers and lenders.

When it comes to traditional lending systems, banks and financial institutions act as intermediaries, setting strict terms and conditions and charging high interest rates. However, with Orbiter Finance, the power is decentralized, allowing individuals to lend and earn interest without the need for intermediaries.

With Orbiter Finance, you can lend your crypto assets and earn interest on them. Whether you have Bitcoin, Ethereum, or any other supported cryptocurrency, you can deposit it into the Orbiter Finance platform and start earning interest right away.

The interest rates on Orbiter Finance are dynamic and based on supply and demand. This means that as more people lend their crypto assets, the interest rates increase. Conversely, if there is less demand for borrowing, the interest rates decrease. This ensures a fair and balanced lending environment for all participants.

In addition to earning interest, Orbiter Finance also provides liquidity to borrowers. If you need to borrow crypto assets, you can do so by leveraging your existing holdings as collateral. This allows individuals to access funds without having to sell their assets, maintaining their exposure to potential upside gains.

Furthermore, Orbiter Finance employs a robust risk management system to ensure the safety and security of all participants. Smart contracts automatically execute transactions, removing the need for trust between parties. All transactions are transparent and verifiable on the blockchain, providing a high level of security and trust.

Whether you are looking to earn interest on your crypto holdings or access funds through borrowing, Orbiter Finance offers a decentralized and efficient solution. Join the Orbiter Finance community today and start earning interest with ease.

A Look into Decentralized Lending

Decentralized lending has emerged as a revolutionary concept in the world of finance. Gone are the days when we were solely reliant on traditional banking institutions to borrow or lend money. With the advent of blockchain technology, decentralized lending platforms have gained immense popularity and are transforming the way we borrow and lend.

Decentralized lending allows individuals to participate in lending activities without the need for intermediaries such as banks. Through the use of smart contracts and blockchain technology, borrowers can directly connect with lenders, eliminating the need for cumbersome paperwork and time-consuming processes.

One of the key advantages of decentralized lending is the transparency it offers. Every transaction is recorded on a public ledger, making it easily verifiable and tamper-proof. This transparency builds trust among borrowers and lenders, resulting in a more efficient lending process.

Benefits of Decentralized Lending

Decentralized lending provides borrowers with access to loans that may not have been available to them through traditional banking channels. The absence of strict requirements and the ability to collateralize digital assets enable borrowers to obtain loans quickly and efficiently.

For lenders, decentralized lending offers an attractive opportunity to earn interest on their idle digital assets. By lending out their digital assets, lenders can earn a passive income while contributing to the growth of the decentralized finance ecosystem.

Orbiter Finance: Revolutionizing Decentralized Lending

One platform that is revolutionizing decentralized lending is Orbiter Finance. With its user-friendly interface and advanced features, Orbiter Finance is a leading platform in the decentralized lending space.

Orbiter Finance offers borrowers competitive interest rates and flexible loan terms, ensuring that they find the best solution for their financial needs. The platform also prioritizes the security of user funds and employs rigorous security measures to safeguard against any potential risks.

For lenders, Orbiter Finance provides a seamless lending experience with attractive interest rates and a diverse range of borrowing options. Lenders can lend out their digital assets while enjoying a hassle-free process and a secure lending environment.

If you are ready to explore the world of decentralized lending, Orbiter Finance is the platform to choose. Join us today and start earning interest with Orbiter Finance!

Advantages of Decentralized Lending

Decentralized lending offers several advantages over traditional lending methods. Here are some key benefits to consider:

1. Transparency:

One of the main advantages of decentralized lending is transparency. With traditional lending, borrowers often have limited visibility into how the interest rates are determined and how their funds are being used. On the other hand, decentralized lending platforms utilize smart contracts, which are transparent and allow borrowers to see exactly how their funds are being utilized.

2. Security:

Decentralized lending platforms provide enhanced security compared to traditional lending. With traditional lending, borrowers are required to provide sensitive personal information, such as Social Security numbers and bank account details, which can be vulnerable to security breaches. In contrast, decentralized lending platforms use blockchain technology to encrypt and secure user data, reducing the risk of data breaches.

3. Efficiency:

Decentralized lending eliminates many of the inefficiencies associated with traditional lending processes. With decentralized lending, borrowers can access funds quickly and easily without going through the lengthy application and approval process required by traditional lending institutions. This saves time and resources for both the borrower and the lender.

4. Global Accessibility:

Decentralized lending platforms offer global accessibility. Traditional lending institutions often have strict eligibility requirements and may only serve certain regions or countries. In contrast, decentralized lending platforms operate on the blockchain, which is accessible to anyone with an internet connection. This enables borrowers from all over the world to participate in decentralized lending and access capital.

5. Peer-to-Peer Transactions:

Decentralized lending platforms enable peer-to-peer transactions, cutting out intermediaries such as banks. This allows borrowers and lenders to interact directly, reducing costs and lowering the barriers to entry for borrowers. By eliminating the need for intermediaries, decentralized lending makes borrowing more affordable and accessible for individuals and businesses.

In conclusion, decentralized lending offers transparency, security, efficiency, global accessibility, and peer-to-peer transactions, making it a compelling alternative to traditional lending methods.

Increased Privacy and Security

At Orbiter Finance, we understand the importance of privacy and security when it comes to financial transactions. That’s why we have implemented a range of measures to ensure the safety of our users’ funds and personal information.

Firstly, we utilize blockchain technology to provide a decentralized platform for lending. This means that your transactions are recorded on a transparent and immutable ledger, ensuring that they cannot be tampered with or altered. By leveraging the power of the blockchain, we eliminate the need for intermediaries, reducing the risk of fraudulent activities.

In addition to blockchain technology, we also prioritize the privacy of our users. We have implemented advanced encryption protocols to protect your personal information and ensure that it remains confidential. Our secure systems are designed to safeguard against unauthorized access and data breaches.

To further enhance privacy, we also offer anonymous lending options. With our anonymous lending feature, you can borrow or lend funds without revealing your identity. This allows you to maintain your financial privacy while still enjoying the benefits of decentralized lending.

Furthermore, we have a dedicated team of security experts who continuously monitor our platform and implement robust security measures. This includes regularly conducting security audits and penetration testing to identify and address any potential vulnerabilities.

| Our Privacy and Security Measures |

|---|

| Utilizing blockchain technology for transparent and secure transactions |

| Implementing advanced encryption protocols to protect personal information |

| Offering anonymous lending options for enhanced privacy |

| Continuous monitoring, security audits, and penetration testing |

By prioritizing privacy and security, Orbiter Finance provides a trustworthy and secure platform for decentralized lending. You can have peace of mind knowing that your funds and personal information are protected.

Join us today and experience the benefits of earning interest with Orbiter Finance, without compromising your privacy and security!

Elimination of Middlemen

With Orbiter Finance, you can say goodbye to the traditional banking system and the need for intermediaries. Our platform operates on the principles of decentralized finance, cutting out the middlemen and enabling direct transactions between lenders and borrowers.

This eliminates the need for banks, brokers, and other intermediaries who often add layers of complexity and cost to lending and borrowing processes. By removing these middlemen, Orbiter Finance offers borrowers competitive interest rates and allows lenders to earn higher interest on their investments.

Decentralized lending provided by Orbiter Finance is powered by smart contracts, ensuring secure and transparent transactions without the need for trust in a centralized authority. This means that borrowers and lenders can interact directly, is completely eliminating the need for a middleman to facilitate the lending process.

By removing middlemen, Orbiter Finance puts the power back into the hands of the people. It allows individuals to have greater control over their finances, as they can directly negotiate loan terms and interest rates with lenders or borrowers. This decentralized approach eliminates the potential biases and restrictions that intermediaries often impose.

Join Orbiter Finance today and experience a financial ecosystem that believes in empowering its users by eliminating the influence of middlemen. Start earning interest and take control of your financial future.

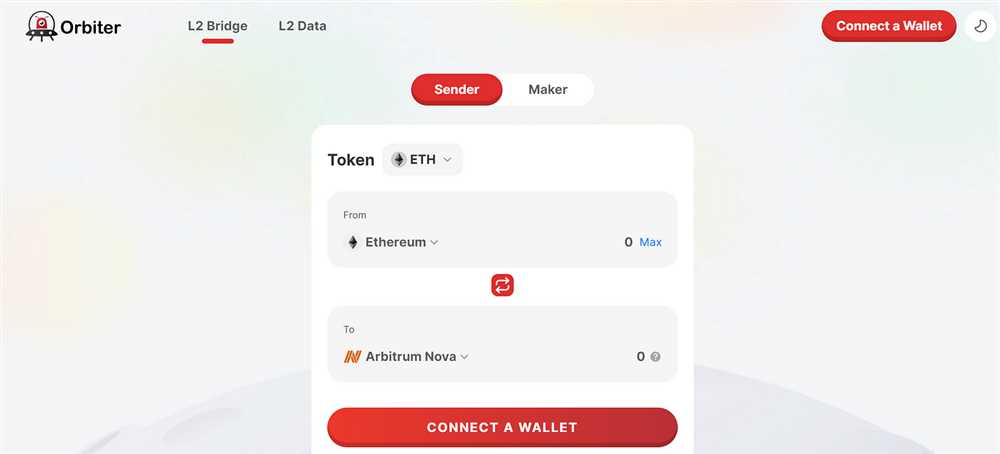

How Orbiter Finance Works

Orbiter Finance is a decentralized lending platform that allows users to earn interest on their assets. The platform operates on the blockchain, ensuring transparency and security for all users.

1. Deposit Assets

To start earning interest with Orbiter Finance, users need to deposit their assets into the platform. These assets can include cryptocurrencies such as Bitcoin, Ethereum, or stablecoins like USDT.

Users can choose the assets they want to deposit and transfer them to their Orbiter Finance wallet. The platform supports a wide range of assets, providing users with flexibility and options.

2. Lending Pool

Once the assets are deposited, they enter the Orbiter Finance lending pool. The platform uses advanced algorithms to match lenders with borrowers, ensuring optimal interest rates for all parties.

Borrowers can access the lending pool to borrow assets for various purposes, such as trading, investments, or personal use. They pay interest on the borrowed assets, which is distributed among the lenders proportionally.

3. Earn Interest

As a lender on Orbiter Finance, users earn interest on their deposited assets. The interest rates are determined by the supply and demand dynamics within the lending pool.

The interest is accrued in real-time and paid out regularly to the lenders’ wallets. Users can choose to reinvest the earned interest or withdraw it to their external wallets.

Overall, Orbiter Finance provides a seamless and efficient way for users to earn interest on their assets through decentralized lending. With its transparent and secure blockchain infrastructure, users can trust the platform with their assets and enjoy passive income opportunities.

What is Orbiter Finance?

Orbiter Finance is a decentralized lending platform that allows users to earn interest by lending their cryptocurrency assets.

How does Orbiter Finance work?

Orbiter Finance works by connecting borrowers and lenders in a decentralized manner. Lenders can deposit their cryptocurrency assets into the platform and earn interest, while borrowers can take out loans by providing collateral.

What cryptocurrencies can I lend on Orbiter Finance?

Orbiter Finance supports lending for a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and many others. You can check the platform for the full list of supported cryptocurrencies.

How much interest can I earn on Orbiter Finance?

The amount of interest you can earn on Orbiter Finance depends on various factors, such as the amount of cryptocurrency you lend, the duration of the lending period, and market conditions. You can check the platform’s interest rates and calculate your potential earnings.

Is my cryptocurrency safe on Orbiter Finance?

Orbiter Finance takes measures to ensure the security of users’ cryptocurrency assets. The platform uses various security protocols, including smart contracts and encryption, to protect against hacking and theft. However, it’s important to note that there is always some level of risk involved in decentralized lending, and users should carefully assess and manage their risk.