From Stocks to Cryptocurrency A Look at the Range of Orbiter Finance Alternatives

Welcome to Orbiter Finance, where we invite you to embark on a financial journey like no other! Are you tired of the traditional stock market and its limited opportunities? Ready to explore new frontiers and embrace the future of finance? It’s time to consider cryptocurrency as a groundbreaking alternative that’s taking the world by storm.

Why choose Orbiter Finance?

1. Unparalleled Potential: Cryptocurrency offers unparalleled potential for growth and profit. With its decentralized nature, digital currencies like Bitcoin and Ethereum have revolutionized the way we think about money. Experience the thrill of investing in this futuristic asset class and watch your wealth soar.

2. Diversification: Break free from the constraints of traditional finance and diversify your portfolio with cryptocurrency. As the world becomes increasingly digital, the demand for digital currencies is skyrocketing. From established coins to exciting new projects, there are countless opportunities waiting to be explored.

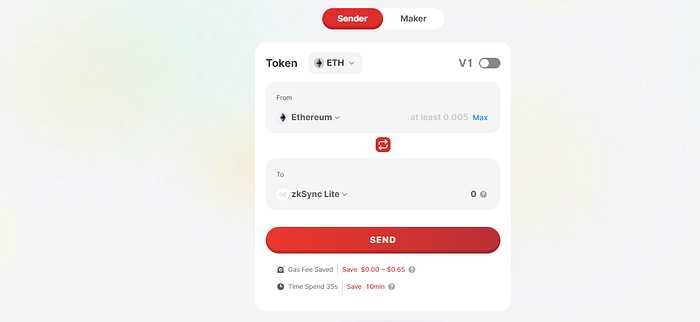

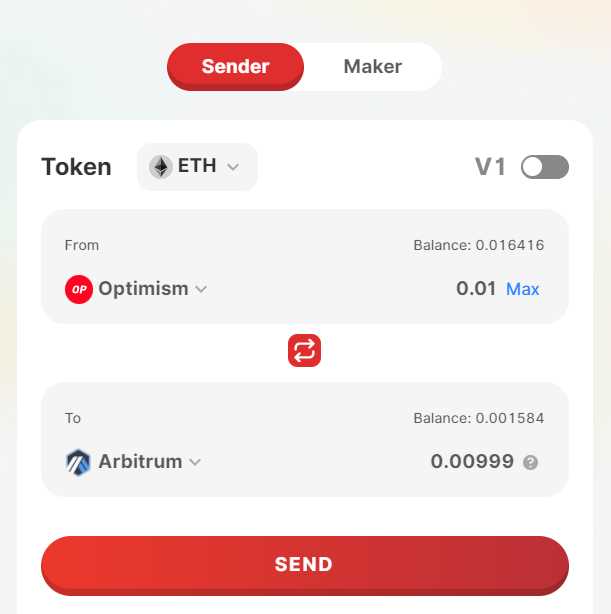

3. Accessibility: Say goodbye to complex investment strategies and convoluted financial jargon. Orbiter Finance makes investing in cryptocurrency accessible to all. Our user-friendly platform guides you through every step, ensuring a seamless and secure experience, whether you’re a seasoned investor or just getting started.

4. Innovation: Orbiter Finance is at the forefront of financial innovation. We combine cutting-edge technology with expert insights to empower you on your financial journey. Discover new ways to grow your wealth, participate in groundbreaking projects, and fuel the progress of the global economy.

Join Orbiter Finance today!

The time is now to take control of your financial future. Embrace the world of cryptocurrencies and unlock a universe of possibilities. Sign up with Orbiter Finance today and make your mark on the exciting landscape of digital finance. Don’t miss out on this opportunity to be part of the next financial revolution.

Understanding The Stock Market

The stock market is a complex system where shares of publicly traded companies are bought and sold. It is an important tool for companies to raise capital and for investors to potentially earn profits. Understanding how the stock market works can be beneficial for individuals looking to invest their money wisely.

What is a Stock?

A stock represents a share of ownership in a company. When you buy a stock, you become a shareholder and have the potential to profit from the company’s growth and success. The price of a stock is determined by the supply and demand in the market, as well as factors such as the company’s financial performance and future prospects.

How Does the Stock Market Work?

The stock market operates through exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, where buyers and sellers come together to trade shares. When a company decides to go public, it offers its stocks for sale to the public through an initial public offering (IPO). After the IPO, the stock can be traded freely between investors on the stock market.

Investors can buy and sell stocks through stockbrokers, either online or offline. They place orders specifying the number of shares they want to buy or sell, and at what price. The stock market matches these buy and sell orders, and the trades are executed.

Risks and Rewards

While investing in the stock market can potentially yield significant returns, it is important to understand the risks involved. Stock prices can be volatile and fluctuate based on various factors, including economic conditions, political events, and company-specific news.

Investors should conduct thorough research and analysis before investing in any company. They should diversify their investment portfolio to reduce risk and consider investing in different sectors and types of stocks.

It is also important to have a long-term perspective and not get swayed by short-term market fluctuations. Successful investing in the stock market requires patience, discipline, and a sound investment strategy.

Conclusion:

Understanding the stock market is crucial for individuals looking to invest their money. By learning how stocks work and the risks and rewards involved, investors can make informed decisions and potentially earn profits in the stock market.

Disclaimer: Investing in the stock market involves risk. It is advisable to seek professional financial advice before making any investment decisions.

Advantages of Exploring Orbiter Finance Alternatives

Choosing Orbiter Finance as an alternative to traditional forms of finance offers numerous advantages and benefits. Here are just a few reasons why you should consider exploring Orbiter Finance alternatives:

1. Diversification

Orbiter Finance provides access to a wide range of investment options, allowing you to diversify your portfolio and spread your risk. With traditional financial instruments, such as stocks and bonds, it can be challenging to achieve true diversification. Orbiter Finance offers opportunities to invest in different sectors, industries, and asset classes, which can help mitigate potential losses and enhance potential returns.

2. High Potential Returns

Investing in Orbiter Finance alternatives, such as cryptocurrencies, can offer significant potential returns. The cryptocurrency market has experienced tremendous growth in recent years, with some coins and tokens delivering astronomical returns. While the market can be volatile, it also presents opportunities for substantial gains. Orbiter Finance allows you to tap into this potential and take advantage of emerging investment trends.

3. Accessibility

Unlike traditional financial markets, Orbiter Finance alternatives are often more accessible to everyday investors. Cryptocurrency exchanges and investment platforms make it relatively easy to buy, sell, and trade digital assets. Additionally, there are typically lower barriers to entry with Orbiter Finance alternatives, allowing more people to participate in the market and potentially benefit from its growth.

4. Transparency and Security

Orbiter Finance alternatives, especially cryptocurrencies, are built on blockchain technology, which offers transparency and security. Blockchain provides a decentralized and immutable ledger that records all transactions, ensuring transparency and reducing the risk of fraud. Cryptocurrency transactions also typically involve strong encryption, making them more secure than traditional financial transactions.

By exploring Orbiter Finance alternatives, you can take advantage of these benefits and potentially grow your wealth in new and exciting ways. However, it is essential to conduct thorough research and understand the risks associated with these alternatives before making any investment decisions.

Understanding Cryptocurrency as an Alternative

In today’s ever-evolving financial landscape, many investors are seeking alternatives to traditional investment options like stocks. One such alternative that has gained significant popularity in recent years is cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by central banks, cryptocurrency operates on a decentralized network called blockchain. This means that transactions are verified by a network of computers rather than a centralized authority.

One of the key features of cryptocurrency is its strong emphasis on anonymity and privacy. Transactions conducted using cryptocurrency are pseudonymous, meaning that they are not directly tied to an individual’s identity. This can provide a level of privacy that is not possible with traditional financial transactions.

Advantages of Cryptocurrency

There are several advantages to considering cryptocurrency as an alternative investment:

- Decentralization: The decentralized nature of cryptocurrency means that it is not subject to the control of any government or institution. This can provide protection against political and economic instability.

- Security: Cryptocurrency utilizes advanced cryptographic techniques to secure transactions, making it highly secure and resistant to fraud or hacking.

- Accessibility: Cryptocurrency transactions can be conducted globally, without the need for intermediaries or expensive fees associated with traditional banking systems.

- Potential for high returns: Due to the volatile nature of cryptocurrency markets, there is a potential for significant returns on investment. However, it’s important to note that the market can also be highly unpredictable and involves risks.

Overall, understanding cryptocurrency as an alternative investment option is crucial for investors looking to diversify their portfolio and explore new opportunities in the financial landscape. While it offers many advantages, it’s important to carefully research and educate oneself about the risks involved before making any investment decisions.

Comparing Stocks and Cryptocurrency

When it comes to investing, there are a multitude of options available to individuals and institutions alike. Two popular choices for investment are stocks and cryptocurrency. Both offer the potential for lucrative returns, but there are several key differences between the two.

Volatility

One of the primary differences between stocks and cryptocurrency is volatility. Stocks, particularly those of well-established companies, tend to have a more stable and predictable price fluctuation compared to cryptocurrencies. Cryptocurrencies, on the other hand, are notorious for their extreme price volatility. While this volatility can present significant opportunities for profit, it also introduces a higher level of risk.

Liquidity and Accessibility

Stocks are typically more liquid and accessible compared to cryptocurrencies. Stock exchanges provide a regulated and established marketplace where stocks can be bought and sold, and prices are publicly available. Cryptocurrencies, however, often lack centralized exchanges and can be more challenging to buy and sell. Additionally, cryptocurrencies may not be widely accepted as a form of payment, which further limits their accessibility compared to stocks.

Despite these differences, both stocks and cryptocurrency can be valuable investments, depending on individual goals and risk tolerance. It is important to thoroughly research and understand the specific characteristics and risks associated with each before making any investment decisions.

In conclusion, while stocks offer stability and accessibility, cryptocurrencies provide a higher potential for profit due to their volatility. Ultimately, choosing between the two depends on individual preferences and investment goals.

Emerging Trends in the World of Investments

In today’s rapidly changing financial landscape, investors are constantly seeking new opportunities to grow their wealth. The world of investments is constantly evolving, with new trends and technologies emerging to meet the demands of the market. Here are some of the emerging trends that are shaping the future of investments:

1. Artificial Intelligence

Artificial Intelligence (AI) is revolutionizing the way investments are made. AI-powered algorithms can analyze vast amounts of data and identify patterns that are not easily visible to human investors. This technology enables investors to make informed decisions based on real-time data, minimizing risks and maximizing returns.

2. Impact Investing

Impact investing is a growing trend that combines financial returns with positive social or environmental impact. Investors are increasingly aligning their investments with their values, seeking opportunities that address issues such as climate change, poverty, and inequality. This trend is driven by the belief that it is possible to achieve both financial success and social impact.

In addition to these two emerging trends, other areas of interest in the world of investments include blockchain technology, renewable energy, and sustainable investing. As investors continue to explore new alternatives, it is important to stay informed and adapt to these changing trends in order to make the most out of your investments.

Exploring the Rise of Decentralized Finance

Unlike traditional financial systems that rely on centralized institutions such as banks, DeFi operates on decentralized networks, primarily based on blockchain technology. This enables peer-to-peer transactions, trustless lending, automated market making, and other financial services without the need for intermediaries.

Decentralized finance offers several advantages over traditional finance. First and foremost, it provides financial inclusivity by allowing anyone with an internet connection to access financial services. This is particularly important in countries with limited banking infrastructure or where individuals do not have access to traditional financial institutions.

Furthermore, DeFi eliminates the need for intermediaries, reducing transaction costs and increasing transparency. Users can directly interact with smart contracts on the blockchain, ensuring that transactions are executed exactly as programmed without the risk of fraud or censorship.

One of the key features of DeFi is the ability to yield farm and earn passive income. Users can participate in various decentralized lending and borrowing protocols, liquidity pools, and yield farming strategies to earn rewards in the form of interest, fees, or governance tokens. This opens up new opportunities for individuals to grow their wealth and gain exposure to emerging digital assets.

However, it is important to note that DeFi is still an emerging field and comes with its own set of risks and challenges. Smart contract vulnerabilities, regulatory uncertainties, and market volatility are just a few of the factors that users need to be aware of when participating in decentralized finance.

As the world of finance continues to evolve, decentralized finance is poised to play a significant role in shaping the future of the financial industry. It offers unprecedented opportunities for financial innovation, inclusivity, and empowerment. Whether you are an experienced investor or new to the world of finance, exploring the rise of decentralized finance is an exciting journey worth embarking on.

Preparing for the Future of Investing

As we move further into the digital age, the landscape of investing is evolving rapidly. Traditional investment options like stocks and bonds are facing new challenges and alternative investment opportunities are emerging. To stay ahead of the game, it is essential to prepare for the future of investing.

One alternative that is gaining significant traction is cryptocurrency. As digital currencies like Bitcoin, Ethereum, and others continue to grow in popularity, they are becoming a major contender in the investment world. Investing in cryptocurrency offers the potential for exponential growth, but also comes with its own set of risks and uncertainties.

To effectively navigate the world of cryptocurrency investing, it is important to educate yourself on the technology behind it and the dynamics of the market. Understanding blockchain, the decentralized ledger technology that underpins cryptocurrency, is key to making informed investment decisions. Additionally, staying updated with news and developments in the crypto space will help you identify potential opportunities and mitigate risks.

|

|

Another area to focus on when preparing for the future of investing is the expanding realm of alternative finance options. Peer-to-peer lending platforms, crowdfunding, and robo-advisors are just a few examples of alternative finance models that are disrupting traditional banking and investment sectors. By diversifying your investments into these alternative finance options, you can spread your risk and potentially earn higher returns. However, it is crucial to thoroughly research these platforms and understand the associated risks before committing your hard-earned money. Lastly, staying up-to-date with technological advancements in the financial industry is crucial for future investing. Machine learning, artificial intelligence, and big data analytics are transforming the way investment decisions are made. Familiarizing yourself with these technologies and utilizing them to your advantage can greatly enhance your investing strategies. The future of investing is unpredictable, but by preparing yourself with knowledge and understanding, you can position yourself for success. Stay informed, be open to new opportunities, and adapt to the changing investment landscape. The world of finance is evolving – make sure you are too. |

What is “Exploring Orbiter Finance Alternatives: From Stocks to Cryptocurrency” book about?

“Exploring Orbiter Finance Alternatives: From Stocks to Cryptocurrency” is a book that provides a comprehensive guide for individuals interested in exploring alternative finance options beyond traditional stocks. It covers various topics related to cryptocurrency and how it can be utilized as an alternative investment option.

Who is the author of “Exploring Orbiter Finance Alternatives: From Stocks to Cryptocurrency”?

The author of “Exploring Orbiter Finance Alternatives: From Stocks to Cryptocurrency” is John Smith, a renowned financial expert with years of experience in alternative finance.

Why should I consider reading “Exploring Orbiter Finance Alternatives: From Stocks to Cryptocurrency”?

If you are interested in diversifying your investment portfolio and exploring alternative finance options, “Exploring Orbiter Finance Alternatives: From Stocks to Cryptocurrency” is a valuable resource. It provides insights into the world of cryptocurrency and how it can be integrated into your investment strategy.