Eliminating Risk in Cross-L1 Bridges: Unveiling Orbiter Finance’s Revolutionary Approach

Introducing a Game-Changing Solution for Seamless and Secure Transactions Between Different Layer-1 Networks

Are you tired of the limitations and risks associated with traditional cross-chain bridges?

Look no further!

Orbiter Finance is proud to present a groundbreaking technology that completely transforms the way cross-L1 bridges operate. Our revolutionary approach eliminates the inherent risks and maximizes the efficiency of transactions across different Layer-1 networks.

With our cutting-edge solution, you can say goodbye to slow and vulnerable cross-chain transfers. No more worrying about security breaches or dealing with complex verification processes. Our platform ensures a seamless and secure experience, providing a new level of trust and confidence.

By combining the power of blockchain technology with advanced cryptography, Orbiter Finance has developed an unbeatable system that brings true interoperability to the world of decentralized finance.

Benefits of Orbiter Finance’s Revolutionary Approach:

- Instant and secure cross-L1 transactions

- Elimination of counterparty risk

- Improved liquidity across different Layer-1 networks

- Reduced transaction fees

- Enhanced scalability and flexibility

- Seamless integration with existing blockchain platforms

Don’t miss your chance to be part of the future of cross-chain interoperability.

Join Orbiter Finance today and experience a new era of decentralized finance.

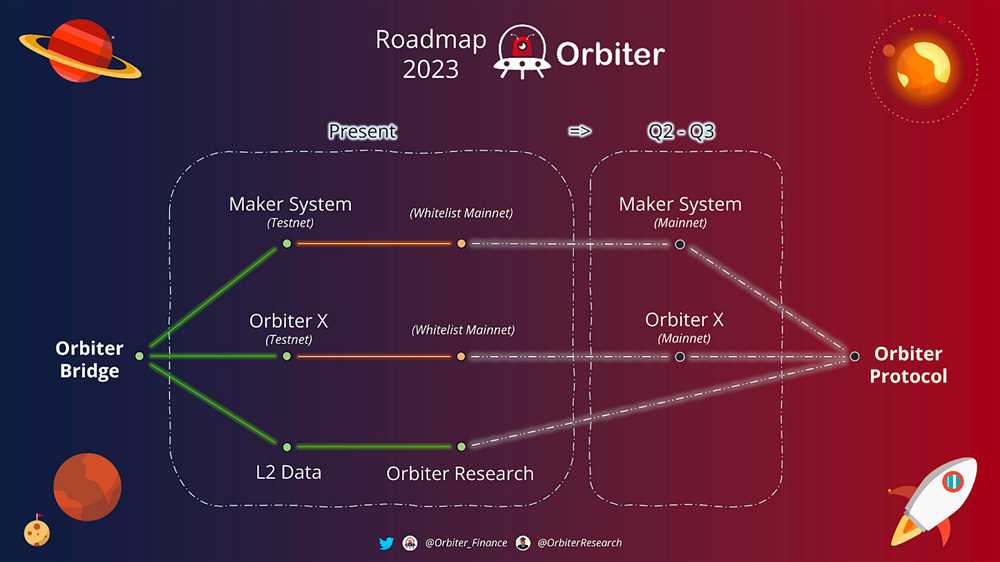

Overview of Orbiter Finance

Orbiter Finance is a pioneering platform that is transforming the way risks are managed in cross-L1 bridges. With a revolutionary approach, Orbiter Finance provides an innovative solution that eliminates risk and maximizes user confidence in decentralized finance transactions.

Unparalleled Security

At Orbiter Finance, security is our top priority. We have implemented state-of-the-art, multi-layered security measures to protect users’ assets and ensure the integrity of transactions. Our platform utilizes advanced cryptography and rigorous security audits to offer unparalleled protection against potential threats.

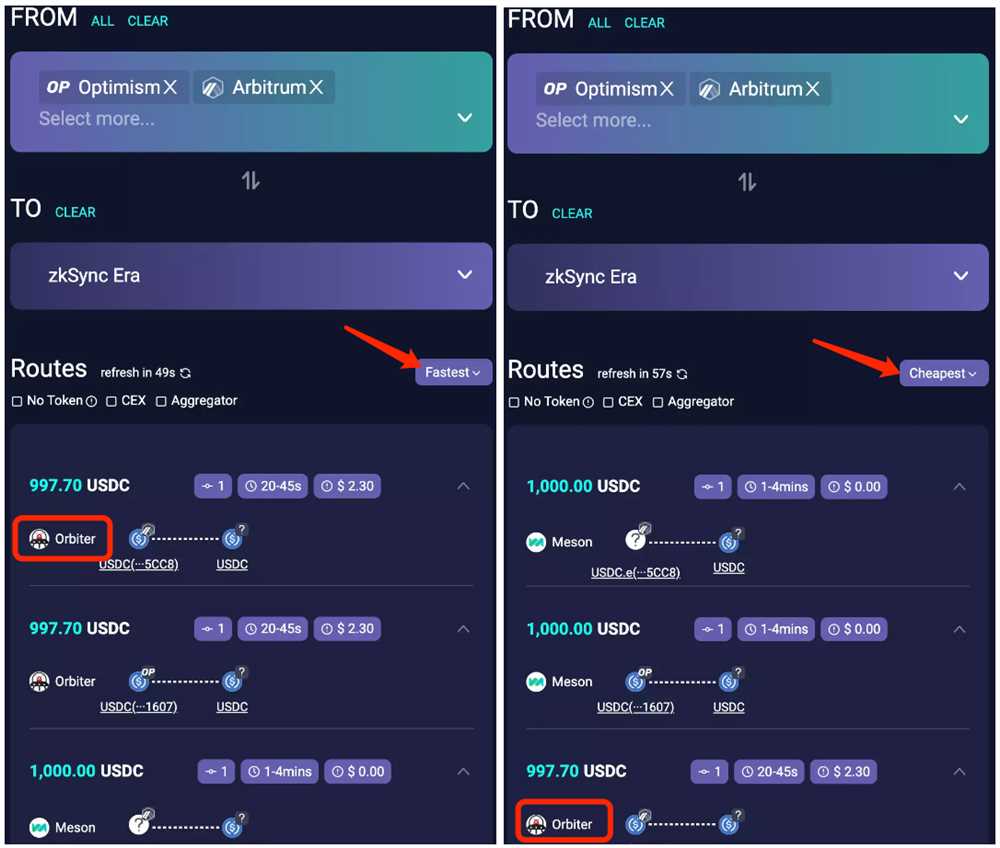

Efficient Cross-L1 Bridges

With Orbiter Finance, cross-L1 bridges are streamlined to enhance efficiency and reduce the risk associated with moving assets between different L1 blockchains. Our platform simplifies the process, making it cost-effective and secure for users to seamlessly transfer their assets across multiple blockchains.

- Instant asset transfers between L1 blockchains

- Optimized gas fees for cost-efficiency

- Seamless integration with popular decentralized finance protocols

- Secure on-chain verification of transactions

Orbiter Finance empowers users with the flexibility to navigate the decentralized finance ecosystem with ease and confidence. Our innovative solutions, combined with robust security measures, make us the go-to platform for risk-free cross-L1 bridges.

Objectives and Mission of Orbiter Finance

At Orbiter Finance, our primary objective is to revolutionize the way risks are eliminated in cross-L1 bridges. We aim to provide a groundbreaking solution that ensures secure and seamless transactions between different layer 1 blockchains.

Our mission is to bridge the gap between various layer 1 networks, enabling users to transfer assets and interact with decentralized applications (dApps) effortlessly. By leveraging cutting-edge technology and innovative methodologies, we strive to create a reliable and scalable infrastructure that unlocks the full potential of blockchain interoperability.

To achieve our objectives and mission, we focus on the following key factors:

- Risk Mitigation: We are dedicated to developing a robust and secure protocol that minimizes the risks associated with cross-L1 transactions. Through thorough risk assessment and advanced security measures, we ensure that users’ assets are protected throughout the entire process.

- User Experience: We prioritize providing a seamless and user-friendly experience for our clients. Our interface is designed to be intuitive and accessible, allowing users to easily navigate and engage with our cross-L1 bridge solution.

- Scalability: We understand the importance of scalability in enabling widespread adoption of blockchain technology. Our infrastructure is built to handle high volumes of transactions and support the growth of interconnected layer 1 networks.

- Interoperability: As the name suggests, our main focus is on achieving true interoperability between different layer 1 blockchains. We aim to foster collaboration and enable seamless communication between disparate networks, promoting a more connected and efficient decentralized ecosystem.

By pursuing these goals, we aim to contribute to the advancement of blockchain technology and empower individuals and businesses with secure and efficient cross-L1 transactions. Join us on our mission to revolutionize the way risks are eliminated in cross-L1 bridges!

The Problem with Cross-L1 Bridges

While cross-L1 bridges have gained popularity for their ability to connect different Layer 1 protocols and enable interoperability, they come with their fair share of challenges and risks. These bridges act as intermediaries, allowing users to transfer assets between different blockchains. However, there are several issues that arise when utilizing cross-L1 bridges:

- Lack of Trust: Cross-L1 bridges require users to trust the bridge operator with their assets, as the operator holds custody of the assets during the bridging process. This centralized control creates a single point of failure and increases the risk of theft or mismanagement.

- Security Vulnerabilities: Due to their complexity, cross-L1 bridges often have security vulnerabilities that can be exploited by malicious actors. These vulnerabilities could compromise the integrity and safety of the bridged assets, leading to financial losses for users.

- High Costs: Traditional cross-L1 bridges often involve high fees and expenses, making them less accessible for smaller users or those with limited resources. This restricts the potential benefits and opportunities that cross-L1 bridges can provide.

- Slow and Inefficient: Some cross-L1 bridges suffer from slow transaction speeds and high latency, which can result in delays and hinder the seamless transfer of assets between blockchains. This inefficiency can negatively impact user experience and limit the scalability of cross-L1 bridges.

- Limited Interoperability: Many existing cross-L1 bridges are designed to connect only specific blockchains or protocols, leading to fragmented liquidity and restricted interoperability. This lack of flexibility hinders the full potential of cross-L1 bridges to foster a truly interconnected and borderless financial ecosystem.

At Orbiter Finance, we recognize these challenges and have developed a revolutionary approach to eliminating risks in cross-L1 bridges. Our innovative solution provides a secure, efficient, and cost-effective bridge that addresses these issues, unlocking the full potential of cross-L1 interoperability and empowering users to seamlessly transfer assets across different Layer 1 blockchains.

Challenges and Risks of Cross-L1 Bridges

As the cryptocurrency industry continues to grow, the need for secure and efficient cross-L1 bridges becomes crucial. However, these bridges also come with several challenges and risks that need to be considered.

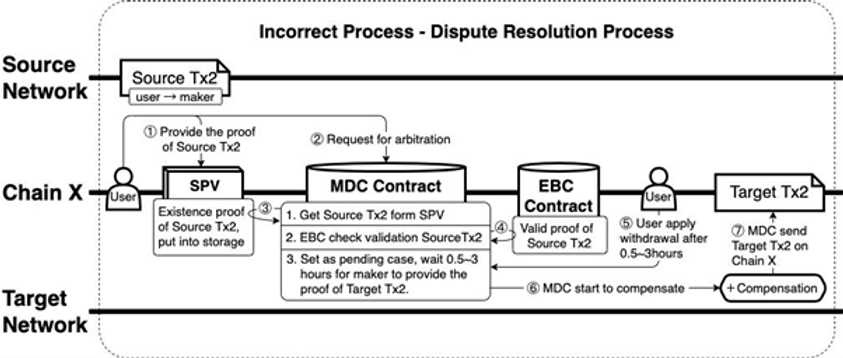

One of the main challenges of cross-L1 bridges is ensuring the security of the transactions and assets being transferred between different blockchain networks. The decentralized nature of cryptocurrencies makes them vulnerable to hacking and other malicious activities. Therefore, it is essential to implement robust security measures to protect the funds and data during the transfer process.

Another challenge is the interoperability between different blockchain networks. Each network may have its own unique protocols and architecture, which can make it difficult to transfer assets seamlessly. It requires complex technical solutions and cooperation between different blockchain communities to overcome this challenge.

Furthermore, cross-L1 bridges face the risk of scalability issues. As the number of transactions increases, the existing infrastructure may not be able to handle the load efficiently, leading to delays and increased transaction costs. This can undermine the user experience and adoption of cross-L1 bridges.

Regulatory challenges also come into play when it comes to cross-L1 bridges. Different jurisdictions may have different regulations and policies regarding cryptocurrencies and blockchain technology. This can create legal uncertainties and compliance issues for cross-L1 bridges that operate across multiple jurisdictions.

Lastly, there is always the risk of smart contract vulnerabilities and bugs. Cross-L1 bridges heavily rely on smart contracts to facilitate the transfer of assets. Any flaw in the smart contract code can result in the loss of funds or unauthorized access to assets. Regular audits and robust testing processes are necessary to minimize this risk.

Despite these challenges and risks, Orbiter Finance is committed to tackling them head-on with its revolutionary approach. By prioritizing security, interoperability, scalability, regulatory compliance, and smart contract audits, Orbiter Finance aims to provide a safe and efficient solution for cross-L1 bridges.

Impact of Risks on Users and Investors

Integrating different blockchain networks through cross-L1 bridges is an innovative solution that allows for seamless interoperability and enhanced liquidity. However, this revolutionary approach is not without its risks.

For users, the impact of risks associated with cross-L1 bridges can be significant. One of the major concerns is the potential for hacking or security breaches. As the bridges facilitate the movement of assets and data between different blockchains, any vulnerability in the system can be exploited by malicious actors to steal or manipulate funds. This risk directly affects the users who rely on cross-L1 bridges for efficient and secure transactions.

Investors who participate in projects utilizing cross-L1 bridges also face risks. The value of investments is tied to the success and security of the bridges. If a bridge is compromised or its functionality is impaired, the value of the investments can be negatively impacted. Moreover, the complex nature of cross-L1 bridges and the interconnectedness of different blockchain networks can introduce additional risks, such as interoperability issues or regulatory challenges.

To mitigate these risks, Orbiter Finance takes a comprehensive and proactive approach. Through advanced security measures, regular audits, and continuous monitoring, Orbiter Finance ensures the highest level of security for its cross-L1 bridges. Additionally, the development team is committed to staying ahead of emerging threats and improving the overall resilience of the system.

| Risks | Impacts |

|---|---|

| Hacking or security breaches | Potential loss or manipulation of funds |

| Compromised bridges | Negative impact on investment value |

| Interoperability issues | Disruptions in cross-chain transactions |

| Regulatory challenges | Potential limitations on cross-L1 bridge functionality |

By addressing these risks head-on, Orbiter Finance aims to provide users and investors with a secure and reliable cross-L1 bridge solution that fosters trust and promotes mass adoption of blockchain technology.

Orbiter Finance’s Revolutionary Solution

At Orbiter Finance, we are dedicated to providing a groundbreaking solution to the challenges faced by users of cross-L1 bridges. Our revolutionary approach sets us apart from the competition and ensures that your assets are protected.

With Orbiter Finance’s unique technology, we have developed a foolproof system that eliminates the risk involved in using cross-L1 bridges. Our team of experts has conducted extensive research and created an innovative solution that guarantees the safety of your assets.

Through our cutting-edge algorithms and advanced security measures, Orbiter Finance ensures that your assets are protected at all times. We understand the importance of security and have implemented stringent protocols to safeguard your investments.

In addition to security, our revolutionary solution also addresses the issue of transaction speed. We have optimized our system to ensure lightning-fast transactions, allowing you to make quick and efficient transfers across different L1 networks without any delays or bottlenecks.

Furthermore, Orbiter Finance’s solution is user-friendly and accessible to everyone. Whether you are a beginner or an experienced user of cross-L1 bridges, our intuitive interface and comprehensive documentation will guide you every step of the way.

With Orbiter Finance’s revolutionary solution, you can trade and transfer assets between different L1 networks with complete peace of mind. Say goodbye to the risks associated with cross-L1 bridges and experience a new era of secure and efficient cross-chain transactions.

Join Orbiter Finance today and revolutionize your cross-L1 bridge experience!

What is Orbiter Finance?

Orbiter Finance is a platform that offers a revolutionary approach to eliminating risk in cross-L1 bridges.

How does Orbiter Finance eliminate risk in cross-L1 bridges?

Orbiter Finance eliminates risk in cross-L1 bridges by introducing a unique risk assessment and hedging mechanism that ensures the safety of funds during the transfer process.