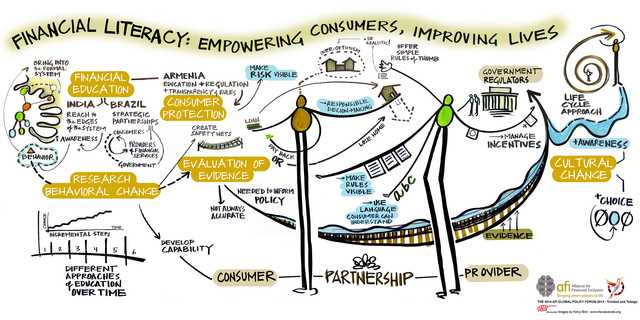

Are you tired of struggling with managing your personal finances? Do you want to take control of your financial future?

Look no further! Orbiter Finance is here to help you enhance your financial literacy and achieve your financial goals. Whether you’re a beginner or an experienced investor, our comprehensive platform offers all the tools and resources you need to make smarter financial decisions.

Why choose Orbiter Finance?

1. Interactive Learning: Our user-friendly interface provides interactive courses and tutorials, allowing you to learn at your own pace. From budgeting basics to advanced investment strategies, we have all the educational materials you need to become a financial expert.

2. Personalized Insights: With Orbiter Finance, you’ll gain valuable insights into your spending habits, savings goals, and investment performance. Our advanced analytics will help you track your progress and make informed decisions.

3. Investment Opportunities: Looking to grow your wealth? Orbiter Finance provides access to a wide range of investment opportunities. From stocks and bonds to real estate and cryptocurrencies, our platform connects you with the investment options that align with your financial goals.

Don’t let financial stress hold you back. Start your journey to financial freedom with Orbiter Finance today!

Benefits of Orbiter Finance

1. Increase your financial knowledge

Orbiter Finance provides comprehensive resources and tools to help you enhance your financial literacy. With easy-to-understand explanations and examples, you can learn about various financial topics such as budgeting, saving, investing, and more.

2. Take control of your finances

By using Orbiter Finance, you can gain a better understanding of your personal finances and take control of your money. The platform allows you to track your income, expenses, and savings, helping you make informed financial decisions and set realistic financial goals.

3. Access to personalized financial advice

Orbiter Finance offers personalized financial advice tailored to your specific needs and goals. Whether you’re looking to pay off debt, start investing, or plan for retirement, the platform provides expert guidance and recommendations to help you make the most of your money.

4. Plan for a secure financial future

Orbiter Finance helps you plan for your future by offering tools to create budgets, set savings goals, and track your progress. By taking proactive steps towards financial security, you can ensure a more stable and comfortable future for yourself and your loved ones.

5. Gain confidence in managing your money

With Orbiter Finance, you can develop the skills and knowledge necessary to confidently manage your money. By understanding financial concepts and having access to tools that simplify financial management, you can take charge of your financial well-being and feel more confident in your financial decisions.

6. Stay up to date with financial trends

Orbiter Finance keeps you informed about the latest financial trends, news, and updates. By staying up to date with the ever-changing financial landscape, you can make informed decisions and stay ahead of the curve when it comes to your personal finances.

Don’t miss out on the benefits of Orbiter Finance. Start enhancing your financial literacy and taking control of your money today!

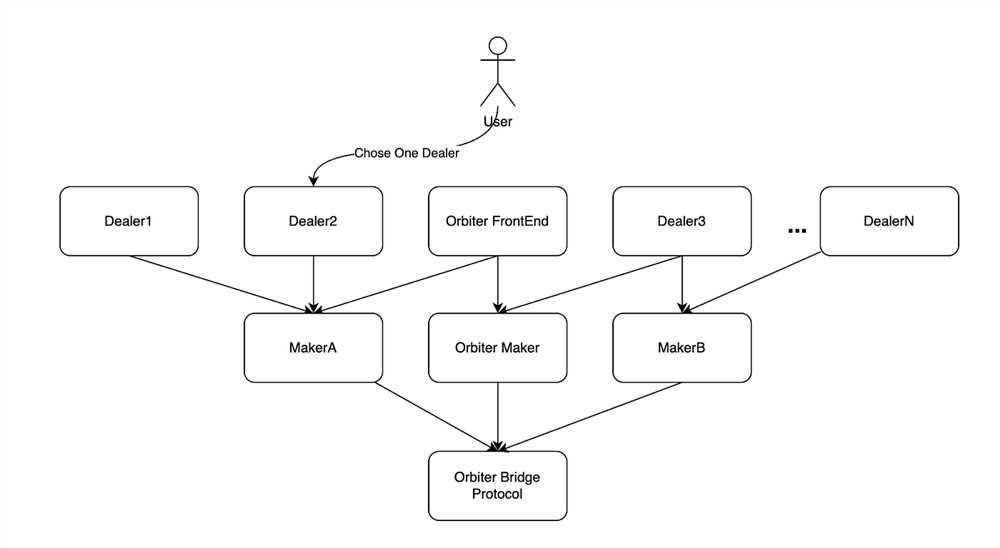

How Orbiter Finance Works

Orbiter Finance is designed to enhance financial literacy by providing easy-to-understand resources and tools for individuals looking to improve their understanding of personal finance. Here is how Orbiter Finance works:

Step 1: Sign Up

To get started with Orbiter Finance, simply sign up for an account on our website. Signing up is quick and easy, and all you need is a valid email address. Once you have signed up, you will gain access to a wide range of financial literacy resources.

Step 2: Education

Once you have signed up and logged in, you can access our educational materials. These materials cover a variety of topics, including budgeting, saving, investing, and managing debt. Our educational resources are created by financial experts and are designed to be accessible and approachable for individuals of all backgrounds and skill levels.

Step 3: Tools and Calculators

Orbiter Finance also provides a range of tools and calculators to help you better understand your financial situation. These tools can assist with budgeting, saving for retirement, calculating loan payments, and more. Our user-friendly interface makes it easy to input your financial information and receive instant results.

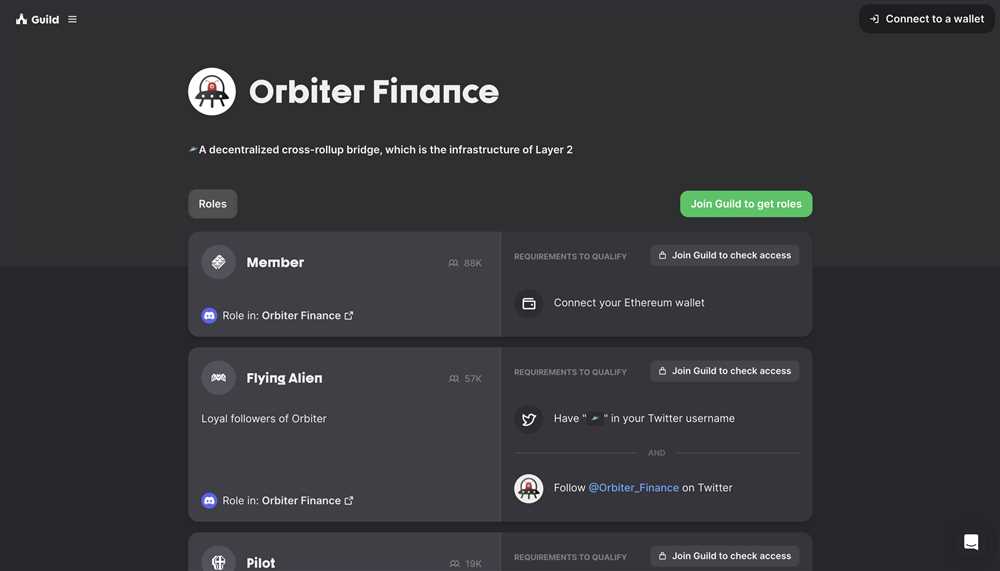

Step 4: Community

At Orbiter Finance, we believe that learning from others is an important part of the financial literacy journey. That’s why we have created a community forum where Members can connect with each other, ask questions, share advice, and learn from real-life experiences. By joining the Orbiter Finance community, you gain access to a supportive network of like-minded individuals who are also on their own financial literacy journey.

Step 5: Monitoring and Progress

As you continue to use Orbiter Finance, you can monitor your progress and track your financial goals. Our platform allows you to see how your budgeting and saving habits change over time, helping you stay accountable and motivated. Celebrate your successes and continue working towards your financial goals with the help of Orbiter Finance.

By combining education, tools, community support, and progress tracking, Orbiter Finance empowers individuals to take control of their finances and achieve financial freedom.

Join Orbiter Finance today and embark on your journey to financial literacy!

Features of Orbiter Finance

Orbiter Finance offers a range of features to enhance your financial literacy and empower you to take control of your personal finances. Here are some key features:

1. Personalized Financial Dashboard

With Orbiter Finance, you have access to a personalized financial dashboard that gives you a comprehensive overview of your financial health. Track your income, expenses, investments, and savings in one convenient location.

2. Budgeting Tools

Orbiter Finance provides powerful budgeting tools that help you create and manage a realistic budget. Set spending limits, categorize your expenses, and track your progress to ensure you’re on the right track to meet your financial goals.

3. Investment Analysis

Make smart investment decisions with Orbiter Finance’s investment analysis feature. Access in-depth market research and analyze your investment portfolio’s performance to maximize your returns and minimize risk.

4. Bill Reminders

Never miss a bill payment again with Orbiter Finance’s bill reminder feature. Set up reminders for upcoming due dates and receive notifications so you can stay on top of your financial obligations and avoid late fees.

5. Financial Education Resources

Expand your financial knowledge with Orbiter Finance’s extensive library of educational resources. Access articles, guides, and tutorials on topics such as budgeting, saving, investing, and more to improve your financial literacy and make informed financial decisions.

6. Secure Data Protection

Your financial data is securely protected with Orbiter Finance. Rest assured that your personal information and financial transactions are encrypted and stored securely, ensuring your privacy and peace of mind.

| Feature | Description |

|---|---|

| 1. Personalized Financial Dashboard | Track your income, expenses, investments, and savings in one convenient location. |

| 2. Budgeting Tools | Create and manage a realistic budget, set spending limits, and track your progress. |

| 3. Investment Analysis | Access market research and analyze your investment portfolio’s performance. |

| 4. Bill Reminders | Set up reminders for bill payments to avoid late fees. |

| 5. Financial Education Resources | Access articles, guides, and tutorials to improve your financial knowledge. |

| 6. Secure Data Protection | Your personal information and financial transactions are securely protected. |

With Orbiter Finance’s features, you can confidently navigate the world of personal finance and achieve your financial goals. Start enhancing your financial literacy today.

Why Choose Orbiter Finance

There are several reasons why Orbiter Finance is the best choice for enhancing your financial literacy:

- Expertise: Orbiter Finance is led by a team of financial experts who have years of experience in the industry. You can trust their knowledge and guidance to help you navigate the complex world of finance.

- Educational Resources: Orbiter Finance provides a wide range of educational resources, including articles, videos, and interactive tools, to help you learn about various financial topics. These resources are designed to be informative and easy to understand, making it easier for you to improve your financial literacy.

- Personalized Approach: Orbiter Finance understands that everyone’s financial situation is unique. They provide personalized advice and solutions tailored to your specific needs and goals. Whether you’re looking to save for retirement, pay off debt, or invest in the stock market, Orbiter Finance can help you create a customized plan.

- Accessibility: With Orbiter Finance, you can access their services and resources anytime, anywhere. They offer a user-friendly online platform that allows you to track your progress, ask questions, and receive support whenever you need it. No matter where you are on your financial journey, Orbiter Finance is there to support you.

- Community: When you choose Orbiter Finance, you become part of a community of like-minded individuals who are also focused on improving their financial literacy. You can connect with other members, share experiences, and learn from each other’s successes and challenges. Orbiter Finance believes in the power of community and encourages collaboration.

By choosing Orbiter Finance, you are making a commitment to improve your financial literacy and take control of your financial future. Don’t wait any longer, start your journey with Orbiter Finance today!

What is Orbiter Finance?

Orbiter Finance is a financial literacy platform that helps users enhance their knowledge and understanding of personal finance. It offers a variety of resources, including articles, videos, and interactive tools, to empower individuals to make informed financial decisions.

How can Orbiter Finance help me improve my financial literacy?

Orbiter Finance provides educational resources and tools that cover various aspects of personal finance. Whether you want to learn about budgeting, investing, or managing debt, Orbiter Finance has content that can help you gain a better understanding of these topics. The platform also offers interactive tools, such as calculators and quizzes, to test and reinforce your knowledge.

Is Orbiter Finance suitable for beginners?

Yes, Orbiter Finance is suitable for beginners. The platform is designed to be user-friendly and accessible to individuals with varying levels of financial knowledge. It provides content that starts from the basics and gradually progresses to more advanced topics, allowing users to learn at their own pace. Whether you are just starting to learn about personal finance or want to expand your existing knowledge, Orbiter Finance can be a valuable resource.