Minimizing the risk of 51% attacks on Orbiter Finance through cross-rollup and Layer 2 compatibility

In the ever-evolving world of blockchain technology, security and scalability are crucial factors that determine the success of any project. One of the most significant risks that blockchain networks face is the 51% attack, where a single entity gains control of more than half of the network’s computing power.

Orbiter Finance has emerged as a pioneer in minimizing the risk of such attacks by introducing innovative solutions that promote cross-rollup and layer 2 compatibility. By combining the strengths of different layer 2 solutions and cross-rollup technology, Orbiter Finance aims to create a more secure and scalable blockchain ecosystem.

With cross-rollup technology, Orbiter Finance enables seamless communication and interoperability between various layer 2 solutions. This allows users to easily transfer their assets and transactions across different layer 2 chains, reducing the risk of centralized control and manipulation. Moreover, by promoting layer 2 compatibility, Orbiter Finance ensures that different layer 2 solutions can work together efficiently, enhancing the overall security and scalability of the network.

By incorporating these groundbreaking features, Orbiter Finance facilitates a more decentralized and robust blockchain ecosystem. With increased security and scalability, users can have confidence in the integrity and reliability of the network, while developers can explore new possibilities and build innovative applications. As the cryptocurrency space continues to grow, Orbiter Finance sets a new standard in mitigating the risk of 51% attacks and fostering the widespread adoption of blockchain technology.

The Importance of Minimizing Risk

When it comes to blockchain technology and decentralized finance, minimizing risk is paramount. With the growing popularity of cryptocurrencies and the increasing number of attacks on the network, it is crucial to take the necessary measures to protect user assets.

One of the biggest risks in the blockchain space is the 51% attack. This occurs when an individual or group of miners control more than 51% of the network’s hashing power. With this majority control, they can manipulate transactions, double-spend coins, and disrupt the integrity of the blockchain.

To prevent such attacks, projects like Orbiter Finance are focused on implementing cross-rollup and layer 2 compatibility. By utilizing layer 2 solutions, like rollups, they can minimize the risk of a 51% attack by offloading transactions to a secondary network that operates alongside the main Ethereum chain.

By implementing cross-rollup and layer 2 compatibility, Orbiter Finance is not only strengthening the security of their platform but also increasing scalability and reducing transaction fees. This allows users to benefit from a faster and more cost-effective decentralized financial ecosystem.

In addition to the technical solutions, educating users about the importance of security measures is essential. This includes encouraging users to utilize hardware wallets, enable two-factor authentication, and stay vigilant against phishing attempts.

In conclusion, minimizing risk is of utmost importance in the blockchain and decentralized finance space. With the implementation of cross-rollup and layer 2 compatibility, projects like Orbiter Finance are taking proactive steps to protect user assets and ensure the long-term viability of the ecosystem.

Cross-Rollup: Enhancing Security

One of the key challenges in the world of blockchain is ensuring the security and integrity of transactions. With the rise of 51% attacks as a major threat, it becomes imperative for developers to explore innovative solutions to minimize this risk. Cross-rollup technology is one such solution that aims to enhance security in the blockchain ecosystem.

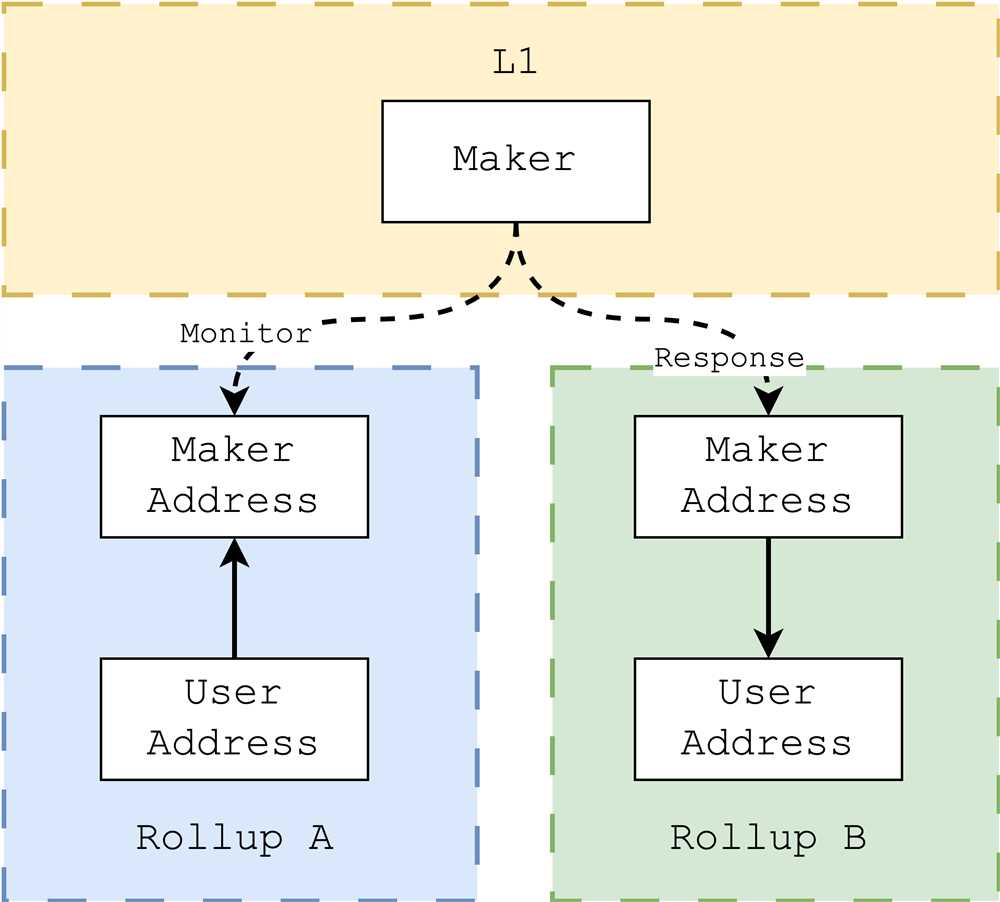

By integrating cross-rollup technology into the Orbiter Finance platform, we can significantly reduce the risk of 51% attacks. Cross-rollup allows for the seamless transfer of assets and transactions across different rollup chains, providing an additional layer of security.

The cross-rollup solution works by creating a network of interconnected rollup chains, allowing for the exchange of assets and information between them. This interconnected network enhances security by ensuring that no single rollup chain has control over the majority of the network’s computing power.

Furthermore, cross-rollup technology also improves scalability and efficiency in the blockchain ecosystem. By enabling the transfer of assets across different rollup chains, users can enjoy faster and cheaper transactions. This enhanced scalability and efficiency make cross-rollup an attractive solution for both developers and users alike.

In conclusion, cross-rollup technology plays a crucial role in enhancing the security and integrity of blockchain transactions. By integrating this technology into the Orbiter Finance platform, we can minimize the risk of 51% attacks and provide a more secure and efficient environment for users to transact.

Layer 2 Compatibility: Strengthening Infrastructure

Layer 2 solutions have shown great potential in scaling the Ethereum network and reducing transaction costs. However, with the increasing adoption of layer 2 protocols, it is crucial to ensure compatibility and interoperability between different solutions. This is where the concept of Layer 2 Compatibility comes into play.

Layer 2 Compatibility refers to the ability of different layer 2 solutions to seamlessly interact with each other, allowing users to easily transfer assets and data across different platforms. By achieving Layer 2 Compatibility, we can strengthen the infrastructure of the entire Ethereum ecosystem and promote a more interconnected and efficient network.

The Benefits of Layer 2 Compatibility

1. Enhanced Liquidity: Layer 2 Compatibility allows users to move assets between different layer 2 platforms without having to go through the cumbersome process of bridging and transferring funds back to the Ethereum mainnet. This significantly improves liquidity and provides users with more flexibility in managing their assets.

2. Lower Transaction Costs: By enabling seamless interoperability between different layer 2 solutions, users can take advantage of the most cost-effective and efficient options for their transactions. This reduces transaction costs and makes decentralized applications more accessible to a wider audience.

Orbiter Finance’s Approach to Layer 2 Compatibility

At Orbiter Finance, we recognize the importance of Layer 2 Compatibility in creating a robust and scalable ecosystem. That’s why we are actively working towards ensuring cross-compatibility between our solution and other layer 2 protocols.

By leveraging industry-standard protocols and open-source development, we are building a flexible and interoperable framework that allows users to seamlessly move assets and data between Orbiter Finance and other layer 2 solutions. Our aim is to provide users with a seamless experience and maximize the potential benefits of layer 2 scalability.

Conclusion

Layer 2 Compatibility is vital for strengthening the infrastructure of the Ethereum ecosystem. By enabling seamless interoperability between different layer 2 solutions, we can enhance liquidity and reduce transaction costs, making decentralized finance more accessible to all users. At Orbiter Finance, we are committed to maximizing Layer 2 Compatibility and contributing to the growth and development of the Ethereum network.

Orbiter Finance: A Solution to 51% Attacks

Orbiter Finance is an innovative project that aims to address the growing concern of 51% attacks in the crypto industry. These attacks occur when a single entity or group gains control of over 50% of the network’s hash power, allowing them to manipulate transactions and potentially double spend coins.

With the increasing popularity of blockchain technology, the risk of 51% attacks has become a pressing issue. Such attacks can lead to significant financial losses and undermine the trust and security of decentralized networks.

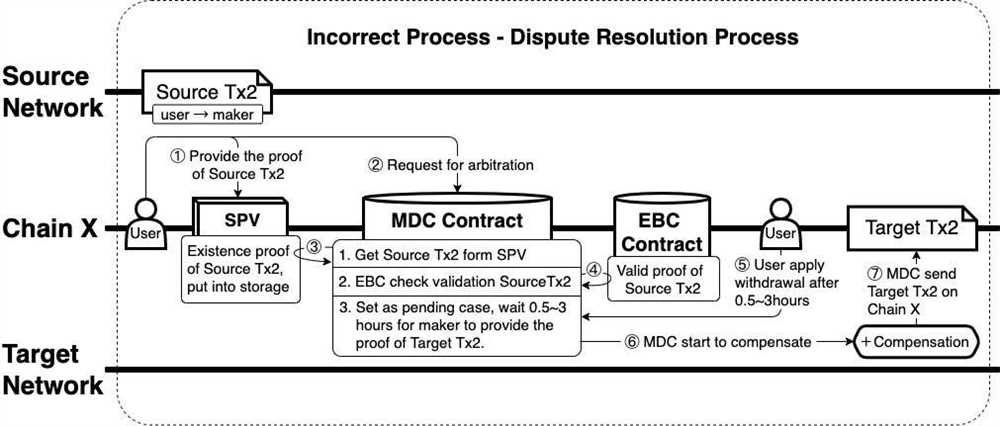

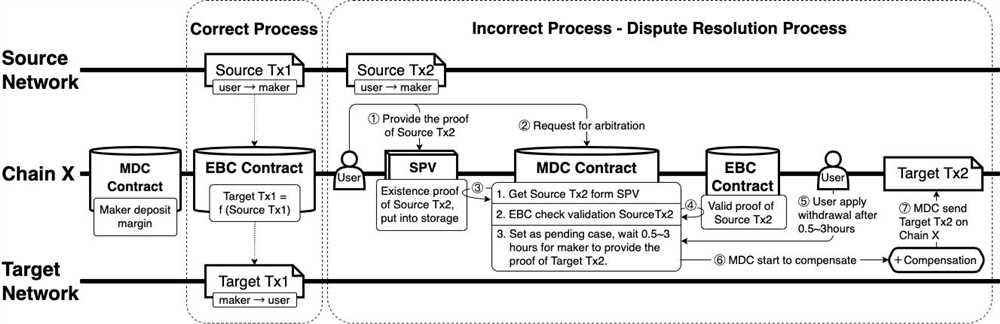

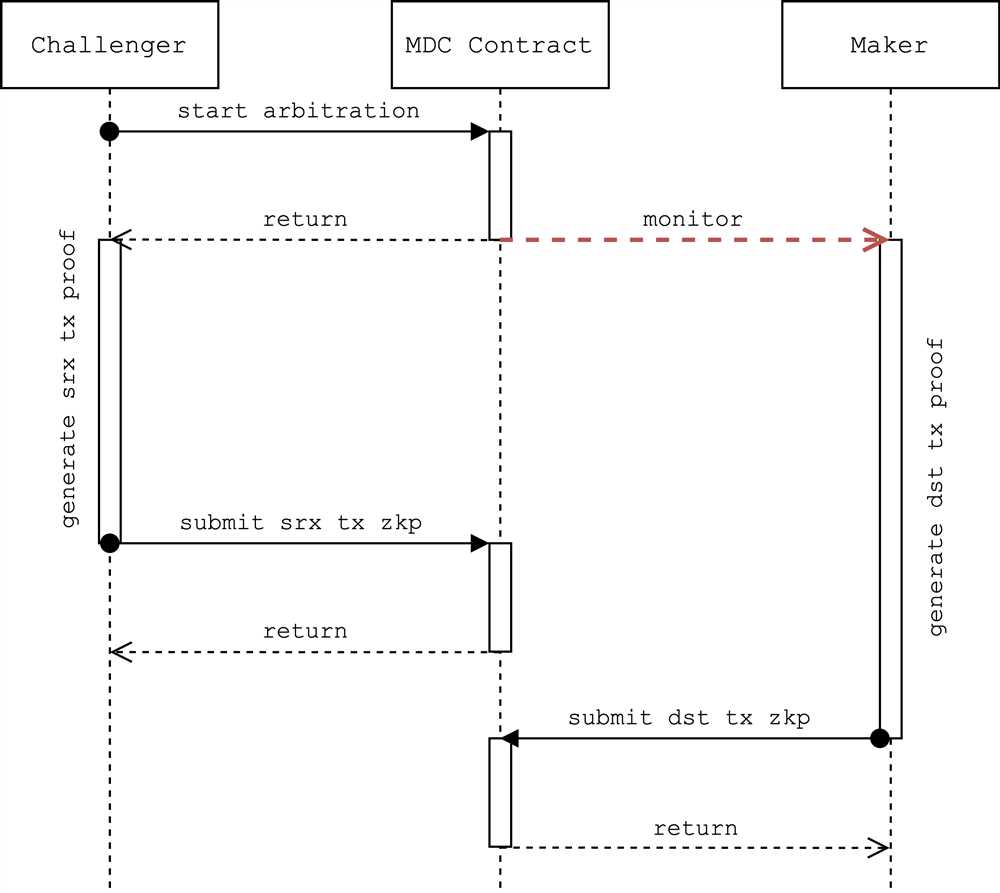

Orbiter Finance offers a unique solution to minimize the risk of 51% attacks by implementing a cross-rollup and Layer 2 compatibility strategy. This approach allows for the seamless integration of different blockchain protocols and layer 2 solutions, enhancing the security and scalability of the network.

By enabling cross-rollup and Layer 2 compatibility, Orbiter Finance ensures that transactions are processed and verified across multiple chains, reducing the vulnerability to 51% attacks. This decentralized approach also enhances the overall resilience and robustness of the network, making it more resistant to manipulation and malicious activities.

In addition to its advanced security measures, Orbiter Finance also prioritizes user privacy and autonomy. The platform empowers users to maintain control over their funds and transactions, further reducing the risks associated with centralized exchanges and custodial services.

With its innovative technology and commitment to security, Orbiter Finance is poised to revolutionize the crypto industry by providing a solution to the persistent threat of 51% attacks. By leveraging cross-rollup and Layer 2 compatibility, this project has the potential to enhance the integrity and reliability of blockchain networks, making them safer and more accessible to users worldwide.

Investing in Orbiter Finance means investing in a future where the risk of 51% attacks is minimized, ensuring the longevity and trustworthiness of decentralized systems. As the crypto industry continues to evolve, projects like Orbiter Finance play a crucial role in safeguarding the fundamentals of blockchain technology and enabling its widespread adoption.

What is a 51% attack and why is it a risk for blockchain networks?

A 51% attack is a situation where a single entity or a group of entities control more than 50% of the mining power on a blockchain network. This gives them the ability to manipulate the network by confirming or invalidating transactions, double-spending coins, and preventing other miners from validating blocks. It is a risk because it undermines the security and integrity of the blockchain network, allowing the attackers to potentially steal funds or disrupt the network.

How does Orbiter Finance minimize the risk of 51% attacks?

Orbiter Finance minimizes the risk of 51% attacks by implementing a Cross-Rollup solution. This involves the use of Layer 2 protocols and multiple blockchain networks to secure the assets and transactions. By using a combination of different networks, the risk of a single entity controlling more than 50% of the mining power is significantly reduced. Additionally, Orbiter Finance focuses on building compatibility with Layer 2 solutions to further strengthen the security and resilience against potential attacks.

What are the benefits of Cross-Rollup and Layer 2 compatibility in minimizing the risk of 51% attacks?

Cross-Rollup and Layer 2 compatibility provide several benefits in minimizing the risk of 51% attacks. Firstly, by leveraging multiple blockchain networks, the risk of a single entity gaining majority control is reduced, as they would need to control multiple networks simultaneously. Secondly, Layer 2 solutions offer additional security measures and scalability, further enhancing the overall security of the network. Lastly, by focusing on compatibility with Layer 2 solutions, Orbiter Finance ensures that it can benefit from the advancements and innovations in the Layer 2 space, staying ahead of potential attack vectors and maintaining a robust security posture.