Exploring Excess Margin Deposits for Cross-Rollup Providers on Orbiter Finance

Are you a maker looking to optimize your trading strategy?

Discover the power and potential of excess margin deposits on Orbiter Finance Cross-Rollup!

Here at Orbiter Finance, we understand that as a maker, every edge counts. That’s why we’ve developed a revolutionary cross-rollup platform that allows you to explore and leverage excess margin deposits to maximize your profits.

What are excess margin deposits, you ask? They are the unused funds that remain in your trading account even after you’ve entered into a position. Instead of letting these funds sit idle, our platform allows you to put them to work by offering them as collateral for other trading opportunities.

Why should you consider exploring excess margin deposits on Orbiter Finance Cross-Rollup?

1. Increased profitability: By utilizing excess margin deposits, you can increase your trading power and potentially boost your overall profitability.

2. Diversification: By collateralizing your excess margin deposits, you can access a wider range of trading opportunities across different markets, optimizing your risk and reward ratio.

3. Liquidity: Our cross-rollup platform ensures quick and efficient access to your collateral, giving you the flexibility to seize potential trading opportunities as they arise.

Discover the untapped potential of excess margin deposits on Orbiter Finance Cross-Rollup today and take your trading strategies to new heights!

Exploring Excess Margin Deposits

Margin deposits play a crucial role in the world of finance, allowing traders to leverage their trades and potentially increase their profits. At Orbiter Finance, we’re taking margin deposits to the next level with our innovative cross-rollup solution.

What exactly are excess margin deposits? Well, when you make a margin deposit, you are required to deposit a certain amount of collateral to secure the trade. This collateral acts as a cushion, protecting both the trader and the platform in case of adverse market conditions or potential losses.

However, what if you find yourself with excess margin deposits? These are the deposits that exceed the required collateral. And that’s where things get interesting.

The Benefits of Excess Margin Deposits

Having excess margin deposits can provide incredible opportunities for traders. First and foremost, it allows you to have more leverage, which means you can amplify your trades and potentially increase your profits. With higher leverage, you can take advantage of market movements and make more significant gains.

Moreover, excess margin deposits also provide an added layer of security, as they act as a buffer against unexpected market fluctuations. This additional buffer can help protect your positions and decrease the risk of liquidation.

Maximizing Excess Margin Deposits with Orbiter Finance

At Orbiter Finance, we understand the potential of excess margin deposits, and that’s why we’ve developed a unique cross-rollup solution. Our innovative technology allows makers to explore the full potential of their excess margin deposits and unlock additional trading opportunities.

By utilizing our cross-rollup solution, makers can benefit from pooled liquidity, enhanced order book depth, and minimized slippage. This means more efficient trades and increased potential for profits.

Whether you’re a novice or an experienced trader, exploring excess margin deposits with Orbiter Finance can take your trading game to new heights. Join us today and experience the power of leveraging your excess margin deposits like never before!

Main Features

Orbiter Finance Cross-Rollup offers a range of exciting features that are designed to enhance the experience of makers who utilize excess margin deposits. Here are the main features of our platform:

1. Access to Excess Margin Deposits:

With Orbiter Finance Cross-Rollup, makers have the opportunity to access excess margin deposits for their trading needs. This feature allows makers to maximize their trading potential by utilizing additional funds that are not currently in use.

2. Increased Trading Opportunities:

By accessing excess margin deposits, makers can take advantage of increased trading opportunities. This means they can explore new markets, diversify their portfolio, and potentially increase their profits.

By utilizing excess margin deposits, makers can amplify their trading power, leading to potentially higher returns on their investments.

By utilizing excess margin deposits, makers can amplify their trading power, leading to potentially higher returns on their investments.

Orbiter Finance Cross-Rollup

The Orbiter Finance Cross-Rollup is a groundbreaking financial solution that allows users to explore excess margin deposits. By utilizing this innovative technology, makers can maximize their profits and take advantage of additional earning opportunities.

With the Orbiter Finance Cross-Rollup, makers can seamlessly move their excess margin deposits between different protocols and platforms, ensuring that their funds are always working for them. This feature eliminates the need for manual transfers and saves time, allowing makers to focus on their trading strategies.

One of the key benefits of the Orbiter Finance Cross-Rollup is its enhanced security measures. The platform utilizes state-of-the-art encryption and multi-factor authentication to ensure that user funds are safe and protected at all times. Makers can trade with confidence, knowing that their assets are secure.

The Orbiter Finance Cross-Rollup also offers a user-friendly interface that is designed to make trading and managing funds intuitive and effortless. Makers can easily navigate through various trading options, monitor their balances, and access detailed transaction histories. The platform provides real-time updates and notifications, keeping makers informed about their investments.

Whether you are an experienced maker looking to optimize your trading strategies or a newcomer exploring the world of cryptocurrency trading, the Orbiter Finance Cross-Rollup is the perfect tool for you. Discover the endless possibilities of excess margin deposits and unlock your full earning potential with Orbiter Finance.

Benefits

1. Increase Your Profit Potential: By exploring excess margin deposits for makers on Orbiter Finance Cross-Rollup, you can maximize your profit potential. These excess margin deposits provide you with additional funds that can be used to execute more trades and take advantage of market opportunities. With increased profit potential, you can grow your portfolio and achieve your financial goals faster.

2. Reduce Risk: By utilizing excess margin deposits, you can reduce your risk exposure. These deposits act as a cushion, protecting you from potential losses during market fluctuations. By having additional funds available, you can better manage your positions and minimize the impact of adverse market conditions.

3. Diversify Your Portfolio: With access to excess margin deposits, you can diversify your portfolio and explore different investment opportunities. This allows you to spread your risk across multiple assets and increase the likelihood of generating consistent returns. Diversification is a key strategy used by successful investors to minimize risk and optimize returns.

4. Enhance Trading Flexibility: Excess margin deposits provide you with greater trading flexibility. You can use these funds to take advantage of various trading strategies, such as scalping, swing trading, or day trading. With enhanced trading flexibility, you can adapt to market conditions and seize profitable opportunities as they arise.

5. Improve Trading Efficiency: By utilizing excess margin deposits, you can improve your trading efficiency. These additional funds allow you to execute trades more quickly and take advantage of price discrepancies. With improved trading efficiency, you can reduce slippage, maximize your returns, and optimize your trading performance.

6. Access to Advanced Features: Exploring excess margin deposits on Orbiter Finance Cross-Rollup gives you access to advanced features and tools. These features can help you analyze market trends, monitor your portfolio, and make informed trading decisions. By using advanced features, you can stay ahead of the competition and elevate your trading experience.

7. Support and Guidance: When you explore excess margin deposits on Orbiter Finance Cross-Rollup, you gain access to a supportive community and expert guidance. You can connect with other experienced traders, share insights, and learn from their strategies. The platform also provides educational resources and dedicated support to help you navigate the world of margin trading.

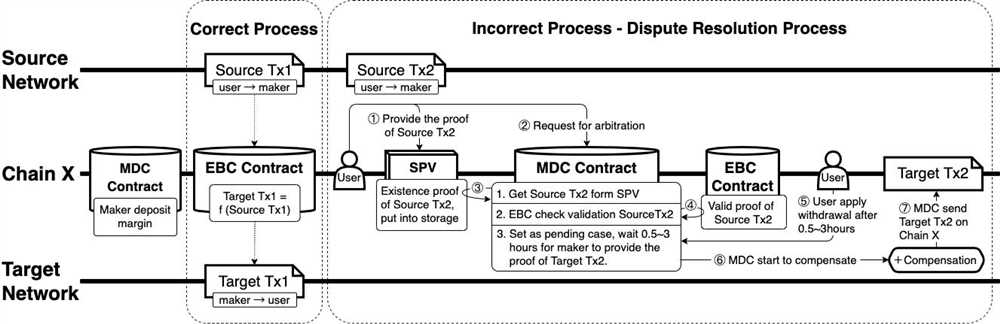

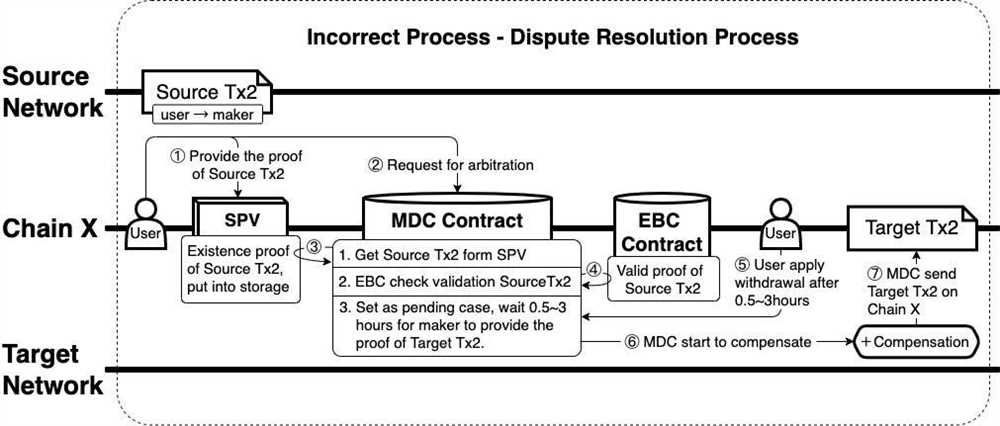

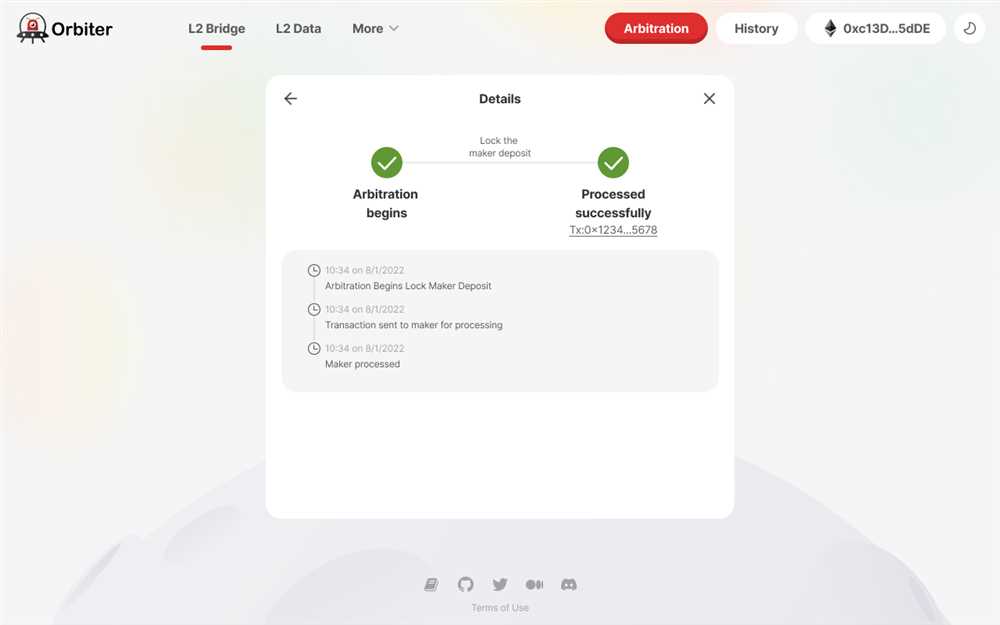

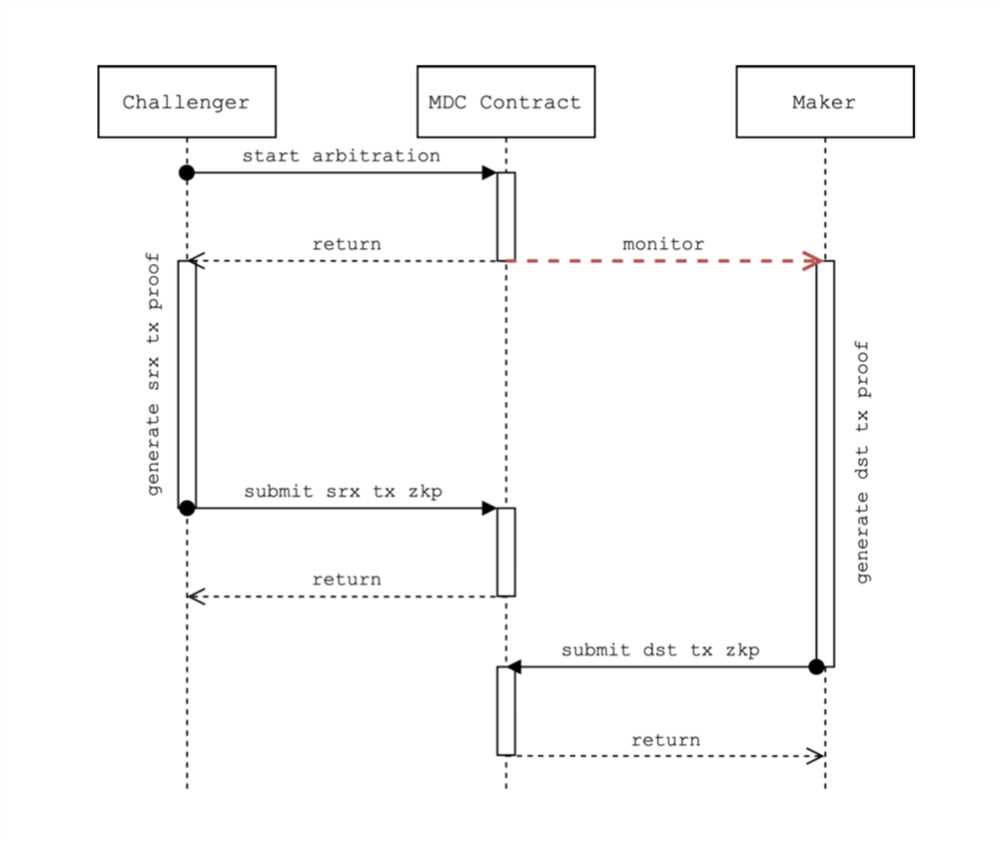

8. Transparency and Security: Orbiter Finance Cross-Rollup ensures transparency and security in all your margin trading activities. The platform employs robust security measures to safeguard your funds and personal information. Additionally, all transactions and margin deposit activities are recorded on the blockchain, providing you with a transparent and immutable record of your trading history.

Start exploring excess margin deposits for makers on Orbiter Finance Cross-Rollup today and unlock the numerous benefits it offers. Maximize your profit potential, reduce risk, diversify your portfolio, and take your trading to new heights.

Makers on Orbiter Finance

At Orbiter Finance, we are proud to provide a platform that empowers makers to explore excess margin deposits. Whether you are an experienced maker or just starting your journey, Orbiter Finance offers the tools and resources you need to succeed.

What is a Maker?

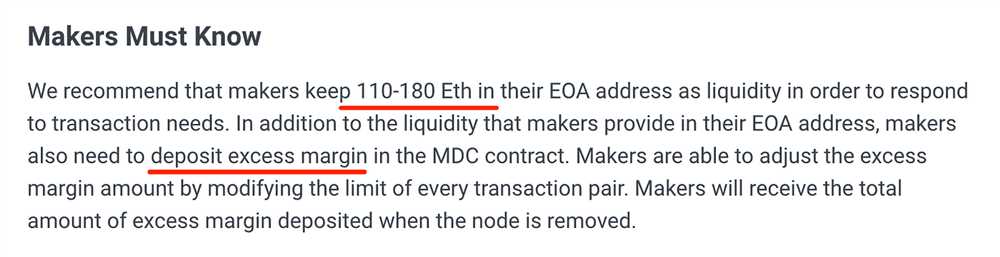

A Maker, in the context of Orbiter Finance, refers to individuals or entities that provide liquidity to the platform by depositing excess margin. Makers play a vital role in the overall functioning of the protocol, ensuring that there is sufficient liquidity available for trading and other activities.

Benefits of Being a Maker on Orbiter Finance

By becoming a Maker on Orbiter Finance, you can enjoy various benefits:

- Access to additional income opportunities through earned interest on excess margin deposits.

- Opportunity to contribute to the stability and growth of the platform.

- Ability to participate in the governance process of Orbiter Finance, influencing important decisions related to the platform.

- Access to a vibrant community of makers, where you can learn, collaborate, and grow your network.

- Flexible deposit and withdrawal options, giving you control over your funds.

How to Become a Maker on Orbiter Finance

Becoming a Maker on Orbiter Finance is a straightforward process:

- Create an account on Orbiter Finance.

- Complete the necessary KYC/AML requirements, ensuring a secure and compliant environment.

- Deposit your excess margin into the platform.

- Start earning interest on your deposited funds while contributing to the liquidity of the platform.

Join the community of makers on Orbiter Finance today and unlock the potential of excess margin deposits!

What is Orbiter Finance?

Orbiter Finance is a decentralized finance protocol that aims to provide users with cross-rollup asset management and lending solutions.

How does the excess margin deposit feature work for makers?

The excess margin deposit feature allows makers on Orbiter Finance to deposit additional assets as collateral beyond the required margin, increasing their borrowing power and potentially earning higher returns on their funds.

What are the benefits of using excess margin deposits?

Using excess margin deposits can provide makers with increased flexibility in managing their assets, as well as the potential for higher profits. It allows them to take advantage of market opportunities and maximize their returns on borrowed funds.