Exploring Orbiter Finance: A Game-Changing Cross-Rollup Bridge on Ethereum

Blockchain technology has revolutionized the way we transact and interact with digital assets. The Ethereum network, with its smart contract capabilities, has opened up endless possibilities for decentralized applications (DApps) and financial services. And now, Orbiter Finance, a cross-rollup bridge built on Ethereum, is taking the blockchain ecosystem by storm.

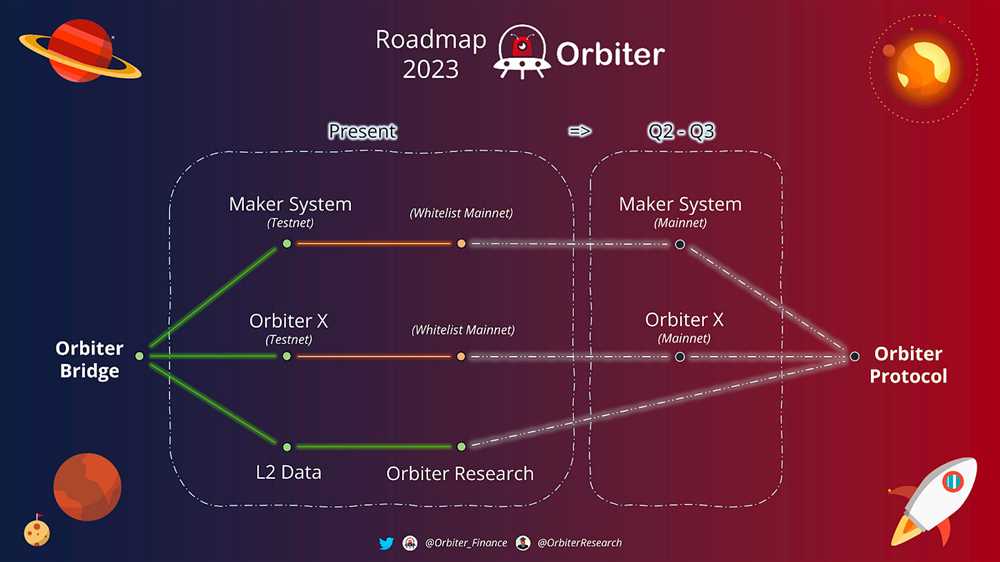

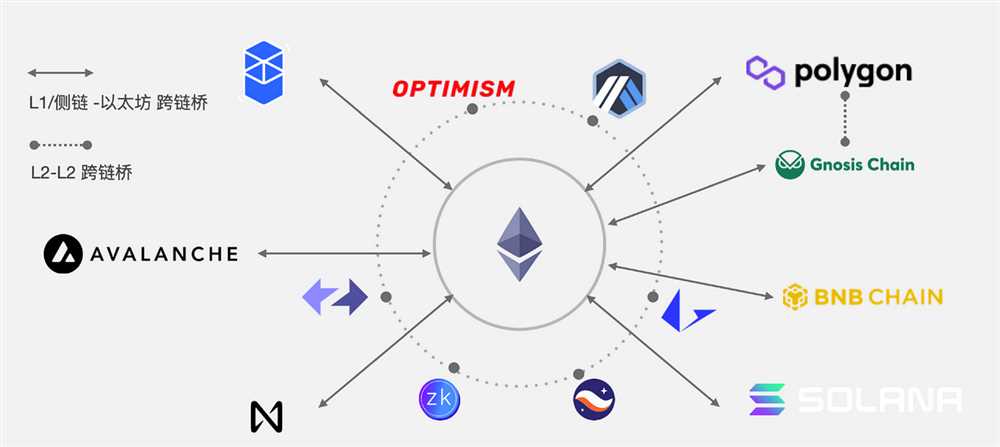

Orbiter Finance aims to solve the scalability issues that plague the Ethereum network by creating an efficient bridge that connects different layer-2 solutions. With this cross-rollup bridge, users can easily transfer assets between various layer-2 networks, enabling fast, low-cost, and secure transactions.

The game-changing aspect of Orbiter Finance lies in its ability to foster interoperability among different layer-2 networks. By creating a bridge that connects these networks, Orbiter Finance empowers users to seamlessly move their assets across platforms and take advantage of the unique features offered by each network.

What is Orbiter Finance?

Orbiter Finance is a game-changing cross-rollup bridge on the Ethereum blockchain. It aims to solve the problem of high fees and slow transaction times that plague the Ethereum network by enabling seamless transfers of assets between different layer-two solutions and the Ethereum mainnet.

The project is built on top of several layer-two technologies, including Optimistic Ethereum and zkSync, to provide users with a fast, efficient, and cost-effective way to transfer assets across different chains. By leveraging the power of these layer-two solutions, Orbiter Finance is able to significantly lower transaction fees and increase transaction speed, making it an ideal choice for users looking to move their assets quickly and affordably.

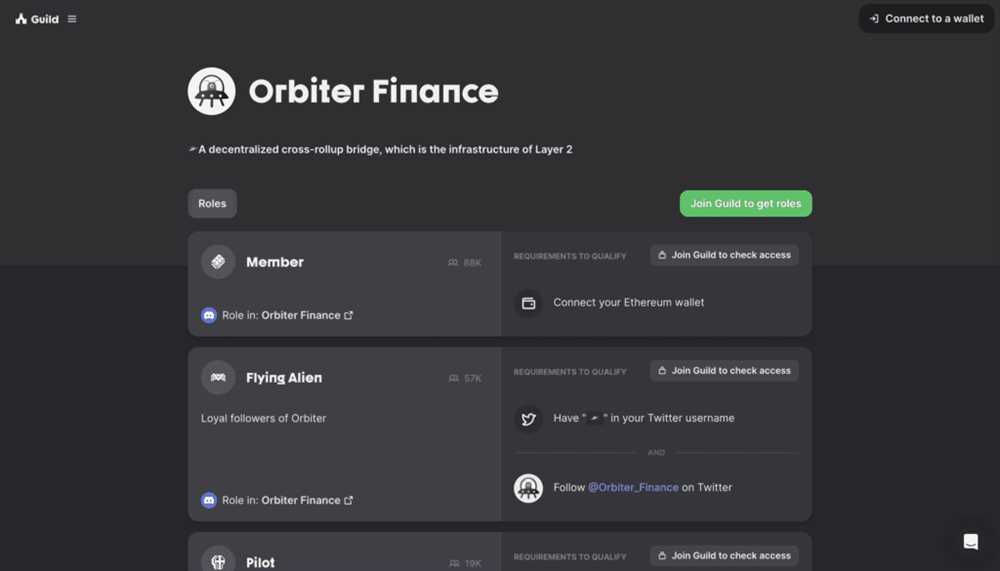

Orbiter Finance also introduces its native token, ORB, which serves as the utility token for the platform. ORB holders can participate in the governance of the protocol, voting on proposals and shaping the future of Orbiter Finance. Additionally, ORB can also be staked to earn rewards, providing users with an opportunity to increase their holdings.

With its cross-rollup bridge and native token, Orbiter Finance aims to revolutionize the way assets are transferred and managed on the Ethereum blockchain, making it easier and more affordable for users to navigate the decentralized finance (DeFi) ecosystem.

| Key Features of Orbiter Finance |

|---|

| • Cross-rollup bridge for seamless asset transfers |

| • Built on top of Optimistic Ethereum and zkSync |

| • Lower transaction fees and faster transaction times |

| • Native token (ORB) for governance and staking rewards |

| • Revolutionizing asset management in DeFi |

The Cross-Rollup Bridge on Ethereum

In the world of blockchain, interoperability and scalability are two significant challenges that need to be addressed. These challenges hinder the growth and adoption of decentralized applications (dApps) and limit their potential impact. However, projects like Orbiter Finance are working towards solving these challenges with the development of a Cross-Rollup Bridge on Ethereum.

The Cross-Rollup Bridge on Ethereum enables seamless and secure transfer of assets and information between different Layer 2 solutions on the Ethereum network. It acts as a gateway that connects various Layer 2 chains, allowing them to communicate and interact with each other.

One of the key benefits of the Cross-Rollup Bridge is the ability to transfer assets across different Layer 2 chains with minimal friction and cost. This means that users can easily move their assets from one Layer 2 solution to another, without the need for complex and expensive transactions on the Ethereum mainnet.

Furthermore, the Cross-Rollup Bridge also improves the scalability and transaction throughput of Ethereum. By offloading transactions to Layer 2 chains, the bridge reduces the congestion on the Ethereum mainnet and enables faster and cheaper transactions.

Additionally, the Cross-Rollup Bridge enhances the composability of dApps on Ethereum. It allows dApps on different Layer 2 chains to interact with each other, enabling the creation of more complex and innovative applications. This opens up new possibilities for DeFi, gaming, and other industries that rely on smart contracts and decentralized technologies.

The development of the Cross-Rollup Bridge on Ethereum is a game-changer for the blockchain ecosystem. It addresses the challenges of interoperability and scalability, paving the way for widespread adoption of decentralized applications and unlocking the full potential of Ethereum and Layer 2 solutions.

Overall, the Cross-Rollup Bridge on Ethereum is a crucial building block for the future of blockchain technology. Its ability to seamlessly connect different Layer 2 chains and facilitate the transfer of assets and information is a significant step towards a more scalable and interconnected blockchain ecosystem.

Exploring Orbiter Finance

Orbiter Finance is a revolutionary cross-rollup bridge built on the Ethereum network. It aims to provide seamless interoperability between different layer 2 solutions, enabling users to easily transfer assets across multiple rollups.

With the increasing popularity of layer 2 scaling solutions, such as Optimistic Rollups and zkRollups, Orbiter Finance bridges the gap between these networks, allowing users to take advantage of the benefits and features offered by each solution.

The cross-rollup bridge provided by Orbiter Finance is powered by state-of-the-art technology, ensuring fast and secure transfers of assets. The bridge uses a two-way pegging mechanism, allowing users to lock their assets on one rollup and mint corresponding tokens on another.

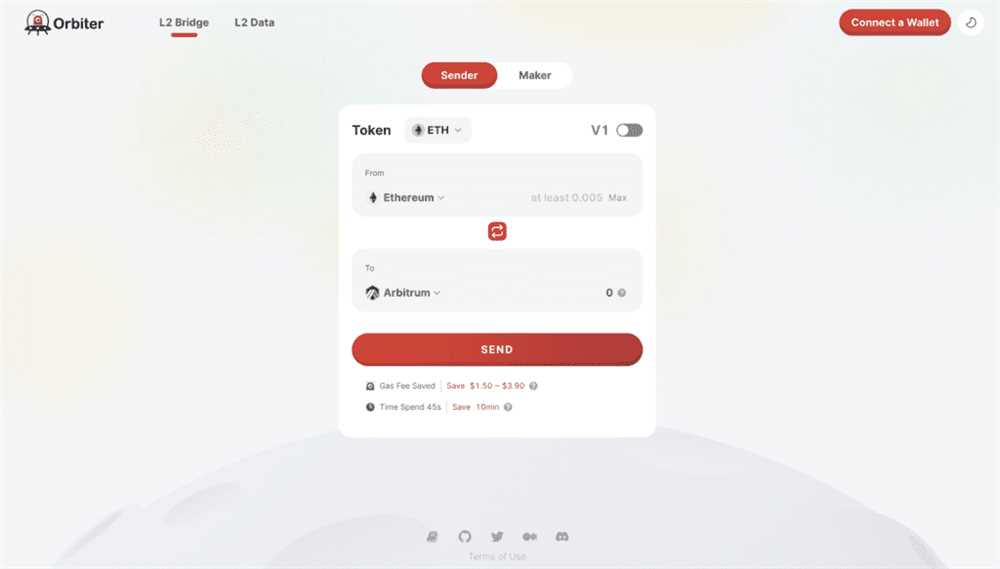

One of the key advantages of Orbiter Finance is its compatibility with existing layer 2 protocols. Users can easily bridge assets from popular rollups such as Arbitrum and Optimism, as well as other layer 2 solutions that implement the Ethereum Virtual Machine (EVM).

To ensure the security of assets transferred through the bridge, Orbiter Finance utilizes decentralized custodians that hold and manage the locked assets. These custodians are responsible for ensuring the correct transfer of assets between rollups and can be replaced by new custodians through a decentralized governance process.

In addition to asset transfers, Orbiter Finance also aims to provide additional features such as decentralized exchange functionality and liquidity mining incentives. These features will further enhance the usability and value proposition of the cross-rollup bridge.

In conclusion, Orbiter Finance is set to revolutionize the Ethereum ecosystem by providing a game-changing cross-rollup bridge. By enabling seamless interoperability between different layer 2 solutions, Orbiter Finance empowers users and developers to take full advantage of the benefits offered by these scaling solutions.

The Benefits of Orbiter Finance

Orbiter Finance offers a wide range of benefits that make it a game-changing cross-rollup bridge on Ethereum. Here are some of the key advantages:

1. Fast and Efficient Cross-Rollup Transactions

Orbiter Finance enables fast and efficient cross-rollup transactions on the Ethereum network. By leveraging the power of layer 2 scaling solutions, Orbiter Finance allows users to transfer assets seamlessly between different rollup chains. This ensures quick and cost-effective transactions, without compromising on security.

2. Increased Liquidity and Accessibility

Orbiter Finance provides increased liquidity and accessibility for users. Through its cross-rollup bridge, users can easily access and trade assets across different rollup chains, creating a more interconnected ecosystem. This paves the way for enhanced opportunities for trading, yield farming, and other DeFi activities.

3. Enhanced Security and Scalability

Orbiter Finance prioritizes security and scalability. By utilizing layer 2 solutions, Orbiter Finance improves the overall security of transactions and reduces the potential for network congestion. Through its cross-rollup bridge, Orbiter Finance is able to handle a larger volume of transactions, making it a scalable solution for the growing demands of the Ethereum network.

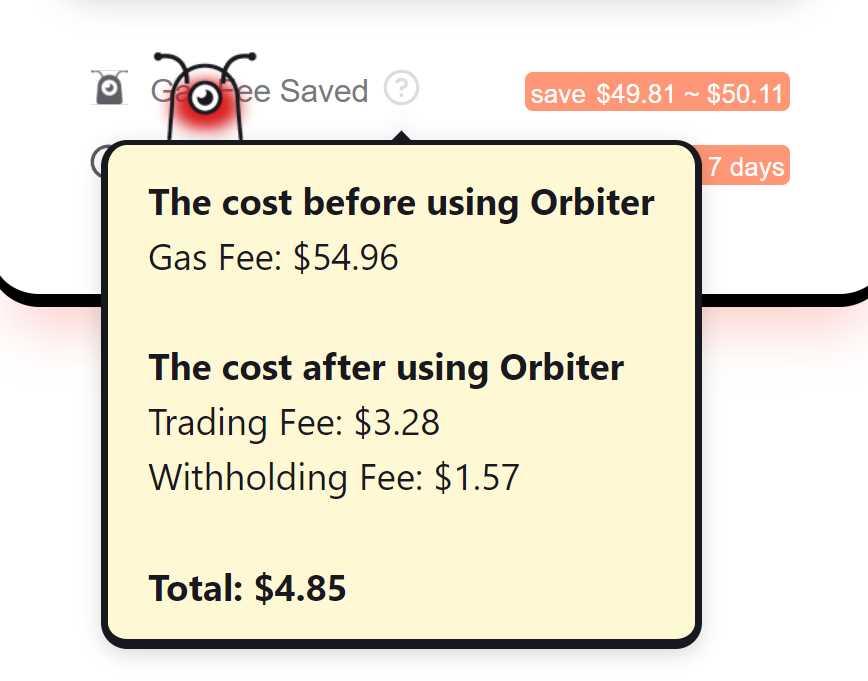

4. Lower Transaction Costs

One of the major advantages of Orbiter Finance is its ability to significantly lower transaction costs. By leveraging layer 2 scalability, users can perform cross-rollup transactions with reduced fees compared to on-chain transactions. This makes Orbiter Finance a cost-effective solution for transferring assets between different rollup chains.

5. Seamless Integration with Existing DeFi Protocols

Orbiter Finance seamlessly integrates with existing DeFi protocols, providing users with a smooth transition from other platforms. Users can easily connect their wallets, import their assets, and start utilizing Orbiter Finance’s cross-rollup bridge without any hassle. This allows users to take advantage of the benefits of Orbiter Finance without disrupting their existing DeFi activities.

In conclusion, Orbiter Finance offers a range of benefits, including fast and efficient cross-rollup transactions, increased liquidity and accessibility, enhanced security and scalability, lower transaction costs, and seamless integration with existing DeFi protocols. With its innovative approach to cross-rollup bridges, Orbiter Finance is set to revolutionize the way assets are transferred and traded on the Ethereum network.

The Game-Changing Features

Orbiter Finance is a cross-rollup bridge on Ethereum that introduces several game-changing features. These features revolutionize the way users can interact with different layer 2 solutions and maximize their potential.

1. Seamless Cross-Rollup Transactions: Orbiter Finance enables users to seamlessly transfer assets between different layer 2 solutions on Ethereum. This means that users can easily move their assets from one platform to another without going through the complicated process of withdrawing and depositing funds.

2. Fast and Efficient Transactions: With Orbiter Finance, users can enjoy fast and efficient transactions due to the cross-rollup technology. Rollups are Layer 2 scaling solutions that aggregate multiple transactions into a single batch, significantly reducing transaction costs and improving scalability.

3. Lower Transaction Fees: Orbiter Finance aims to reduce transaction fees by utilizing layer 2 solutions. By aggregating multiple transactions into a single batch, users can save significantly on gas fees, making it more affordable to interact with different platforms.

4. Interoperability: Orbiter Finance provides interoperability between different layer 2 solutions, allowing users to seamlessly transfer assets across multiple platforms. This opens up endless possibilities for DeFi applications and enables users to access a wider range of investment opportunities.

5. Enhanced User Experience: With its user-friendly interface and easy-to-use features, Orbiter Finance aims to enhance the overall user experience. Users can easily navigate through the platform and perform transactions without the need for complex technical knowledge.

6. Security and Trust: Orbiter Finance prioritizes security and trust. By leveraging the Ethereum network and layer 2 scaling solutions, users can have confidence in the safety of their assets and transactions.

Overall, Orbiter Finance introduces game-changing features that revolutionize the way users interact with layer 2 solutions on Ethereum. With its seamless cross-rollup transactions, fast and efficient transactions, lower transaction fees, interoperability, enhanced user experience, and focus on security and trust, Orbiter Finance is set to transform the DeFi landscape.

How Does Orbiter Finance Work?

Orbiter Finance is a revolutionary cross-rollup bridge that aims to provide seamless interoperability between different Layer 2 solutions on Ethereum. It allows users to move their assets and liquidity across different rollups in a fast, secure, and cost-effective manner.

The core mechanism of Orbiter Finance is based on a two-step process: depositing assets into the bridge and withdrawing assets from the bridge.

When a user wants to deposit assets into the bridge, they first need to lock their assets on the source rollup. This involves creating a proof of the asset’s ownership and submitting it to the Orbiter Finance contract on the source rollup. Once the assets are locked, the user can then initiate a transfer to the destination rollup.

The transfer process involves creating a proof of the locked assets and submitting it to the Orbiter Finance contract on the source rollup. The contract verifies the proof and releases the locked assets, allowing them to be transferred to the destination rollup.

On the destination rollup, the user can then withdraw their assets by providing a proof of the transfer and submitting it to the Orbiter Finance contract. The contract verifies the proof and releases the assets, making them available for the user to use on the destination rollup.

To ensure the security and integrity of the transfer process, Orbiter Finance utilizes a combination of cryptographic proofs and smart contract logic. These mechanisms guarantee that the assets being transferred are valid and unaltered, protecting users’ funds from any potential attacks or manipulation.

In addition to the core transfer mechanism, Orbiter Finance also includes features such as asset tracking, liquidity provisioning, and fee distribution. These features enable users to track the status of their assets, provide liquidity to the bridge, and earn rewards for their participation in the network.

| Key Features of Orbiter Finance |

|---|

| Seamless interoperability between different Layer 2 solutions |

| Fast, secure, and cost-effective asset transfers |

| Utilization of cryptographic proofs and smart contract logic for security |

| Asset tracking, liquidity provisioning, and fee distribution |

Overall, Orbiter Finance is set to revolutionize the cross-rollup bridge space on Ethereum, providing users with a seamless and efficient way to move their assets across different Layer 2 solutions.

What is Orbiter Finance?

Orbiter Finance is a cross-rollup bridge built on Ethereum that aims to revolutionize the DeFi space. It allows users to transfer assets seamlessly across different rollups on Ethereum, enabling greater scalability and interoperability.

How does Orbiter Finance work?

Orbiter Finance utilizes a state-of-the-art scaling solution called Rollup technology to aggregate transactions and process them off-chain. It then periodically submits a compressed summary of these transactions to the Ethereum mainnet for secure and decentralized verification.

What are the benefits of using Orbiter Finance?

Orbiter Finance provides several key benefits for users, including faster and cheaper transactions, increased scalability of the Ethereum network, and improved interoperability between different rollups. It also helps to reduce congestion and gas fees on the Ethereum mainnet.

Can I use Orbiter Finance with any cryptocurrency?

Orbiter Finance is designed to work with ERC-20 tokens on the Ethereum network. While it currently focuses on Ethereum-based assets, there may be plans to expand its capabilities to other blockchains in the future.