Exploring the Fluctuating Total Value Locked of Orbiter Finance on Arbitrum and zkSync

Orbiter Finance, a leading decentralized finance (DeFi) platform, has seen a significant increase in its Total Value Locked (TVL) on both Arbitrum and zkSync. TVL is a key metric in the DeFi space that represents the total amount of assets locked in a particular protocol or platform. It is often used to gauge the popularity and success of a DeFi project.

Arbitrum and zkSync are layer 2 scaling solutions that aim to address the scalability issues of the Ethereum network. These technologies enable faster and cheaper transactions, making them ideal for DeFi platforms like Orbiter Finance. By leveraging these layer 2 solutions, Orbiter Finance is able to attract more users and lock in higher amounts of assets, ultimately increasing its TVL.

One of the main reasons behind Orbiter Finance’s increasing TVL is its innovative and user-friendly features. The platform offers a wide range of financial products, including yield farming, lending, and borrowing, all of which are designed to maximize returns for users. Additionally, Orbiter Finance has implemented robust security measures to protect user funds, further contributing to its growing popularity.

As the DeFi ecosystem continues to evolve, layer 2 solutions like Arbitrum and zkSync are becoming increasingly important. They not only address scalability issues but also provide a more seamless and cost-effective user experience. With its rising TVL on these layer 2 platforms, Orbiter Finance is well-positioned to capitalize on the growing demand for decentralized finance and solidify its position as a leader in the industry.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol that aims to bring a new level of efficiency and scalability to the cryptocurrency market. Built on the Ethereum blockchain, Orbiter Finance leverages layer 2 solutions such as Arbitrum and zkSync to improve transaction speeds and reduce fees.

By using layer 2 technology, Orbiter Finance enables users to access a wide range of DeFi services without sacrificing security or decentralization. It achieves this by offloading the majority of its transactions to layer 2 networks, while still maintaining the security and trustlessness of the Ethereum mainnet.

One of the standout features of Orbiter Finance is its ability to provide users with high-yield staking opportunities. Through innovative strategies and partnerships with other DeFi protocols, Orbiter Finance offers users competitive rewards for staking their tokens.

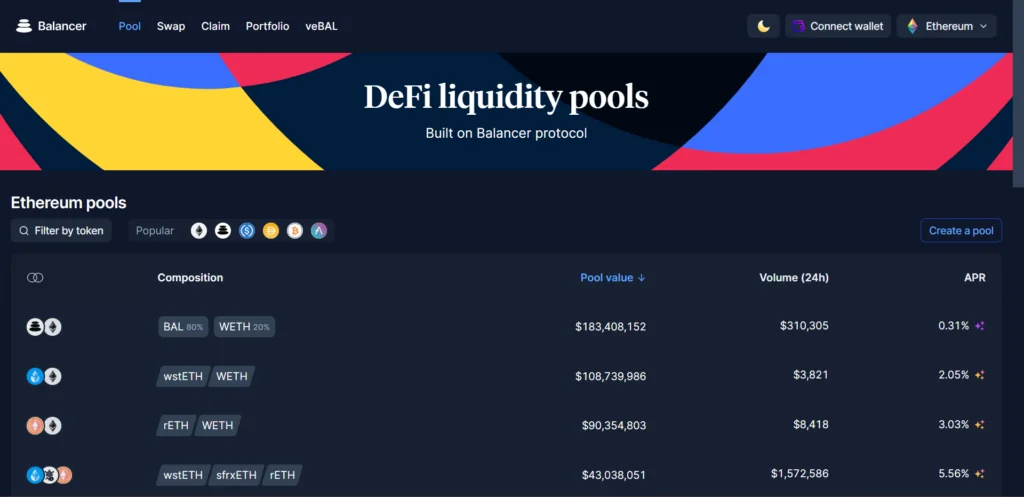

In addition to staking, Orbiter Finance also allows users to participate in liquidity mining and yield farming. These activities involve providing liquidity to various pools and earning rewards in return. Orbiter Finance makes it easy for users to get involved in these activities with a simple and intuitive user interface.

Overall, Orbiter Finance is a promising DeFi protocol that is poised to revolutionize the way we interact with decentralized finance. With its focus on efficiency, scalability, and high-yield opportunities, Orbiter Finance is well-positioned to attract both experienced and new users to the world of DeFi.

What is Total Value Locked (TVL)?

Total Value Locked (TVL) is a key metric in the decentralized finance (DeFi) space that represents the total amount of assets, typically in the form of cryptocurrency tokens, locked and actively being used in a particular DeFi protocol or platform. TVL serves as an important indicator of the overall health and popularity of a DeFi project, as it reflects the level of trust and confidence users have in the platform.

To calculate the TVL of a DeFi protocol, the value of all assets entrusted to the protocol is taken into account. This includes assets that have been deposited by users and are being used in various DeFi activities such as lending, borrowing, staking, yield farming, and liquidity provision.

TVL is typically measured in USD, as it provides a standardized unit of value for different assets. The value of each token is converted to USD based on its market price, which can change over time. TVL can fluctuate as the value of the assets held in a DeFi protocol changes due to market dynamics and user activity.

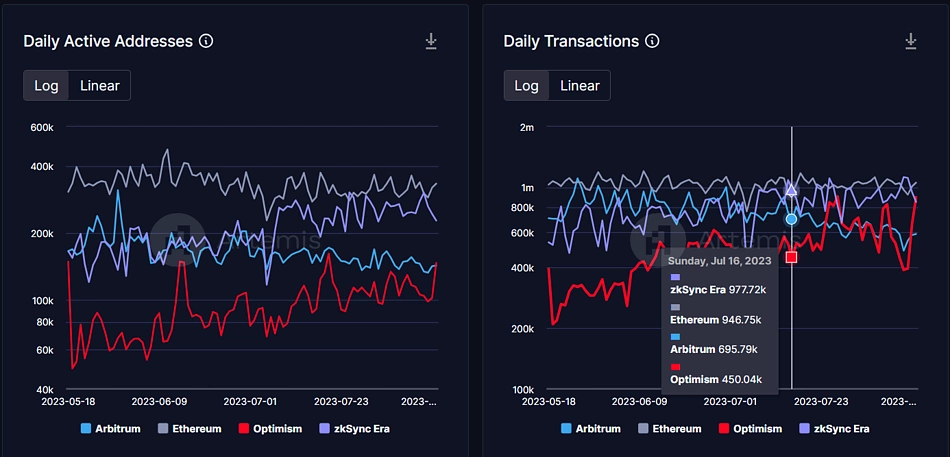

The concept of TVL is especially relevant in the context of Layer 2 scaling solutions like Arbitrum and zkSync. These scaling solutions aim to alleviate the scalability issues of the Ethereum blockchain by moving some of the transactional activity and smart contract execution off-chain while still maintaining a high level of security and decentralization. The TVL on these Layer 2 protocols represents the amount of assets locked and being used in DeFi applications running on these solutions, providing insights into the adoption and growth of Layer 2 infrastructure.

To summarize, Total Value Locked (TVL) is a metric used in DeFi to measure the total value of assets locked and actively utilized in a DeFi protocol or platform. It serves as an indicator of trust, confidence, and usage in the DeFi ecosystem, and is particularly relevant in the context of Layer 2 scaling solutions like Arbitrum and zkSync.

Orbiter Finance’s TVL on Arbitrum

Arbitrum is gaining traction as a layer 2 scaling solution for Ethereum, offering faster and cheaper transactions compared to the Ethereum mainnet. Orbiter Finance, a leading decentralized finance (DeFi) project, is taking advantage of Arbitrum’s benefits to enhance its total value locked (TVL) and provide users with a seamless and efficient experience.

TVL is a crucial metric in the DeFi space as it represents the total amount of assets locked in a protocol. It serves as an indicator of the community’s confidence in the project and its ability to generate returns for its users. Orbiter Finance’s TVL on Arbitrum has been steadily growing, attracting more users and assets to the platform.

By leveraging Arbitrum, Orbiter Finance offers users lower transaction fees and faster confirmation times, enabling them to quickly navigate through the DeFi ecosystem without bottleneck issues. This scalability solution enhances the overall user experience and reduces barriers to entry for new users.

The integration of Orbiter Finance with Arbitrum has also opened up new opportunities for users to participate in various yield farming and liquidity mining strategies, further driving the TVL growth. Users can easily deposit their assets into Orbiter Finance’s smart contracts on Arbitrum and start earning passive income by supplying liquidity to different DeFi protocols.

Moreover, the security and reliability offered by Arbitrum ensure that users’ funds are protected from potential vulnerabilities and attacks. This level of trust and protection has played a significant role in attracting more capital to Orbiter Finance’s TVL on Arbitrum.

As more users recognize the benefits of Arbitrum’s scalability and efficiency, Orbiter Finance’s TVL is expected to continue its upward trajectory. The project’s commitment to providing a seamless and secure DeFi experience on a scalable network sets it apart, solidifying its position as a prominent player in the DeFi space.

In conclusion, Orbiter Finance’s TVL on Arbitrum showcases its ability to leverage leading technologies and provide users with enhanced features, lower fees, and increased security. This growth in TVL demonstrates the community’s trust in the project and its potential for further expansion in the DeFi ecosystem.

Orbiter Finance’s TVL on zkSync

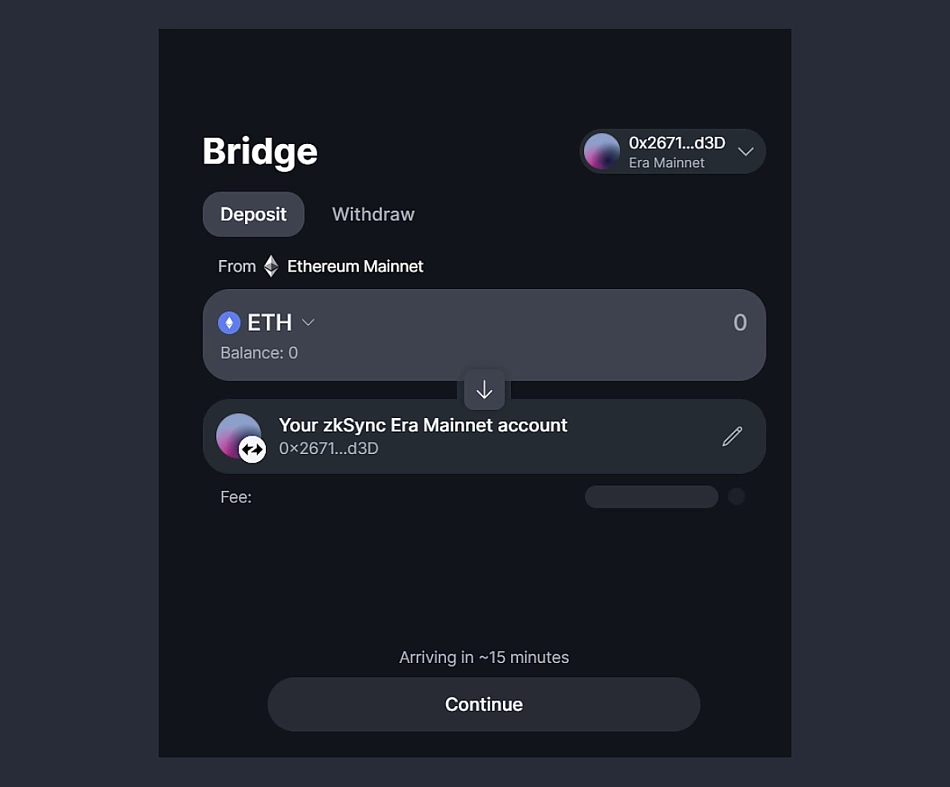

zkSync is a layer-2 scaling solution for Ethereum that enables fast and low-cost transactions. Orbiter Finance, a DeFi protocol, has integrated with zkSync to leverage its scalability and cost-effectiveness.

zkSync allows Orbiter Finance users to deposit and withdraw funds to and from the protocol with much lower gas fees compared to the Ethereum mainnet. This scalability benefit has attracted many users to Orbiter Finance, resulting in a significant increase in the protocol’s Total Value Locked (TVL) on zkSync.

The TVL on zkSync represents the total amount of assets, in terms of value, locked in Orbiter Finance on the zkSync layer-2 network. It includes the value of deposits made by users, as well as any outstanding loans or liquidity provided to the protocol.

The TVL on zkSync reflects the confidence of users in Orbiter Finance as they choose to lock their assets in the protocol to earn rewards or access its various services. As the TVL grows, it indicates the increasing popularity and adoption of Orbiter Finance on zkSync.

Monitoring the TVL on zkSync provides valuable insights into the growth and success of Orbiter Finance’s integration with zkSync. It also highlights the effectiveness of zkSync’s scalability solutions in attracting users and facilitating the growth of the DeFi ecosystem.

Orbiter Finance’s TVL on zkSync can be tracked and analyzed through various data analytics platforms, allowing users and stakeholders to stay updated on the protocol’s performance and the overall adoption of zkSync in the DeFi space.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol that aims to provide users with a seamless and secure experience for swapping and trading assets across different networks. It leverages layer 2 scaling solutions like Arbitrum and zkSync to reduce transaction costs and improve scalability.

How does Orbiter Finance calculate its Total Value Locked?

Orbiter Finance calculates its Total Value Locked (TVL) by summing up the value of all assets deposited and locked within the protocol. This includes all funds in various liquidity pools, staking contracts, and any other assets held within the protocol. TVL is an important metric used to gauge the overall health and adoption of a DeFi project.

What is Arbitrum and zkSync?

Arbitrum and zkSync are both layer 2 scaling solutions for Ethereum, designed to address the network’s scalability and high transaction fees. Arbitrum uses a rollup technology to batch multiple transactions into a single one, thus significantly reducing costs and increasing throughput. zkSync, on the other hand, utilizes zero-knowledge proofs to achieve a similar outcome. These solutions enable Orbiter Finance to provide users with faster and cheaper transactions.

How does Orbiter Finance leverage Arbitrum and zkSync?

Orbiter Finance leverages Arbitrum and zkSync by integrating with these layer 2 solutions to enable faster and cheaper transactions for its users. By utilizing these technologies, users can swap and trade assets on Orbiter Finance with reduced gas fees and improved scalability, resulting in a better overall experience. This integration also allows Orbiter Finance to attract more users and increase its Total Value Locked (TVL).