Navigating Margin Requirements and Compensation Process in Orbiter Finance Cross-Rollup Services

Welcome to Orbiter Finance, the premier platform for cross-rollup services! Our mission is to help you navigate the world of decentralized finance with ease and simplicity. With our innovative solutions, you can maximize your potential earnings while minimizing your risks.

When it comes to margin requirements, Orbiter Finance sets the bar high. We believe in responsible investing and prioritize the security of your assets. Our robust margin requirements ensure that you have ample collateral to support your trades, providing you with peace of mind and a solid foundation for your financial ventures.

But that’s not all – at Orbiter Finance, we understand that accidents happen. If you’re ever faced with a situation where your trades result in losses, don’t fret! Our compensation process has got you covered. We offer a comprehensive compensation package that aims to protect your investments and provide you with the support you need in case of unexpected outcomes. Your success is our success, and we’re here to help you bounce back stronger than ever.

So whether you’re a seasoned trader or just starting out, Orbiter Finance is your go-to platform for all your cross-rollup needs. Join us today and experience the future of decentralized finance!

Overview of Navigating Orbiter Finance’s Cross-Rollup Services

Navigating Orbiter Finance offers innovative cross-rollup services that provide seamless and efficient financial solutions to our clients. With our expertise and advanced technology, we strive to revolutionize the way people navigate the world of finance.

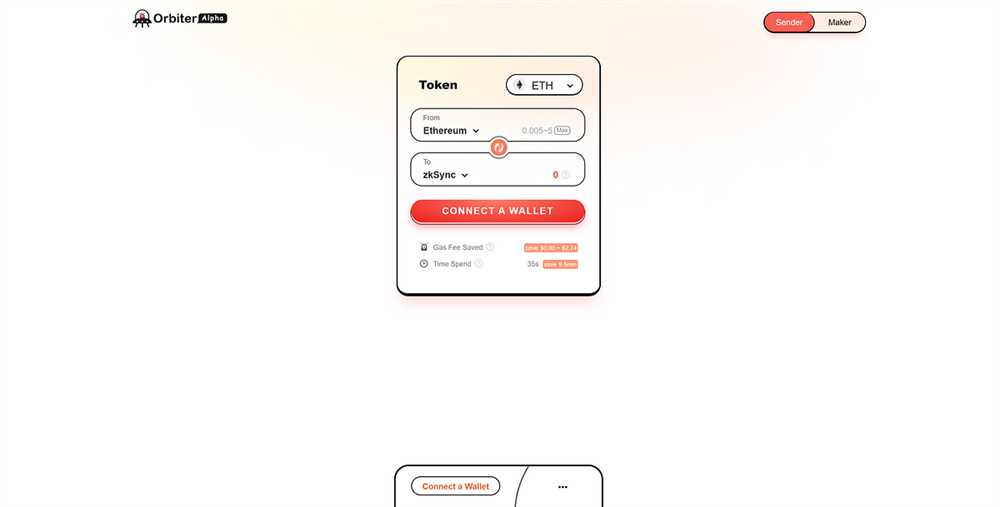

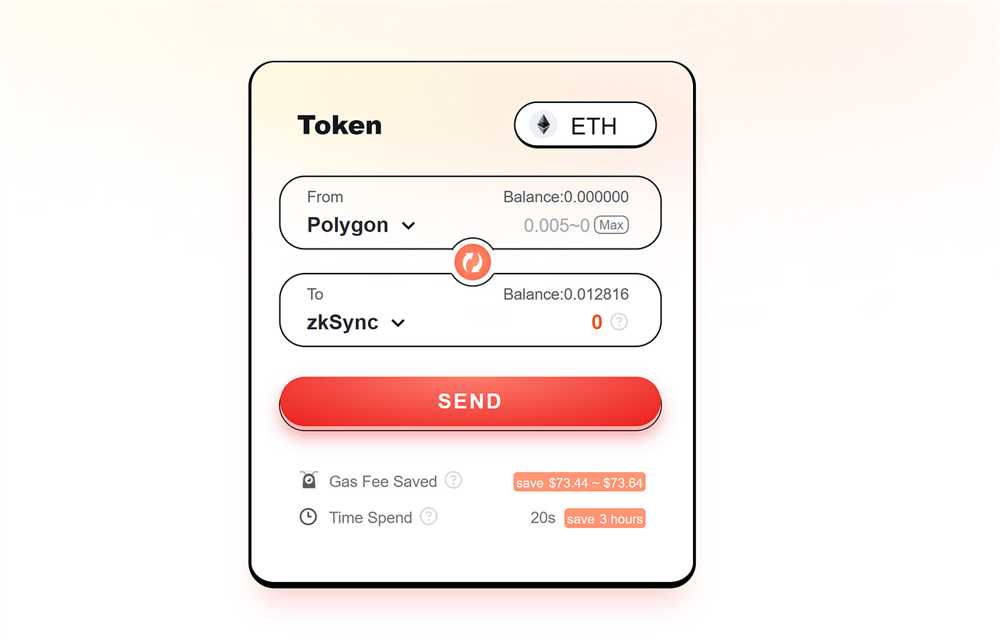

Our cross-rollup services enable you to optimize your assets and securely transfer them across multiple platforms. Whether you want to diversify your portfolio or take advantage of new investment opportunities, our platform offers a user-friendly interface that simplifies the process.

One of the key features of our cross-rollup services is the ability to consolidate your assets into a single wallet. This streamlines your portfolio management and eliminates the need to manage multiple wallets across different platforms. With just a few clicks, you can easily transfer your assets, monitor their performance, and make informed decisions.

Our platform also offers competitive margin requirements, ensuring that you have the flexibility to access additional funds for trading or investing. We understand the importance of having enough capital to seize the right opportunities, and our margin requirements are designed to support your financial goals.

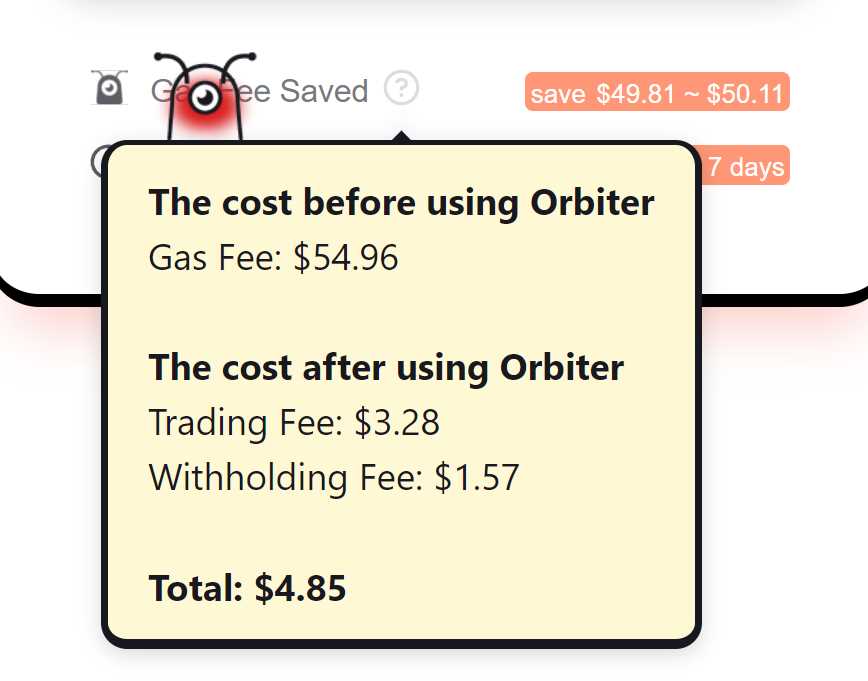

In addition, our compensation process is designed to provide a fair and transparent experience for our clients. We offer competitive fees and rewards for participating in our cross-rollup services. By aligning our interests with yours, we aim to create a mutually beneficial relationship that fosters trust and long-term partnerships.

| Benefits of Navigating Orbiter Finance’s Cross-Rollup Services |

|---|

| Seamless asset transfer across multiple platforms |

| User-friendly interface for easy portfolio management |

| Competitive margin requirements for enhanced capital access |

| Fair and transparent compensation process |

At Navigating Orbiter Finance, we believe in empowering our clients with the tools and services they need to navigate the complex world of finance confidently. Whether you are an experienced investor or just starting your financial journey, our cross-rollup services are designed to make your life easier and more profitable.

Margin Requirements

At Orbiter Finance, we understand the importance of margin requirements when it comes to cross-rollup services. Margin requirements are necessary to ensure the safety and stability of the platform while allowing our users to maximize their trading potential.

What are Margin Requirements?

Margin requirements are the minimum amount of collateral or initial margin that a trader must maintain to open and hold a position. These requirements act as a buffer to cover potential losses and mitigate risks associated with trading.

How do Margin Requirements work at Orbiter Finance?

When you use our cross-rollup services, you’ll need to meet the margin requirements set for each specific trading pair. The margin requirements are calculated based on factors such as the volatility of the assets, market conditions, and the desired leverage.

For example, if you want to trade a high volatility pair, the margin requirements may be higher to account for the increased risk. Conversely, less volatile pairs may have lower margin requirements.

Orbiter Finance uses a sophisticated risk management system that constantly monitors the margin requirements and adjusts them accordingly to ensure the platform’s integrity and the safety of your funds.

Why are Margin Requirements important?

Margin requirements are essential because they provide a safety net for traders and the platform itself. By setting minimum collateral thresholds, we prevent excessive leverage and potential liquidation events, which can lead to substantial losses. This helps maintain the overall stability of the platform and ensures fair and secure trading for all users.

By adhering to margin requirements, traders can better manage their risk and protect their investment. It’s crucial to carefully consider the margin requirements for each trading pair before entering a position to avoid any unwanted consequences.

At Orbiter Finance, we prioritize transparency and aim to educate our users about the importance of margin requirements. By understanding and adhering to these requirements, you can make informed trading decisions and navigate the cross-rollup services with confidence.

Understanding Margin Requirements

Margin requirements play a crucial role in Orbiter Finance’s cross-rollup services. It is important for our users to have a clear understanding of what margin requirements are and how they work.

Margin refers to the collateral that a user needs to maintain in their account in order to participate in cross-rollup services. This collateral acts as a security deposit and helps protect against the potential risk of default. The margin requirements ensure that users have sufficient funds to cover potential losses.

How Margin Requirements Work

In order to engage in cross-rollup services, users must satisfy specific margin requirements set by Orbiter Finance. These requirements include a minimum margin level that must be maintained at all times. If the margin level falls below the specified threshold, users may be required to add additional collateral or risk having their position liquidated.

The margin level is determined by considering the value of the assets being traded and the potential risk associated with those assets. The more volatile the asset, the higher the margin requirement. This helps mitigate the risk of default and protect both the user and Orbiter Finance.

Benefits of Margin Requirements

Margin requirements offer several benefits to users participating in Orbiter Finance’s cross-rollup services:

- Protection against potential losses: By setting margin requirements, Orbiter Finance ensures that users have sufficient collateral to cover potential losses, reducing the risk of default.

- Access to leverage: Margin requirements allow users to access leverage, enabling them to increase their exposure to potential returns.

- Enhanced risk management: Margin requirements help users manage and mitigate risk by setting clear thresholds for maintaining collateral levels.

By understanding and adhering to the margin requirements set by Orbiter Finance, users can maximize their participation in cross-rollup services while minimizing the potential risks involved.

Benefits of Margin Trading on Orbiter Finance

Margin trading provides numerous benefits to traders on Orbiter Finance. Here are some of the advantages:

1. Increased Buying Power

Margin trading allows traders to amplify their buying power by using borrowed funds. This enables them to increase the size of their trades and potentially generate higher returns on investment.

2. Diversification

With margin trading, traders can diversify their investment portfolio and take advantage of various trading strategies. They can allocate funds across different assets and markets, reducing the risk of being exposed to a single asset or market.

3. Increased Profit Potential

Margin trading opens up opportunities for traders to profit from both bullish and bearish market conditions. They can take long positions when they anticipate price increases and short positions when they expect price decreases. This flexibility allows traders to benefit from market movements in any direction.

4. Leveraged Trading

Margin trading on Orbiter Finance offers leveraged trading, which means traders can control larger positions with a smaller initial investment. This allows them to amplify their potential profits, but it’s important to note that it also increases the risk of losses.

Note: Margin trading involves a certain level of risk, and traders should carefully consider their risk tolerance and financial situation before engaging in margin trading.

Overall, margin trading on Orbiter Finance provides traders with increased buying power, diversification opportunities, increased profit potential, and leveraged trading options. It is an advanced trading strategy that can help traders maximize their investment opportunities and potentially achieve higher returns.

Compensation Process

At Navigating Orbiter Finance, we understand the importance of providing compensation to our clients for any inconvenience or loss they may experience while using our cross-rollup services. We strive to ensure that our clients are adequately compensated and their needs are taken care of.

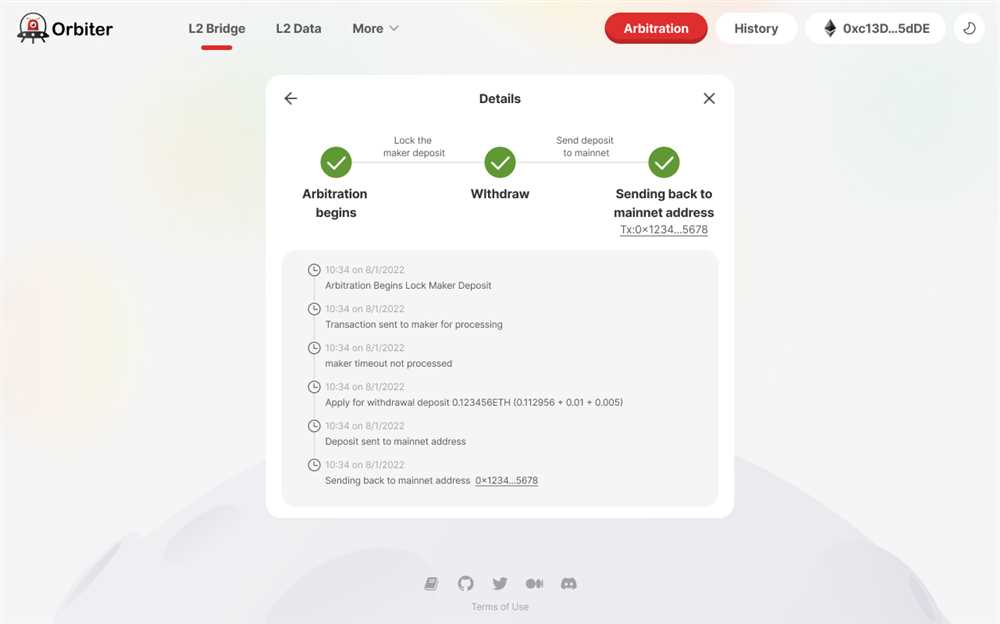

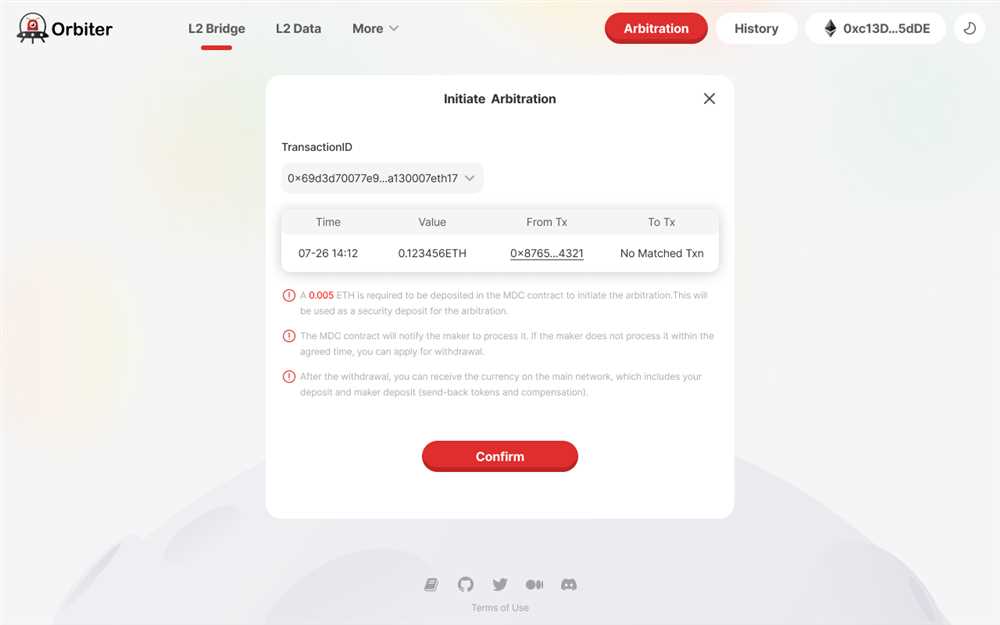

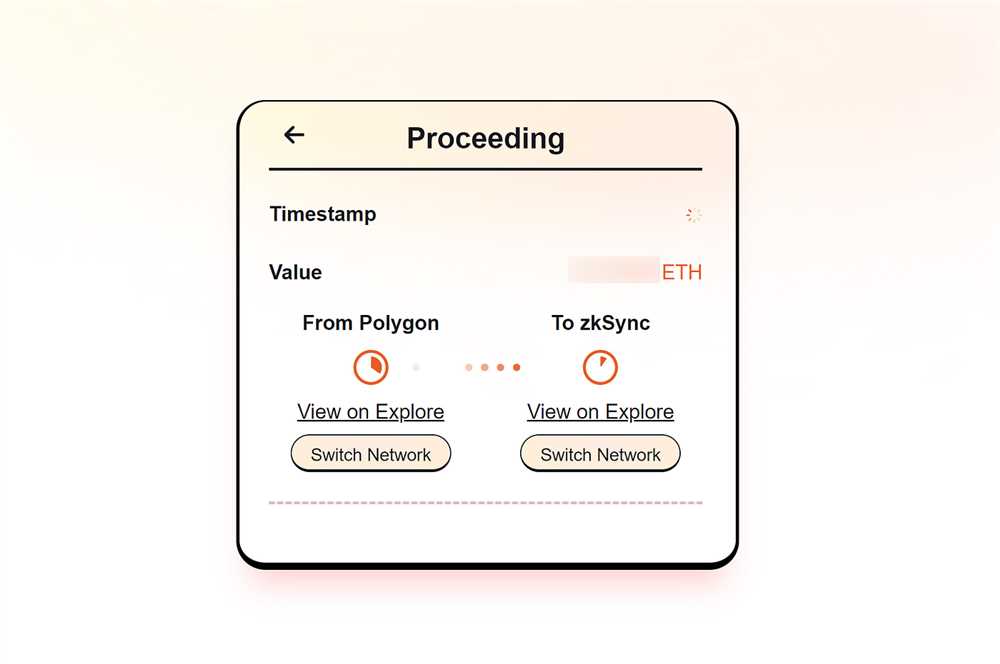

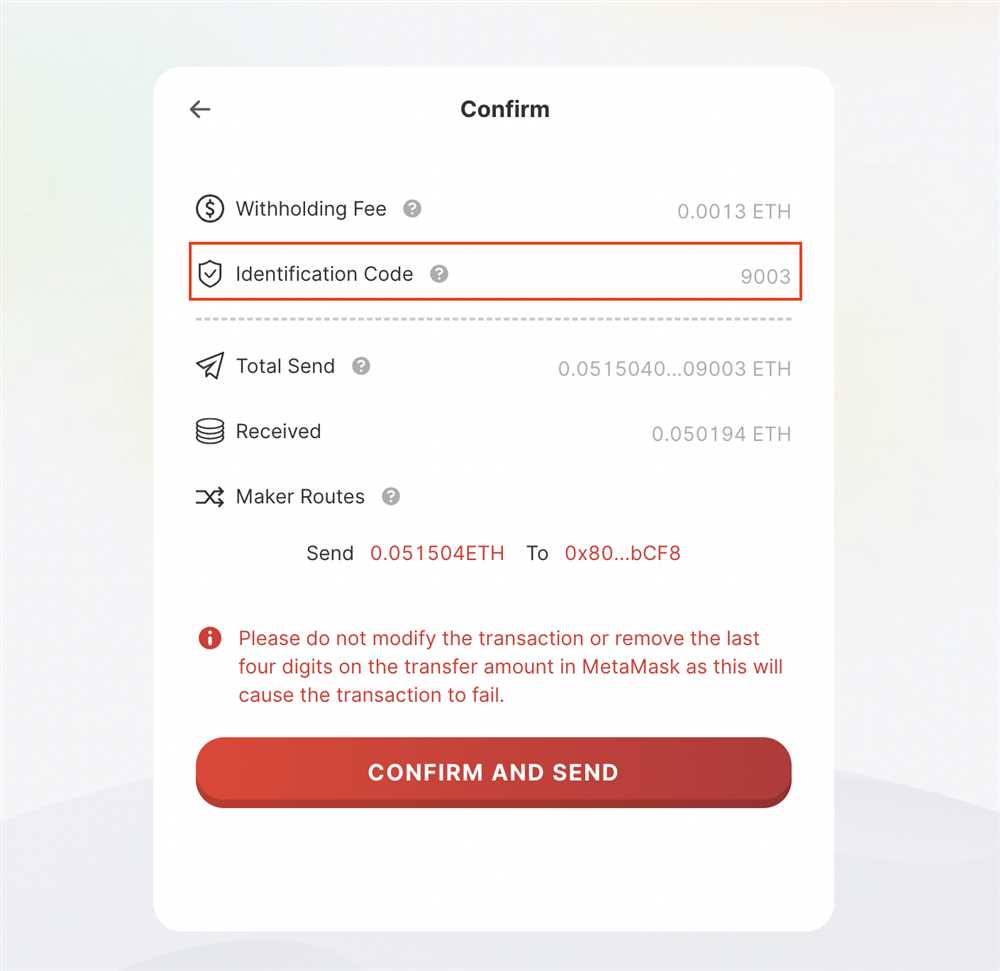

When it comes to the compensation process, we have a straightforward and efficient system in place. Here’s a step-by-step guide to help you understand how it works:

1. Identifying the Issue

If you encounter any issues while using our cross-rollup services, it’s essential to notify our customer support team immediately. You can reach out to us through our dedicated helpline or by sending an email to our support address. Our team will guide you through the next steps.

2. Assessment and Evaluation

Once we receive the details of your issue, our experts will carefully assess and evaluate the situation. They will review the relevant information, including any logs or documentation, to understand the impact and severity of the problem.

Our goal during this stage is to determine the extent of the inconvenience or loss you have suffered and ensure the compensation is fair and reasonable.

3. Compensation Offer

Based on the assessment, our team will provide you with a compensation offer. This offer will be tailored to address the specific inconvenience or loss you have experienced and will be communicated to you in a transparent and timely manner.

We believe in open communication and will take into account your feedback and suggestions while finalizing the compensation offer.

Note: In cases where the issue can be rectified or resolved, we will strive to do so promptly. Compensation will be in addition to any necessary remedial actions taken.

4. Disbursement of Compensation

Once both parties agree on the compensation offer, Navigating Orbiter Finance will initiate the disbursement process. The funds will be transferred to your designated account or wallet within the agreed-upon timeframe.

Your satisfaction is our priority, and we aim to ensure that you receive the compensation in a timely manner, without any unnecessary delays.

We place great emphasis on maintaining transparency and accountability throughout the compensation process to build trust and provide you with a seamless experience.

At Navigating Orbiter Finance, we value our clients and their trust in our cross-rollup services. Our compensation process is designed to address any issues you may encounter and provide you with the comfort and reassurance you deserve.

If you have any questions or concerns regarding the compensation process, please don’t hesitate to contact our customer support team. We are here to assist you and ensure that your experience with us is nothing short of excellent.

What are the margin requirements for using Orbiter Finance’s Cross-Rollup Services?

The margin requirements for using Orbiter Finance’s Cross-Rollup Services depend on the specific service being utilized. Each service has its own set of margin requirements, which are designed to ensure the safety and integrity of the platform. It is recommended to review the documentation and guidelines provided by Orbiter Finance to understand the specific margin requirements for each service.

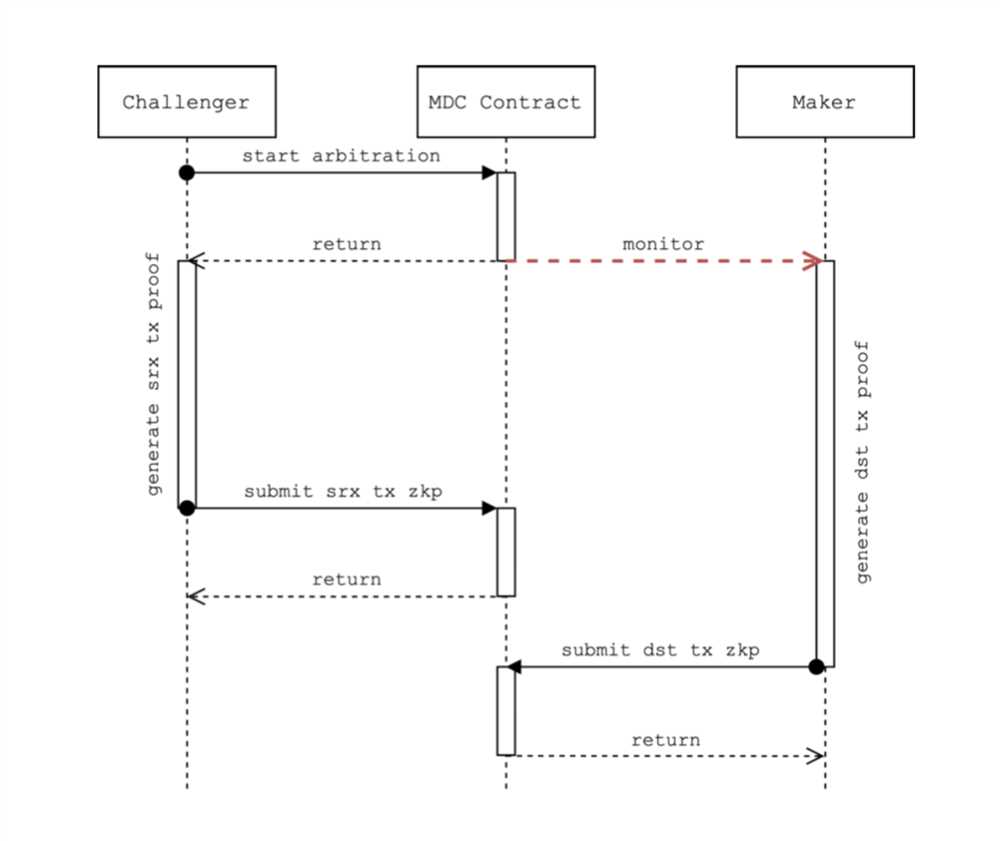

How does the compensation process work for Orbiter Finance’s Cross-Rollup Services?

The compensation process for Orbiter Finance’s Cross-Rollup Services varies depending on the circumstances. In general, if there is any loss or inconvenience experienced by the user due to the platform’s operational issues or failures, the user may be eligible for compensation. This compensation process is regulated and has certain criteria and procedures that need to be followed. It is advisable to refer to Orbiter Finance’s documentation and support channels to understand the specific compensation process in detail.

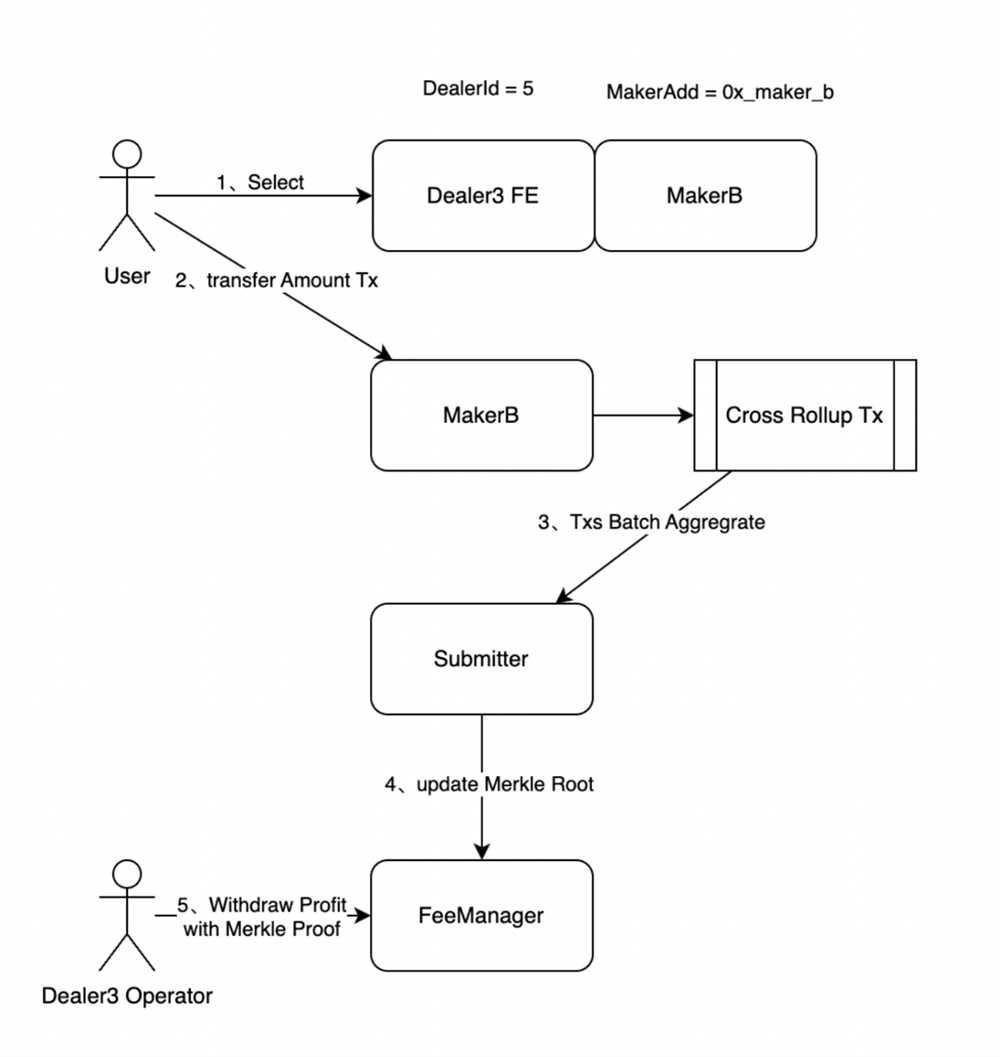

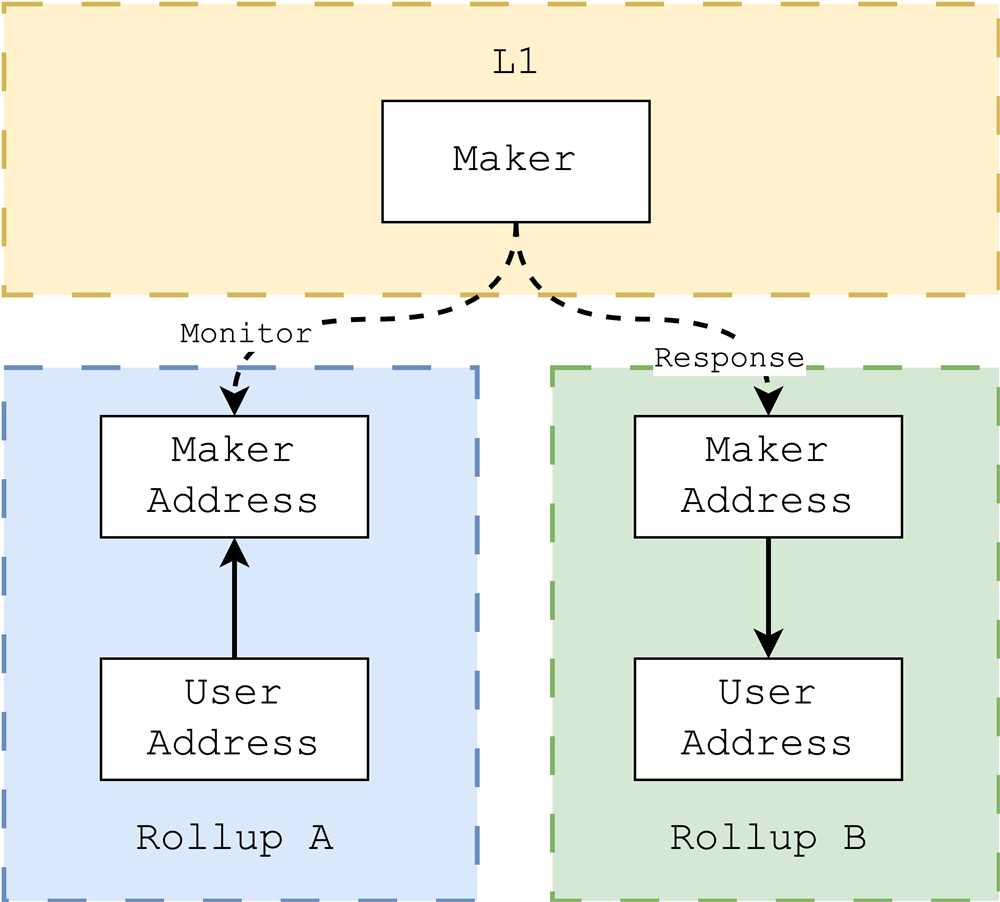

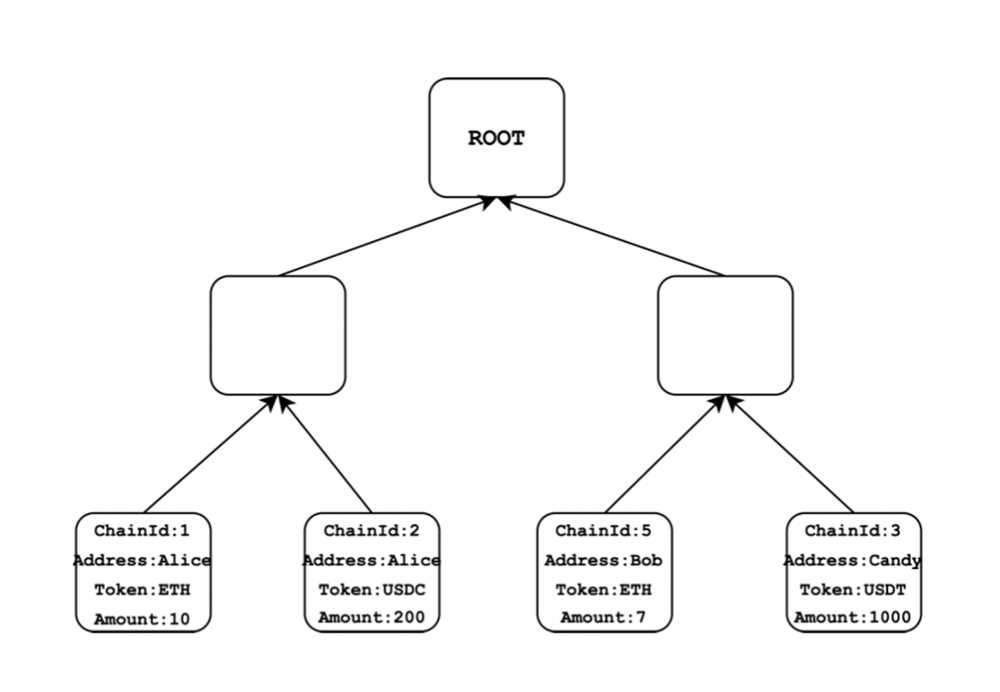

Can you please explain the concept of cross-rollup services offered by Orbiter Finance?

Orbiter Finance’s cross-rollup services allow users to interact with multiple layer 2 solutions and take advantage of various protocols and applications built on them. These services facilitate seamless asset transfers and transactions across different layer 2 networks. By using cross-rollup services, users can enjoy the benefits of multiple layer 2 solutions without the need for complicated bridging or conversions. It provides a convenient and efficient way to access different layer 2 networks and participate in the decentralized finance ecosystem.