Exploring the Functions and Responsibilities of Sender and Maker in Orbiter Finance

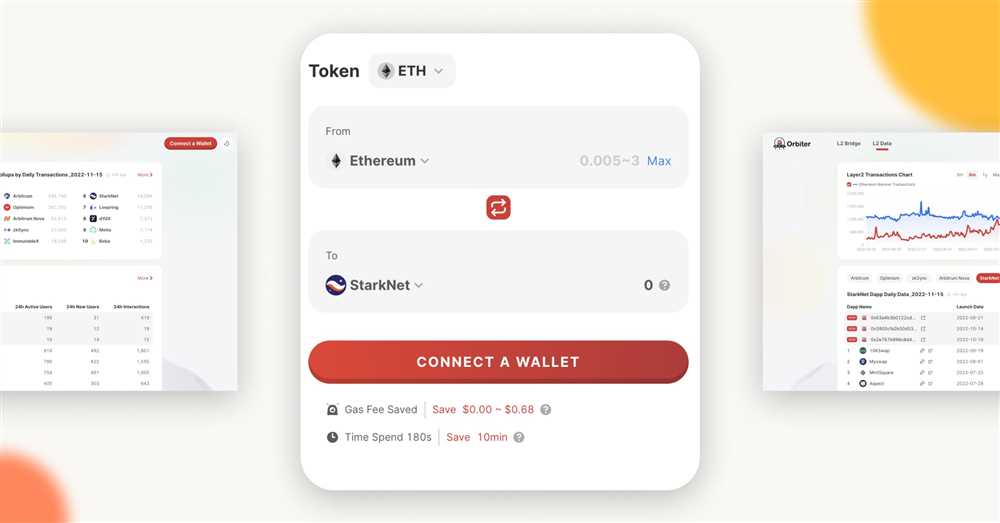

Orbiter Finance is a decentralized finance protocol that has gained significant attention in the crypto space. It offers users the ability to participate in liquidity provision and yield farming, allowing them to earn passive income on their crypto assets. To fully comprehend how this platform functions, it is important to understand the roles of the Sender and Maker in the Orbiter Finance ecosystem.

The Sender plays a crucial role in Orbiter Finance as they are responsible for initiating transactions by sending assets to liquidity pools. They are the ones who provide liquidity to the pools, which helps to facilitate seamless transactions on the protocol. Without Senders, the liquidity pools would not exist, and users would not be able to trade their assets effectively.

On the other hand, the Maker is an essential part of the Orbiter Finance ecosystem as well. Makers are the users who create trading pairs and determine the initial parameters for liquidity provision. They set the price ranges for each asset pair and decide how much liquidity they are willing to provide. In essence, Makers act as the market makers on the platform, ensuring that there is sufficient liquidity for efficient trading.

In conclusion, understanding the roles of the Sender and Maker in Orbiter Finance is vital for anyone looking to participate in the protocol. Both these roles contribute to the overall functionality and liquidity of the platform, enabling users to engage in seamless transactions and earn passive income on their crypto assets.

Understanding the Roles of Sender and Maker

In Orbiter Finance, the sender and maker play crucial roles in the functioning of the platform. These roles are vital for enabling seamless transactions and ensuring the security and integrity of the marketplace.

The sender refers to the user who initiates a transaction by sending a specific cryptocurrency to another user or contract. The sender is responsible for providing the necessary inputs and ensuring that the transaction is confirmed and recorded on the blockchain. They typically have control over the funds being sent and must authorize the transaction through their wallet or other authentication methods.

On the other hand, the maker is the user or contract that receives the cryptocurrency from the sender. Makers are usually liquidity providers or service providers on the Orbiter Finance platform. They may offer their resources or services in exchange for the cryptocurrency being sent. Makers play a crucial role in facilitating transactions and can provide value to the Orbiter Finance ecosystem by offering services such as lending, borrowing, or trading.

Both senders and makers must understand their roles and responsibilities when participating in Orbiter Finance. For example, senders need to ensure that they are sending funds to a legitimate maker and verify the terms of the transaction before initiating it. Makers, on the other hand, should provide accurate and timely information about their services or resources to attract potential senders and build trust in the platform.

In conclusion, the roles of sender and maker are integral to the smooth operation of Orbiter Finance. By understanding these roles and fulfilling their responsibilities, participants can contribute to the growth and success of the platform, enabling secure and efficient transactions.

in Orbiter Finance

Orbiter Finance is a revolutionary blockchain-based platform that aims to transform the world of decentralized finance (DeFi). It provides a one-stop solution for users to access, manage, and utilize various DeFi services and protocols.

The roles of sender and maker play a crucial role in the Orbiter Finance ecosystem. The sender is responsible for initiating transactions and sending funds across the blockchain network. With Orbiter Finance, users can easily and securely send various cryptocurrencies to others without the need for intermediaries.

On the other hand, the maker is an essential participant in the Orbiter Finance platform, particularly in the context of liquidity provision. Makers contribute funds to liquidity pools, allowing users to trade and swap different tokens without the need for traditional order books. By providing liquidity, makers earn rewards in the form of transaction fees.

In Orbiter Finance, the sender and maker roles work together to facilitate seamless and efficient DeFi transactions. Senders can easily access liquidity pools provided by makers to execute their desired trades, while makers earn rewards by contributing liquidity to the platform.

By combining these roles within a secure and transparent blockchain infrastructure, Orbiter Finance aims to revolutionize the way people access and utilize decentralized financial services. The platform provides a user-friendly interface, making it accessible to both experienced users and newcomers to the world of DeFi.

The Importance of the Sender Role

The sender role plays a crucial part in the Orbiter Finance ecosystem, ensuring the smooth operation of transactions and maintaining the integrity of the platform.

A sender, also known as a liquidity provider, is responsible for supplying assets to the Orbiter Finance protocol. These assets are used for various purposes, such as enabling decentralized exchanges, lending, borrowing, and staking. By providing liquidity, senders facilitate the seamless flow of value within the platform, allowing users to access and utilize different financial services.

Furthermore, the sender role is essential for maintaining the stability and efficiency of the protocol. When there is high demand for a specific asset, senders ensure that there is enough liquidity available to meet the needs of users. This helps to prevent issues such as slippage and ensures that trades can be executed at fair market prices.

In addition, senders play a crucial role in minimizing the risks associated with decentralized finance. By providing liquidity, senders help to reduce price volatility, lower the chances of market manipulation, and enhance the overall security of the ecosystem.

To incentivize individuals to take on the sender role, Orbiter Finance offers various rewards and benefits. These may include earning transaction fees, receiving governance rights, and participating in yield farming programs. These incentives help to attract liquidity providers and ensure the continuous availability of assets within the platform.

In conclusion, the sender role is of utmost importance in the Orbiter Finance ecosystem. By providing liquidity, senders enable the smooth operation of transactions, enhance the stability of the protocol, and mitigate the risks associated with decentralized finance. Their role is crucial for the success and growth of the platform, making them vital participants in the ecosystem.

Exploring the Maker Role

The Maker role in Orbiter Finance plays a crucial role in the decentralized finance ecosystem. Makers are essentially liquidity providers who lock their assets in smart contracts called “pools”. These pools are utilized by users who want to borrow or lend assets.

As a Maker, you can choose which assets you want to provide liquidity for and determine the terms of your lending or borrowing agreements. When you lock your assets in a pool, you earn interest based on the demand for that asset. The interest rate is determined by the market dynamics of supply and demand.

Makers have the opportunity to earn passive income by providing liquidity to the platform. They also have the ability to influence the interest rates by adjusting the supply of assets they provide. Increasing the supply of an asset can lower the interest rates, whereas reducing the supply can drive up the interest rates.

Being a Maker requires careful consideration of the risks involved. It’s important to assess the risk of borrowers defaulting on their loans and the volatility of the assets being provided as liquidity. Makers should also stay informed about the market conditions and adjust their strategies accordingly to maximize their returns.

In summary, the Maker role in Orbiter Finance is essential for maintaining the liquidity of the platform. Makers provide assets for users to borrow or lend and earn interest in return. They have the power to influence interest rates and must carefully manage the risks involved. Participating as a Maker in Orbiter Finance can be a rewarding experience for those who understand and navigate the complexities of the role.

How the Sender and Maker Roles Interact

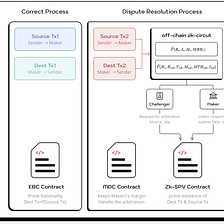

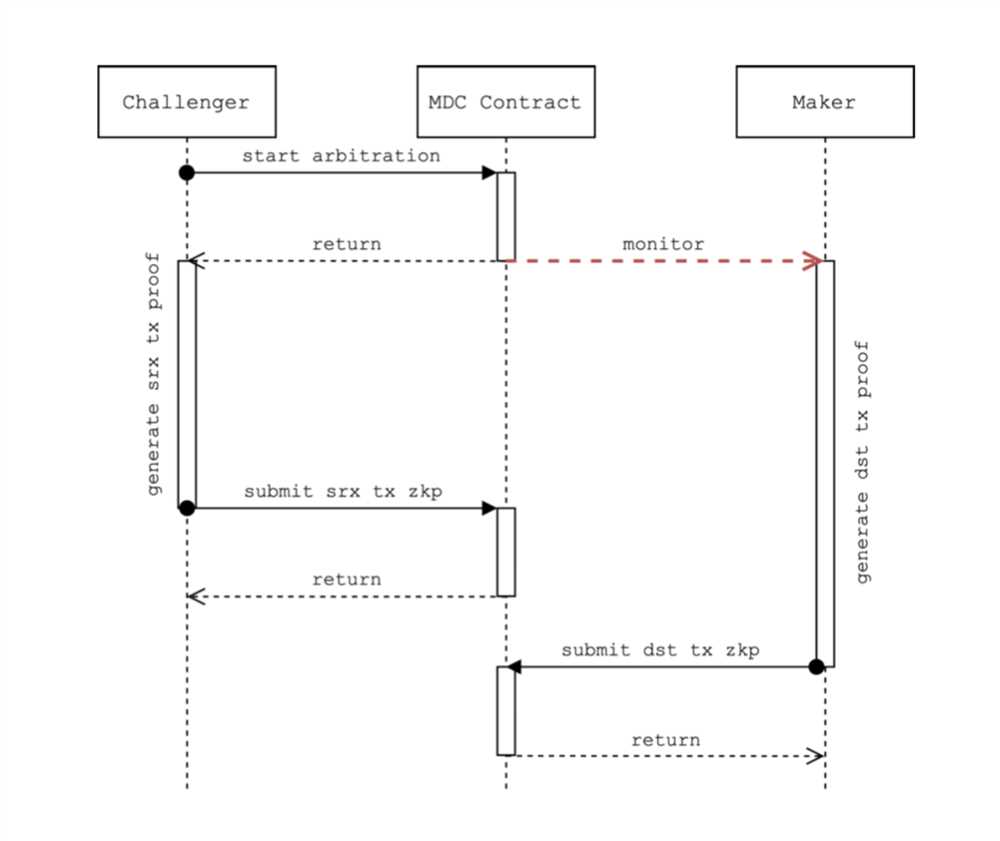

In the Orbiter Finance ecosystem, the Sender and Maker roles play a vital role in enabling the smooth functioning of transactions. These roles work together to facilitate the transfer of funds securely and efficiently.

The Sender’s role is to initiate the transaction by providing all the necessary information and funds. They are responsible for specifying the amount and the designated Maker for the transaction. The Sender must ensure that they have sufficient funds to initiate the transaction.

The Maker’s role is to execute the transaction. Once they receive the necessary information from the Sender, they validate the transaction and ensure that all the requirements are met. The Maker then proceeds to transfer the requested funds to the specified recipient.

The interaction between the Sender and the Maker is crucial for a successful transaction. The Sender must provide accurate and complete information to the Maker to ensure that the transaction is processed correctly. Any errors or discrepancies in the provided information can result in delays or failed transactions.

The Maker, on the other hand, must carefully review and validate the transaction details provided by the Sender. They need to ensure that the requested funds are available and that the transfer aligns with the established protocols. The Maker plays a crucial role in safeguarding the funds and preventing fraud or unauthorized transfers.

Communication between the Sender and Maker is also essential during the transaction process. They may need to clarify any discrepancies or address any concerns before proceeding with the transfer. Timely and accurate communication between the two parties ensures a smooth and secure transaction process.

In summary, the Sender and Maker roles are interdependent in facilitating successful transactions within the Orbiter Finance ecosystem. The Sender initiates the transaction with the required information and funds, while the Maker executes the transfer based on the provided details. Effective communication and adherence to established protocols are vital for the seamless interaction between these roles.

What is Orbiter Finance?

Orbiter Finance is a blockchain-based platform that aims to provide decentralized financial services to its users. It offers various financial products such as lending, borrowing, and interest-earning. The platform operates on the Binance Smart Chain (BSC) and utilizes smart contracts to ensure transparency and security.

What are the roles of the sender and maker in Orbiter Finance?

In Orbiter Finance, the sender refers to the user who initiates a transaction, such as lending or borrowing funds. The sender submits a transaction request, specifying the amount, terms, and other relevant details. On the other hand, the maker is the user who fulfills the transaction request by providing the required funds. They act as the counterparty to the sender’s transaction, either by lending or borrowing.

How does Orbiter Finance ensure the security of transactions?

Orbiter Finance utilizes blockchain technology and smart contracts to ensure the security of transactions. Smart contracts are self-executing contracts with the terms of the agreement directly written into the code. They automatically facilitate and verify transactions, eliminating the need for intermediaries. This ensures that transactions are executed in a transparent and secure manner, without the risk of fraud or manipulation.