Maximizing Your Profits in the Orbiter Finance Market: A Comprehensive Analysis

Introducing Orbiter Finance Market: The Key to Unlocking Your Financial Success

Are you ready to take your financial game to the next level? Look no further than Orbiter Finance Market! As a leading platform for savvy investors, we provide a comprehensive analysis that enables you to maximize your profits and make informed decisions.

Why settle for average returns when you can soar to new heights with Orbiter Finance Market?

Our team of expert analysts has designed a cutting-edge system that reveals the most lucrative investments and opportunities in the market. With our comprehensive analysis, you’ll have access to real-time data, in-depth research, and valuable insights that will give you the competitive edge.

Don’t let your hard-earned money be left grounded – take control of your financial future with Orbiter Finance Market!

The Benefits of Orbiter Finance Market:

- Accurate and reliable investment information

- Customized investment strategies tailored to your specific goals and risk tolerance

- Real-time market updates and alerts

- Expert analysis and insights from industry professionals

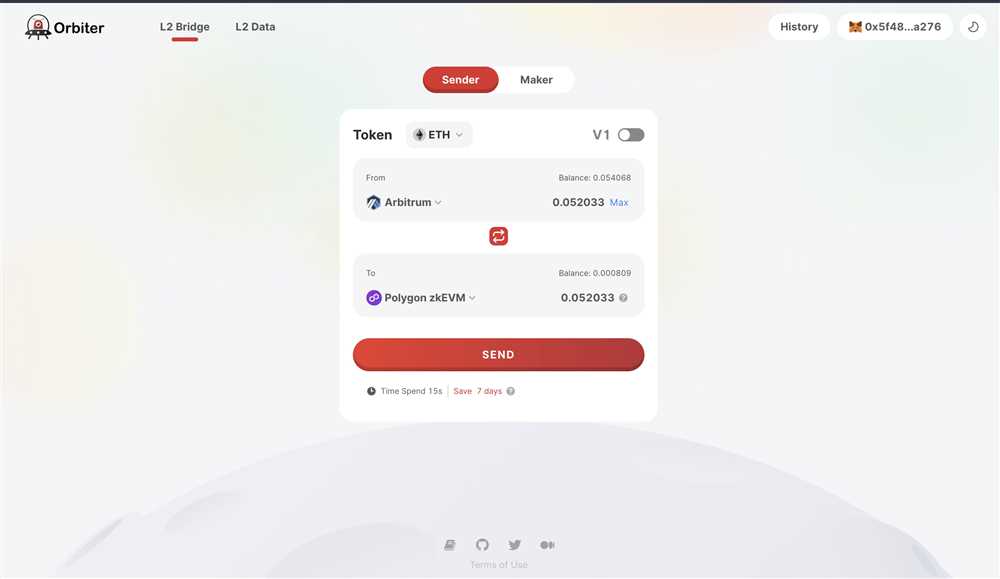

- Seamless and user-friendly interface for easy navigation

Join Orbiter Finance Market today and experience the power of informed investing!

Understanding the Orbiter Finance Market

The Orbiter Finance Market is a dynamic and fast-paced arena where investors can maximize their profits through comprehensive analysis and strategic decision-making. It provides a unique opportunity for individuals and businesses to grow their wealth and achieve financial independence.

1. Market Overview

The Orbiter Finance Market is a decentralized platform that allows participants to trade a wide range of financial instruments, including stocks, bonds, derivatives, and cryptocurrencies. It operates globally, with participants from all over the world contributing to its liquidity and price discovery.

2. Key Factors Influencing the Market

- Economic Conditions: The overall state of the global economy and specific regions has a significant impact on the performance of the Orbiter Finance Market. Factors such as GDP growth, inflation rates, and central bank policies can affect investor sentiment and market trends.

- Market Sentiment: The collective psychology of investors, as reflected in their emotions, beliefs, and behavior, plays a crucial role in shaping market dynamics. Positive sentiment can lead to bullish trends, while negative sentiment can trigger bearish movements.

- Regulatory Landscape: Government regulations and policies regarding financial markets, trading activities, and investor protection can have both short-term and long-term impacts on the Orbiter Finance Market. Changes in regulations can create opportunities or pose challenges for market participants.

- Technological Advancements: Rapid advancements in technology, such as artificial intelligence, blockchain, and high-frequency trading, are transforming the Orbiter Finance Market. These innovations are enhancing efficiency, improving data analysis capabilities, and changing trading strategies.

3. Comprehensive Analysis Techniques

To maximize profits in the Orbiter Finance Market, investors need to employ comprehensive analysis techniques that incorporate both fundamental and technical analysis:

- Fundamental Analysis: This approach involves evaluating the intrinsic value of an asset by analyzing its financial statements, industry trends, and macroeconomic factors. By understanding the underlying value of an asset, investors can make informed investment decisions.

- Technical Analysis: This technique involves studying price patterns, trends, and market indicators to identify potential buying or selling opportunities. Technical analysts rely on charts, graphs, and mathematical calculations to forecast future price movements.

By combining these analysis techniques and staying updated on market news and trends, investors can gain a competitive edge in the Orbiter Finance Market and increase their chances of maximizing profits.

Analyzing Trends and Patterns

In order to maximize profits in the Orbiter Finance Market, it is crucial to analyze trends and patterns that emerge within the market. By understanding these trends, traders can make more informed decisions and take advantage of profitable opportunities.

Identifying Market Trends

One of the first steps in analyzing trends and patterns is to identify market trends. This involves analyzing historical data and looking for recurring patterns and movements in the market. It is important to look at both short-term and long-term trends in order to fully understand the market dynamics.

Technical Analysis

Technical analysis is a common approach used to analyze trends and patterns in the Orbiter Finance Market. This involves using various tools and indicators to study price charts and identify trends and patterns. Some commonly used indicators include moving averages, trendlines, and oscillators.

By analyzing these indicators, traders can identify trend reversals, breakouts, and other patterns that may indicate potential trading opportunities. Technical analysis can be a valuable tool in predicting market movements and maximizing profits.

Fundamental Analysis

While technical analysis focuses on price movements and patterns, fundamental analysis takes into account external factors that can impact the market. This includes analyzing economic data, market news, and company financials.

By understanding the fundamental factors that drive the market, traders can make more informed decisions and take advantage of profitable opportunities. Fundamental analysis can help identify undervalued assets or market sectors that are primed for growth.

Utilizing Data Analysis Techniques

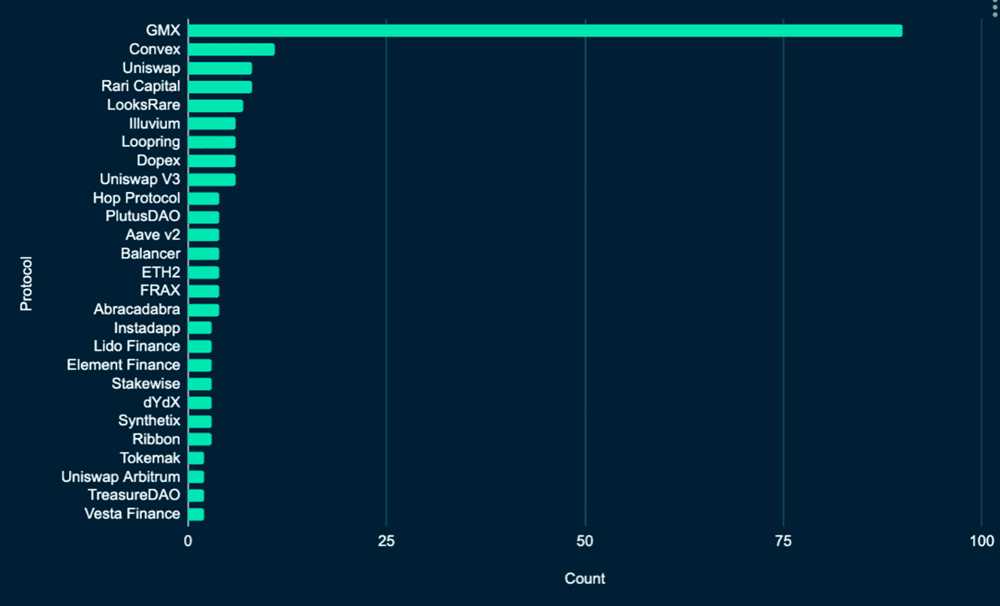

In addition to technical and fundamental analysis, traders can also utilize various data analysis techniques to uncover trends and patterns. This can involve statistical analysis, data visualization, and machine learning algorithms.

By combining different data analysis techniques, traders can gain deeper insights into market trends and make more accurate predictions. This can ultimately lead to higher profits and better investment strategies in the Orbiter Finance Market.

Tracking and Monitoring

Finally, it is important to continuously track and monitor market trends and patterns. This involves regularly reviewing market data, staying informed about industry news, and adapting strategies as needed.

By staying proactive and responsive to market changes, traders can position themselves for success and maximize their profits in the Orbiter Finance Market.

| Benefits of Analyzing Trends and Patterns |

|---|

| Increased profitability |

| Better decision-making |

| Identification of trading opportunities |

| Minimized risks |

Identifying Profitable Opportunities

In the Orbiter Finance Market, the key to maximizing profits lies in identifying the most profitable opportunities. With a comprehensive analysis of the market, you can make informed decisions and take advantage of the right opportunities at the right time.

1. Evaluate Market Trends

One way to identify profitable opportunities is to evaluate market trends. Analyze historical data to identify patterns and trends that can help you predict future market movements. By understanding these trends, you can position yourself to make profitable investments.

2. Conduct In-depth Research

Another important step in identifying profitable opportunities is to conduct in-depth research. Stay up to date with the latest news and developments in the finance market. Research different sectors and industries to identify potential growth areas and investment opportunities.

Tip: Use reliable sources, such as financial news websites and research reports, to gather information and make informed decisions.

3. Monitor Market Indicators

To identify profitable opportunities, it’s crucial to monitor market indicators. These indicators can provide valuable insights into market conditions and potential opportunities. Keep track of key economic indicators, such as GDP growth, inflation rates, and interest rates. Additionally, monitor specific market indicators related to the finance industry, such as stock market indices and currency exchange rates.

Tip: Utilize data visualization tools and charts to track and analyze market indicators effectively.

By following these steps and continuously monitoring the market, you can identify profitable opportunities and maximize your profits in the Orbiter Finance Market.

Disclaimer: Investing in the finance market carries risks. Always do your own research and seek professional advice before making any investment decisions.

Developing Effective Trading Strategies

When it comes to maximizing profits in the Orbiter Finance market, developing effective trading strategies is essential. A well-thought-out and carefully executed trading strategy can make all the difference in achieving success in this highly competitive market.

Analyze Market Trends

The first step in developing an effective trading strategy is to analyze market trends. By closely monitoring the Orbiter Finance market and studying historical data, you can identify patterns and trends that can guide your trading decisions. Understanding market trends will help you determine when to buy or sell, allowing you to take advantage of profitable opportunities.

Diversify Your Portfolio

Another crucial element of developing a successful trading strategy is to diversify your portfolio. Investing in a wide range of assets, such as stocks, bonds, and commodities, can help spread the risk and increase the chances of making profitable trades. Diversification can also provide protection against market volatility and reduce the impact of any single investment on your overall portfolio.

Furthermore, by diversifying your portfolio, you can take advantage of various market conditions and opportunities. For example, if one sector of the Orbiter Finance market is experiencing a downturn, another sector may be thriving. By having a diverse portfolio, you can allocate your investments accordingly and potentially minimize losses.

It’s important to regularly review and adjust your diversification strategy as market conditions change. By staying informed and adapting to market trends, you can optimize your trading strategy and maximize your profits in the Orbiter Finance market.

Implementing Risk Management Techniques

Risk management is a crucial aspect of any successful investment strategy. In the Orbiter Finance Market, where volatility and uncertainty are inherent, implementing effective risk management techniques is paramount to maximizing profits and minimizing potential losses.

Here are some key techniques to consider when managing risks in the Orbiter Finance Market:

- Diversification: Spreading your investments across different assets can help reduce the impact of potential losses in case of a downturn in one particular asset. By diversifying your portfolio, you increase the likelihood of having some investments perform well even if others don’t.

- Setting Stop-Loss Orders: A stop-loss order is a predetermined price at which you automatically sell a security to limit your losses. By setting stop-loss orders for each of your investments, you can protect your capital and minimize the impact of sudden market movements.

- Staying Informed: Keeping up-to-date with the latest news, market trends, and economic indicators is essential for effective risk management. By staying informed, you can make informed decisions and react quickly to any changes that may affect your investments.

- Using Leverage with Caution: While leverage can amplify potential profits, it can also magnify potential losses. It is important to use leverage judiciously and consider the risk associated with it.

- Analyzing Historical Data: Examining the historical performance of assets can provide insights into their potential risks and rewards. By studying past trends and patterns, you can make more informed investment decisions.

- Implementing a Risk-Adjusted Investment Strategy: A risk-adjusted investment strategy involves assessing the potential risks and rewards of each investment and allocating capital accordingly. This approach allows for a more balanced portfolio that can withstand market fluctuations.

- Regularly Reassessing Your Portfolio: The market dynamics and risk landscape can change rapidly. It is crucial to regularly reassess your portfolio’s risk exposure and adjust your investments accordingly to ensure they align with your risk tolerance and objectives.

By implementing these risk management techniques, you can navigate the Orbiter Finance Market with confidence and maximize your profits while minimizing potential losses.

What is “Maximize Profits in Orbiter Finance Market: Comprehensive Analysis”?

“Maximize Profits in Orbiter Finance Market: Comprehensive Analysis” is a comprehensive guide that provides analysis and strategies to help you maximize your profits in the Orbiter Finance Market. It covers various techniques and approaches that you can use to achieve better results in your financial investments.

Who is this book for?

This book is for anyone who is interested in maximizing their profits in the Orbiter Finance Market. It is suitable for both beginners and experienced traders who want to improve their financial performance.

What topics does this book cover?

This book covers a wide range of topics including market analysis, investment strategies, risk management, and maximizing returns. It provides a comprehensive overview of the various factors that can affect your profits in the Orbiter Finance Market.

How can this book help me maximize my profits?

This book provides valuable insights and strategies that can help you make informed decisions in the Orbiter Finance Market. It teaches you important techniques for analyzing market trends, managing risks, and identifying profitable investment opportunities. By implementing the strategies discussed in the book, you can increase your chances of maximizing your profits.

Does this book provide practical examples?

Yes, this book includes practical examples and case studies to help you understand how the strategies and techniques can be applied in real-world scenarios. These examples provide practical guidance and illustrate the concepts discussed in the book.