When it comes to managing our finances, we are constantly seeking ways to make the process easier, more efficient, and more secure. In recent years, traditional banking has faced significant competition from innovative financial technology companies like Orbiter Finance. These fintech companies offer alternative solutions to traditional banking services, promising greater convenience and flexibility. In this article, we will compare Orbiter Finance and traditional banking to determine which option is superior and more suitable for modern individuals.

Orbiter Finance:

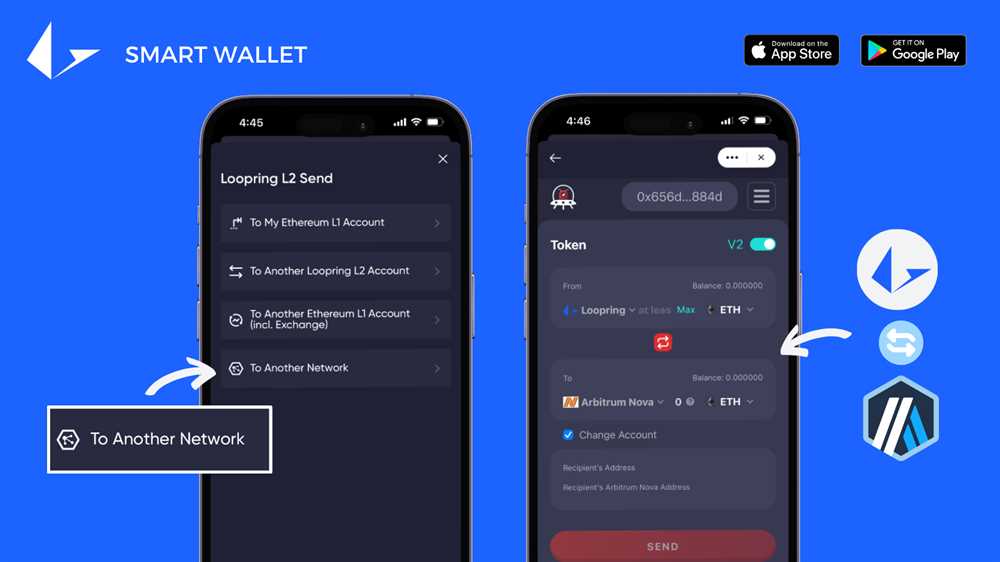

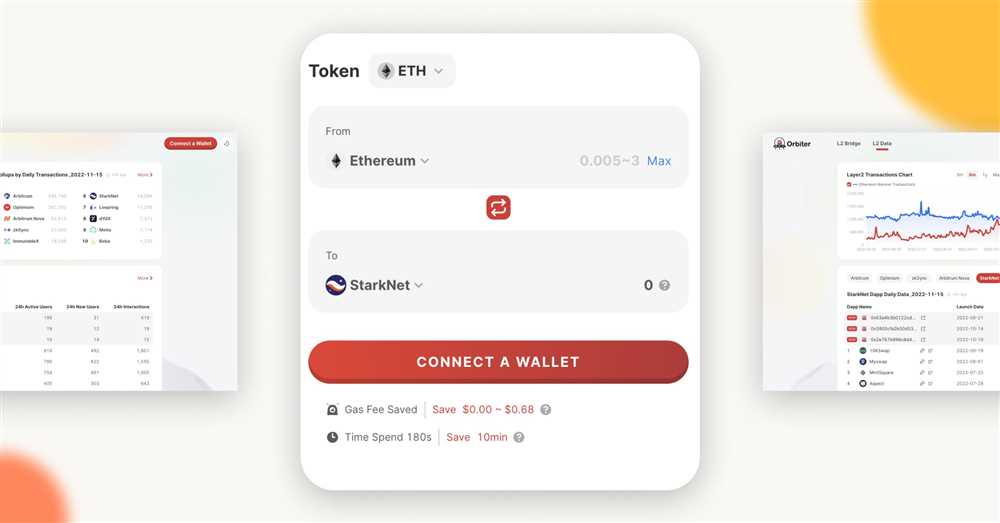

Orbiter Finance is a rising star in the world of finance, providing cutting-edge digital solutions that have revolutionized how we handle our money. With Orbiter Finance, individuals can securely manage their finances online, without the need for physical bank branches or time-consuming paperwork. This fintech company offers a range of services, including online banking, investing, and borrowing, all accessible through a user-friendly platform.

Traditional Banking:

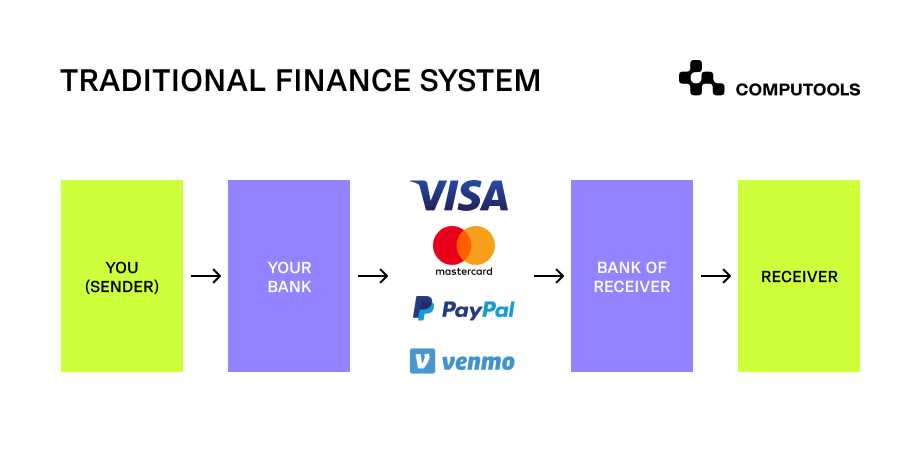

On the other hand, traditional banking refers to the long-established system of managing finances through physical bank branches and face-to-face interactions. Put simply, it’s the way we’ve been handling our money for centuries. Traditional banks offer an array of services, from basic savings and checking accounts to mortgage loans and investment opportunities. While they may seem more familiar and reliable, traditional banks often come with their own set of limitations and inconveniences.

So, which is the superior option?

Determining whether Orbiter Finance or traditional banking is the better choice entirely depends on personal preferences and individual financial needs. While Orbiter Finance offers unparalleled convenience and seamless digital access, traditional banking institutions often provide a sense of security and in-person assistance that may be appealing to some individuals. In the end, making a decision between Orbiter Finance and traditional banking requires careful consideration of various factors, such as financial goals, technological comfort, and preferences for personal interactions.

The rise of Orbiter Finance

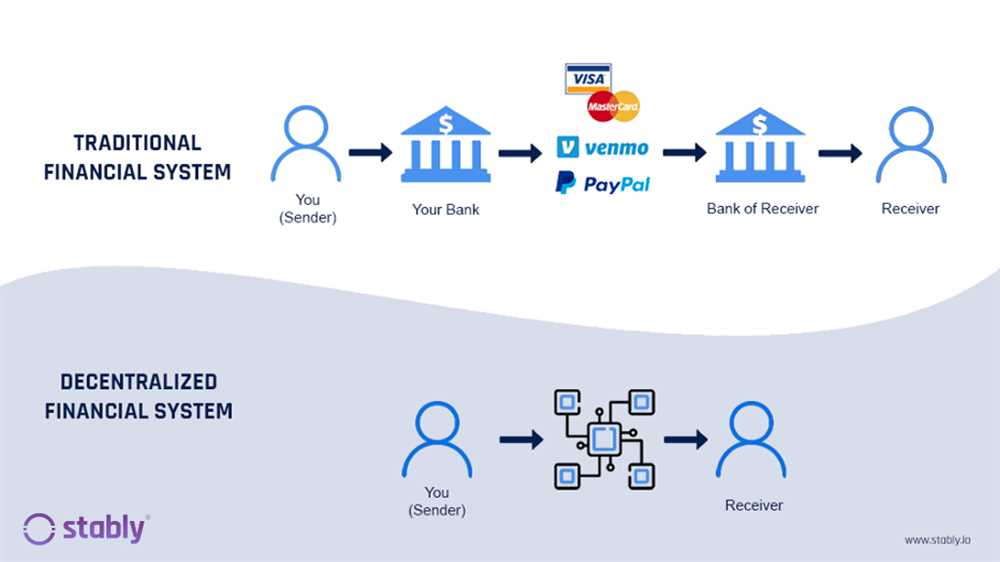

The emergence of Orbiter Finance has created a significant shift in the financial industry. Orbiter Finance is a decentralized finance (DeFi) platform that leverages blockchain technology to offer financial services without the need for traditional intermediaries such as banks. This has paved the way for a new era of financial freedom and accessibility.

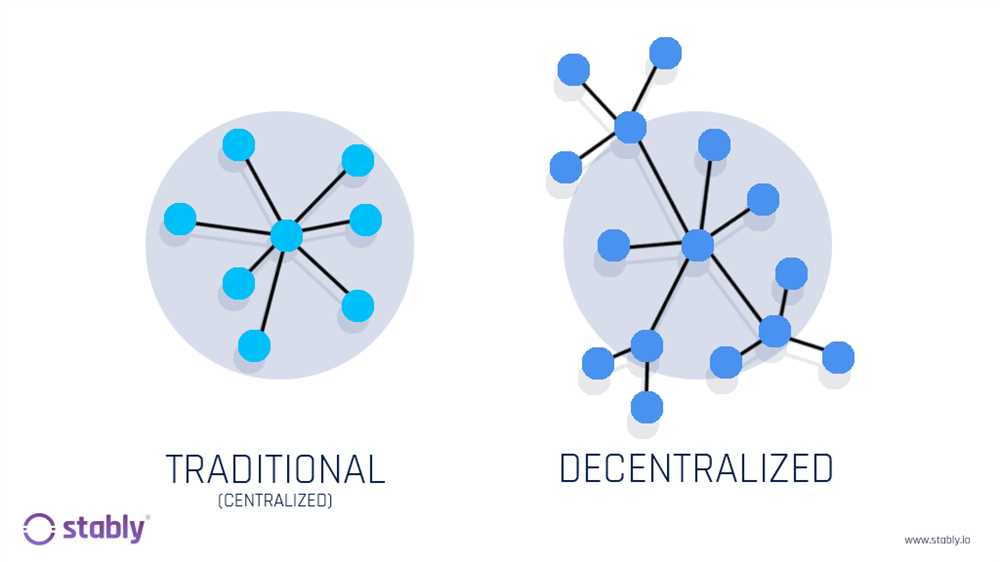

One of the main advantages of Orbiter Finance is its ability to provide users with greater control over their finances. With traditional banking, individuals are often subject to centralized decision-making and restrictions imposed by banks. However, Orbiter Finance allows users to be the sole custodians of their funds, giving them the power to make autonomous financial decisions.

Additionally, Orbiter Finance has increased financial inclusivity by providing services to unbanked individuals who lack access to traditional banking services. This is particularly beneficial for individuals in developing countries where traditional banking infrastructure may be limited. With Orbiter Finance, all that is needed is an internet connection, enabling access to a wide range of financial services.

Another key feature of Orbiter Finance is its transparency. Traditional banking often relies on opaque processes and hidden fees, making it difficult for individuals to fully understand the true costs of financial transactions. In contrast, Orbiter Finance utilizes blockchain technology, which ensures transparent and verifiable transactions. Users can view and track all financial activity on the network, providing a level of transparency that traditional banks cannot match.

Furthermore, Orbiter Finance offers users the opportunity to earn passive income through various DeFi protocols. Users can lend their assets, participate in liquidity pools, or yield farm to earn interest on their holdings. This presents a more lucrative alternative to traditional banking, where interest rates on savings accounts are often minimal.

Overall, the rise of Orbiter Finance has brought about significant changes to the financial landscape. With its decentralized and transparent nature, Orbiter Finance offers a superior option to traditional banking, providing users with greater control, accessibility, and financial opportunities.

Key Differences

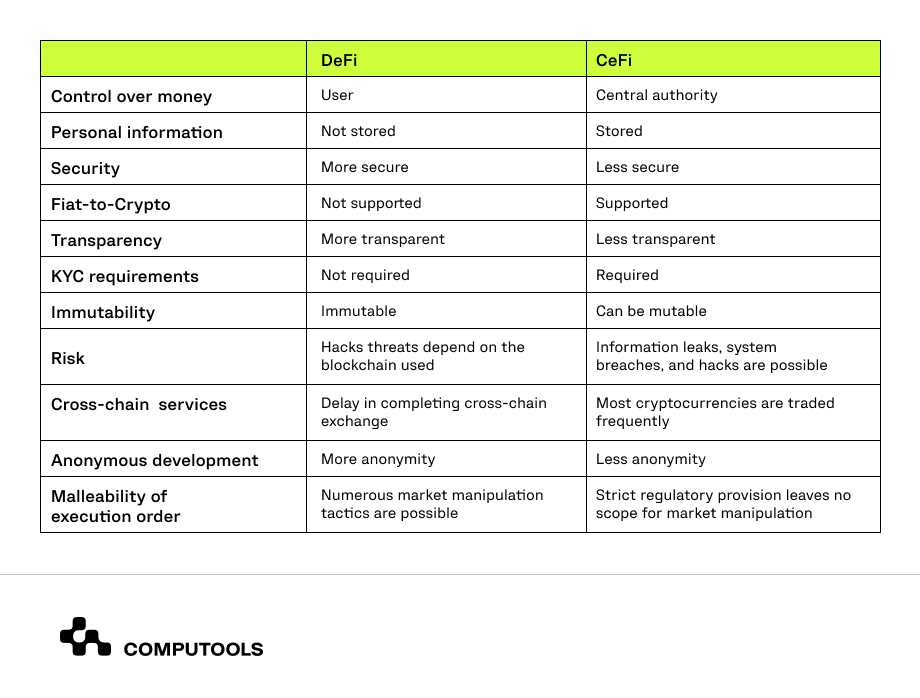

When comparing Orbiter Finance and traditional banking, there are several key differences that set them apart:

1. Decentralization

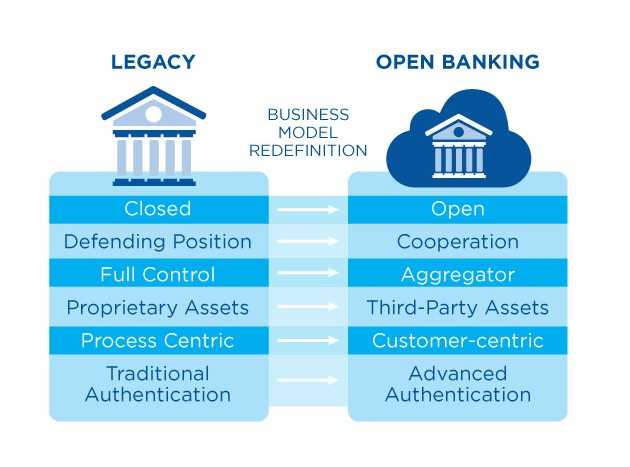

Orbiter Finance operates on a decentralized blockchain network, while traditional banking relies on a centralized authority. This means that Orbiter Finance relies on a network of computers spread across the globe to maintain and verify transactions, ensuring transparency and security. Traditional banking, on the other hand, is controlled by a central bank or financial institution, which can potentially lead to issues such as corruption and censorship.

2. Accessibility

Orbiter Finance provides financial services to anyone with an internet connection, regardless of their geographic location or financial status. Traditional banking, on the other hand, typically requires a physical presence, such as a branch or ATM, limiting access for individuals in remote or underserved areas. Orbiter Finance also offers financial services to the unbanked and underbanked populations, who may not have access to traditional banking services.

3. Transparency

The transparency of transactions is another major difference between Orbiter Finance and traditional banking. On the Orbiter Finance blockchain, all transactions are recorded on a public ledger that is accessible to anyone. This ensures that all transactions can be easily audited and verified. In contrast, traditional banking often lacks transparency, with the details of transactions being hidden from the public.

4. Control

With Orbiter Finance, individuals have full control over their finances. They can securely store their digital assets in a wallet and have the sole ownership of their private keys. In traditional banking, individuals rely on banks to secure their funds and manage their financial transactions. This can lead to issues such as bank freezes, account closures, or limited control over one’s own finances.

5. Speed and Cost

When it comes to speed and cost, Orbiter Finance has the advantage. Transactions on the Orbiter Finance blockchain can be processed much faster compared to traditional banking, which often involves several intermediaries and manual processes. Additionally, the fees associated with Orbiter Finance transactions tend to be lower compared to traditional banking fees, making it a more cost-effective option for financial transactions.

In conclusion, Orbiter Finance offers several advantages over traditional banking, including decentralization, accessibility, transparency, control, speed, and cost-effectiveness. These key differences highlight the potential of Orbiter Finance to revolutionize the financial industry and provide an alternative to traditional banking systems.

Accessibility and Ease of Use

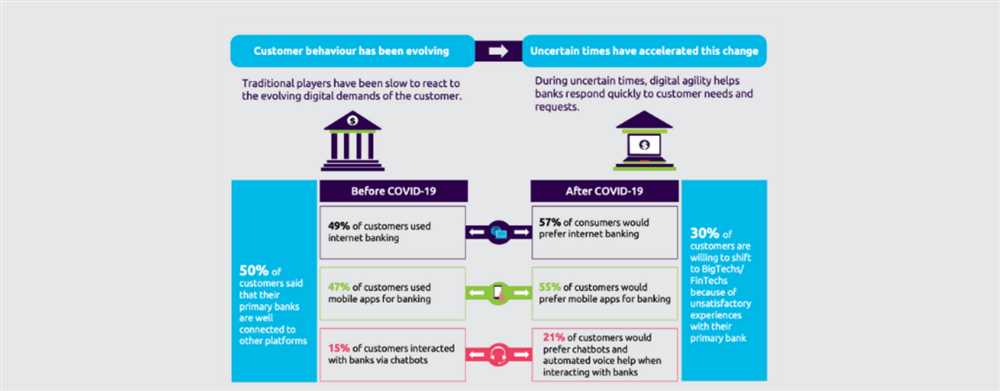

When it comes to accessibility and ease of use, there is a clear winner between Orbiter Finance and traditional banking. Orbiter Finance is an online platform that can be accessed anytime, anywhere, as long as you have an internet connection. This means that you can manage your finances and make transactions from the comfort of your own home or on the go using your mobile device.

On the other hand, traditional banking often requires you to visit physical bank branches during limited working hours, which can be inconvenient and time-consuming. This especially becomes an issue for individuals living in remote areas where bank branches are not easily accessible.

In terms of ease of use, Orbiter Finance offers a user-friendly interface that is designed to make managing finances simple and intuitive. The platform provides clear instructions and guidance throughout the process, making it easy for even those with minimal financial knowledge to navigate and utilize its features.

In contrast, traditional banking can sometimes be complex and confusing, especially for individuals who are not familiar with banking procedures and terminology. The paperwork involved and the need to interact with bank staff can add further complications and make the process more time-consuming.

Furthermore, Orbiter Finance offers a range of convenient features, such as automatic bill payments, account alerts, and easy access to account statements. These features help users stay organized and informed about their financial activities without having to keep track of physical documents or visit bank branches.

Overall, when it comes to accessibility and ease of use, Orbiter Finance clearly stands out as the superior option. Its online platform allows for convenient access from anywhere, while its user-friendly interface and convenient features make managing finances a hassle-free experience.

Financial Services Offered

When it comes to comparing Orbiter Finance and traditional banking, one of the key factors to consider is the range of financial services offered by each. Here is a comparison of the services provided by both options:

| Orbiter Finance | Traditional Banking |

|---|---|

| 1. Savings Accounts | 1. Savings Accounts |

| 2. Checking Accounts | 2. Checking Accounts |

| 3. Personal Loans | 3. Personal Loans |

| 4. Home Loans | 4. Home Loans |

| 5. Credit Cards | 5. Credit Cards |

| 6. Investment Options | 6. Investment Options |

| 7. Insurance Services | 7. Insurance Services |

| 8. Mobile Banking App | 8. Mobile Banking App |

Both Orbiter Finance and traditional banking offer a comprehensive range of financial services to meet the needs of their customers. Whether you’re looking for simple banking options like savings and checking accounts or more complex services like loans and investments, both options have you covered.

Cost and Fees

When it comes to comparing Orbiter Finance and traditional banking, one of the most important factors to consider is the cost and fees associated with each option.

Traditional banks often charge various fees for their financial services, such as account maintenance fees, transaction fees, and ATM fees. These fees can add up quickly, especially for individuals who frequently use ATMs or make multiple transactions per month. Additionally, traditional banks may require minimum balance requirements, which can result in fees if the account balance falls below the specified amount.

On the other hand, Orbiter Finance takes a different approach by offering a fee-free banking experience. They do not charge any account maintenance fees or transaction fees, allowing customers to save money on banking services. Furthermore, Orbiter Finance does not have any minimum balance requirements, which means that individuals do not have to worry about incurring fees if their account balance falls below a certain threshold.

Additional Cost Considerations

In addition to basic fees, it’s important to also consider other potential costs associated with both options. With traditional banks, customers may face charges for overdrafts, returned checks, or wire transfers. These additional expenses can quickly add up and impact an individual’s overall financial well-being.

Orbiter Finance, on the other hand, offers overdraft protection at no additional cost. This feature helps customers avoid overdraft fees and provides peace of mind knowing that their transactions are covered. Orbiter Finance also offers competitive foreign exchange rates and low-cost international transfers, making it an attractive option for individuals who frequently engage in international transactions.

The Bottom Line

When it comes to cost and fees, Orbiter Finance emerges as a superior option compared to traditional banking. With its fee-free banking experience, lack of minimum balance requirements, and additional cost-saving features, Orbiter Finance offers customers a transparent and financially advantageous solution.

Benefits of Orbiter Finance

Orbiter Finance offers a wide range of benefits that make it a superior option compared to traditional banking. Here are some of the key advantages:

|

1. Decentralization: |

Unlike traditional banks, Orbiter Finance operates on a decentralized network. This means that there is no central authority controlling the system, making it more secure and less prone to fraud or manipulation. |

|

2. Transparency: |

Orbiter Finance provides transparent and accessible financial information. All transactions are recorded on the blockchain, allowing users to verify and track their transactions easily. This level of transparency builds trust among users and eliminates the need for intermediaries. |

|

3. Accessibility: |

With Orbiter Finance, individuals from around the world can access financial services without needing a traditional bank account. This opens up opportunities for the unbanked population to participate in the global financial system and gain access to loans, investments, and other financial products. |

|

4. Lower Fees: |

Orbiter Finance operates on a peer-to-peer model, which eliminates the need for costly intermediaries. As a result, the platform offers lower transaction fees compared to traditional banks. This can lead to significant savings for users, especially for frequent or large transactions. |

|

5. Faster Transactions: |

The decentralized nature of Orbiter Finance allows for faster and more efficient transactions. Users can send and receive funds instantly, without the need for delays or clearance from third parties. This is particularly beneficial for cross-border transactions, which can take days to process through traditional banking channels. |

|

6. Innovation: |

Orbiter Finance is at the forefront of innovation in the financial industry. The platform harnesses the power of blockchain technology to offer new and exciting financial products such as decentralized lending, staking, and yield farming. These innovations provide users with opportunities to earn passive income and diversify their investment portfolios. |

Overall, Orbiter Finance offers a range of benefits that surpass traditional banking in terms of security, transparency, accessibility, cost-effectiveness, speed, and innovation. As the world becomes more interconnected and digital, Orbiter Finance provides a modern and superior option for individuals to manage their finances.

Higher Interest Rates

One of the major advantages of Orbiter Finance over traditional banking is the higher interest rates offered to customers. While traditional banks may offer relatively low interest rates on savings accounts and other investments, Orbiter Finance takes a different approach by providing attractive interest rates that can help customers grow their wealth more effectively.

With Orbiter Finance, customers have the opportunity to earn higher returns on their savings and investments. This means that over time, their money can work harder for them and generate more substantial profits. Whether it’s a savings account, a fixed deposit, or an investment portfolio, Orbiter Finance offers competitive interest rates that are designed to be more rewarding for their customers.

Benefits of Higher Interest Rates

There are several benefits associated with higher interest rates offered by Orbiter Finance:

- Increased earnings: Customers can enjoy larger returns on their savings and investments, resulting in increased wealth accumulation over time.

- Faster goal achievement: Whether it’s saving for a down payment on a home or planning for retirement, higher interest rates can help customers reach their financial goals more quickly.

- Inflation protection: Higher interest rates can provide a buffer against inflation, ensuring that the value of customers’ savings is not eroded over time.

Overall, the higher interest rates offered by Orbiter Finance make it a superior option for individuals and businesses looking to maximize their financial gains and secure a better future.

What is Orbiter Finance?

Orbiter Finance is a digital platform that offers financial services such as banking, lending, and investing. It operates entirely online and aims to provide a more convenient and accessible option compared to traditional banking.

How does Orbiter Finance compare to traditional banks?

Orbiter Finance offers several advantages over traditional banks. Firstly, it operates entirely online, which means customers can access their accounts and carry out transactions from anywhere at any time. This level of convenience is not possible with traditional banking. Secondly, Orbiter Finance has lower fees and charges compared to traditional banks, making it more cost-effective for customers. Lastly, Orbiter Finance provides a wider range of financial services, including investing options, that are not typically offered by traditional banks.