When it comes to managing your finances, you have a multitude of options at your disposal. Two popular choices are Orbiter Finance and traditional banking. While both offer financial services, they differ significantly in their approach and offerings.

Orbiter Finance is a cutting-edge financial platform that leverages advanced technology and innovative solutions to provide a seamless and user-friendly banking experience. With Orbiter Finance, you can access a range of financial services, including banking, lending, investing, and more, all from the convenience of your computer or mobile device.

Traditional banking, on the other hand, refers to the established model of banking that has been around for centuries. It involves physical branches, in-person interactions, and a more traditional approach to managing your finances. Traditional banks offer a range of services similar to Orbiter Finance, but with some key differences.

One of the key differences between Orbiter Finance and traditional banking is the level of convenience and accessibility. With Orbiter Finance, you can access your accounts and manage your finances anytime, anywhere, as long as you have an internet connection. Traditional banking, on the other hand, requires you to visit a physical branch during limited hours, which can be inconvenient and time-consuming.

Additionally, Orbiter Finance often offers more competitive interest rates and fees compared to traditional banks. This is because Orbiter Finance operates solely online, reducing overhead costs and allowing for more competitive pricing. Traditional banks, with their physical branches and higher operating costs, may come with higher fees and less competitive interest rates.

Orbiter Finance: Revolutionizing Banking Solutions

In the rapidly changing financial landscape, Orbiter Finance has emerged as a game changer, revolutionizing traditional banking solutions. With its innovative approach, Orbiter Finance aims to provide individuals and businesses with a seamless and efficient banking experience like never before.

The Rise of Orbiter Finance

Founded with the vision to disrupt the banking industry, Orbiter Finance has quickly gained traction among tech-savvy customers who seek more convenience and flexibility in managing their finances. Leveraging cutting-edge technology, Orbiter Finance offers a wide range of digital banking services that cater to the specific needs of its users.

Key Features and Benefits

Orbiter Finance distinguishes itself from traditional banking by introducing several key features and benefits that set it apart. Some of the notable features include:

| 1 | Easy Account Setup | Opening a bank account with Orbiter Finance is a hassle-free process that can be done entirely online. No more lengthy paperwork and visits to the branch, making it convenient for individuals and businesses alike. |

| 2 | 24/7 Accessibility | Orbiter Finance ensures round-the-clock availability of its banking services, allowing customers to manage their accounts, make transfers, and access financial information at any time, from anywhere. |

| 3 | Advanced Security Measures | With the increasing prevalence of cyber threats, Orbiter Finance prioritizes the safety and security of its users’ financial data. It employs robust encryption and authentication protocols to ensure that sensitive information remains protected. |

| 4 | Intuitive User Interface | Orbiter Finance offers an intuitive and user-friendly interface, making it easy for customers to navigate and perform various banking transactions with minimal effort. |

| 5 | Personalized Banking Solutions | Orbiter Finance strives to provide personalized banking solutions tailored to the unique needs of its customers. Whether it’s saving goals, investment opportunities, or loan facilities, users can expect customized options to meet their financial objectives. |

Overall, Orbiter Finance has gained popularity for its customer-centric approach, delivering a seamless and efficient banking experience. By embracing technology and innovation, Orbiter Finance has revolutionized the way individuals and businesses manage their finances, paving the way for a new era of banking solutions.

Understanding the Key Differences between Orbiter Finance and Traditional Banking

Orbiter Finance and traditional banking are two different approaches to managing and accessing financial services. While both serve the purpose of handling money and providing financial solutions, they have significant differences in their operations, approaches, and features.

1. Structure and Ownership

In traditional banking, financial institutions are typically structured as centralized entities, such as commercial banks or credit unions. They are owned by shareholders and governed by a board of directors. Orbiter Finance, on the other hand, operates on a decentralized model using blockchain technology. It is owned and controlled by its users, with no central authority governing it.

2. Transparency and Security

Traditional banking systems rely on centralized databases and require customers to trust the financial institution to secure their funds and personal information. In contrast, Orbiter Finance utilizes blockchain technology, which offers a higher level of transparency and security. Transactions are recorded on the blockchain, making them tamper-proof and readily auditable.

3. Access and Inclusion

Traditional banking services are often limited by geographical locations and require customers to visit physical branches. This can exclude individuals who do not have access to banking facilities or those living in remote areas. Orbiter Finance, being decentralized and accessible through the internet, provides greater financial inclusion by allowing anyone with an internet connection to access its services.

4. Speed and Efficiency

Traditional banking transactions can be time-consuming, involving manual processes, paperwork, and delays due to reliance on intermediaries. Orbiter Finance utilizes smart contracts and automation, enabling faster and more efficient transactions. Payments, investments, and other financial activities can be executed in real-time without the need for intermediaries, reducing processing times and costs.

5. Innovation and Flexibility

Orbiter Finance is built on blockchain technology, which allows for the development of innovative financial products and services. It enables the creation of decentralized applications (dApps) and opens up opportunities for new financial models. Traditional banking, while evolving with technology, may face limitations and regulatory challenges that can impede innovation and flexibility.

| Orbiter Finance | Traditional Banking |

|---|---|

| Decentralized | Centralized |

| Transparent and secure | Relies on trust and security measures of the bank |

| Accessible online | Requires physical presence at bank branches |

| Fast and efficient | Can involve manual processes and delays |

| Encourages innovation | May face regulatory limitations |

In conclusion, Orbiter Finance and traditional banking have distinct differences that stem from their structures, operations, and technologies. Orbiter Finance leverages blockchain to provide transparency, security, accessibility, speed, and innovation, while traditional banking relies on centralized systems and physical infrastructure. Understanding these key differences can help individuals make informed decisions about which financial services best fit their needs.

Enhanced Flexibility and Accessibility

One of the key differences between Orbiter Finance and traditional banking is the enhanced flexibility and accessibility offered by Orbiter Finance.

Traditional banking often comes with rigid rules and requirements, making it difficult for many people to access financial services. On the other hand, Orbiter Finance offers a more flexible approach, allowing individuals to access financial services easily and conveniently.

With Orbiter Finance, users can access their accounts and manage their finances anytime and from anywhere, thanks to the intuitive online platform offered by the company. This accessibility eliminates the need for physical branch visits and allows users to seamlessly perform transactions and access their funds whenever they need to.

In addition to enhanced accessibility, Orbiter Finance also offers greater flexibility in terms of available financial products and services. Traditional banks often have limited options when it comes to financial products, whereas Orbiter Finance offers a wide range of services to cater to the diverse needs of individuals. Whether it’s personal loans, savings accounts, or insurance products, Orbiter Finance provides a comprehensive suite of financial solutions.

Advanced Technology and Innovation

One of the reasons behind the enhanced flexibility and accessibility of Orbiter Finance is the utilization of advanced technology and innovation. Orbiter Finance leverages cutting-edge technologies such as artificial intelligence and blockchain to provide seamless and efficient financial services.

With the help of artificial intelligence, Orbiter Finance is able to offer personalized recommendations and insights, helping users make informed financial decisions. This level of customization and guidance is often lacking in traditional banking, making Orbiter Finance a preferred choice for those seeking tailored financial solutions.

Furthermore, the integration of blockchain technology ensures the security and transparency of transactions on the Orbiter Finance platform. By using a decentralized ledger, Orbiter Finance eliminates the need for intermediaries, reducing costs and increasing efficiency for users.

In conclusion, Orbiter Finance stands out from traditional banking by offering enhanced flexibility and accessibility. Through its intuitive online platform, wide range of financial services, and advanced technological features, Orbiter Finance provides a more convenient and personalized experience for users.

Simplified Processes and Reduced Costs

One of the key advantages of Orbiter Finance over traditional banking is the simplified processes and reduced costs. Traditional banking often involves lengthy procedures and numerous paperwork, which can be time-consuming and inconvenient for customers. On the other hand, Orbiter Finance offers a streamlined application and approval process that can be completed online, saving customers time and effort.

With Orbiter Finance, the need for physical branches and in-person visits is eliminated, leading to reduced operating costs for the company. These cost savings are then passed on to customers in the form of lower fees and interest rates. Traditional banks, on the other hand, have to bear the costs of maintaining physical branches and staffing them with employees, which can contribute to higher fees and interest rates for their customers.

Efficient Account Management

Orbiter Finance provides its customers with easy and convenient account management tools. Through a user-friendly online platform, customers can view their account balances, transaction history, and make payments or transfers at their convenience. This eliminates the need to visit a bank branch or wait in long queues, making account management faster and more efficient.

Lower Transaction Fees and Interest Rates

Another benefit of Orbiter Finance is the lower transaction fees and interest rates compared to traditional banking. As mentioned earlier, the reduced operating costs of Orbiter Finance enable them to offer more competitive rates to their customers. This can result in significant cost savings for individuals and businesses who frequently engage in financial transactions.

In addition to lower interest rates, Orbiter Finance also offers competitive rewards and cashback programs, allowing customers to earn rewards on their everyday transactions. These incentives further enhance the overall value and cost-effectiveness of using Orbiter Finance for their financial needs.

In conclusion, Orbiter Finance stands out from traditional banking by offering simplified processes and reduced costs. The online application, efficient account management, and lower fees and interest rates make Orbiter Finance an attractive alternative for individuals and businesses looking for a more convenient and cost-effective banking solution.

Secure and Transparent Transactions

One of the key differences between Orbiter Finance and traditional banking is the level of security and transparency provided in transactions.

Orbiter Finance uses blockchain technology to ensure that all transactions are secure. Blockchain is a decentralized and distributed ledger that records all transactions in a secure and transparent manner. This means that the details of every transaction are recorded on the blockchain and cannot be altered or tampered with.

Traditional banking, on the other hand, relies on centralized systems that are susceptible to cyber attacks and fraud. In traditional banking, transactions are recorded and managed by a centralized authority, such as a bank. While traditional banking institutions have implemented security measures, they are still vulnerable to hacking and data breaches.

With Orbiter Finance, users have full control over their transactions. They can view their transaction history and verify the details of each transaction, ensuring transparency. This level of transparency is not typically found in traditional banking systems, where users often have limited visibility into the inner workings of their transactions.

In addition to security and transparency, Orbiter Finance also offers faster and more efficient transactions. Traditional banking transactions can take several days to complete, especially for international transactions. With Orbiter Finance, transactions are executed almost instantly, thanks to the use of blockchain technology.

Overall, the secure and transparent nature of transactions in Orbiter Finance sets it apart from traditional banking systems. The use of blockchain technology ensures the integrity of each transaction, while providing users with full control and visibility.

What is Orbiter Finance?

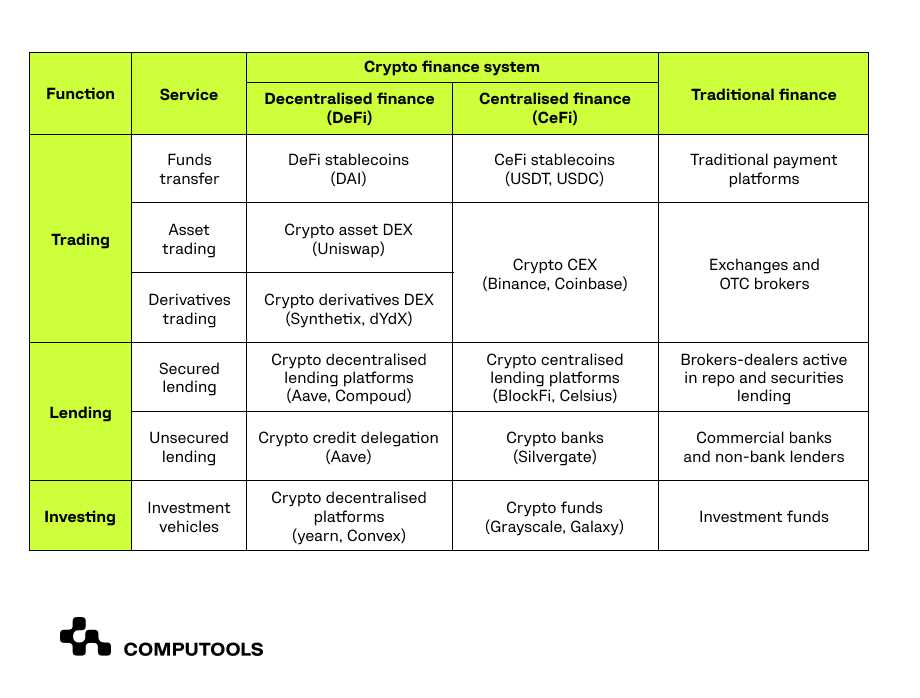

Orbiter Finance is a decentralized finance (DeFi) platform that aims to provide users with a more transparent, inclusive, and efficient financial system compared to traditional banking.

How does Orbiter Finance differ from traditional banking?

Orbiter Finance differs from traditional banking in several ways. Firstly, Orbiter Finance is built on blockchain technology, which means that transactions are recorded on a public ledger and can be verified by anyone. This enhances transparency and reduces the risk of fraud. Additionally, Orbiter Finance allows users to interact with the platform without the need for intermediaries such as banks. Users have control over their funds and can participate in lending, borrowing, and other financial activities directly. This eliminates the need for traditional banking services and fees.

What are the benefits of using Orbiter Finance over traditional banking?

There are several benefits of using Orbiter Finance over traditional banking. Firstly, as a decentralized platform, Orbiter Finance allows users to have full control over their funds and transactions. This means that users do not have to rely on third parties such as banks to facilitate their financial activities. Secondly, Orbiter Finance offers lower fees compared to traditional banking. Traditional banks often charge fees for various services such as wire transfers, account maintenance, and ATM withdrawals. In contrast, Orbiter Finance operates on a peer-to-peer model, which reduces costs and allows for lower fees. Lastly, Orbiter Finance enhances financial inclusion by providing access to financial services to individuals who may not have access to traditional banking services. This is particularly important in regions with underdeveloped banking infrastructure.