Orbiter Finance Under Investigation for Suspicious Activity and Missing Transactions

In a shocking turn of events, Orbiter Finance, a prominent financial institution, has recently come under fire for alleged suspicious activity and unaccounted transactions. The accusations, made by an anonymous whistleblower, have led to an ongoing investigation by regulatory authorities and has sent shockwaves through the financial community.

The allegations against Orbiter Finance include the manipulation of financial records, unexplained discrepancies in client accounts, and the misappropriation of funds. These serious claims have raised concerns among clients and investors, who are now questioning the integrity and transparency of the institution.

As news of the accusations spreads, many are left wondering how such alleged misconduct could have gone unnoticed for so long. Orbiter Finance, once regarded as a trustworthy and reputable institution, now finds itself in the midst of a reputational crisis. The investigation aims to uncover any wrongdoing and determine the veracity of the claims made against the company.

Officials from Orbiter Finance have yet to comment on the allegations, leaving clients and investors in a state of uncertainty and concern. As the investigation unfolds, the future of the financial institution remains uncertain, with potential legal and financial consequences looming over the horizon.

Orbiter Finance Accused

Orbiter Finance, a prominent financial institution, has recently been accused of suspicious activity and missing transactions. This accusation has led to an investigation into the company’s practices and has raised concerns among its clients and stakeholders.

The allegations of suspicious activity first came to light when several customers reported unexplained discrepancies in their financial statements. These discrepancies ranged from missing transactions to unauthorized withdrawals, raising red flags about the integrity of Orbiter Finance’s operations.

Investigation Launched

As a result of the serious nature of the allegations, a formal investigation has been initiated by regulatory authorities. The investigation aims to determine the extent of the suspicious activity and identify any potential breaches in Orbiter Finance’s internal controls or compliance procedures.

The investigation team will closely examine the company’s transaction records, financial statements, and communication logs to gather evidence and assess the validity of the accusations. They will also interview employees, customers, and other relevant parties who may have insights into the matter.

Potential Implications

The accusations against Orbiter Finance carry significant repercussions for the company and its stakeholders. If proven true, these allegations could lead to severe penalties, including fines, legal actions, and damage to the company’s reputation.

Furthermore, clients who have been affected by the missing transactions and suspicious activity may suffer financial losses, which could have long-lasting consequences for their personal and business finances. This situation highlights the importance of staying vigilant and regularly monitoring financial transactions.

It is crucial for Orbiter Finance to fully cooperate with the investigation and provide all necessary information to assist in a thorough and unbiased examination. The company’s response to these allegations will be closely watched by regulators, clients, and the financial industry as a whole.

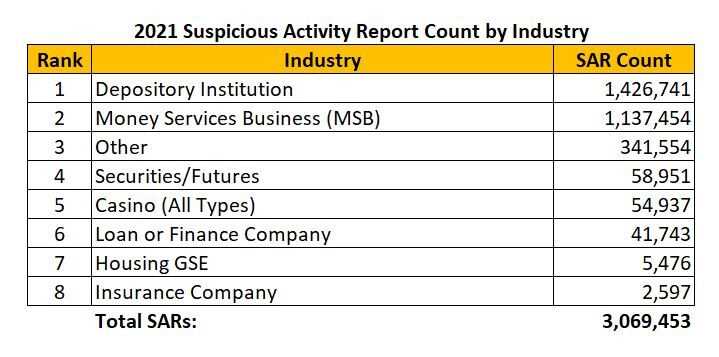

Suspicious Activity

Orbiter Finance, a financial institution specializing in online banking and transactions, has recently come under scrutiny for suspicious activity and missing transactions. Concerns have been raised by customers who have noticed discrepancies in their account statements and experienced delays in their transactions.

Reports have surfaced of unauthorized access to customer accounts, with large sums of money being transferred to unknown recipients. These incidents have raised alarm among customers, who fear that their personal information may have been compromised and their funds may be at risk.

Furthermore, several clients have reported instances of transactions that mysteriously vanished from their account records. These missing transactions have left customers confused and concerned about the integrity and reliability of Orbiter Finance’s online banking platform.

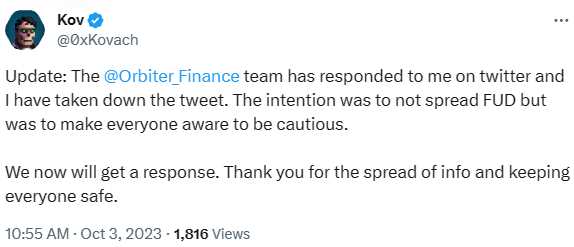

The company has stated that it is fully committed to conducting a thorough investigation into these allegations of suspicious activity and missing transactions. They have assured customers that their security protocols are being reviewed and enhanced to prevent unauthorized access and ensure the safety of customer funds.

In the meantime, it is advised that customers regularly monitor their account statements for any unusual activity and report any discrepancies immediately. Orbiter Finance has also advised its customers to update their account passwords and enable two-factor authentication for added security.

As the investigation progresses, customers are urged to exercise caution when conducting transactions online and to report any suspicious activity to the proper authorities. Orbiter Finance is working diligently to address these concerns and restore trust in its financial services.

Missing Transactions

As part of the investigation into Orbiter Finance’s suspicious activity, a significant number of transactions have been found to be missing from the company’s records. These missing transactions raise serious concerns about the transparency and integrity of the company’s financial operations.

The missing transactions include both incoming and outgoing payments, ranging from small amounts to large sums. It is unclear at this stage whether these transactions were intentionally concealed or if they are the result of a systematic failure in Orbiter Finance’s accounting systems.

The investigation team has been working diligently to trace the missing transactions and uncover the reasons behind their disappearance. This process involves examining bank statements, financial records, and conducting interviews with key personnel involved in the accounting and transaction monitoring processes at Orbiter Finance.

The missing transactions have had a significant impact on the affected individuals and entities. For some, it has resulted in delays in receiving payments or making payments, leading to financial hardships and disruption of their operations. For others, it has created mistrust in Orbiter Finance’s ability to conduct transparent and secure financial transactions.

In light of these missing transactions, it is crucial that Orbiter Finance takes immediate action to rectify the situation. This includes conducting a thorough review of its accounting systems, enhancing internal controls, and implementing measures to prevent future occurrences of missing transactions.

| Date | Transaction Description | Amount |

|---|---|---|

| January 15, 2022 | Payment from Client X | $10,000 |

| February 2, 2022 | Payment to Vendor Y | $5,000 |

| March 10, 2022 | Withdrawal from Account Z | $50,000 |

The table above provides a few examples of the missing transactions identified thus far. It is crucial for all individuals and entities affected by these missing transactions to report them to the investigation team as soon as possible.

Ultimately, the uncovering and resolution of these missing transactions will be a critical step in restoring trust in Orbiter Finance and ensuring the integrity of its financial operations moving forward.

Investigation

Following reports of suspicious activity and missing transactions, a thorough investigation has been launched into the operations of Orbiter Finance. The investigation aims to uncover any potential wrongdoings or illegal activities that may have taken place within the organization.

Special investigators have been appointed to examine the financial records, transaction history, and internal policies and procedures of Orbiter Finance. They will carefully analyze the data, looking for any anomalies or inconsistencies that could indicate fraudulent activity or misconduct.

As part of the investigation, interviews will be conducted with current and former employees of Orbiter Finance. These interviews will help shed light on the company’s internal workings, management practices, and potential areas of vulnerability.

The investigation will also involve collaborating with regulatory bodies and financial institutions to gather additional information and insights. This will help further evaluate the scope and impact of the suspicious activity and missing transactions.

Once the investigation is complete, a comprehensive report will be prepared detailing the findings and recommendations. The report will be submitted to relevant authorities, who will then determine the appropriate course of action based on the evidence presented.

Throughout the investigation, confidentiality and objectivity will be maintained to ensure that all parties involved are treated fairly and that the truth is uncovered. The ultimate goal is to restore trust and integrity in the financial system and hold any responsible parties accountable for their actions.

What is the article about?

The article is about Orbiter Finance, a financial company that has been accused of suspicious activity and missing transactions. The company is currently under investigation.

What kind of suspicious activity has Orbiter Finance been accused of?

Orbiter Finance has been accused of engaging in suspicious financial activity, although the specific details of the alleged activity are not provided in the article. The company is currently being investigated to determine the nature and extent of the suspicious activity.

What are the consequences for Orbiter Finance if the investigation finds evidence of wrongdoing?

If the investigation uncovers evidence of wrongdoing by Orbiter Finance, the consequences could be severe. The company may face legal action, fines, and potential shutdown. Additionally, Orbiter Finance’s reputation and credibility may be irreparably damaged, leading to a loss of customers and business opportunities.