Understanding the Mechanics of Orbiter Finance’s Cross-chain Bridge Paving the Way for Cross-chain Transactions

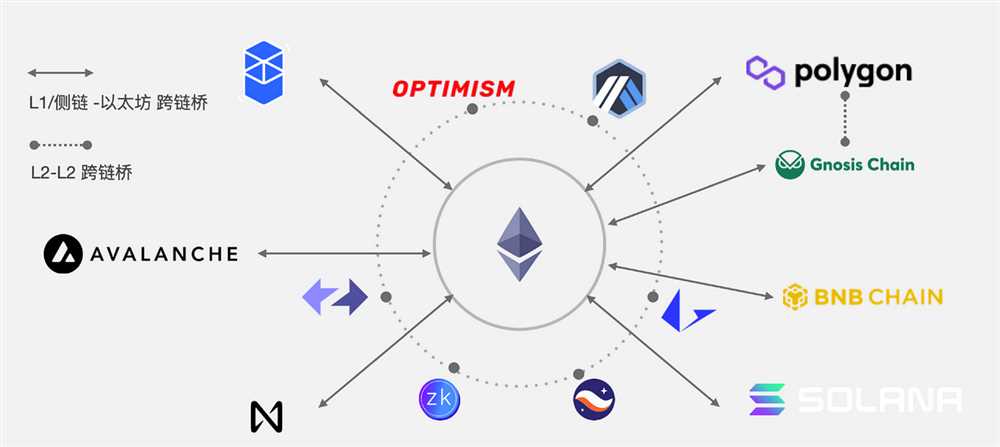

With the increasing popularity of blockchain technology, the need for efficient cross-chain transactions has become more apparent. Traditional blockchains are often isolated from each other, making it challenging for users to interact with assets across different chains. However, Orbiter Finance’s cross-chain bridge is changing the game by enabling seamless transactions between diverse blockchains.

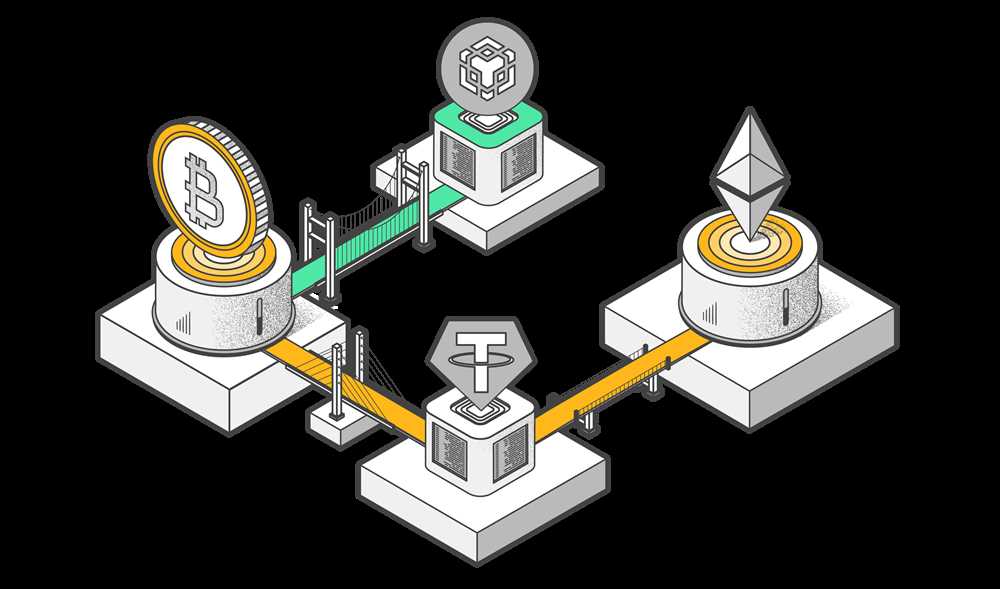

Orbiter Finance’s cross-chain bridge acts as a connection between different chains, allowing users to transfer assets from one blockchain to another. Through this bridge, users can transact with cryptocurrencies, tokens, and other digital assets without the limitations imposed by individual blockchains. By bridging the gap between different chains, Orbiter Finance is revolutionizing the way people interact with blockchain networks.

One of the key features of Orbiter Finance’s cross-chain bridge is its interoperability. The bridge allows users to transfer assets from one blockchain to another, regardless of the underlying technology. Whether it’s Ethereum, Binance Smart Chain, or any other blockchain, the cross-chain bridge ensures that assets can be seamlessly transferred and utilized across different networks.

Another noteworthy aspect of Orbiter Finance’s cross-chain bridge is its security. The bridge relies on robust encryption algorithms and smart contract technology to ensure the safety of transactions. Users can trust that their assets are protected during the cross-chain transfer process, minimizing the risk of hacks or unauthorized access.

Overall, Orbiter Finance’s cross-chain bridge is a game-changer in the world of blockchain technology. It enables users to overcome the barriers of isolated blockchains, facilitating seamless cross-chain transactions. With its interoperability and security features, the cross-chain bridge opens up a world of possibilities for the future of decentralized finance.

The Importance of Cross-chain Transactions

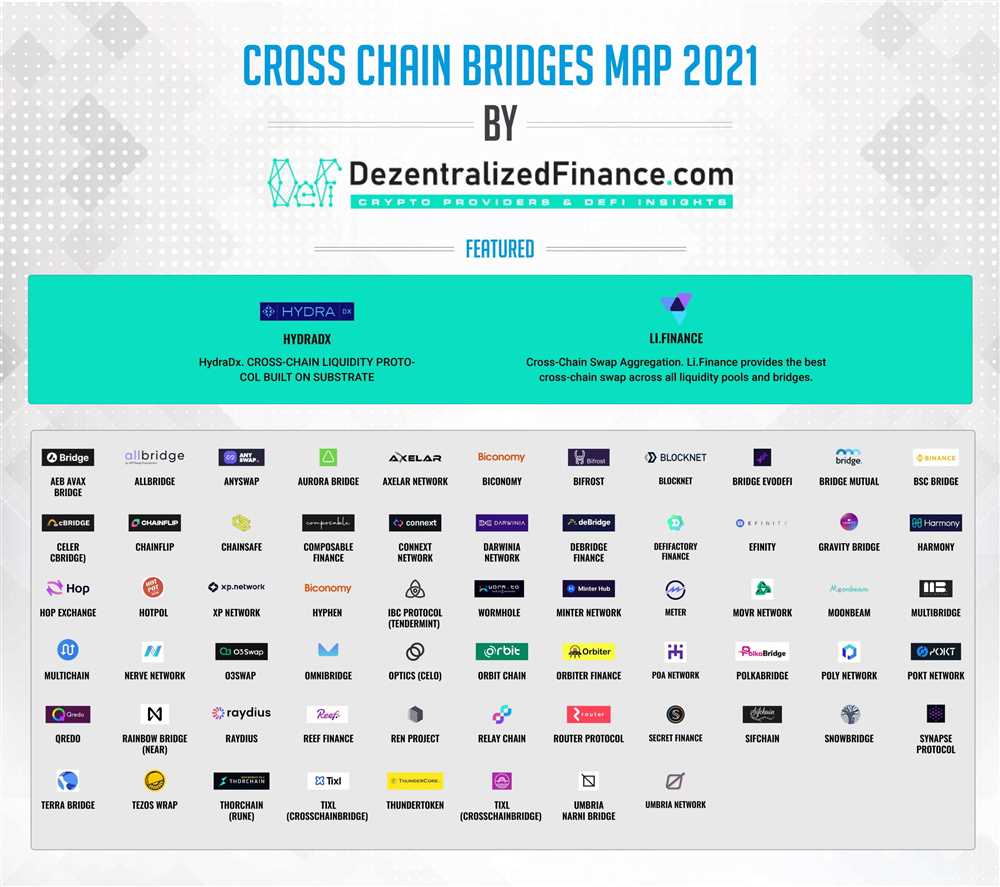

As the decentralized finance (DeFi) ecosystem continues to grow, the ability to transfer assets and data seamlessly across different blockchain networks becomes increasingly important. This is where cross-chain transactions play a crucial role.

Cross-chain transactions refer to the movement of digital assets or data between two or more blockchain networks. They enable interoperability and connectivity between disparate blockchains, allowing users to access and utilize resources from different networks. This is especially essential in a multi-chain ecosystem where each blockchain serves a specific purpose or has unique features.

Enhanced Liquidity

One of the main benefits of cross-chain transactions is the enhancement of liquidity in the DeFi space. By connecting different blockchain networks, cross-chain bridges enable the seamless transfer of assets between chains, expanding the liquidity pool and allowing users to access a wider range of opportunities. This enables liquidity providers to allocate their assets more efficiently, benefiting both market participants and the overall DeFi ecosystem.

Expanded Functionality

Cross-chain transactions also enable the expansion of functionality across different blockchains. By bridging chains together, developers can leverage the unique features and capabilities of each blockchain for various applications. This creates a more versatile and robust ecosystem where developers can build decentralized applications (dApps) that can interact with multiple blockchains. This, in turn, opens up new possibilities and use cases for DeFi and blockchain technology as a whole.

For example, cross-chain transactions can enable the integration of decentralized exchanges (DEXs) on different blockchains, allowing users to trade assets across multiple networks. It can also facilitate the creation of synthetic assets that represent real-world assets on different blockchains, enabling users to access and trade these assets in a decentralized manner.

Reduced Dependence

By enabling cross-chain transactions, DeFi platforms can reduce their dependence on a single blockchain network. This is advantageous as it reduces the potential risks and vulnerabilities associated with relying on a single network. If a particular blockchain experiences congestion, high fees, or security issues, users can still continue to transact and utilize assets on other chains. This provides a level of resilience and flexibility to the DeFi ecosystem and mitigates the impact of potential network failures or limitations.

| Benefits of Cross-chain Transactions | |

|---|---|

| Enhanced Liquidity | Expanded Functionality |

| Reduced Dependence |

In conclusion, cross-chain transactions are an essential component of the evolving DeFi ecosystem. They enable enhanced liquidity, expanded functionality, and reduced dependence on a single blockchain network. As the demand for interoperability and connectivity between blockchain networks grows, cross-chain transactions will play an increasingly important role in unlocking the full potential of decentralized finance.

The Limitations of Individual Chains

While blockchain technology has revolutionized various industries, individual chains have faced certain limitations that hinder the seamless flow of information and assets across different networks. Some of the key limitations are:

| Limitation | Description |

|---|---|

| Isolation | Most blockchain networks operate in isolation, which means they lack interoperability with other chains. This restricts the transfer of assets and data between different networks. |

| Scalability | Individual chains often struggle with scalability issues, particularly when it comes to handling a large number of transactions. As the number of users and transactions increases, the network’s performance can significantly degrade. |

| Speed | Due to the consensus mechanisms and block confirmation times, individual chains can be relatively slow when it comes to transaction processing. This can be a significant drawback for applications that require real-time or near-instantaneous transactions. |

| Limited Asset Support | Individual chains may have limited asset support, which means that not all types of assets can be easily transferred or utilized on a specific chain. This lack of asset interoperability restricts the potential use cases and value of individual chains. |

| Cost | Operating on individual chains can be expensive, especially when it comes to transaction fees and network congestion. The cost of using individual chains can impact the accessibility and affordability of blockchain-based applications. |

Addressing these limitations is crucial to enable a seamless and efficient cross-chain ecosystem. Cross-chain bridges, such as Orbiter Finance’s, aim to overcome these limitations by facilitating the transfer of assets, data, and value between different chains, ultimately unlocking the full potential of blockchain technology.

The Solution: Orbiter Finance’s Cross-chain Bridge

Orbiter Finance’s cross-chain bridge provides a secure and efficient solution for enabling cross-chain transactions. By leveraging advanced technology and a robust infrastructure, Orbiter Finance has developed a bridge that allows users to transfer assets between different blockchain networks seamlessly.

One of the key features of Orbiter Finance’s cross-chain bridge is its interoperability. The bridge is designed to enable the transfer of assets between disparate blockchain networks, such as Ethereum, Binance Smart Chain, and Solana. This interoperability ensures that users can easily move their assets across different chains, opening up a world of possibilities for decentralized finance.

Another important aspect of Orbiter Finance’s cross-chain bridge is its security. The bridge is built on a decentralized architecture, utilizing a network of validators to ensure the integrity of transactions. These validators are responsible for confirming and securing cross-chain transactions, making it almost impossible for malicious actors to manipulate or tamper with the transfer of assets.

The efficiency of Orbiter Finance’s cross-chain bridge is another standout feature. The bridge leverages a combination of advanced algorithms and optimization techniques to minimize transaction times and reduce fees. This means that users can enjoy fast and cost-effective cross-chain transactions without compromising on security.

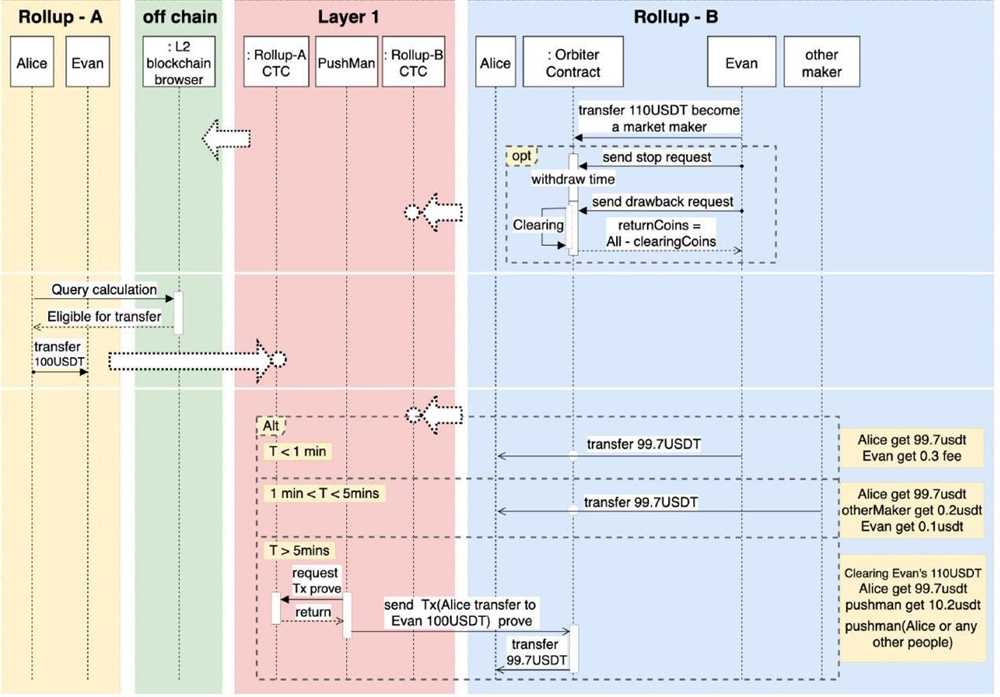

How it works

The cross-chain bridge works by utilizing a smart contract on each blockchain network involved in the transaction. When a user initiates a transfer, the bridge locks the assets on the source chain and mints a corresponding representation of the assets on the destination chain. Once the transaction is confirmed by the validators, the assets are released on the destination chain and made available to the user.

This process ensures that the transfer of assets is secure and transparent, as all transactions are recorded on the respective blockchains. Additionally, the cross-chain bridge supports bi-directional asset transfers, allowing users to easily move assets back and forth between different chains.

Use cases and benefits

Orbiter Finance’s cross-chain bridge opens up a world of possibilities for decentralized finance. Users can take advantage of the bridge to access a wider range of financial products and services, regardless of the blockchain network they are on. This includes lending and borrowing platforms, decentralized exchanges, and yield farming protocols.

Furthermore, the cross-chain bridge allows for the seamless integration of different blockchain networks, fostering collaboration and innovation in the industry. Developers can leverage the bridge to build cross-chain applications and create new use cases that were previously not possible.

In conclusion, Orbiter Finance’s cross-chain bridge is a game-changer in the world of decentralized finance. With its interoperability, security, and efficiency, the bridge enables users to unlock the full potential of cross-chain transactions, opening up new opportunities for innovation and collaboration in the blockchain industry.

How Orbiter Finance’s Cross-chain Bridge Works

Orbiter Finance’s cross-chain bridge is designed to enable seamless cross-chain transactions between different blockchain networks. The bridge acts as a connector between the source and destination networks, allowing users to transfer assets from one chain to another.

The process of transferring assets across chains starts with the user depositing their assets into the bridge contract on the source network. These assets are then locked within the contract, ensuring their safety and security.

Once the assets are locked within the bridge contract, the bridge generates a unique identifier for the transfer. This identifier is used to track the progress of the transaction and ensure its completion.

Next, the bridge notifies the destination network of the pending asset transfer. This triggers the destination network to mint an equivalent amount of tokens on its own chain, representing the assets being transferred.

Once the newly minted tokens are created on the destination network, they are transferred to the user’s specified wallet address. The user now has access to their assets on the destination chain.

In order to maintain a secure and trustless environment, Orbiter Finance’s cross-chain bridge implements a number of security measures. These include multi-signature wallets, time locks, and other mechanisms to prevent potential attacks or hacks.

Overall, Orbiter Finance’s cross-chain bridge offers a seamless and secure solution for enabling cross-chain transactions. It allows users to transfer assets between different blockchain networks, opening up new opportunities for decentralized finance and enhancing the interoperability of blockchain ecosystems.

The Benefits of Cross-chain Transactions

Cross-chain transactions offer several significant benefits for users and the wider blockchain ecosystem. Here are some key advantages:

1. Interoperability

Cross-chain transactions enable seamless communication and interoperability between different blockchain networks. This means that users can transfer assets and data from one blockchain to another without having to rely on intermediaries or centralized exchanges. It allows for greater flexibility and freedom when managing digital assets across multiple platforms.

2. Increased Liquidity

By enabling cross-chain transactions, liquidity can be increased across different blockchain networks. Users can access a wider pool of assets and markets, which improves the efficiency of the overall ecosystem. It also opens up opportunities for arbitrage and increases the chances of finding better prices for digital assets.

Cross-chain transactions also make it easier to participate in decentralized finance (DeFi) protocols and access various lending, borrowing, and yield farming opportunities across different blockchains.

3. Security and Scalability

Implementing cross-chain transactions can enhance the security and scalability of blockchain networks. By allowing assets to be transferred across different chains, it reduces the risk of bottlenecks and congestion on a single blockchain. It also minimizes the reliance on a single blockchain ecosystem, reducing the potential impact of security vulnerabilities or network failures.

Additionally, cross-chain transactions can facilitate smart contract interactions between different platforms, enabling developers to leverage the strengths of multiple blockchains and create more robust and scalable applications.

In conclusion, cross-chain transactions offer many benefits, including interoperability, increased liquidity, and improved security and scalability. As blockchain technology continues to evolve, cross-chain transactions are likely to play a crucial role in connecting and integrating various blockchain ecosystems, further enhancing the overall functionality and utility of the decentralized web.

What is Orbiter Finance’s Cross-chain Bridge?

Orbiter Finance’s Cross-chain Bridge is a technology that enables cross-chain transactions, which means it allows users to move assets and data between different blockchains.

How does Orbiter Finance’s Cross-chain Bridge work?

Orbiter Finance’s Cross-chain Bridge works by effectively creating a bridge between two blockchains. It locks the user’s assets in one blockchain and mints a corresponding representation of those assets on the destination blockchain. This allows users to seamlessly transfer assets from one blockchain to another.

What are the benefits of Orbiter Finance’s Cross-chain Bridge?

Orbiter Finance’s Cross-chain Bridge offers several benefits. First, it enables interoperability between different blockchains, allowing users to leverage the unique features and capabilities of multiple platforms. Second, it provides liquidity between different blockchain ecosystems, making it easier for users to access and trade assets on different chains. Third, it enhances security by ensuring that assets are safely transferred between blockchains.

Are there any limitations or risks associated with Orbiter Finance’s Cross-chain Bridge?

While Orbiter Finance’s Cross-chain Bridge offers many benefits, there are also some limitations and risks to consider. One limitation is the potential for delays or congestion when transferring assets between blockchains, especially during periods of high network activity. Additionally, there is a risk of smart contract bugs or vulnerabilities that could be exploited by malicious actors. It is important for users to exercise caution and conduct thorough research before utilizing the bridge.