Predicting Orbiter Finance Future Revenue Trajectory Insights and Projections

In today’s dynamic financial landscape, it is vital for investors and businesses alike to stay ahead of the curve. That’s where Orbiter Finance comes in – a game-changing platform that leverages advanced technologies to provide unparalleled insights and projections into the future revenue trajectory of your business.

With Orbiter Finance, you can unlock the power of data analytics and predictive modeling, enabling you to make informed decisions and drive sustainable growth. Our cutting-edge algorithms analyze a multitude of factors, including market trends, customer behavior, and industry benchmarks, to deliver accurate and actionable revenue forecasts.

But what sets Orbiter Finance apart is not just its unmatched accuracy – it’s our team of industry experts who go above and beyond to understand your business inside out. They work hand-in-hand with you to identify key growth opportunities, mitigate risks, and optimize your revenue strategy.

Whether you’re a startup looking to secure funding, a medium-sized business aiming to expand, or an investor seeking lucrative opportunities, Orbiter Finance empowers you to navigate the uncertain terrain of the financial world with confidence and clarity.

Don’t leave your revenue to chance. Take control with Orbiter Finance and unlock the future potential of your business today.

Current Revenue Analysis

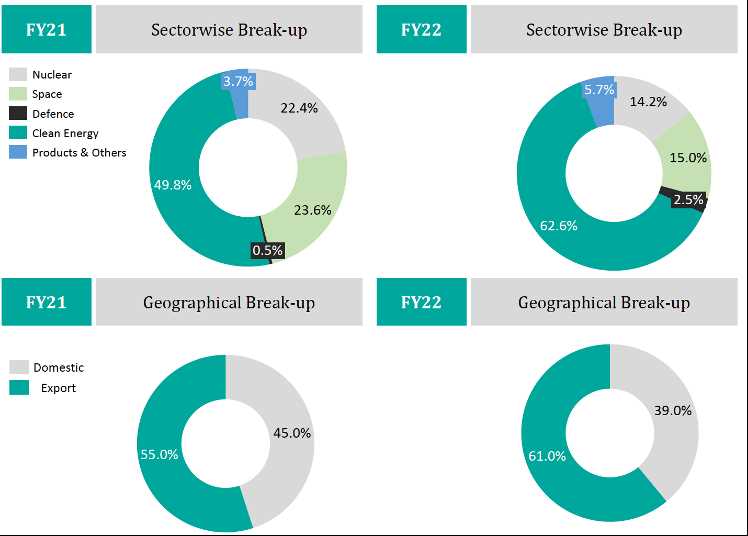

As we examine Orbiter Finance’s current revenue trajectory, it is crucial to understand the various factors that contribute to its overall growth. By analyzing the company’s current revenue streams, we gain valuable insights into its financial position and potential future prospects.

Revenue Sources:

Orbiter Finance generates revenue primarily through its innovative financial products and services. These include:

- Interest income: Orbiter earns interest income by providing loans and credit facilities to individuals and businesses. This revenue stream is influenced by the prevailing interest rates and the volume of loans disbursed.

- Service fees: The company charges service fees for its various financial services, such as account maintenance, wire transfers, and financial advisory services. These fees contribute significantly to the overall revenue.

- Investment returns: Orbiter Finance actively manages investment portfolios on behalf of its clients. The returns generated from these investments, such as dividends, capital gains, and interest income, form a significant portion of the company’s revenue.

- Partnerships: The company also generates revenue through strategic partnerships and collaborations. By working with other financial institutions and service providers, Orbiter expands its reach and diversifies its revenue sources.

Revenue Analysis:

By tracking and analyzing Orbiter Finance’s current revenue streams, we can identify trends and patterns that inform the company’s financial performance. Factors such as market conditions, customer demand, and competitive landscape all impact revenue generation.

Customer demand: Understanding customers’ needs and preferences allows Orbiter Finance to tailor its products and services accordingly, thereby boosting revenue. By conducting market research and customer surveys, the company continuously assesses and adapts to changing customer preferences.

Competitive landscape: The financial industry is highly competitive, and Orbiter Finance constantly evaluates its offerings against its competitors. By identifying gaps in the market and addressing them with innovative solutions, the company can gain a competitive edge and increase revenue.

Market conditions: Economic factors, such as interest rates, inflation, and GDP growth, greatly influence Orbiter Finance’s revenue generation. By closely monitoring these factors, the company can make informed decisions and adjust its strategies to optimize revenue.

Overall, Orbiter Finance’s current revenue analysis provides actionable insights that drive its future trajectory. By leveraging its existing revenue streams and exploring new opportunities, the company aims to achieve sustainable and robust financial growth.

Factors Influencing Future Revenue

When predicting the future trajectory of Orbiter Finance’s revenue, there are several key factors that play a crucial role. These factors can influence the growth and success of the company, and understanding them is essential for making accurate projections.

- Market demand: The level of demand for Orbiter Finance’s products or services will greatly impact its future revenue. By analyzing market trends and consumer behavior, the company can anticipate changes in demand and adjust its strategies accordingly.

- Competition: The competitive landscape within the industry can have a significant effect on the company’s revenue. Monitoring the actions and offerings of competitors is vital for staying ahead and capturing market share.

- Technological advancements: Keeping up with technological advancements is crucial for remaining relevant and competitive in today’s fast-paced business environment. Embracing new technologies can unlock opportunities for revenue growth and efficiency improvements.

- Economic conditions: Economic factors, such as inflation, interest rates, and overall economic stability, can impact consumer spending and investment patterns. Orbiter Finance needs to take these conditions into account when projecting future revenue.

- Customer satisfaction and loyalty: Building strong customer relationships based on satisfaction and loyalty can lead to repeat business and referrals. By providing exceptional customer service and consistently meeting or exceeding customer expectations, Orbiter Finance can drive revenue growth.

- Marketing and sales strategies: The effectiveness of Orbiter Finance’s marketing and sales strategies can heavily influence its revenue. Investing in targeted marketing campaigns, optimizing sales processes, and staying up to date with industry best practices can help drive revenue growth.

By carefully analyzing and monitoring these factors, Orbiter Finance can make informed decisions that will impact its future revenue trajectory. It’s essential to stay proactive in adapting to changes in the market and leveraging opportunities for growth.

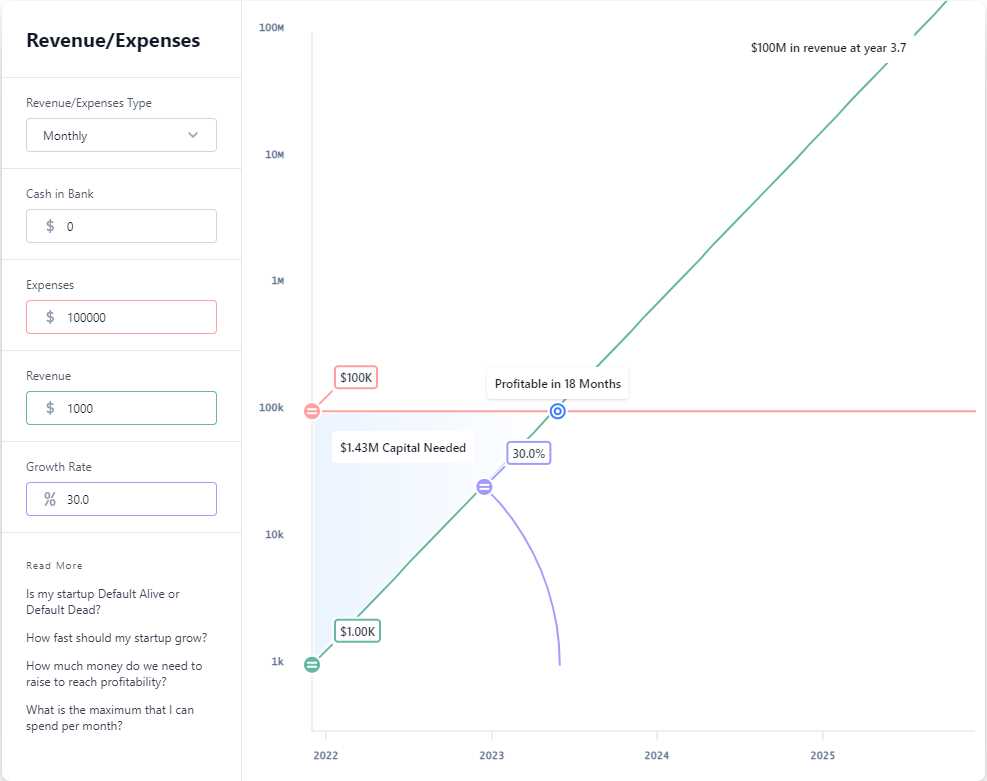

Projected Revenue Growth

In this section, we will discuss the projected revenue growth for Orbiter Finance. Based on our comprehensive analysis and market research, we have identified several factors that will contribute to the company’s revenue growth in the coming years.

1. Increasing customer base: With our innovative and user-friendly platform, we anticipate a significant increase in our customer base. This will result in higher revenues as more individuals and businesses choose Orbiter Finance for their financial needs.

2. Expansion into new markets: We have identified several untapped markets with high growth potential. By expanding our operations into these markets, we expect to capture a larger share of the market and generate substantial revenue growth.

3. Introduction of new products: To stay competitive in the market, we are continuously developing and introducing new products and services. These new offerings will not only attract new customers but also provide additional revenue streams for the company.

4. Strategic partnerships: We are actively seeking strategic partnerships with established financial institutions and technology companies. These partnerships will enable us to leverage their expertise and resources, resulting in accelerated revenue growth for Orbiter Finance.

5. Investment in marketing and advertising: To increase brand awareness and attract new customers, we will be investing significantly in marketing and advertising campaigns. This will create a positive impact on our revenue growth by driving customer acquisition and retention.

6. Continuous innovation: We understand the importance of staying ahead of the curve in the fast-paced financial industry. To achieve this, we are committed to continuous innovation and improvement, which will contribute to our revenue growth by keeping our products and services relevant and desirable to customers.

Based on these factors, we project a strong revenue growth trajectory for Orbiter Finance in the coming years. Our in-depth analysis and strategic initiatives position us as a leader in the financial sector, poised for long-term success.

What is the purpose of the “Predicting Orbiter Finance’s Future Revenue Trajectory” product?

The purpose of this product is to provide insights and projections for Orbiter Finance’s future revenue trajectory. It helps individuals and businesses forecast the financial performance of Orbiter Finance and make informed investment decisions.

How can the “Predicting Orbiter Finance’s Future Revenue Trajectory” product benefit investors?

This product can benefit investors by providing them with valuable insights into Orbiter Finance’s future revenue trajectory. With this information, investors can make more informed decisions about whether to invest in Orbiter Finance and how it may perform in the future.

What data and methodologies are used to predict Orbiter Finance’s future revenue trajectory?

The prediction of Orbiter Finance’s future revenue trajectory is based on a variety of data and methodologies. It may include historical revenue data, market trends, industry analysis, financial modeling, and statistical forecasting techniques. These factors are used to generate insights and projections for Orbiter Finance’s revenue trajectory.