Stay Ahead of the Curve: How Orbiter Finance’s Cross-Chain Asset Management Enhances Risk Management

Experience the future of asset management with Orbiter Finance. We offer a state-of-the-art cross-chain platform that allows you to stay ahead of the curve and effectively manage your risks. Our cutting-edge technology enables seamless asset transfers across multiple blockchains, providing you with unparalleled control and flexibility.

With Orbiter Finance, you can diversify your portfolio like never before. Our platform supports a wide range of digital assets, including cryptocurrencies, tokens, and NFTs, giving you access to a world of investment opportunities. Whether you’re a seasoned investor or just getting started, our robust risk management tools will help you optimize your strategy and maximize your returns.

Unlock the potential of decentralized finance with Orbiter Finance’s innovative solutions. Our team of experts is committed to delivering top-notch security, transparency, and efficiency, so you can have peace of mind while navigating the ever-evolving crypto landscape.

Don’t settle for traditional asset management methods. Embrace the future with Orbiter Finance and take control of your financial future. Join us today and stay ahead of the curve!

Exploring Cross-Chain Asset Management

In today’s rapidly evolving digital landscape, cross-chain asset management has emerged as a powerful tool for enhancing risk management and maximizing investment opportunities. With Orbiter Finance’s innovative cross-chain asset management platform, investors can take advantage of the interconnected nature of blockchain networks to optimize their portfolios and stay one step ahead of the curve.

Unlocking New Possibilities

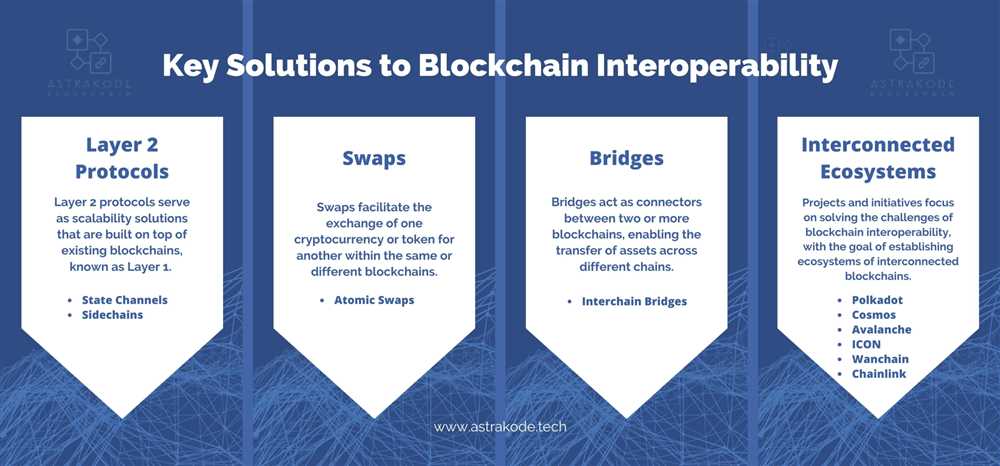

Cross-chain asset management allows investors to diversify their holdings across different blockchain networks, enabling them to tap into a broader range of investment opportunities. By leveraging this technology, investors can gain exposure to a wider variety of assets, such as cryptocurrencies, stablecoins, and decentralized finance (DeFi) tokens, without being limited to a single blockchain ecosystem.

Furthermore, cross-chain asset management offers the potential for enhanced risk management. By spreading investments across multiple blockchains, investors can reduce the impact of any single network’s volatility or security vulnerabilities on their portfolio. This diversification minimizes the overall risk exposure and provides a more stable investment environment.

The Orbiter Finance Advantage

Orbiter Finance’s cross-chain asset management platform stands out from the crowd with its cutting-edge technology and comprehensive ecosystem. Powered by advanced algorithms and machine learning, Orbiter Finance ensures seamless interoperability between different blockchain networks, allowing for efficient and secure asset transfers.

With Orbiter Finance, investors can easily navigate the complexities of cross-chain asset management through a user-friendly interface. The platform provides real-time portfolio monitoring, performance analysis, and risk assessment, empowering investors to make informed decisions based on accurate data.

Stay ahead of the curve with Orbiter Finance’s cross-chain asset management platform, and unlock the full potential of your investments.

Disclaimer: Investing in cryptocurrencies and other blockchain assets carries a high level of risk. Please conduct thorough research and consult with a financial advisor before making any investment decisions.

The Need for Enhanced Risk Management

With the ever-changing and unpredictable nature of financial markets, staying ahead of the curve and ensuring robust risk management is crucial for any investor or asset manager. Traditional risk management strategies often fall short in today’s complex and interconnected financial landscape. This is why Orbiter Finance offers its revolutionary cross-chain asset management solution.

Traditional risk management approaches focus primarily on portfolio diversification and asset allocation. While these strategies have their merits, they often fail to account for the dynamic and fast-paced nature of the market. With traditional risk management, investors may find themselves limited in their ability to swiftly adapt to changing market conditions, resulting in missed opportunities or excessive exposure to risk.

Orbiter Finance’s cross-chain asset management takes risk management to the next level by leveraging blockchain technology and decentralized finance (DeFi) protocols. By combining different blockchains and DeFi platforms, Orbiter Finance offers investors a comprehensive and holistic approach to managing risk.

With cross-chain asset management, investors can benefit from a wide range of risk management strategies, including automated rebalancing, smart contract audits, and real-time portfolio tracking. These features provide investors with enhanced visibility and control over their assets, enabling them to make data-driven decisions and respond quickly to market fluctuations.

Another key advantage of cross-chain asset management is improved security. Traditional centralized systems are vulnerable to hacking and fraud, which can result in significant financial losses. With Orbiter Finance’s cross-chain asset management, the decentralized nature of blockchain technology ensures that assets are securely stored across multiple chains, reducing the risk of theft or unauthorized access.

In conclusion, the need for enhanced risk management in today’s financial landscape is more prominent than ever. Traditional approaches fall short in addressing the dynamic and interconnected nature of the market. Orbiter Finance’s cross-chain asset management provides a revolutionary solution that leverages blockchain technology and DeFi protocols to offer investors enhanced risk management strategies, improved security, and the ability to stay ahead of the curve.

| Benefits of Orbiter Finance’s Cross-Chain Asset Management: |

|---|

| 1. Enhanced risk management strategies |

| 2. Real-time portfolio tracking |

| 3. Automated rebalancing |

| 4. Smart contract audits |

| 5. Improved security |

Understanding Orbiter Finance

Orbiter Finance is a leading cross-chain asset management platform that offers enhanced risk management solutions for crypto enthusiasts and investors. With a deep understanding of the complex crypto market, Orbiter Finance provides users with unique tools and features to stay ahead of the curve.

What is Cross-Chain Asset Management?

Cross-chain asset management refers to the practice of managing and trading assets across different blockchain networks. Traditionally, managing assets on different blockchains has been a complex and time-consuming process. However, Orbiter Finance simplifies this process by providing a unified platform that allows users to easily manage their assets across multiple chains.

The Benefits of Enhanced Risk Management

One of the key features of Orbiter Finance is its enhanced risk management solutions. By leveraging advanced algorithms and data analysis, Orbiter Finance helps users mitigate risks and make informed investment decisions. Whether you are a seasoned trader or a novice investor, Orbiter Finance provides you with the tools and insights needed to navigate the volatile crypto market.

- Real-time risk monitoring: Orbiter Finance provides users with real-time risk monitoring, allowing them to stay updated on the latest market trends and potential risks.

- Portfolio diversification: With Orbiter Finance, users can diversify their portfolios across different chains, reducing the impact of market volatility on their investments.

- Automated risk management: Orbiter Finance offers automated risk management tools that help users set stop-loss limits and take-profit levels, ensuring optimal risk management without constant monitoring.

With Orbiter Finance’s cross-chain asset management platform, you can take control of your crypto investments and stay ahead of the curve in the ever-evolving crypto market.

The Orbiter Finance Platform

The Orbiter Finance platform is a revolutionary cross-chain asset management solution that is designed to help you stay ahead of the curve and enhance your risk management strategies. With Orbiter Finance, you have access to cutting-edge tools and technologies that empower you to make informed decisions and optimize your investment portfolio.

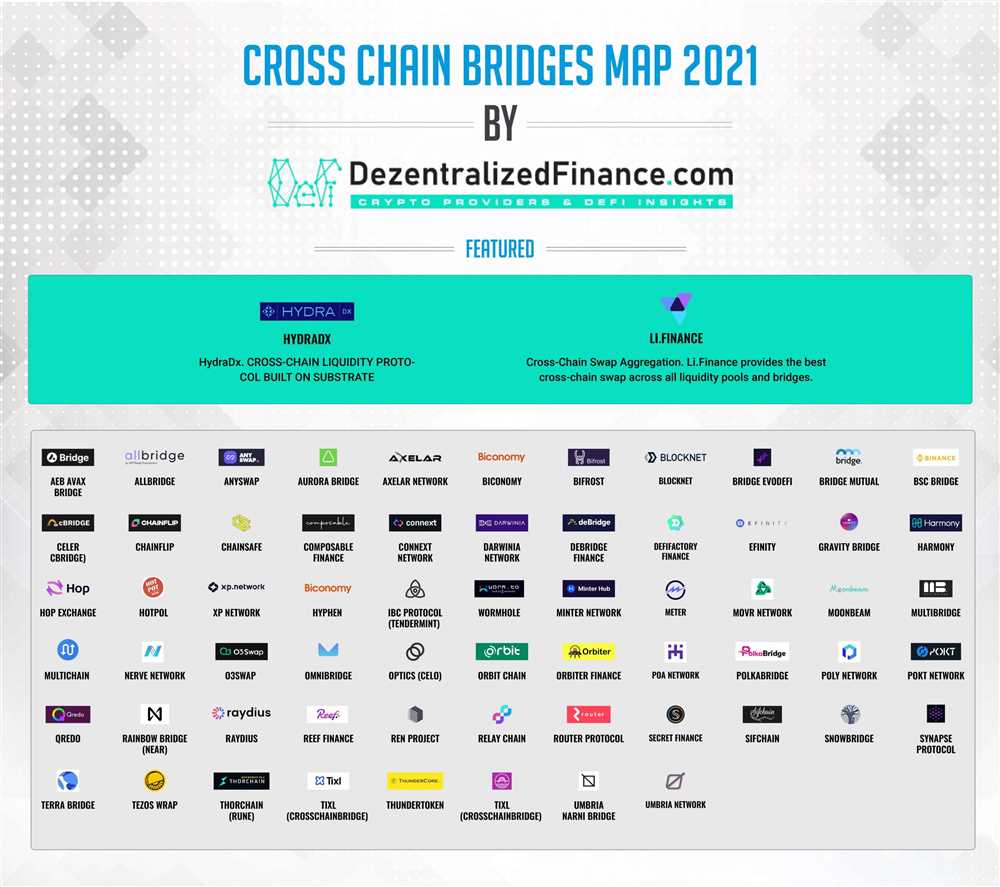

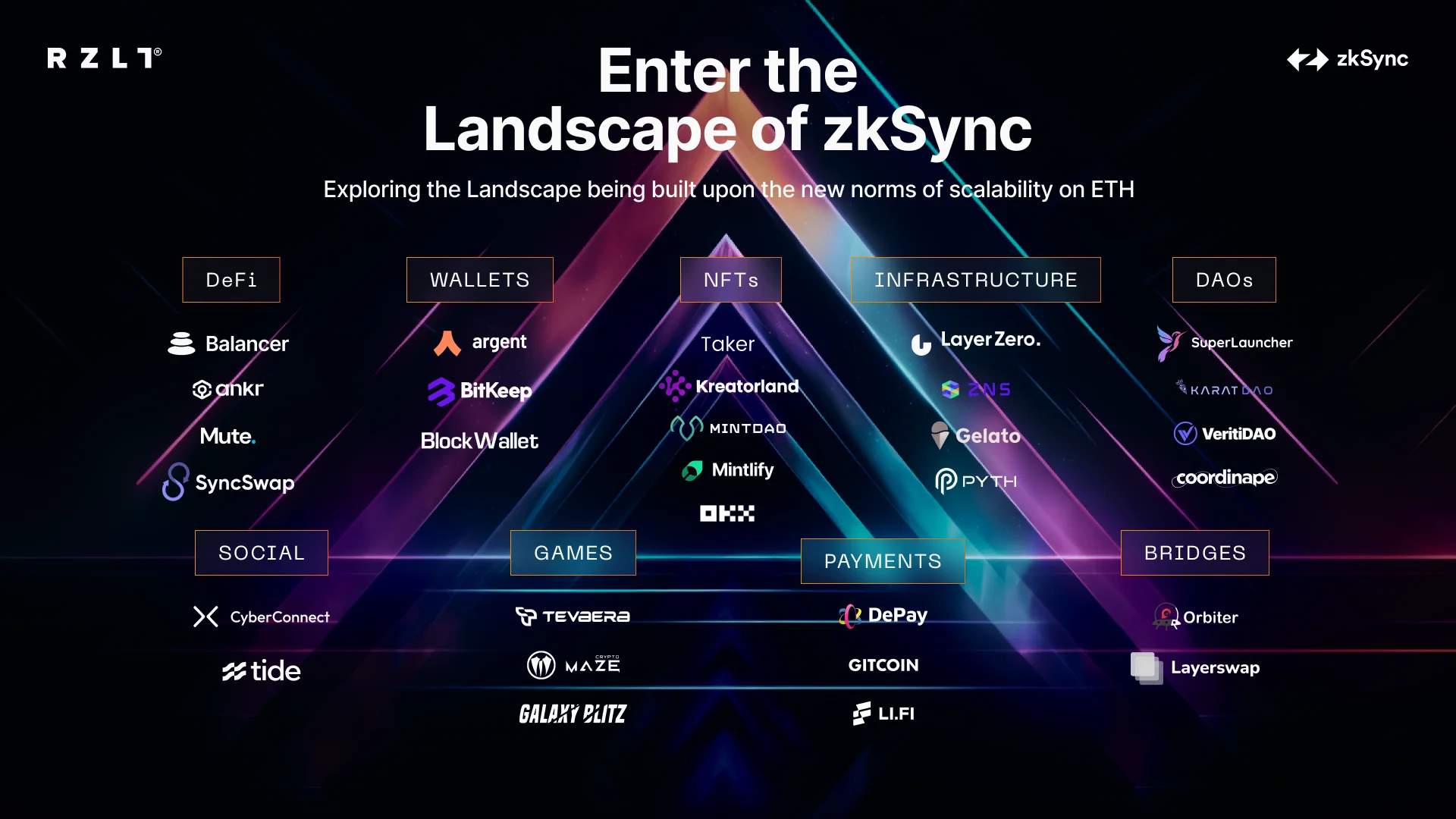

One of the standout features of the Orbiter Finance platform is its seamless integration with multiple blockchains, allowing you to manage your assets across different chains with ease. This cross-chain functionality provides you with the flexibility to diversify your portfolio and take advantage of different opportunities in the fast-evolving crypto landscape.

With Orbiter Finance, you can also enjoy enhanced risk management capabilities. The platform offers advanced analytics and risk assessment tools that enable you to monitor and mitigate potential risks in real-time. By leveraging these features, you can make data-driven decisions and protect your investment against market volatility.

Furthermore, the Orbiter Finance platform is user-friendly and intuitive, making it suitable for both beginners and experienced investors. The clean and streamlined interface allows you to navigate through the platform effortlessly and access the information you need in a matter of seconds.

Overall, the Orbiter Finance platform is your ultimate asset management solution. Whether you are an individual investor or a financial institution, Orbiter Finance empowers you to stay ahead of the curve in the ever-changing crypto market, maximize your returns, and minimize your risks.

Benefits of Cross-Chain Asset Management

1. Diversification: Cross-chain asset management allows you to diversify your investment portfolio across multiple blockchains. By spreading your assets across different chains, you can reduce the risk of potential losses caused by a failure or hack on a single chain.

2. Enhanced Risk Management: Orbiter Finance’s cross-chain asset management provides you with advanced risk management tools. By leveraging the capabilities of different blockchains, you can minimize the impact of market volatility and reduce the risk of loss.

3. Increased Liquidity: With cross-chain asset management, you can access liquidity across different blockchains. This allows you to quickly and easily convert your assets into different cryptocurrencies or fiat currencies, providing you with greater flexibility and liquidity options.

4. Interoperability: Cross-chain asset management enables seamless interoperability between different blockchain networks. This means that you can easily transfer and manage your assets across different chains without any hassle or friction.

5. Future-Proofing: As the blockchain industry continues to evolve, cross-chain asset management ensures that you stay ahead of the curve. By embracing cross-chain technology, you are prepared for the future and can easily adapt to new trends and opportunities in the market.

6. Maximizes Opportunities: By utilizing cross-chain asset management, you can take advantage of new investment opportunities that may arise on different blockchains. This allows you to maximize your potential returns and expand your investment horizon.

7. Security: Cross-chain asset management enhances the security of your assets by spreading them across multiple blockchains. This reduces the risk of a single point of failure and enhances the overall security of your portfolio.

8. Transparency: Orbiter Finance’s cross-chain asset management provides you with transparent and auditable records of your asset transactions. This allows you to track and verify your investments easily, ensuring trust and transparency.

9. Cost Efficiency: By leveraging the capabilities of different blockchains, cross-chain asset management can help reduce transaction costs. This allows you to optimize your portfolio and maximize your returns while minimizing costs.

10. Access to New Markets: Cross-chain asset management opens up new markets and investment opportunities that may not be available on a single blockchain. This allows you to expand your investment reach and explore new avenues for growth.

What is Orbiter Finance?

Orbiter Finance is a platform that provides cross-chain asset management solutions for enhanced risk management. It allows users to access a wide range of investment opportunities across different blockchains, helping them stay ahead of the curve in the rapidly evolving DeFi landscape.

How does Orbiter Finance enhance risk management?

Orbiter Finance enhances risk management by offering cross-chain asset management solutions. This allows users to diversify their investments across different blockchains, spreading the risk and reducing the potential impact of any single blockchain failure or vulnerability. By staying ahead of the curve and accessing a wide range of investment opportunities, users can better manage their risk and maximize their potential returns.