When it comes to understanding the world of finance, one key aspect to grasp is the concept of funding rounds. These rounds play a crucial role in the growth and development of companies, providing them with the necessary capital to fuel their operations and achieve their strategic goals.

Orbiter Finance, a leading financial technology company, has recently gone through a series of funding rounds that have propelled its growth and positioned the company as a key player in the industry. In this article, we will explore the key information about Orbiter Finance’s funding rounds, shedding light on the different stages, investors involved, and the impact these rounds have had on the company’s trajectory.

Firstly, it’s important to understand what a funding round entails. Typically, a funding round is a process in which a company raises capital from external investors to finance its activities and accelerate its growth. This capital can be raised through different means, such as selling equity in the company or issuing debt instruments. Funding rounds are typically divided into different stages, each with its own objectives and investor requirements.

In the case of Orbiter Finance, the company has successfully completed several funding rounds, starting with its seed round and subsequently progressing to Series A, B, and C rounds. These rounds have allowed Orbiter Finance to secure capital from a diverse range of investors, including venture capital firms, private equity funds, and strategic partners.

In conclusion, understanding the details of funding rounds is key to gaining insight into the growth trajectory of companies like Orbiter Finance. By raising capital at different stages, companies are able to fuel their operations, expand their market presence, and ultimately achieve their strategic goals. Orbiter Finance’s funding rounds have played a critical role in its success, positioning the company as a leader in the financial technology industry.

What are Orbiter Finance funding rounds?

Orbiter Finance funding rounds refer to the different stages of investment that a company goes through to raise capital for their operations and growth. These rounds typically involve the sale of equity or debt securities to investors in exchange for funding.

During each funding round, the company sets a specific fundraising target and seeks investment from venture capitalists, angel investors, or institutional investors. The funds raised during these rounds are crucial for the company’s development, expansion, and product/service improvement.

Orbiter Finance’s funding rounds can be categorized into different stages:

| Round | Description |

|---|---|

| Seed Round | The initial funding stage where the company raises capital to develop its idea or prototype. This round often involves investment from founders, friends, and family, as well as early-stage venture capitalists. |

| Series A | This round takes place when the company has a proven concept, with some traction and a growing customer base. It aims to secure more substantial investments from venture capitalists to fuel further growth and expansion. |

| Series B, C, and beyond | These subsequent rounds occur as the company continues to scale, expand its operations, and increase its market share. They involve raising additional funds from a mix of existing and new investors. |

| IPO (Initial Public Offering) | At this stage, the company decides to go public by offering its shares to the general public for the first time. This allows the company to raise significant capital and provide liquidity to its existing shareholders. |

Each funding round usually comes with different expectations and valuations. As the company progresses through each round, the valuation tends to increase based on its growth potential, market performance, and investor confidence.

Understanding the various funding rounds of Orbiter Finance can provide valuable insights into the company’s financial trajectory and its ability to attract investment for its future endeavors.

Understanding the basics of Orbiter Finance funding rounds

In the world of finance, funding rounds are a crucial step for companies seeking capital to fuel their growth. Orbiter Finance, a leading financial technology company, is no exception. Understanding the basics of Orbiter Finance funding rounds can help investors and stakeholders make informed decisions.

What are funding rounds?

Funding rounds are stages in a company’s financing journey where it raises capital from investors. In the case of Orbiter Finance, these rounds are crucial for the company’s expansion plans, innovation, and product development.

Typically, each funding round represents a milestone in the company’s growth. It allows Orbiter Finance to secure the necessary funding to scale its operations, acquire new customers, and invest in research and development.

Stages of Orbiter Finance funding rounds

Orbiter Finance goes through several stages in its funding rounds, each denoting a different phase of the company’s development:

Seed Round:

The seed round is the initial stage of financing for Orbiter Finance. At this stage, the company seeks investments to fund its early operations, market research, and product development. Seed funding is usually provided by angel investors, venture capital firms, or other early-stage investors.

Series A:

In the Series A funding round, Orbiter Finance has already achieved certain milestones and has a proven track record. At this stage, the company looks for larger investments to further scale its operations, strengthen its market position, and expand its customer base. Series A funding is usually provided by venture capital firms.

Series B and beyond:

As Orbiter Finance continues to grow, it may go through additional funding rounds, such as Series B, C, D, and so forth. These rounds are aimed at obtaining significant capital to fund ambitious growth plans, pursue strategic acquisitions, or enter new markets. It also helps the company attract additional support from institutional investors and other financial institutions.

Each funding round represents a critical milestone for Orbiter Finance. It allows the company to finance its growth, innovate, and stay competitive in the rapidly evolving financial technology landscape. Investors and stakeholders should carefully monitor Orbiter Finance’s funding rounds to understand its financial health and growth potential.

Key information about Orbiter Finance funding rounds

Orbiter Finance, a leading financial technology company, has successfully completed several funding rounds to support its operations and growth. These funding rounds have been crucial in enabling Orbiter Finance to develop innovative products and services, expand its customer base, and stay ahead of its competitors in the market.

Types of funding rounds

Orbiter Finance has raised funds through various types of funding rounds, including:

- Seed funding: This initial funding round helps the company develop its business concept and build a minimum viable product.

- Series A funding: Once the company has validated its concept and achieved some level of traction, Series A funding helps fuel its growth and expansion.

- Series B funding: This funding round typically takes place when the company has proven its business model and is ready to scale.

- Series C funding: As the company continues to grow and expand, Series C funding provides additional capital to support its operations.

Investors

Some notable investors who have participated in Orbiter Finance funding rounds include:

- High-profile venture capital firms: These firms provide financial backing and strategic guidance to help Orbiter Finance succeed in the market.

- Angel investors: Individual investors who believe in Orbiter Finance’s potential and provide early-stage funding.

- Corporate investors: Established companies in the financial industry who see the value in partnering with Orbiter Finance and invest in its growth.

Funding goals

The primary goals of Orbiter Finance funding rounds are:

- To raise capital for product development and innovation.

- To support customer acquisition and retention efforts.

- To expand into new markets and geographical regions.

- To attract and retain top talent.

- To drive profitability and create long-term value for investors.

Overall, Orbiter Finance’s funding rounds have played a crucial role in its success and growth, helping it remain at the forefront of the financial technology industry.

Discover the essential details about Orbiter Finance funding rounds

Orbiter Finance, a leading financial technology company, has successfully raised several rounds of funding to support its growth and development. Understanding the key details of these funding rounds is essential for investors and stakeholders interested in the company’s future.

Here are some important facts about Orbiter Finance’s funding rounds:

- Series A funding: Orbiter Finance’s first funding round, known as Series A, raised $10 million from a group of venture capital firms and angel investors. This initial investment allowed the company to develop its innovative financial technology platform and expand its team.

- Series B funding: In its second funding round, Orbiter Finance raised $20 million to further scale its operations and enter new markets. The Series B funding was led by a prominent venture capital firm and attracted additional investments from existing and new investors.

- Series C funding: Orbiter Finance’s most recent funding round, Series C, raised a significant amount of $50 million. The funding was secured from a combination of venture capital firms, institutional investors, and strategic partners. The capital infusion will be used to accelerate Orbiter Finance’s global expansion and invest in research and development.

With each funding round, Orbiter Finance has been able to attract an increasing amount of capital and secure the support of top-tier investors. These funding rounds not only provide the necessary financial resources for the company’s growth but also serve as a testament to the confidence and potential of Orbiter Finance’s business model.

As Orbiter Finance continues to expand its product offerings and explore new opportunities, keeping an eye on future funding rounds will be crucial for investors and stakeholders looking to capitalize on the company’s success.

How to participate in Orbiter Finance funding rounds

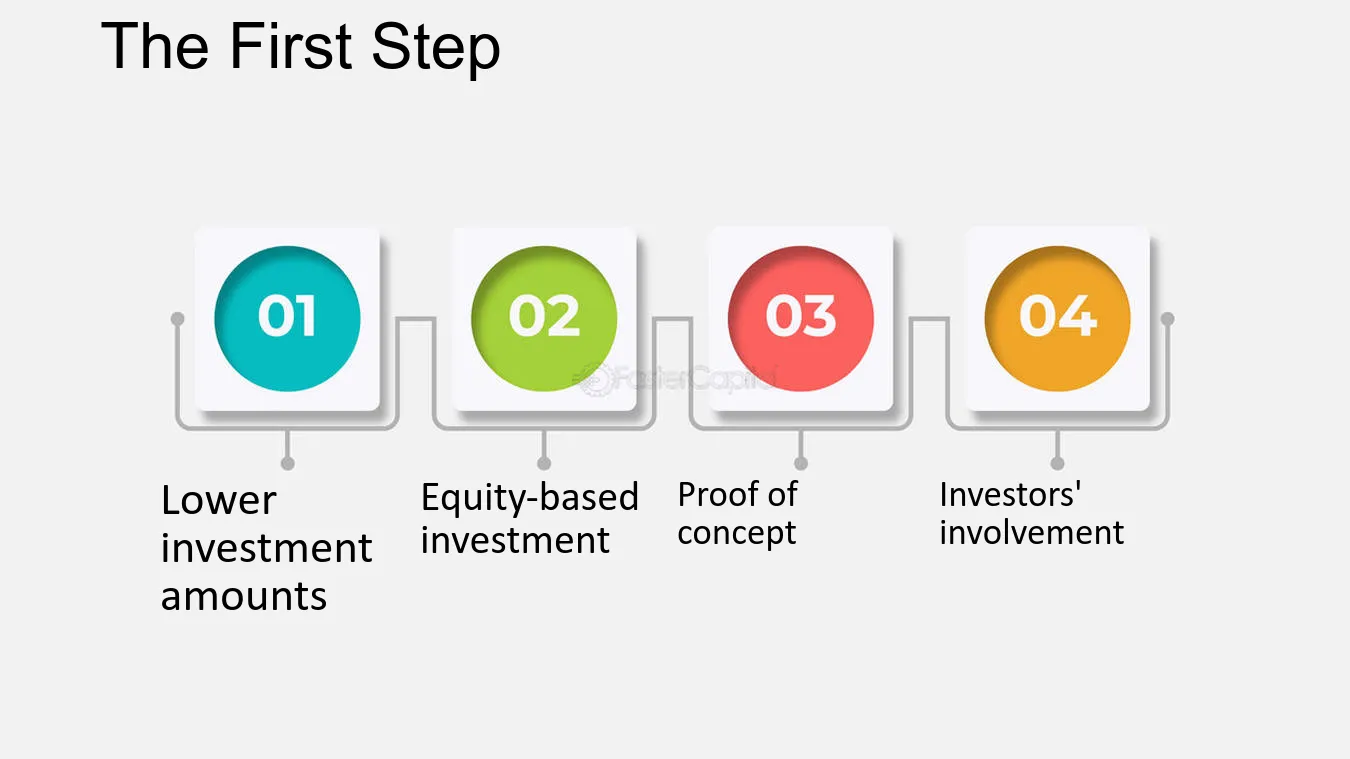

Participating in Orbiter Finance funding rounds is a straightforward process that allows you to contribute to the growth and development of the platform. Here are the steps to participate:

Step 1: Research

Before participating in any funding round, it is essential to conduct thorough research to understand the project, its mission, and its potential. Familiarize yourself with Orbiter Finance and its goals to make an informed decision.

Step 2: Acquire eligible tokens

In order to participate in Orbiter Finance funding rounds, you need to acquire eligible tokens accepted for the funding round. These tokens could be ORB, the native token of Orbiter Finance, or other cryptocurrencies mentioned by the project.

Step 3: Connect your wallet

Connect your cryptocurrency wallet, such as MetaMask, to the Orbiter Finance platform. This will enable you to interact with the funding rounds and participate in them. Ensure that your wallet is funded with the required tokens for the specific round.

Step 4: Access the funding round

Once you have connected your wallet, access the Orbiter Finance platform and navigate to the funding round section. Here, you will find all the details and requirements for the ongoing funding round.

Step 5: Contribute to the funding round

Follow the instructions provided on the Orbiter Finance platform to contribute to the funding round. This may involve entering the desired amount of tokens to be invested or following specific guidelines set by the project.

Step 6: Confirm and wait

After you have entered the required information and made your contribution, confirm the transaction and wait for it to be processed. Depending on network congestion and other factors, it may take some time before the transaction is confirmed.

By following these steps, you can actively participate in Orbiter Finance funding rounds and support the development of the platform. Remember to stay updated with the project’s announcements and follow their official channels for the latest information on upcoming funding rounds.

A step-by-step guide to getting involved in Orbiter Finance funding rounds

If you’re interested in participating in Orbiter Finance funding rounds, follow these steps to get started:

- Create an Account: Visit the Orbiter Finance website and create an account by providing the required information.

- Complete the KYC Process: Once your account is created, you will need to complete the KYC (Know Your Customer) process by providing the requested documents and verifying your identity.

- Review Available Funding Rounds: Check the Orbiter Finance platform for information on available funding rounds. Make sure to review the details of each round, including the target amount, funding period, and token allocation.

- Choose a Funding Round: Select a funding round that aligns with your investment goals and risk tolerance. Consider factors such as the project’s stage of development, potential returns, and the team behind it.

- Invest Funds: Once you have chosen a funding round, decide on the amount you would like to contribute and transfer the funds to your Orbiter Finance account.

- Participate in the Token Sale: During the funding round, you will have the opportunity to purchase tokens at a predetermined price. Follow the instructions provided on the platform to participate in the token sale.

- Monitor your Investment: After participating in the funding round, keep track of your investment and stay updated on the project’s progress. Orbiter Finance will provide regular updates on their platform and communication channels.

- Consider Future Opportunities: As the project develops and new funding rounds become available, evaluate whether you would like to participate in additional rounds or explore other investment opportunities in the Orbiter Finance ecosystem.

Remember, investing in funding rounds involves risks, and it’s important to conduct thorough research and seek professional advice if needed. By following these steps, you can start your journey to participate in Orbiter Finance funding rounds.

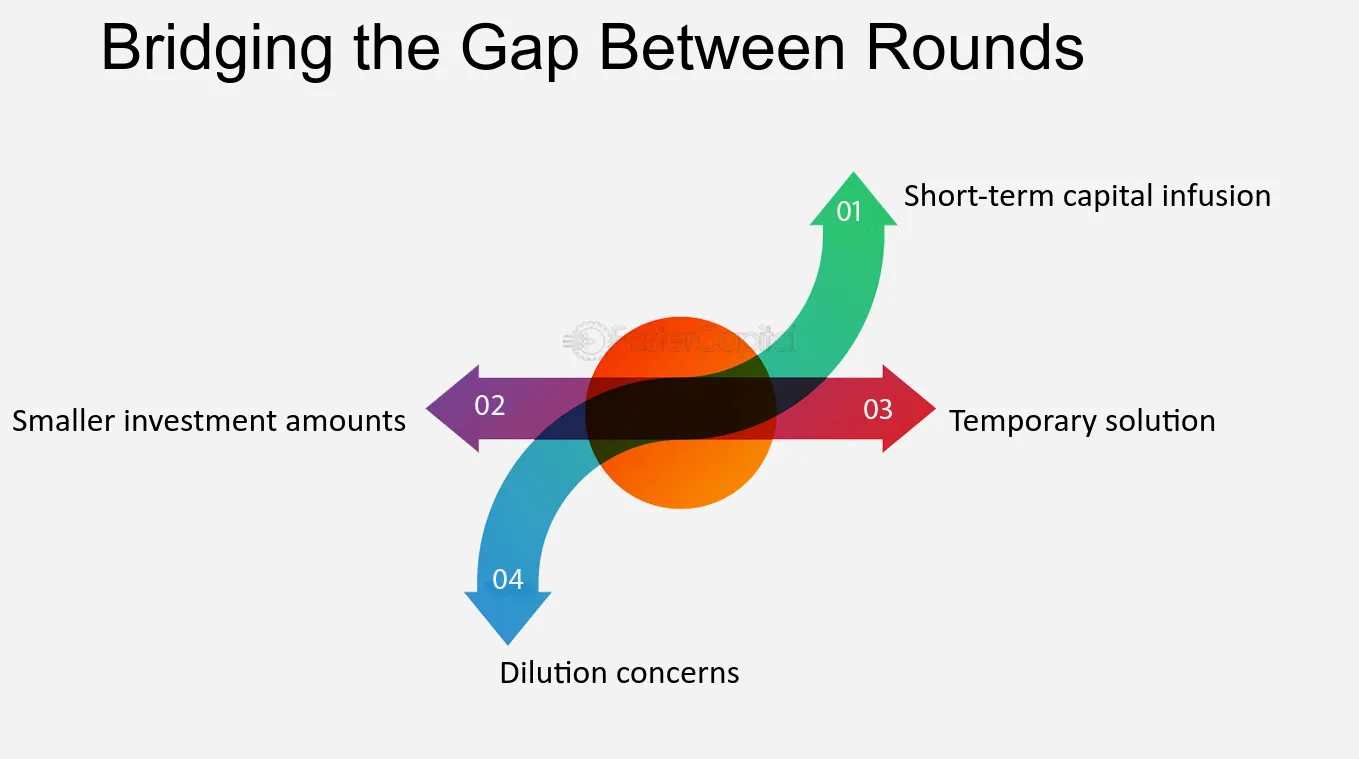

Benefits and risks of Orbiter Finance funding rounds

Orbiter Finance funding rounds present several benefits for both the project and investors. However, they also come with certain risks that should be considered.

Benefits

1. Access to Capital: One of the key benefits of Orbiter Finance funding rounds is that they provide the project with access to capital. This funding can be used to fuel growth, develop new products or services, expand operations, or invest in marketing and sales efforts.

2. Investor Network: Participating in Orbiter Finance funding rounds allows the project to tap into a network of investors. These investors not only provide funding but also bring with them valuable expertise, connections, and guidance. This network can offer strategic advice and open doors to potential partnerships or collaborations.

3. Market Validation: Successfully completing a funding round can act as a validation of the project’s market potential. It demonstrates that investors believe in the project’s vision, business model, and growth prospects. This validation can further enhance the project’s reputation and attract attention from other investors, customers, and potential business partners.

Risks

1. Equity Dilution: One of the main risks associated with funding rounds is the dilution of equity. As more investors participate in the rounds, the ownership stake of existing shareholders gets diluted. This means that founders and early investors may have decreased control and ownership over the project.

2. High Expectations: Funding rounds often come with high expectations from investors. They expect the project to deliver on its promises, generate returns on their investment, and achieve growth targets. Failing to meet these expectations can lead to dissatisfaction among investors, damage the project’s reputation, and make future fundraising more challenging.

3. Investor Relations: Managing investor relations can be a complex task. Communication with a diverse group of investors, addressing their concerns, providing regular updates, and keeping them engaged can be time-consuming and resource-intensive. Failure to effectively manage these relationships could result in strained partnerships or conflicts of interest.

It is crucial for both the project and potential investors to carefully evaluate the benefits and risks associated with Orbiter Finance funding rounds. Thorough due diligence, understanding the terms and conditions, and aligning expectations can help mitigate risks and maximize the benefits of participating in these rounds.

What are the different funding rounds in Orbiter Finance?

Orbiter Finance has different funding rounds, including seed round, Series A, Series B, and Series C. Each of these rounds represents a stage of funding that the company goes through as it grows.

What is the purpose of a seed round in Orbiter Finance?

The seed round in Orbiter Finance is the initial stage of funding where the company raises capital to develop and validate its business idea. It helps to build a prototype, hire a team, and conduct market research.