Exploring the Significance of Margin in Orbiter Finance’s Cross-Rollup Services

Margin is a crucial aspect of Orbiter Finance’s innovative cross-rollup services. With the increasing popularity of decentralized finance (DeFi), understanding the role of margin has become essential for investors looking to optimize their profit potential.

At its core, margin refers to the borrowed funds that investors use to increase their buying power and leverage their trading positions. In the context of Orbiter Finance’s cross-rollup services, margin plays a vital role in enabling users to access liquidity across different blockchains.

By utilizing margin, Orbiter Finance users can take advantage of arbitrage opportunities and maximize their returns by trading on multiple exchanges simultaneously. This innovative approach allows investors to tap into fragmented liquidity pools, ensuring optimal execution of their trades and minimizing slippage.

Orbiter Finance’s cross-rollup services enable users to borrow margin across different blockchains and execute trades with minimal friction. This interoperability is a game-changer in the world of decentralized finance, as it enhances liquidity and opens up a wealth of opportunities for yield farmers and traders alike.

Understanding the role of margin in Orbiter Finance’s cross-rollup services is key to unlocking the full potential of decentralized finance. By leveraging borrowed funds and tapping into fragmented liquidity pools, investors can optimize their profits and take advantage of the rapidly evolving DeFi landscape.

Understanding the concept of leverage and its role in trading

In the world of finance and trading, the concept of leverage plays a crucial role. Leverage refers to the use of borrowed funds to magnify the potential gains or losses of a trade. It allows traders to control larger positions with a relatively smaller investment, amplifying both profits and risks.

Leverage is typically represented as a ratio, such as 1:10 or 1:100, which indicates the amount of funds a trader can control in relation to their own capital. For example, with a leverage ratio of 1:100, a trader can control $10,000 worth of assets with just $100 of their own capital.

The role of leverage in trading is to amplify returns. With leverage, traders have the potential to make higher profits by trading larger positions than they would be able to without it. However, it is important to note that leverage also increases the potential for losses. If a trade goes against the trader, the losses can be magnified, and it is possible to lose more than the initial investment.

Traders must exercise caution when using leverage and understand the risks involved. It is important to have a clear risk management strategy in place and to never risk more than they can afford to lose. Additionally, traders should be aware that leverage can increase the volatility of their positions, as even small market movements can have a significant impact when trading with leverage.

Leverage is commonly used in various financial markets, including stocks, currencies, commodities, and derivatives. It allows traders to take advantage of market opportunities and increase their potential profits. However, it is crucial to have a thorough understanding of how leverage works and the associated risks before using it in trading.

| Pros of leverage | Cons of leverage |

|---|---|

| 1. Increased potential profits | 1. Increased potential losses |

| 2. Ability to trade larger positions | 2. Higher risk and volatility |

| 3. Access to more market opportunities | 3. Possibility of losing more than the initial investment |

Overall, leverage can be a powerful tool in trading when used properly. It allows traders to maximize their potential profits and gain exposure to a larger portion of the market. However, it is important to approach leverage with caution and to always be aware of the associated risks.

The Importance of Margin in Orbiter Finance’s Cross-Rollup Services

Margin plays a crucial role in Orbiter Finance’s cross-rollup services, providing various benefits to traders and liquidity providers. Margin refers to the collateral that traders provide in order to open and maintain their positions. In the context of cross-rollup services, margin ensures the smooth operation and integrity of the platform.

1. Increased Trading Opportunities

By utilizing margin, Orbiter Finance’s cross-rollup services enable traders to amplify their trading power and take advantage of larger trading positions. This increased leverage allows traders to generate higher potential profits compared to traditional spot trading. Margin trading also opens up opportunities for traders to engage in various trading strategies, such as short-selling or using derivatives, to hedge their positions or speculate on price movements.

2. Enhanced Liquidity Provision

Margin is not only beneficial for traders but also for liquidity providers on the Orbiter Finance platform. Liquidity providers can use their capital to supply liquidity to the margin pools, earning fees and incentives in return. Margin pools help ensure that there is sufficient liquidity available for margin traders to execute their trades, further promoting a vibrant and efficient marketplace.

In summary, margin plays a vital role in Orbiter Finance’s cross-rollup services by empowering traders with increased trading opportunities and liquidity providers with enhanced earning potential. It is a fundamental mechanism that supports the efficient functioning of the platform and fosters a dynamic ecosystem for traders and liquidity providers alike.

Exploring the Benefits and Risks of Margin Trading in Orbiter Finance

Margin trading is a popular financial strategy that allows traders to borrow funds to increase their purchasing power in the market. In the context of Orbiter Finance’s cross-rollup services, margin trading offers several benefits, but it also comes with certain risks that traders need to be aware of.

One of the main benefits of margin trading is the ability to amplify potential profits. By using leverage, traders can control larger positions and magnify their gains when the market moves in their favor. This can be particularly advantageous in volatile markets where price fluctuations are more common.

Additionally, margin trading allows traders to diversify their portfolios and access a wider range of investment opportunities. It gives them the flexibility to trade on different exchanges and markets, enabling them to take advantage of various trading strategies and potentially increase their overall returns.

Another benefit of margin trading in Orbiter Finance is the ability to hedge positions. Traders can open short positions to profit from market downturns or to protect their existing long positions. This can help mitigate potential losses and provide a level of risk management in the face of market volatility.

However, it’s important for traders to understand the risks associated with margin trading. One of the main risks is the potential for significant losses. While leverage can amplify gains, it can also magnify losses, resulting in a higher level of risk. Traders need to carefully consider their risk tolerance and use risk management tools to protect their investment.

Furthermore, margin trading requires a thorough understanding of the market and the ability to accurately predict price movements. Incorrect predictions can lead to substantial losses, especially when using leverage. Traders should have a solid trading strategy in place and keep up with market news and trends to make informed decisions.

Another risk of margin trading is the possibility of liquidation. If the market moves against a leveraged position and the trader’s account value falls below a certain threshold, the position may be forcibly closed to prevent further losses. This can result in the loss of the initial investment and any profits made.

In conclusion, margin trading in Orbiter Finance’s cross-rollup services offers various benefits such as increased profit potential, portfolio diversification, and hedging opportunities. However, it also carries risks such as potential losses, the need for accurate market predictions, and the possibility of liquidation. Traders should carefully weigh these factors and consider their own risk tolerance before engaging in margin trading.

How Margin Trading Works on Orbiter Finance’s Cross-Rollup Services

Margin trading is a key feature of Orbiter Finance’s cross-rollup services, allowing users to amplify their trading positions by borrowing funds. With margin trading, users can access a larger pool of funds and potentially increase their profits, but it also comes with increased risk.

What is Margin Trading?

Margin trading is a practice that enables traders to borrow funds and trade with leverage. It allows users to open positions that are larger than their account balance, using the borrowed funds as collateral. In the context of Orbiter Finance’s cross-rollup services, margin trading is facilitated through smart contracts and automated protocols.

When a user wants to margin trade on Orbiter Finance, they can deposit their assets and lock them into a smart contract. This collateral serves as security for the borrowed funds, ensuring that if the trade goes against the user’s position, the lender can liquidate the collateral to recover their funds. In return for the borrowed funds, the user must pay interest on the loan.

Benefits and Risks of Margin Trading

The main benefit of margin trading is the ability to amplify trading positions. By borrowing funds, users can open larger positions and potentially increase their profits. This is especially useful in volatile markets where price movements can be substantial. Margin trading also enables users to diversify their trading strategies and take advantage of market opportunities that may not be feasible with their account balance alone.

However, margin trading also carries significant risks. If the trade goes against the user’s position, they may suffer substantial losses that exceed their initial investment. The borrowed funds are a double-edged sword, as they can amplify both profits and losses. It is crucial for users to understand the risks involved and only trade with what they can afford to lose.

Orbiter Finance’s cross-rollup services aim to provide a secure and efficient platform for margin trading. Through the use of smart contracts and automated protocols, users can access margin trading with ease while minimizing counterparty risk. It is important for users to perform thorough research and monitor their positions closely when engaging in margin trading.

In conclusion, margin trading on Orbiter Finance’s cross-rollup services allows users to amplify their trading positions by borrowing funds. While it offers the potential for increased profits, it is crucial for users to understand the risks involved and trade responsibly.

Step-by-step process of executing margin trades on Orbiter Finance

Margin trading is a powerful tool offered by Orbiter Finance that allows users to borrow additional funds to increase their trading positions. By using margin trading, users can potentially maximize their profits but also expose themselves to greater risk.

Here is a step-by-step guide on how to execute margin trades on Orbiter Finance:

- Step 1: Register and verify your account

- Step 2: Deposit funds into your account

- Step 3: Enable margin trading

- Step 4: Determine your trading strategy

- Step 5: Choose the asset and leverage

- Step 6: Execute the margin trade

- Step 7: Monitor and manage your position

- Step 8: Close your margin trade

- Step 9: Settle your margin borrowing

The first step is to register an account on Orbiter Finance’s platform. Once registered, you will need to complete the verification process, which may include providing identification documents and meeting certain eligibility criteria set by the platform.

After your account is verified, you can deposit funds into your account. Orbiter Finance supports a wide range of cryptocurrencies and fiat currencies, allowing you to choose the currency of your preference.

Before you can start margin trading, you will need to enable this feature in your account settings. Make sure to carefully read and understand the terms and conditions related to margin trading on Orbiter Finance.

Margin trading requires a well-defined trading strategy. Consider factors such as the market conditions, risk tolerance, and potential returns before executing any margin trades. It is important to have a clear plan in place to manage your risk effectively.

Once your trading strategy is in place, select the asset you would like to trade and determine the desired leverage ratio. Leverage allows you to amplify your trading position, but keep in mind that it also amplifies potential losses.

On the Orbiter Finance platform, navigate to the trading interface and input the details of your trade, including the amount, leverage ratio, and desired trade parameters. Review all the details carefully before confirming the trade.

After executing the margin trade, keep a close eye on your position. Regularly monitor the market movements and adjust your stop-loss and take-profit levels accordingly. It is crucial to have a risk management strategy in place to protect your investment.

If the market moves in your favor and you achieve your desired profit, you can choose to close your margin trade. On the other hand, if the market moves against your position and you start incurring losses, you may need to decide whether to close the trade to limit further losses.

Once you close your margin trade, you will need to settle any borrowing incurred. This may involve repaying the borrowed funds along with any interest or fees accrued during the trading period.

Margin trading on Orbiter Finance can be a powerful tool if used wisely, but it is important to be aware of the risks involved. Always conduct thorough research and understand the potential outcomes before engaging in margin trading.

Managing Risk in Margin Trading on Orbiter Finance’s Cross-Rollup Services

Margin trading can be a highly profitable strategy, but it also comes with inherent risks. Orbiter Finance’s Cross-Rollup services aim to provide users with a secure and efficient platform for margin trading, while minimizing the risks involved. In this article, we will explore the various risk management measures implemented by Orbiter Finance to ensure the safety of users’ funds.

1. Leverage Limits

One of the key risk management tools employed by Orbiter Finance is the implementation of leverage limits. Leverage allows traders to amplify their positions and potentially increase their profits. However, excessive leverage can also lead to significant losses. By imposing leverage limits, Orbiter Finance ensures that traders do not overextend themselves and helps protect against large-scale losses.

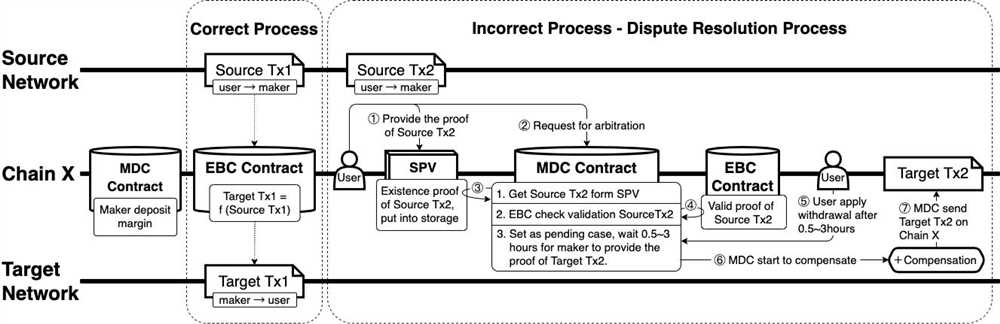

2. Margin Calls and Liquidation

In the event that a trader’s margin falls below a certain threshold, Orbiter Finance’s platform automatically triggers a margin call. This prompts the trader to either add more collateral or close a portion of their position to meet the required margin level. If a trader fails to respond to a margin call within a specified time frame, their position may be liquidated to prevent further losses.

Orbiter Finance’s liquidation system is designed to minimize market impact and maximize user recovery. By using an optimized liquidation algorithm, positions can be efficiently closed without causing excessive slippage or volatility in the market. This helps mitigate the risk of cascading liquidations and ensures that users’ funds are protected.

By implementing these risk management measures, Orbiter Finance aims to provide users with a secure and reliable platform for margin trading. While no system can completely eliminate the risks associated with margin trading, these measures help minimize the potential for large-scale losses and protect users’ funds.

Tips and strategies for minimizing risk and maximizing returns in margin trading

Margin trading can be a highly profitable strategy for investors, but it also carries significant risks. To help you navigate the world of margin trading and make the most of your investments, here are some tips and strategies for minimizing risk and maximizing returns:

1. Understand the risks: Before you engage in margin trading, it is crucial to fully understand the risks involved. Margin trading involves borrowing money to trade larger positions, which amplifies potential losses. Make sure you are aware of the risks and are prepared to accept them.

2. Set strict stop-loss orders: Set stop-loss orders to automatically sell your position if the price drops below a certain level. This can help limit your losses and prevent you from getting emotionally attached to a losing trade.

3. Diversify your portfolio: Spread your investments across different assets and sectors to reduce the impact of any single investment. By diversifying, you can lower your exposure to risk and potentially increase your returns.

4. Start with small positions: When starting out with margin trading, it’s wise to begin with small positions. This allows you to gain experience and learn from any mistakes without risking a significant amount of capital.

5. Monitor the market closely: Keep a close eye on market trends and developments. Stay updated on news that might impact your investments and be prepared to adjust your trading strategy accordingly.

6. Use proper risk management techniques: Implement risk management techniques such as setting a maximum percentage of your capital to risk on any single trade. This helps protect your capital in case of adverse market conditions.

7. Take profits when you can: Don’t get too greedy and hold onto a winning trade for too long. Take profits when you have reached your target and consider re-evaluating your positions regularly.

8. Keep emotions in check: Emotions can cloud judgment when trading on margin. Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

9. Stay informed about margin requirements: Margin requirements can change, especially during volatile market conditions. Stay informed about the margin requirements of your trading platform to avoid unexpected margin calls.

10. Seek professional advice: If you are unsure about margin trading or need help developing a trading strategy, consider seeking professional advice from a qualified financial advisor.

By following these tips and strategies, you can minimize the risks associated with margin trading and increase your chances of generating higher returns.

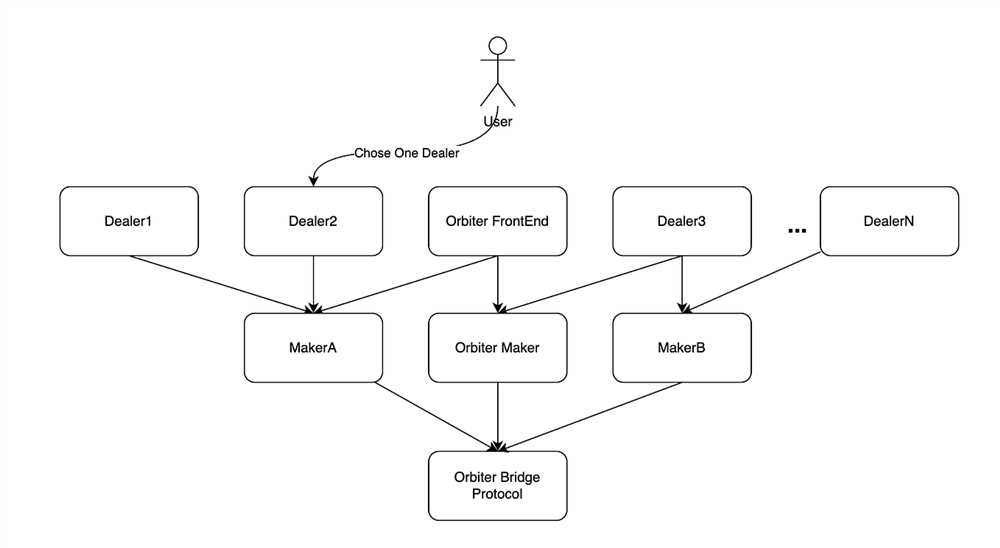

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol that offers cross-rollup services for margin trading. It allows users to access margin trading across different rollup chains, providing them with more liquidity and trading opportunities.

How does Margin work in Orbiter Finance?

In Orbiter Finance, margin trading allows users to borrow funds to amplify their trading positions. Users can pledge their assets as collateral and borrow a certain amount of funds to increase their trading power. However, margin trading also involves risks, as users can be liquidated if the value of their collateral drops below a certain threshold.