For many investors in the world of cryptocurrencies, the fear of being rug pulled is a legitimate concern. Rug pulling refers to the act of developers or insiders of a project abruptly pulling out, taking with them a large portion of the investors’ funds. This practice has become alarmingly common in the DeFi space, causing investors to be wary of new projects and their potential for rug pulls.

One project that has recently caught the attention of investors is Orbiter Finance. With its innovative approach to decentralized finance and promises of high returns, many are curious about the measures Orbiter Finance has taken to prevent rug pulls and protect investors.

Orbiter Finance understands the importance of maintaining trust and transparency in the DeFi ecosystem. To address the rug pull concerns, the team has implemented several key features and strategies. First and foremost, Orbiter Finance has renounced ownership of its smart contract, ensuring that no single entity has the ability to make changes or manipulate the platform. This decentralization is a crucial step in protecting investors from rug pulls.

In addition to renouncing ownership, Orbiter Finance has also undergone a thorough security audit by a reputable third-party firm. This audit ensures that the platform’s smart contract is free from vulnerabilities and potential security risks. By subjecting their code to external scrutiny, Orbiter Finance demonstrates its commitment to providing a secure and reliable platform for investors.

Furthermore, Orbiter Finance has implemented a transparent and open communication strategy. The team regularly updates the community on the project’s progress, future plans, and any potential risks. This level of transparency helps build trust among investors and ensures that any concerns or issues can be addressed promptly.

Overall, Orbiter Finance’s response to rug pull concerns showcases their dedication to creating a safe and trustworthy investment platform. By renouncing ownership, undergoing security audits, and maintaining open communication, Orbiter Finance aims to alleviate the fears of investors and provide a secure environment for participating in decentralized finance.

The Origins of Rug Pull Concerns in DeFi

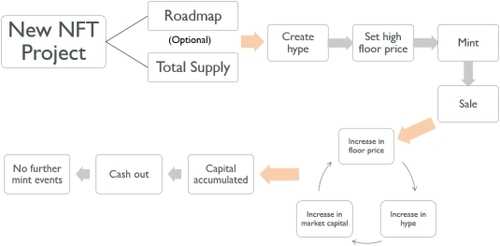

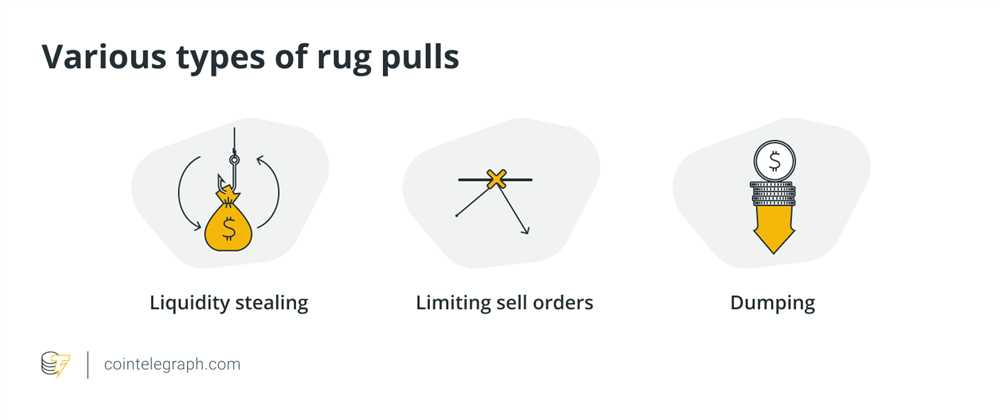

The concept of rug pulling originated in the decentralized finance (DeFi) space, specifically within the realm of token investing. Rug pulls refer to a deceptive practice where developers or token creators abandon a project after attracting substantial funds from investors. This results in a sudden and significant drop in the token’s value, leaving investors with little to no recourse.

Rug pulls gained prominence in the DeFi ecosystem as the space exploded in popularity, leading to an influx of new projects and tokens. While DeFi presents exciting opportunities for investors to participate in decentralized financial systems, it also creates an environment ripe for malicious actors to take advantage of unsuspecting investors.

Many rug pulls occur in the form of exit scams, where developers who initially present themselves as trustworthy and credible suddenly vanish after accumulating a significant amount of funds. They often employ various tactics to gain the trust of investors, such as audited smart contracts, community engagement, and endorsements from influencers.

These rug pulls can have devastating consequences for investors, causing them to lose substantial amounts of money. There have been instances where rug pulls have resulted in losses of millions of dollars within a matter of minutes.

As rug pulls became more prevalent, the DeFi community started to take notice and become increasingly vigilant. Investors began scrutinizing projects more thoroughly, conducting due diligence, and seeking transparency from developers. Additionally, auditing firms and independent analysts emerged to evaluate and assess the legitimacy of projects.

Various platforms and communities within the DeFi ecosystem also started implementing safeguards to mitigate the risk of rug pulls. These include measures such as locked liquidity, time-locks on developer funds, and decentralized governance to ensure community involvement in decision-making processes.

Despite the efforts to combat rug pulls, they still pose a significant threat to the DeFi space. Investors must remain cautious and informed, conducting thorough research and exercising due diligence before investing in any project.

Rug pulls have undoubtedly raised concerns within the DeFi community and highlighted the need for improved security and trust in the ecosystem. By understanding the origins of rug pull concerns and learning from past incidents, the DeFi ecosystem can continue to evolve and provide a safer environment for investors.

The Impact of Rug Pulls on Investors

Rug pulls in the cryptocurrency market have become a major concern for investors. These fraudulent schemes involve the sudden withdrawal of funds by individuals or groups responsible for a project, leaving investors with little to no recourse to recover their losses.

One of the most significant impacts of rug pulls is the loss of trust in the project and the wider cryptocurrency community. Investors who fall victim to rug pulls may become hesitant to invest in future projects, fearing a similar outcome. This loss of trust can have a long-term detrimental effect on the overall market, making it harder for genuine projects to attract funding and support.

Rug pulls also have a direct financial impact on investors. In many cases, investors lose their entire investment when a rug pull occurs. These losses can be devastating for individuals who may have invested significant amounts of money, hoping to see substantial returns. The sudden disappearance of funds leaves investors with little to no chance of recovering their money, leading to financial hardships and potential bankruptcy.

Furthermore, rug pulls can have a negative psychological impact on investors. The feeling of being deceived and betrayed can lead to emotional distress and anxiety. Investors may feel embarrassed for falling victim to a fraudulent scheme, and their confidence in their own investment decisions may be shaken.

The impact of rug pulls extends beyond individual investors. They can also harm the broader cryptocurrency ecosystem and hinder its adoption. When news of rug pulls spreads, it erodes trust in the entire market, discouraging potential investors from participating. This lack of confidence can slow down the growth of the cryptocurrency sector, preventing it from reaching its full potential.

In conclusion, rug pulls have a significant impact on investors, both financially and emotionally. They erode trust in the market, cause financial losses, and hinder the growth and adoption of cryptocurrency. To protect investors and ensure the long-term success of the market, it is crucial for regulators and participants to implement stricter measures to detect and prevent rug pulls.

Introducing Orbiter Finance: A Solution to Rug Pull Concerns

With the rise in popularity of decentralized finance (DeFi), rug pulls have become a major concern for investors. Rug pulls refer to malicious acts where developers of a DeFi project drain the liquidity pool and run away with investors’ funds. This has resulted in a loss of trust and confidence in the DeFi space.

Orbiter Finance aims to address these concerns by providing a secure and transparent platform for investors. Built on the Binance Smart Chain (BSC), Orbiter Finance ensures its users a rug pull-free experience.

One of the key features of Orbiter Finance is its automated liquidity pool (LP) lock. Unlike traditional DeFi projects, where developers have full control over the LP funds, Orbiter Finance locks the LP tokens immediately after the project launch. This ensures that the LP funds are safe and cannot be accessed by anyone, not even the developers.

Additionally, Orbiter Finance implements a set of strict auditing and verification processes. The project undergoes a thorough security audit by reputable third-party firms to ensure that the contract is free from vulnerabilities and loopholes. Furthermore, Orbiter Finance’s smart contracts are verified and made publicly available for anyone to review, ensuring transparency and trust.

Orbiter Finance also introduces a community-driven governance model. By allowing token holders to participate in decision-making processes, Orbiter Finance ensures that the interests of its community members are represented. This not only brings accountability but also ensures that the project’s direction is aligned with the needs of its users.

Lastly, Orbiter Finance has a strong commitment to education and user support. The project provides extensive documentation and resources to educate users about rug pulls and how to identify and avoid them. Orbiter Finance also offers a dedicated support team to assist users and address any concerns or questions that may arise.

By integrating various security measures, a community-driven governance model, and a strong focus on user support and education, Orbiter Finance aims to set a new standard in DeFi and provide a safe and reliable platform for investors.

Understanding Orbiter Finance’s Security Measures

When it comes to investing in cryptocurrency projects, security is a top priority. Orbiter Finance understands this concern and has implemented several security measures to protect its users’ funds. These measures are designed to safeguard against potential rug pulls and other fraudulent activities.

Audited Smart Contracts

Orbiter Finance’s smart contracts have undergone extensive audits by reputable third-party firms. These audits help identify any vulnerabilities or weaknesses in the code that could be exploited by malicious actors. By ensuring that the smart contracts are safe and secure, Orbiter Finance aims to provide its users with peace of mind.

Transparent and Publicly Available Code

Orbiter Finance believes in transparency and provides its users with access to its smart contract code. This allows users to review the code themselves and verify its security. By making the code publicly available, Orbiter Finance aims to foster trust and confidence among its user base.

Community Governance

One of the key security measures implemented by Orbiter Finance is community governance. This means that the decision-making process and project direction are voted on by the community. By involving the community in the decision-making process, Orbiter Finance aims to prevent any potential malicious actions that could harm the project and its users.

Additionally, community governance helps to ensure transparency and accountability. Users can actively participate in discussions, propose changes, and vote on important project decisions. This collective effort promotes a sense of ownership and responsibility among the community members.

Robust Risk Assessment and Management

Orbiter Finance employs a comprehensive approach to risk assessment and management. The team diligently identifies and assesses potential risks, both internal and external, to the project’s security. By staying vigilant and proactive, Orbiter Finance aims to mitigate any potential threats and vulnerabilities.

To further enhance its security measures, Orbiter Finance continuously evaluates and updates its risk management strategies, incorporating the latest industry best practices.

In conclusion, Orbiter Finance recognizes the importance of security in the cryptocurrency space and has taken several measures to protect its users’ funds. Through audited smart contracts, transparent code, community governance, and robust risk assessment and management, Orbiter Finance strives to provide a secure investment environment for its users.

The Role of Audits and Smart Contract Design

When it comes to rug pull concerns and ensuring the security of decentralized finance protocols, two crucial factors come into play: audits and smart contract design.

Audits play a vital role in identifying potential vulnerabilities and flaws in the code of a smart contract. By conducting comprehensive audits, developers can ensure that their code is secure and free from any potential risks. Audits involve a thorough review of the code, analyzing its logic, functionality, and potential vulnerabilities.

There are different levels of audits, ranging from basic code reviews to more comprehensive security audits. These audits are typically performed by independent third-party firms specializing in blockchain security. Their expertise and experience in identifying vulnerabilities make them an essential component in securing decentralized finance protocols.

Smart contract design is another critical element in preventing rug pulls. Well-designed contracts will have built-in security measures and features to mitigate potential risks. This includes employing best practices such as using well-tested libraries, implementing secure coding patterns, and conducting rigorous testing.

One of the key aspects of smart contract design is the use of multiple layers of security. This involves employing various security mechanisms such as access controls, permission systems, and encryption. By implementing these layers, developers can greatly reduce the risk of rug pulls and malicious attacks.

Furthermore, continuous monitoring and updates are crucial to maintaining the security of a decentralized finance protocol. As new vulnerabilities and attack vectors emerge, it is essential for developers to stay vigilant and address any potential threats promptly.

In conclusion, audits and smart contract design play a crucial role in ensuring the security of decentralized finance protocols. By conducting comprehensive audits and implementing robust smart contract design practices, developers can minimize the risk of rug pulls and provide users with a secure and reliable financial ecosystem.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) project that aims to provide users with a secure and efficient platform for investing and earning passive income. It utilizes smart contracts on the Ethereum blockchain to automate various financial services, such as lending, borrowing, and yield farming.

What is a rug pull?

A rug pull is a deceptive maneuver commonly seen in the world of decentralized finance (DeFi), where the creators of a project suddenly and intentionally drain the liquidity or funds from the project, leaving investors with worthless tokens. This usually results in significant financial losses for investors who have invested their money in the project.

How has Orbiter Finance addressed rug pull concerns?

Orbiter Finance has taken several measures to address rug pull concerns and ensure the security of its users’ funds. Firstly, it conducts thorough audits of its smart contracts by reputable third-party auditing firms to identify and fix any vulnerabilities. Additionally, it implements strict security protocols, such as multi-signature wallets and time locks, to prevent unauthorized access and ensure the safe storage of funds. Lastly, it has established a transparent and open communication channel with its community, providing regular updates and addressing any concerns or questions raised by its users.