Are you tired of struggling with your personal finances? Do you want to learn the secrets of successful money management? Look no further than Orbiter Finance! Our expert team has years of experience and insider knowledge to help you unlock the power of financial success.

With Orbiter Finance, you’ll gain a deep understanding of the strategies and tactics that can make a real difference in your financial well-being. Whether you’re looking to save for retirement, pay off debt, or simply build a better budget, our tips and tricks are designed to help you achieve your goals.

Maximize your potential with our proven techniques that have helped countless individuals and families take control of their finances. From budgeting basics to advanced investment strategies, our comprehensive guides will empower you to make informed decisions and set you on the path to financial independence.

Don’t let financial stress hold you back from living the life you truly desire. Trust Orbiter Finance to guide you towards a brighter, more prosperous future.

Unlocking Success with Orbiter Finance

Orbiter Finance is more than just a tool for managing your finances. It’s a comprehensive platform that can help you unlock your full potential and achieve success in your financial journey.

With Orbiter Finance, you gain access to a wide range of features and tools that are designed to provide you with the knowledge and strategies needed to make informed financial decisions. Through our tips and tricks, you can take control of your money and maximize your wealth.

One of the key advantages of Orbiter Finance is its ability to provide personalized recommendations based on your unique financial goals and circumstances. Our intelligent algorithms analyze your spending patterns, savings habits, and investment preferences to offer tailored advice that can accelerate your financial growth.

Discover the power of budgeting: Orbiter Finance equips you with the tools to create and maintain a budget that works for you. By understanding your income and expenses, you can plan your finances more effectively and avoid unnecessary debt. Our intuitive interface makes it easy to track your progress and make adjustments as needed.

Make your money work for you: Orbiter Finance helps you optimize your investments and grow your wealth. Our platform offers insights into various investment opportunities, such as stocks, bonds, and real estate. With our expert guidance and market analysis, you can make informed decisions to maximize your returns and achieve long-term financial success.

Protect yourself from financial pitfalls: Orbiter Finance provides tips and tricks to help you navigate financial challenges. From managing debt to dealing with unexpected expenses, our platform offers strategies to keep you on track and safeguard your financial well-being.

Unlock your financial potential with Orbiter Finance. Start your journey today and take control of your financial future.

The Power of Orbiter Finance

Orbiter Finance is a powerful tool that can help you achieve success in your financial journey. With its innovative features and expert advice, Orbiter Finance provides you with the knowledge and tools to take control of your finances and make informed decisions.

One of the key powers of Orbiter Finance is its ability to provide personalized financial tips and tricks. Through advanced algorithms and machine learning, Orbiter Finance analyzes your financial situation and provides tailored recommendations. Whether you want to save for a specific goal or optimize your investments, Orbiter Finance can help you navigate the complex world of finance.

Orbiter Finance also offers a range of educational resources to help you improve your financial literacy. From articles and tutorials to interactive tools and calculators, Orbiter Finance provides you with the knowledge and skills to make smart financial choices.

Another powerful feature of Orbiter Finance is its ability to track and monitor your financial progress. With its intuitive dashboard, you can easily visualize your income, expenses, and investments. You can set goals, track your spending habits, and receive alerts and notifications to stay on top of your finances.

Orbiter Finance is not just a financial tool – it is a partner in your financial journey. Whether you are a beginner or an experienced investor, Orbiter Finance provides you with the resources and support you need to succeed. Take control of your financial future with the power of Orbiter Finance.

Understanding Orbiter Finance Tips

Orbiter Finance is dedicated to helping individuals and businesses achieve financial success and stability. We understand the importance of managing your finances wisely, and we’re here to provide you with valuable tips and advice. By implementing these tips, you can take control of your financial future and make informed decisions.

1. Create a Budget

One of the first steps to financial success is creating a budget. This allows you to track your income and expenses, prioritize your spending, and save for the future. Start by listing all your sources of income and categorizing your expenses. Make sure to allocate funds for savings and emergency funds.

2. Reduce Your Debt

Debt can be a significant burden on your finances. Make it a priority to reduce and eliminate debt as much as possible. Focus on paying off high-interest debts first and consider consolidation options to streamline your payments. By reducing your debt, you can free up more money for savings and investments.

| Tips | Benefits |

|---|---|

| 1. Track your expenses | Identify areas for cost-cutting |

| 2. Automate your savings | Build a nest egg for the future |

| 3. Diversify your investments | Reduce risk and maximize returns |

| 4. Educate yourself about personal finance | Make informed decisions |

| 5. Consult with a financial advisor | Get professional guidance |

Remember, achieving financial success is a journey. By following these Orbiter Finance tips and making smart choices, you can improve your financial health and achieve your long-term goals.

Achieving Financial Freedom

When it comes to achieving financial freedom, Orbiter Finance understands your needs. We believe that everyone has the potential to gain control over their financial situation, and we are here to help you do just that.

Setting financial goals: The first step in achieving financial freedom is setting clear and achievable goals. Whether your goal is to save for retirement, pay off debt, or buy your dream home, we can provide you with the tools and guidance to create a solid financial plan.

Creating a budget: A budget is a crucial tool in managing your finances effectively. Our experts can teach you how to create a budget that tracks your income and expenses and helps you allocate your funds towards your financial goals.

Investing wisely: Investing is a key component of building long-term wealth. We can help you understand different investment options and develop an investment strategy that aligns with your risk tolerance and financial goals.

Managing debt: Debt can be a major obstacle to achieving financial freedom. Our team can offer strategies and advice for managing and reducing your debt, so you can take control of your financial future.

Building an emergency fund: Life is full of unexpected expenses, and having an emergency fund is essential to protect your financial stability. We can guide you in building an emergency fund that will provide a safety net during challenging times.

Developing good financial habits: Creating sustainable financial habits is vital for long-term success. Our resources and tips can help you develop good habits, such as saving consistently, avoiding unnecessary expenses, and staying disciplined with your financial goals.

Continued education: The world of finance is constantly evolving, and staying informed is crucial. Orbiter Finance provides ongoing educational resources, such as webinars and articles, to keep you updated on the latest trends and strategies in personal finance.

With Orbiter Finance by your side, achieving financial freedom is within reach. Contact us today to start your journey towards a secure and prosperous future.

Orbiter Finance Strategies

When it comes to achieving financial success, having effective strategies in place is crucial. At Orbiter Finance, we understand the importance of implementing the right approaches that will help you reach your financial goals. In this section, we will explore some tried and tested strategies that can propel your financial journey to new heights.

1. Diversify Your Investments

One of the key strategies to minimize risk and maximize returns is to diversify your investments. This involves spreading your investment portfolio across different asset classes such as stocks, bonds, real estate, and commodities. By diversifying, you can reduce the impact of any single investment’s poor performance on your overall portfolio.

2. Create a Budget

A budget is an essential tool for managing your finances effectively. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards savings and investments. By creating a realistic budget and sticking to it, you can take control of your spending and ensure that you are saving enough to achieve your financial goals.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund in place can provide you with a safety net during difficult times. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This will give you peace of mind knowing that you have a financial cushion to fall back on in case of job loss, medical emergencies, or other unexpected events.

4. Pay Off High-Interest Debt

High-interest debt, such as credit card debt, can quickly accumulate and become a burden. Make it a priority to pay off any high-interest debt as soon as possible. By eliminating this debt, you can free up more money for savings and investments, and avoid wasting money on interest payments.

5. Seek Professional Advice

Managing your finances can be complex, and seeking professional advice can help you make informed decisions and optimize your financial strategies. Consider working with a financial advisor who can provide guidance tailored to your specific goals and circumstances. They can help you navigate through market fluctuations, tax planning, retirement savings, and other important financial considerations.

By implementing these Orbiter Finance strategies, you can take control of your financial future and work towards achieving your goals with confidence and success.

Tips and Tricks for Success

Orbiter Finance is dedicated to helping you achieve financial success. We understand that financial management can be overwhelming, so we have compiled some tips and tricks to help you navigate the complex world of personal finance.

1. Set Clear Financial Goals

Start by setting clear and achievable financial goals. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having specific goals will give you direction and motivation.

2. Create a Budget

A budget is an essential tool for managing your money. Take the time to track your income and expenses to identify areas where you can cut back and save. Stick to your budget and make adjustments as needed.

3. Save and Invest

Make saving and investing a priority. Set aside a portion of your income each month and consider automating your savings. Explore different investment options to grow your wealth and secure your financial future.

4. Pay off Debt

High-interest debt can hinder your financial progress. Develop a plan to pay off your debts strategically. Consider using the debt snowball or debt avalanche method and make extra payments whenever possible.

5. Educate Yourself

Take the time to educate yourself about personal finance. Read books, articles, or attend workshops to expand your knowledge. The more you understand about money management, the better equipped you will be to make informed financial decisions.

6. Seek Professional Advice

If you are unsure about certain financial matters or need guidance, don’t be afraid to seek professional advice. A financial advisor can provide personalized strategies and help you make the most of your money.

Remember, achieving financial success takes time and effort. Stay committed to your goals, stay informed, and make smart financial choices. With Orbiter Finance’s tips and tricks, you are on the right path to a prosperous future.

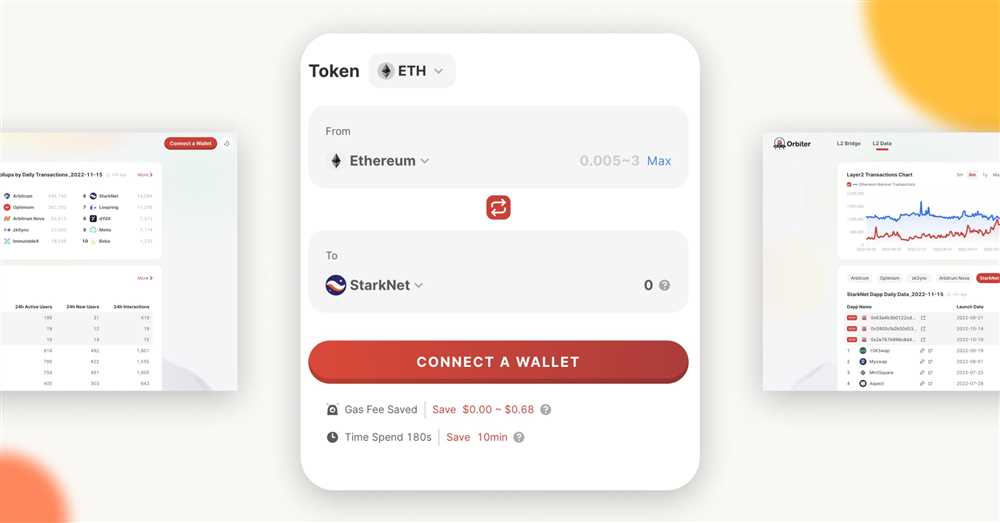

What is Orbiter Finance?

Orbiter Finance is a financial platform that provides tips and tricks for achieving success in the financial world. It offers insights and strategies for managing money, investing, and reaching financial goals.

What kind of tips and tricks does Orbiter Finance provide?

Orbiter Finance provides a wide range of tips and tricks for success in the financial world. It covers topics such as personal finance management, budgeting, saving, debt management, investing, and building wealth. The platform offers step-by-step guides, expert advice, and practical strategies to help users make informed financial decisions and achieve their financial goals.

Can Orbiter Finance help me with investing?

Yes, Orbiter Finance can definitely help with investing. The platform provides tips and tricks for successful investing, including choosing the right investment opportunities, diversifying portfolios, managing risks, and maximizing returns. It offers insights into different investment options such as stocks, bonds, mutual funds, real estate, and more. Whether you are a beginner investor or an experienced one, Orbiter Finance can help you make smarter investment decisions.