Orbiter Finance has become an increasingly popular investment opportunity in recent years. This innovative financial system offers individuals the chance to earn high returns on their investments, but it also comes with its fair share of risks. In this article, we will explore the various risks and rewards associated with Orbiter Finance, providing a balanced perspective for investors looking to get involved.

One of the main attractions of Orbiter Finance is the potential for high returns. The system operates by pooling investments together and using them to fund various projects and ventures. These projects can range from startups to real estate development, and the returns can be significant. Investors have the opportunity to earn substantial profits, with some reported returns reaching double or even triple digits.

However, with the potential for high returns come significant risks. Orbiter Finance operates in a highly volatile market, and investments can be subject to sudden and dramatic fluctuations. Market downturns or unexpected events can lead to losses, and investors must be prepared to accept these risks. It is important to approach Orbiter Finance with a clear understanding of the potential for both profits and losses.

Another risk associated with Orbiter Finance is the lack of regulation and oversight. Unlike traditional financial institutions, Orbiter Finance operates outside of government control. While this can provide investors with more freedom and flexibility, it also exposes them to potential scams and fraudulent activities. Investors must be diligent in conducting due diligence and ensuring they are dealing with reputable platforms and investment opportunities.

In conclusion, Orbiter Finance offers investors the opportunity for high returns, but it also comes with significant risks. It is crucial for individuals to approach this innovative financial system with caution and diligence. By understanding the potential rewards and risks associated with Orbiter Finance, investors can make informed decisions and navigate this exciting market with confidence.

Understanding the Concept of Orbiter Finance

Orbiter finance is a relatively new concept in the world of investing and finance. It refers to a strategy where investors allocate a portion of their investment portfolio to projects that are related to space exploration and the technology behind it.

This concept is based on the belief that space exploration and technology will play a significant role in shaping the future of humanity. By investing in companies and projects in the space industry, investors hope to capitalize on the potential for growth and profit that this sector presents.

One of the main reasons why orbiter finance is gaining popularity is the increasing interest and investment in space exploration. Governments and private companies around the world are investing heavily in space missions, satellite technology, and other space-related projects. This creates an environment where there are plenty of opportunities for investors to participate and potentially profit.

However, like any investment strategy, orbiter finance comes with its own set of risks. The space industry is highly speculative, with many companies and projects failing to deliver on their promises. This makes it crucial for investors to conduct thorough research and due diligence before allocating their funds to specific projects.

Another risk associated with orbiter finance is the long-term nature of many space projects. Investments in space exploration often take several years or even decades to materialize into profits. This means that investors need to have a long-term investment horizon and be prepared to wait for their investments to pay off.

The potential rewards of orbiter finance

Despite the risks involved, orbiter finance can also offer significant rewards for investors. The space industry is evolving rapidly, with advancements in technology and increased interest from various sectors. This creates opportunities for companies and projects to innovate and grow.

Investing in orbiter finance allows investors to participate in the growth of the space industry and potentially benefit from the successes of individual companies and projects. It also allows investors to support the advancement of space exploration and technology, which can have far-reaching impacts on society as a whole.

In conclusion

Orbiter finance is a concept that combines investment opportunities with a passion for space exploration and technology. While it presents potential rewards, it also comes with risks that investors should be aware of. With proper research and due diligence, investors can navigate this exciting sector and potentially benefit from the growth and advancements in the space industry.

The Potential Gains from Orbiter Finance

Orbiter Finance offers a unique opportunity for investors to gain significant financial benefits. Here are some potential gains that can be achieved through Orbiter Finance:

- High Returns: One of the main attractions of Orbiter Finance is the potential for high returns on investment. By providing liquidity to space exploration projects, investors can earn substantial profits if the projects succeed and their tokens appreciate in value.

- Diversification: Investing in Orbiter Finance allows investors to diversify their portfolios beyond traditional asset classes. This can help reduce overall risk by spreading investments across different projects and industries.

- Access to Early-Stage Investments: Orbiter Finance provides investors with access to early-stage space projects that may have limited funding options. By investing in these projects, investors can potentially benefit from their growth and success as they move from concept to reality.

- Tokenization Benefits: Orbiter Finance leverages blockchain technology to tokenize assets and enable fractional ownership. This means that investors can have access to assets that were previously inaccessible or required large sums of capital to invest in.

- Supporting Innovation: Investing in Orbiter Finance not only offers financial gains but also supports innovation in the space industry. By providing funds to space projects, investors contribute to the development of new technologies and advancements in space exploration.

Overall, Orbiter Finance presents a range of potential gains for investors, including high returns, diversification, access to early-stage investments, tokenization benefits, and supporting innovation in the space industry. However, it’s important to note that investing in Orbiter Finance also carries risks, and investors should conduct thorough research and seek professional advice before making any investment decisions.

The Possible Pitfalls of Orbiter Finance

While there are undoubtedly many benefits to orbiter finance, it is important to also consider the potential risks and pitfalls involved. The following are some of the key concerns that investors and users should be aware of:

- Volatility: The cryptocurrency market, which is closely tied to orbiter finance, is notoriously volatile. Prices can fluctuate wildly in a short period of time, which can lead to both significant gains and losses. Investors need to be prepared for this level of volatility and have a risk management strategy in place.

- Regulatory Uncertainty: Governments around the world are still figuring out their approach to cryptocurrency and decentralized finance. This can lead to uncertainty and potential crackdowns or regulatory changes that could impact the use and viability of orbiter finance. Users and investors need to stay informed and be prepared for potential shifts in the regulatory landscape.

- Hacking and Security Risks: The decentralized nature of orbiter finance means that there is no central authority or entity responsible for security. This can make the system vulnerable to hacking and security breaches. It is important for users to take steps to secure their investments and be aware of potential risks.

- Limited Adoption: While the popularity of orbiter finance has been growing, it is still a relatively new and niche technology. This means that its adoption may be limited and it may not be widely accepted or recognized by mainstream financial institutions and individuals. This lack of adoption could impact liquidity and limit the potential for growth and development.

- Smart Contract Risks: Orbiter finance relies heavily on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. While smart contracts can offer efficiency and transparency, they are not immune to bugs and vulnerabilities. A single bug or vulnerability in a smart contract can lead to significant financial losses, so users need to thoroughly review and test smart contracts before interacting with them.

It is important to approach orbiter finance with a clear understanding of these potential pitfalls and to carefully weigh the risks against the potential rewards. By staying informed, being proactive, and conducting thorough due diligence, users and investors can navigate the world of orbiter finance and make informed decisions.

Making an Informed Decision about Orbiter Finance

When considering whether to invest in Orbiter Finance, it is crucial to make an informed decision. While there are potential risks involved, there are also rewards to be gained. By carefully weighing the pros and cons and gathering relevant information, you can determine whether Orbiter Finance is the right investment for you.

Here are some key factors to consider:

- Risk assessment: Before investing in Orbiter Finance, it is important to conduct a thorough risk assessment. Evaluate the potential risks associated with the platform, such as market volatility, regulatory changes, and security vulnerabilities. Understanding these risks will help you make an informed decision.

- Market analysis: Analyze the market trends and dynamics of the cryptocurrency industry. Consider how Orbiter Finance fits into the overall market and whether it has the potential for long-term growth. Look for any competitive advantages or unique features that could set it apart from other platforms.

- Financial stability: Examine Orbiter Finance’s financial stability and track record. Assess the company’s financial statements, profitability, and liquidity. Look for signs of consistent growth and a strong financial position.

- User feedback: Seek out feedback and reviews from other users of Orbiter Finance. Consider joining online communities and forums to gather insights and experiences. This can provide valuable information about the platform’s usability, customer support, and overall satisfaction among users.

- Transparency: Evaluate the transparency and openness of Orbiter Finance. Look for information about the team behind the platform, their experience, and any partnerships they have established. Transparency is crucial in building trust and confidence in an investment opportunity.

By taking these factors into account, you can make a more informed decision about whether to invest in Orbiter Finance. Remember to carefully assess the risks and rewards, conduct thorough research, and seek professional advice if needed. Investing in any financial product carries its own set of risks, so it’s important to approach it with caution and diligence.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) platform that allows users to earn rewards by providing liquidity to different tokens in the ecosystem.

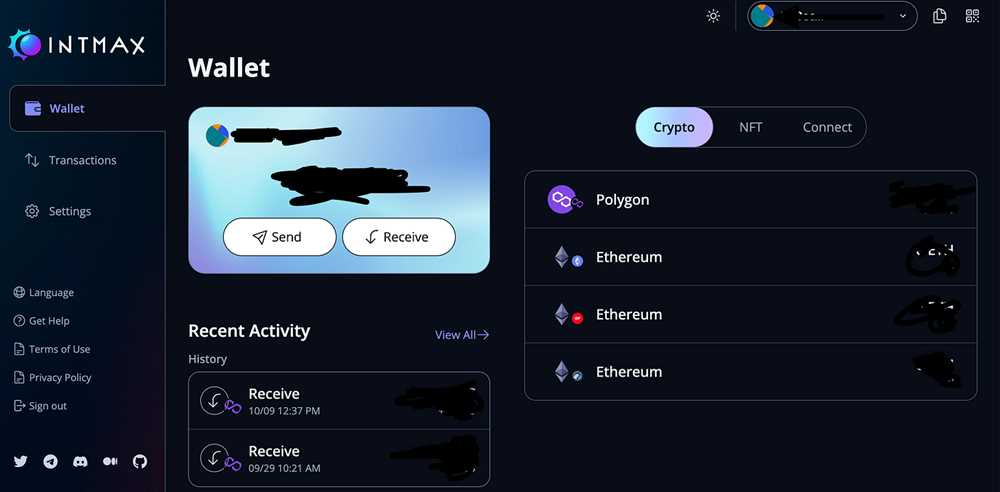

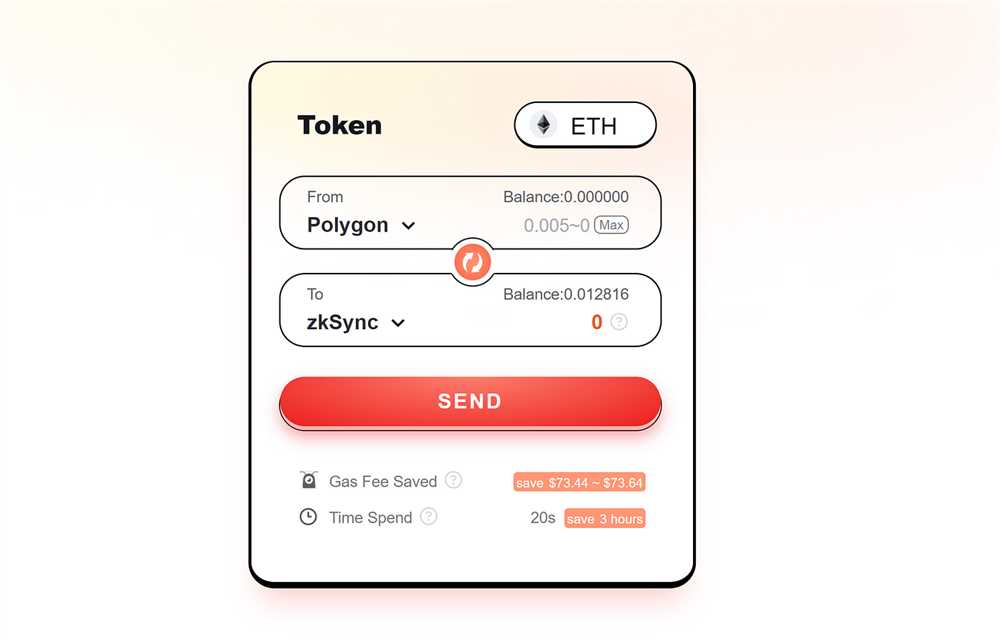

How can I start using Orbiter Finance?

To start using Orbiter Finance, you need to connect your wallet to the platform and deposit your desired tokens into the liquidity pool. Once your tokens are in the pool, you will start earning rewards based on the amount of liquidity you provide.