Advantages of Orbiter Finance: Diving into the Maturity of Decentralized Finance in the Lending and Borrowing Space

Experience the future of finance with Orbiter Finance, a decentralized lending and borrowing platform powered by blockchain technology.

Are you tired of traditional banks controlling your money and limiting your financial options? With Orbiter Finance, you can take full control of your finances, free from intermediaries and unnecessary fees.

Our innovative platform allows you to lend and borrow digital assets in a secure and transparent manner. By leveraging the power of blockchain, Orbiter Finance ensures that your transactions are fast, efficient, and immutable.

What sets Orbiter Finance apart? We provide a seamless and user-friendly experience for both lenders and borrowers. With our intuitive interface, you can easily browse through a wide range of lending and borrowing options.

For lenders, Orbiter Finance offers:

- Opportunities to earn passive income by lending your digital assets

- Flexible lending terms and interest rates

- Ability to diversify your portfolio with different asset types

For borrowers, Orbiter Finance offers:

- Access to a wide range of digital assets for borrowing

- Competitive interest rates and flexible repayment terms

- No credit checks or lengthy application processes

Join the decentralized finance revolution with Orbiter Finance and unlock a world of financial possibilities. Whether you are a lender looking to grow your wealth or a borrower in need of funds, our platform is here to empower you.

Take control of your financial future with Orbiter Finance today!

The Evolution of Lending and Borrowing

In the world of finance, lending and borrowing have long been essential components. From the early days of bartering goods and services, to the development of traditional banking systems, the concept of lending and borrowing has evolved over time to meet the needs of individuals and businesses alike.

Ancient Origins

Lending and borrowing can be traced back to ancient civilizations, where individuals would lend resources to others in exchange for something of value in return. This primitive form of lending and borrowing laid the groundwork for future financial systems.

Modern Banking Systems

With the advent of modern banking systems, lending and borrowing became more formalized and regulated. Banks began offering loans and credit facilities, enabling individuals and businesses to access capital for various purposes. This marked a significant milestone in the evolution of lending and borrowing.

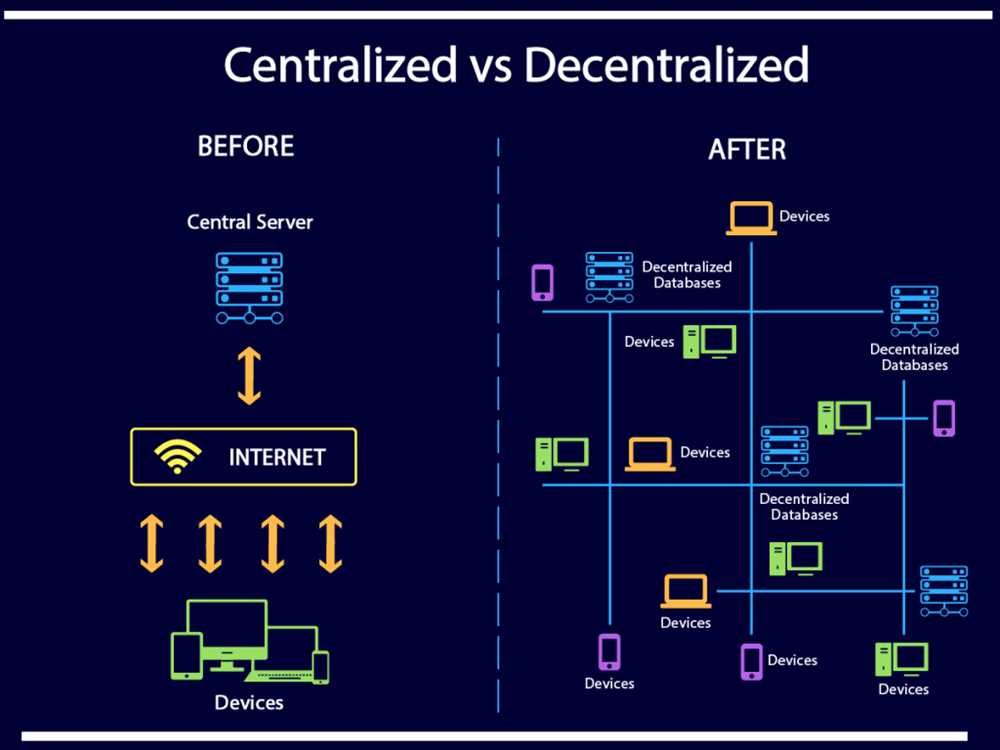

However, traditional banking systems have their limitations, such as intermediaries, lengthy processes, and limited access for certain individuals or regions. These limitations have spurred the development of decentralized finance (DeFi) platforms like Orbiter Finance.

The Rise of DeFi

Decentralized finance has revolutionized lending and borrowing by leveraging blockchain technology and smart contracts. It eliminates the need for intermediaries and central control, allowing for direct and peer-to-peer interactions. This opens up a world of opportunities for individuals and businesses, providing greater accessibility, transparency, and efficiency in the lending and borrowing process.

Orbiter Finance is at the forefront of this DeFi revolution, offering a decentralized lending and borrowing platform that connects borrowers and lenders directly. With Orbiter Finance, individuals can easily access loans at competitive interest rates, and lenders can earn passive income by lending their digital assets.

Through its innovative features and user-friendly interface, Orbiter Finance is democratizing finance, making lending and borrowing accessible to everyone, regardless of their geographical location or financial background. Join the revolution of decentralized finance and experience the many benefits of lending and borrowing with Orbiter Finance today.

The Benefits of Orbiter Finance

Orbiter Finance brings numerous benefits to the world of decentralized finance. By utilizing the latest advancements in blockchain technology, Orbiter Finance offers individuals and businesses advanced lending and borrowing options with unmatched security and efficiency.

1. Enhanced Privacy and Security

With Orbiter Finance, users can enjoy enhanced privacy and security for their financial transactions. The platform ensures the confidentiality of user information and employs advanced encryption techniques to safeguard against unauthorized access.

Additionally, Orbiter Finance operates on a decentralized network, which means that there is no central authority controlling the platform. This eliminates the risk of a single point of failure and reduces the potential for fraud or hacking.

2. Lowered Cost and Increased Accessibility

The decentralized nature of Orbiter Finance allows for reduced costs compared to traditional lending and borrowing options. There are no intermediaries or middlemen involved, which means lower fees for users.

Furthermore, Orbiter Finance has a user-friendly interface and provides access to lending and borrowing services to individuals and businesses with minimal barriers. This level of accessibility opens up new opportunities for those who may have been excluded from traditional financial systems.

Moreover, Orbiter Finance employs transparent and decentralized lending and borrowing protocols, ensuring equal opportunities for all participants. This promotes financial inclusion and empowers individuals to take control of their financial future.

Overall, Orbiter Finance represents a significant milestone in the evolution of decentralized finance. With its enhanced privacy and security measures, lower costs, and increased accessibility, Orbiter Finance is revolutionizing the way individuals and businesses approach lending and borrowing in the digital age.

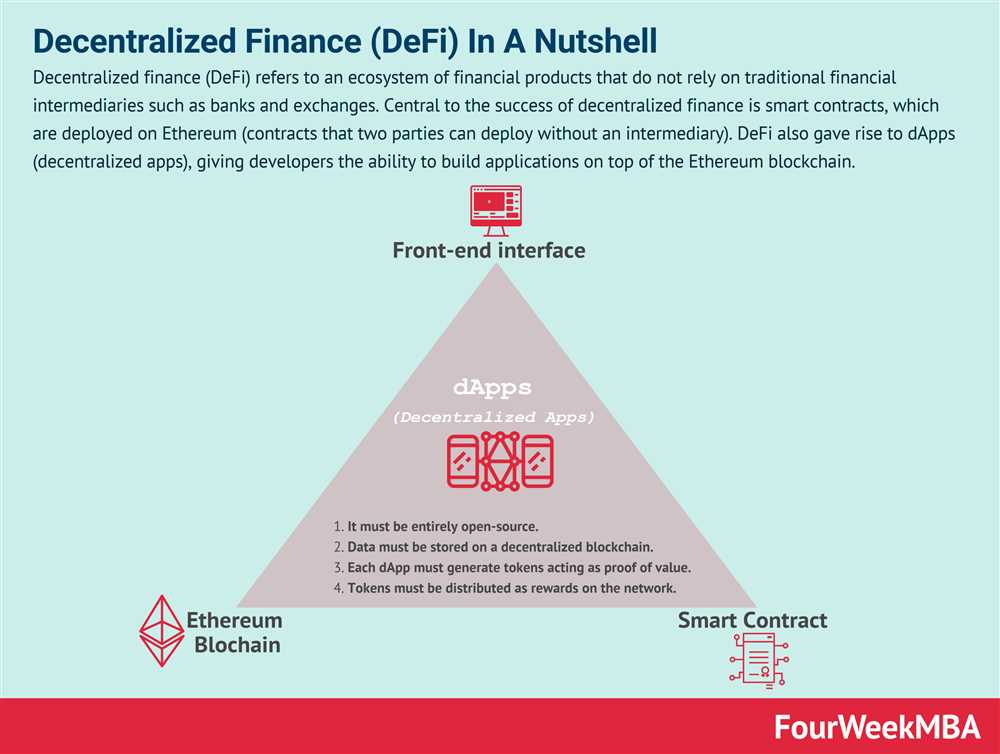

How Decentralized Finance Works

Decentralized Finance (DeFi) is a revolutionary concept that leverages blockchain technology to transform traditional financial systems. Unlike traditional finance, which relies on intermediaries such as banks and lending institutions, DeFi operates on a peer-to-peer network, enabling individuals to interact directly with each other, eliminating the need for intermediaries.

At the core of DeFi is the use of smart contracts, which are self-executing contracts with the terms of the agreement written into code. These smart contracts are powered by blockchain technology, ensuring transparency, security, and immutability.

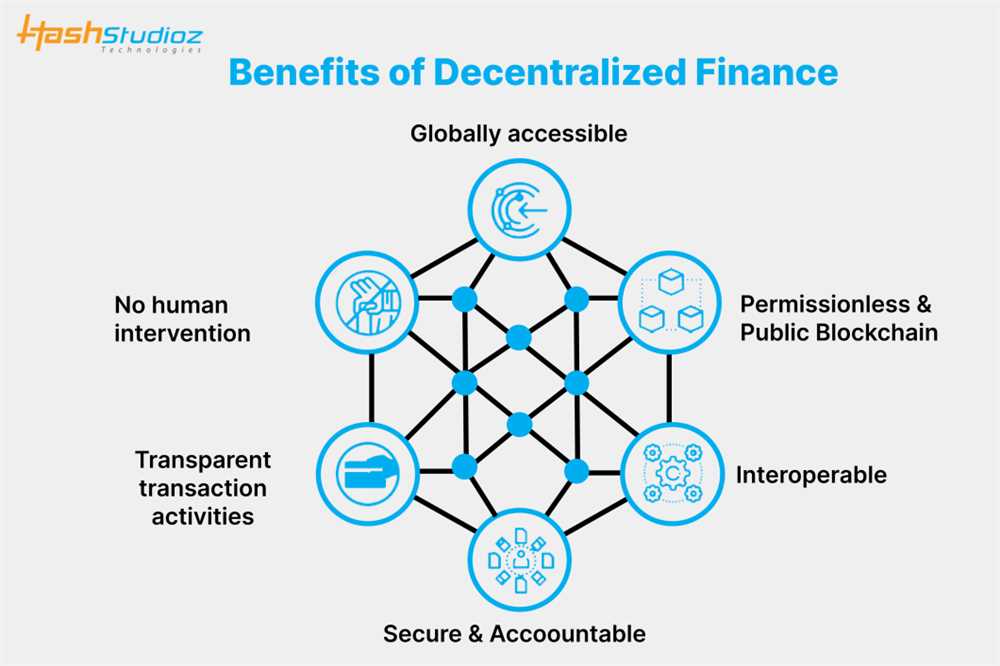

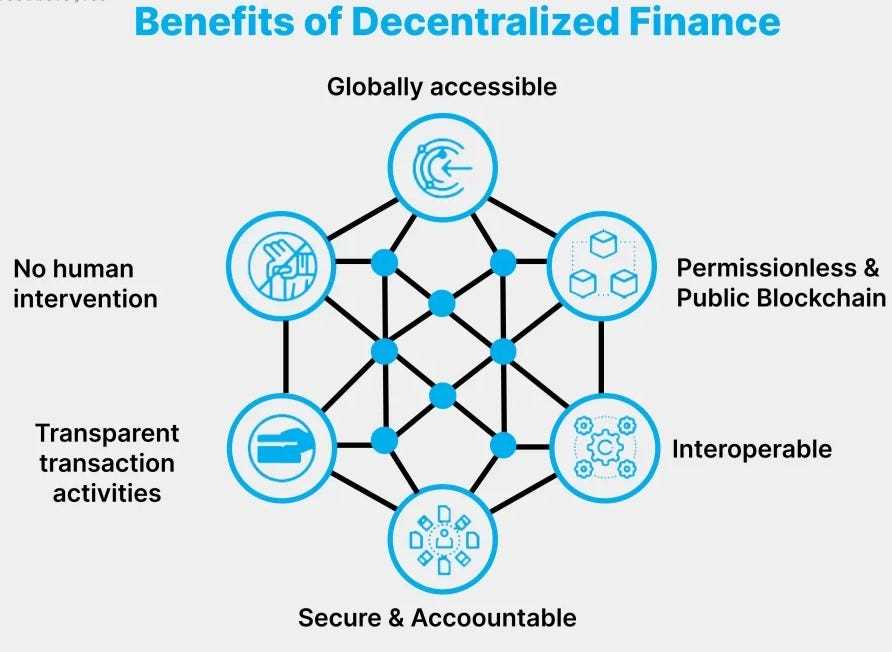

Benefits of Decentralized Finance

1. Borderless Transactions: With DeFi, users can transact with anyone, anywhere in the world, without the need for a middleman. This opens up new opportunities for individuals who were previously excluded from traditional financial systems.

2. Increased Financial Inclusion: DeFi platforms enable access to financial services for the unbanked and underbanked population, helping them to build credit, invest, and participate in the global economy.

3. Enhanced Privacy and Security: Since transactions on DeFi platforms are recorded on the blockchain, they are highly secure and resistant to hacking. Additionally, users have greater control over their personal data and can choose what information they want to share.

4. Lower Costs: By eliminating intermediaries, DeFi platforms reduce transaction costs and fees associated with traditional financial systems. This allows for greater efficiency and cost savings for users.

5. Automated and Programmable: DeFi platforms allow for the creation of complex financial instruments and protocols that can be executed automatically. This automation eliminates the need for manual processes and reduces the risk of human error.

Overall, decentralized finance offers a more inclusive, transparent, and efficient financial system that empowers individuals to have more control over their finances.

Join Orbiter Finance today and experience the benefits of decentralized finance!

The Future of Lending and Borrowing

The world of decentralized finance (DeFi) has revolutionized the way we think about traditional lending and borrowing. With the rise of blockchain technology, decentralized applications (dApps), and smart contracts, the future of lending and borrowing is expected to be even more innovative and efficient.

1. Trustless and Transparent

One of the major advantages of DeFi lending and borrowing platforms is their trustless and transparent nature. Traditional lending institutions often require borrowers to trust them with their assets, as they act as intermediaries between lenders and borrowers. However, with DeFi, smart contracts replace the need for intermediaries, making the system fully trustless. Smart contracts are programmable contracts that self-execute based on pre-defined conditions, ensuring that the terms of the loan or borrowing agreement are automatically enforced without the need for human intervention. This transparency and trustless nature of DeFi lending and borrowing platforms greatly reduces the risk of fraud or manipulation.

2. Global Access and Inclusivity

DeFi lending and borrowing platforms have the potential to provide financial services to anyone with an internet connection, regardless of their location or socioeconomic status. Traditional financial systems often have entry barriers, such as credit scores, collateral requirements, and geographical restrictions. These barriers can prevent individuals from accessing the financial services they need. However, with DeFi, anyone can participate in lending or borrowing activities by simply connecting their digital wallet to a DeFi platform. This global access and inclusivity have the potential to empower individuals in underserved regions and promote financial inclusion on a global scale.

The future of lending and borrowing is a decentralized, trustless, and inclusive financial ecosystem built on blockchain technology. With the development of advanced protocols and the increasing adoption of DeFi, we can expect to see even more innovative lending and borrowing solutions that further enhance efficiency, security, and accessibility for individuals around the world.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance platform that allows users to lend and borrow digital assets.

How does Orbiter Finance work?

Orbiter Finance uses smart contracts to facilitate lending and borrowing. Users can deposit their digital assets into the platform and earn interest by lending them out. Borrowers can use these assets as collateral to borrow other digital assets.