Exploring the Importance of Orbiter Finance in Streamlining Asset Transfers between Layer 2 Rollups

The rise of Layer 2 rollups has significantly enhanced the scalability and efficiency of blockchain networks. These Layer 2 solutions have enabled faster and cheaper transactions, attracting a growing number of users and developers. However, transferring assets between different Layer 2 rollups can be a complex and time-consuming process.

This is where Orbiter Finance comes into play. Orbiter Finance is a cutting-edge protocol that aims to simplify and streamline asset transfers across Layer 2 rollups. By leveraging innovative technologies such as cross-rollup bridges and liquidity aggregation, Orbiter Finance enables seamless and frictionless transfers of assets, empowering users to move their assets across different Layer 2 networks with ease.

One of the key features of Orbiter Finance is its interoperability with multiple Layer 2 rollups. Whether you’re using Optimistic Rollups, ZK-Rollups, or any other Layer 2 solution, Orbiter Finance provides a reliable bridge that connects these networks together. This eliminates the need for users to go through multiple steps and platforms to transfer assets, saving time and reducing the risk of errors.

In addition to its interoperability, Orbiter Finance also focuses on optimizing liquidity across Layer 2 rollups. By aggregating liquidity from various sources, including decentralized exchanges and liquidity pools, Orbiter Finance ensures that users have access to the best possible rates when transferring assets. This not only maximizes efficiency but also minimizes the costs associated with asset transfers, making it an attractive solution for users looking to save time and money.

The Importance of Understanding Orbiter Finance

Orbiter Finance plays a crucial role in facilitating asset transfers across Layer 2 Rollups. It is important for crypto enthusiasts and investors to fully grasp the concept and functionality of Orbiter Finance for a seamless experience in utilizing Layer 2 solutions.

One of the key reasons why understanding Orbiter Finance is essential is its ability to provide liquidity to various Layer 2 Rollups. Liquidity is a vital aspect of any financial system, and the world of cryptocurrency is no exception. By comprehending Orbiter Finance, users can harness its liquidity pools and optimize their asset transfers.

Additionally, a thorough understanding of Orbiter Finance aids in ensuring the security and integrity of asset transfers. By grasping the mechanisms of Orbiter Finance, users can better navigate potential risks and make informed decisions when it comes to transferring their valuable assets across Layer 2 Rollups.

Furthermore, Orbiter Finance offers a range of features and benefits that can greatly enhance the efficiency and effectiveness of asset transfers. These include faster transaction times, reduced fees, and improved scalability. By familiarizing themselves with Orbiter Finance, users can fully leverage these advantages and optimize their overall crypto experience.

In conclusion, understanding Orbiter Finance is paramount for any individual or business involved in crypto asset transfers across Layer 2 Rollups. It not only provides access to liquidity pools but also ensures the security and efficiency of transfers. By gaining a thorough understanding of Orbiter Finance, users can maximize the potential of Layer 2 solutions and stay at the forefront of the ever-evolving world of cryptocurrency.

Why Orbiter Finance is Essential for Asset Transfers

Orbiter Finance plays a crucial role in facilitating asset transfers across Layer 2 Rollups. As Layer 2 scalability solutions continue to gain traction in the blockchain space, the need for a reliable and efficient asset transfer mechanism has become increasingly important.

Layer 2 solutions are designed to alleviate the scalability issues faced by the Ethereum network, allowing for faster and cheaper transactions. However, transferring assets between different Layer 2 rollups can be complex and time-consuming. This is where Orbiter Finance comes in.

Seamless Cross-Rollup Asset Transfers

Orbiter Finance provides a seamless solution for cross-rollup asset transfers. By leveraging the power of decentralized finance (DeFi) protocols and innovative technology, Orbiter Finance allows users to easily move their assets between different Layer 2 rollups.

The protocol ensures trustless and secure transfers by leveraging smart contracts and off-chain protocols. This eliminates the need for intermediaries and reduces the risk of asset loss or theft during the transfer process.

Enhanced Liquidity and Accessibility

Orbiter Finance also enhances liquidity and accessibility in the Layer 2 ecosystem. By allowing assets to be easily transferred between different rollups, the protocol increases the interoperability and compatibility of Layer 2 solutions.

Moreover, Orbiter Finance enables users to take advantage of the various liquidity pools and yield farming opportunities available on different Layer 2 rollups. This allows users to maximize their returns and participate in a wide range of decentralized finance activities.

Overall, Orbiter Finance plays a crucial role in overcoming the challenges associated with transferring assets across Layer 2 rollups. By providing a seamless and secure transfer mechanism, the protocol enhances liquidity, accessibility, and compatibility in the Layer 2 ecosystem, helping to drive the adoption and scalability of Layer 2 solutions.

Exploring the Role of Layer 2 Rollups

Layer 2 rollups are an important advancement in blockchain technology that aim to address the scalability issues of Layer 1 protocols like Ethereum. These rollups are designed to enhance transaction throughput and reduce fees by batching multiple transactions together and submitting them as a single transaction to the Layer 1 chain.

One of the key features of layer 2 rollups is the ability to aggregate and compress multiple transactions into a single data structure, known as a rollup block. This allows for a more efficient use of block space and significantly reduces the overall transaction fees for users. By using rollups, users can take advantage of increased scalability without compromising on the security and trustlessness of the Layer 1 chain.

Layer 2 rollups also provide greater flexibility in terms of transaction types. While Layer 1 protocols often have limited support for complex smart contracts and dApps, layer 2 rollups can support a wider range of transaction types, including advanced functionality like private transactions, cross-chain swaps, and more.

Furthermore, layer 2 rollups facilitate interoperability between different Layer 1 protocols, allowing assets and data to be transferred seamlessly across chains. This interoperability opens up new possibilities for cross-chain decentralized finance (DeFi) applications and enables users to leverage the benefits of different Layer 1 ecosystems.

Overall, layer 2 rollups play a crucial role in scaling blockchain networks and enabling the efficient transfer of assets and data. By addressing the scalability challenges of Layer 1 protocols, rollups enhance the usability, accessibility, and cost-effectiveness of blockchain technology, ultimately driving its widespread adoption and utility in various industries.

How Layer 2 Rollups Enhance Asset Transfers

Layer 2 rollups play a crucial role in enhancing asset transfers within the decentralized finance (DeFi) ecosystem. These solutions are designed to address the scalability challenges faced by Layer 1 blockchains, enabling faster and more cost-effective transactions.

One of the key benefits of Layer 2 rollups is their ability to aggregate multiple transactions into a single batch, reducing congestion and gas fees on the main blockchain. This approach is achieved through various scaling technologies, such as optimistic rollups and zk rollups, which bundle multiple transfers and execute them off-chain. Once the batch is completed, a single proof is submitted to the main chain, greatly increasing the efficiency and throughput of asset transfers.

Optimistic Rollups

An optimistic rollup is a Layer 2 solution that relies on fraud proofs to ensure the integrity of transactions. In this process, all transactions are initially assumed to be valid, and only if a discrepancy is detected, a fraud proof is submitted to the main chain for verification. By using this approach, optimistic rollups provide a high degree of scalability while maintaining the security guarantees of the underlying Layer 1 blockchain.

Asset transfers on optimistic rollups are faster and more cost-efficient compared to Layer 1 transactions. This is because the bulk of the processing is done off-chain, reducing the burden on the main chain. As a result, users can enjoy near-instantaneous transfer times and lower transaction fees when moving assets between different accounts or smart contracts.

ZK Rollups

ZK rollups, short for zero-knowledge rollups, offer an alternative Layer 2 scaling solution by leveraging advanced cryptography. These rollups utilize succinct zero-knowledge proofs to validate the correctness of transactions without revealing sensitive information.

With ZK rollups, asset transfers become more private and secure as transaction information is kept private while still being verifiable by anyone. This privacy-preserving feature ensures that sensitive user data, such as account balances and transaction amounts, remains confidential. Additionally, ZK rollups provide high scalability by aggregating multiple transfers into a single proof, similar to optimistic rollups.

In summary, Layer 2 rollups enhance asset transfers by significantly improving scalability, reducing gas fees, and enhancing transaction privacy. These solutions are at the forefront of optimizing the DeFi ecosystem, facilitating seamless and efficient transfer of assets across various Layer 1 blockchains.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with a professional financial advisor before making any investment decisions.

Leveraging Orbiter Finance in Asset Transfer Processes

Orbiter Finance plays a crucial role in facilitating asset transfers across Layer 2 rollups. By integrating with various Layer 2 solutions, it provides a seamless experience for users looking to transfer their assets from one rollup to another.

One of the main advantages of leveraging Orbiter Finance is its ability to optimize asset transfers and reduce transaction fees. Through its advanced algorithms and liquidity pools, it analyzes the best routes and exchanges for each asset transfer, ensuring efficient and cost-effective transactions.

Furthermore, Orbiter Finance offers a secure and trusted environment for asset transfers. It implements robust security measures, including encryption and authentication protocols, to safeguard users’ assets throughout the transfer process. Additionally, its smart contract technology ensures transparency and eliminates the need for intermediaries, enhancing the overall security and trustworthiness of asset transfers.

Another key aspect of leveraging Orbiter Finance is its compatibility with various Layer 2 rollups and protocols. Whether users are transferring assets between different rollups or across different Layer 2 solutions, Orbiter Finance provides the necessary interoperability to seamlessly facilitate these transfers. This interoperability significantly enhances the usability and accessibility of asset transfers, allowing users to easily navigate between different Layer 2 ecosystems.

In conclusion, leveraging Orbiter Finance in asset transfer processes offers several benefits, including optimized transactions, enhanced security, and increased interoperability. By utilizing Orbiter Finance’s capabilities, users can efficiently and cost-effectively transfer their assets across Layer 2 rollups, contributing to a more seamless and decentralized financial ecosystem.

Key Benefits of Using Orbiter Finance for Asset Transfers

Orbiter Finance is an innovative platform that offers a range of benefits for users seeking to transfer assets across Layer 2 rollups. Here are some key advantages of using Orbiter Finance:

Simplicity

Orbiter Finance provides a user-friendly interface that simplifies the asset transfer process. With just a few clicks, users can easily transfer assets between different Layer 2 rollups without the need for complex manual procedures.

Speed and Efficiency

By leveraging the power of Layer 2 technology, Orbiter Finance enables fast and efficient asset transfers. Transactions are processed quickly, minimizing waiting times and ensuring that assets are transferred with minimal delays.

Additionally, Orbiter Finance optimizes gas costs by aggregating multiple transfers into a single transaction. This reduces the overall transaction fees and enhances the cost-effectiveness of asset transfers.

Flexibility

Orbiter Finance supports a wide range of assets, including cryptocurrencies and tokens from various networks. This allows users to seamlessly transfer their assets across different Layer 2 rollups, regardless of the network they are currently on.

Furthermore, Orbiter Finance offers flexible integration options, making it compatible with different wallets and platforms. Users can easily connect their preferred wallets to Orbiter Finance and initiate asset transfers seamlessly.

Security

Orbiter Finance prioritizes the security of asset transfers. The platform employs robust security measures to protect user funds and ensure a safe transfer process. Additionally, Orbiter Finance utilizes smart contract technology to ensure transparency and immutability in asset transfers.

Moreover, Orbiter Finance conducts regular security audits and maintains a strong relationship with leading security firms to address any potential vulnerabilities and ensure the utmost security for user transactions.

Overall, Orbiter Finance offers a seamless and secure solution for asset transfers across Layer 2 rollups, providing users with simplicity, speed, flexibility, and security in their transactions.

What is Orbiter Finance?

Orbiter Finance is a platform that enables smooth and efficient asset transfers across Layer 2 rollups.

How does Orbiter Finance work?

Orbiter Finance acts as a bridge between different Layer 2 rollups, allowing users to easily transfer assets between these networks. It achieves this by maintaining liquidity pools and leveraging flash swaps.

What are Layer 2 rollups?

Layer 2 rollups are scaling solutions for blockchains that bundle multiple transactions together and submit them as a single transaction to the main chain. This helps improve scalability and reduces transaction fees.

Why is Orbiter Finance important?

Orbiter Finance plays a crucial role in facilitating asset transfers across Layer 2 rollups, making it easier for users to move their assets between different networks. This can enhance liquidity and interoperability within the Layer 2 ecosystem.

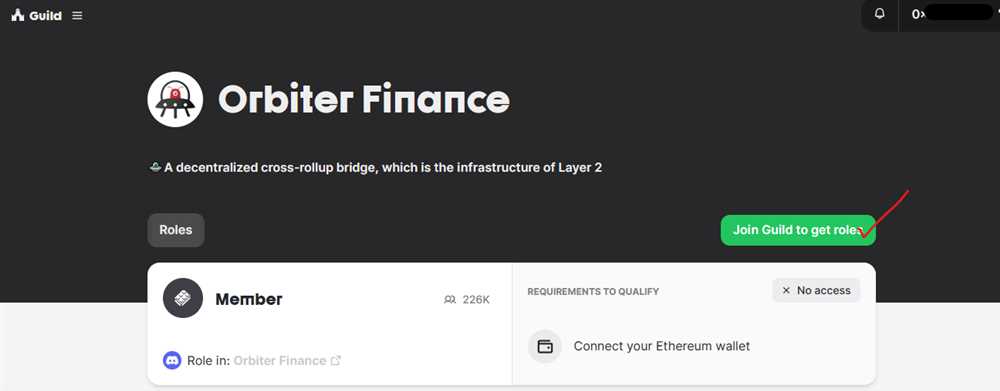

Can anyone use Orbiter Finance?

Yes, anyone can use Orbiter Finance to transfer assets across Layer 2 rollups. However, users will need to have accounts on the respective rollups they wish to transfer assets between.